Oil Holds Steady With Focus on Russian Trade Looming Oversupply – Financial Post

Published on: 2025-09-15

Intelligence Report: Oil Holds Steady With Focus on Russian Trade Looming Oversupply – Financial Post

1. BLUF (Bottom Line Up Front)

The most supported hypothesis is that geopolitical tensions, particularly involving Ukraine’s actions against Russian oil infrastructure, will maintain upward pressure on oil prices despite potential oversupply. Confidence level is moderate due to uncertainties in geopolitical developments and market responses. Recommended action is to monitor geopolitical developments closely and prepare for potential volatility in oil markets.

2. Competing Hypotheses

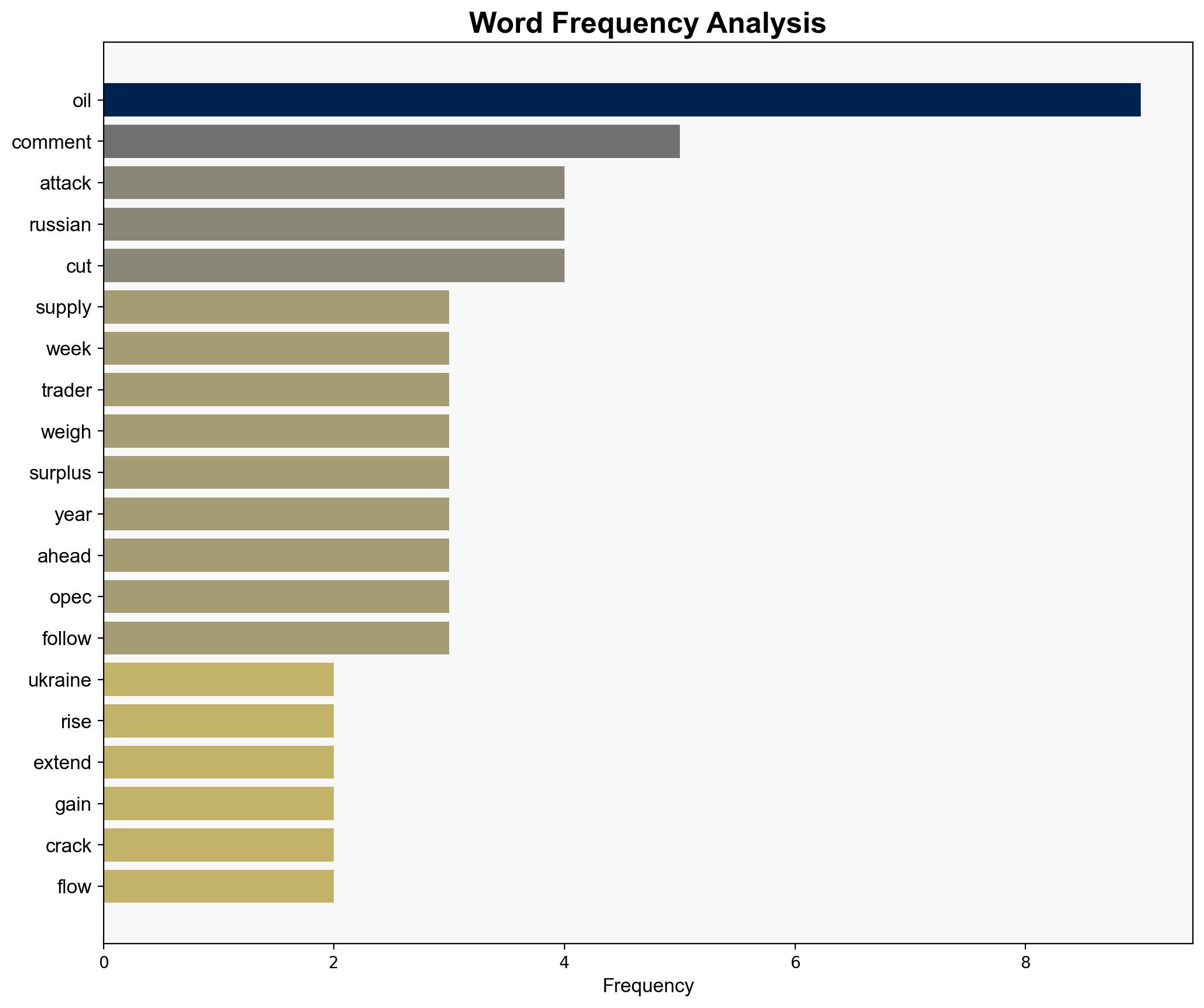

Hypothesis 1: Geopolitical tensions, particularly Ukraine’s attacks on Russian oil infrastructure, will sustain or increase oil prices despite forecasts of oversupply. This hypothesis is supported by recent drone strikes on Russian facilities and the potential for further disruptions.

Hypothesis 2: The anticipated oversupply, driven by OPEC’s increased production and potential sanctions on Russian oil, will eventually lead to a decline in oil prices. This is supported by the International Energy Agency’s projection of a record surplus and the potential for sanctions to alter trade dynamics.

Using ACH 2.0, Hypothesis 1 is better supported due to the immediate impact of geopolitical actions on market sentiment and price stability, whereas Hypothesis 2 relies on longer-term market adjustments that have not yet materialized.

3. Key Assumptions and Red Flags

Assumptions include the continuation of geopolitical tensions and the effectiveness of Ukrainian attacks in disrupting Russian oil supply. A red flag is the potential overestimation of the impact of these attacks on long-term supply. Additionally, assumptions about OPEC’s production capabilities and willingness to adjust output in response to market conditions may not hold.

4. Implications and Strategic Risks

Geopolitical tensions could escalate, leading to broader regional instability and further impacting global oil supply chains. Economic implications include potential inflationary pressures due to rising oil prices. There is also a risk of cyber retaliation targeting critical infrastructure. The psychological impact on market participants could lead to increased volatility.

5. Recommendations and Outlook

- Monitor geopolitical developments and market responses closely to anticipate price movements.

- Prepare for potential supply disruptions by diversifying energy sources and increasing strategic reserves.

- Scenario-based projections:

- Best Case: Geopolitical tensions ease, leading to stabilized oil prices.

- Worst Case: Escalation in conflicts leads to significant supply disruptions and price spikes.

- Most Likely: Continued volatility with periodic price increases due to ongoing tensions.

6. Key Individuals and Entities

Donald Trump, Scott Bessent, Veena Ali Khan

7. Thematic Tags

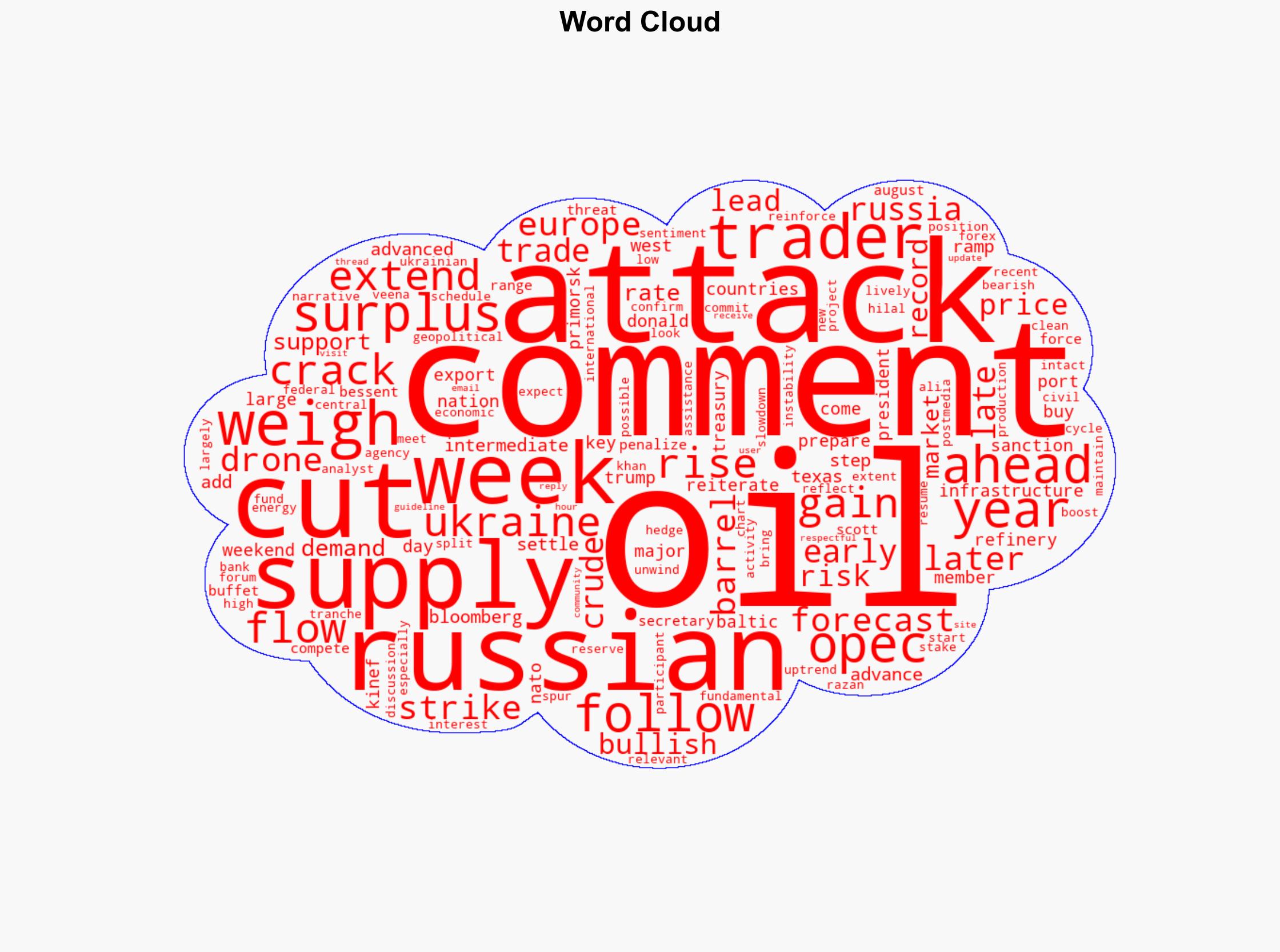

national security threats, energy security, geopolitical instability, market volatility