Asian stocks cautious as markets anticipate potential rate cut from US Fed – The Times of India

Published on: 2025-09-15

Intelligence Report: Asian stocks cautious as markets anticipate potential rate cut from US Fed – The Times of India

1. BLUF (Bottom Line Up Front)

The most supported hypothesis is that the US Federal Reserve will implement a rate cut in response to sluggish economic indicators and external pressures, including political influence from the US administration. Confidence level: Moderate. Recommended action: Monitor central bank communications closely and prepare for potential market volatility, particularly in Asian markets.

2. Competing Hypotheses

Hypothesis 1: The US Federal Reserve will cut interest rates due to weak economic data and political pressure, leading to a cautious but positive response in Asian markets.

Hypothesis 2: The US Federal Reserve will hold interest rates steady, despite external pressures, due to concerns about inflation and maintaining economic stability, resulting in market disappointment and potential volatility.

3. Key Assumptions and Red Flags

Assumptions:

– Hypothesis 1 assumes that political pressure significantly influences the Federal Reserve’s decisions.

– Hypothesis 2 assumes that the Federal Reserve prioritizes inflation control over political considerations.

Red Flags:

– Inconsistent data on employment and economic growth could mislead projections.

– Potential bias in interpreting political influence as a primary driver of monetary policy.

4. Implications and Strategic Risks

A rate cut could stimulate short-term market optimism but may also signal deeper economic issues, leading to long-term instability. Conversely, holding rates could preserve economic stability but risk political backlash and market volatility. Geopolitical tensions, particularly US-China trade relations, could exacerbate these risks.

5. Recommendations and Outlook

- Monitor Federal Reserve communications for indications of policy direction.

- Prepare for market volatility by diversifying investments and hedging against currency fluctuations.

- Scenario Projections:

- Best Case: Rate cut stimulates global market growth, stabilizing Asian stocks.

- Worst Case: Rate hold leads to significant market downturn and geopolitical tensions.

- Most Likely: Moderate rate cut with cautious market optimism and continued volatility.

6. Key Individuals and Entities

– Jerome Powell

– Donald Trump

– Christine Lagarde

7. Thematic Tags

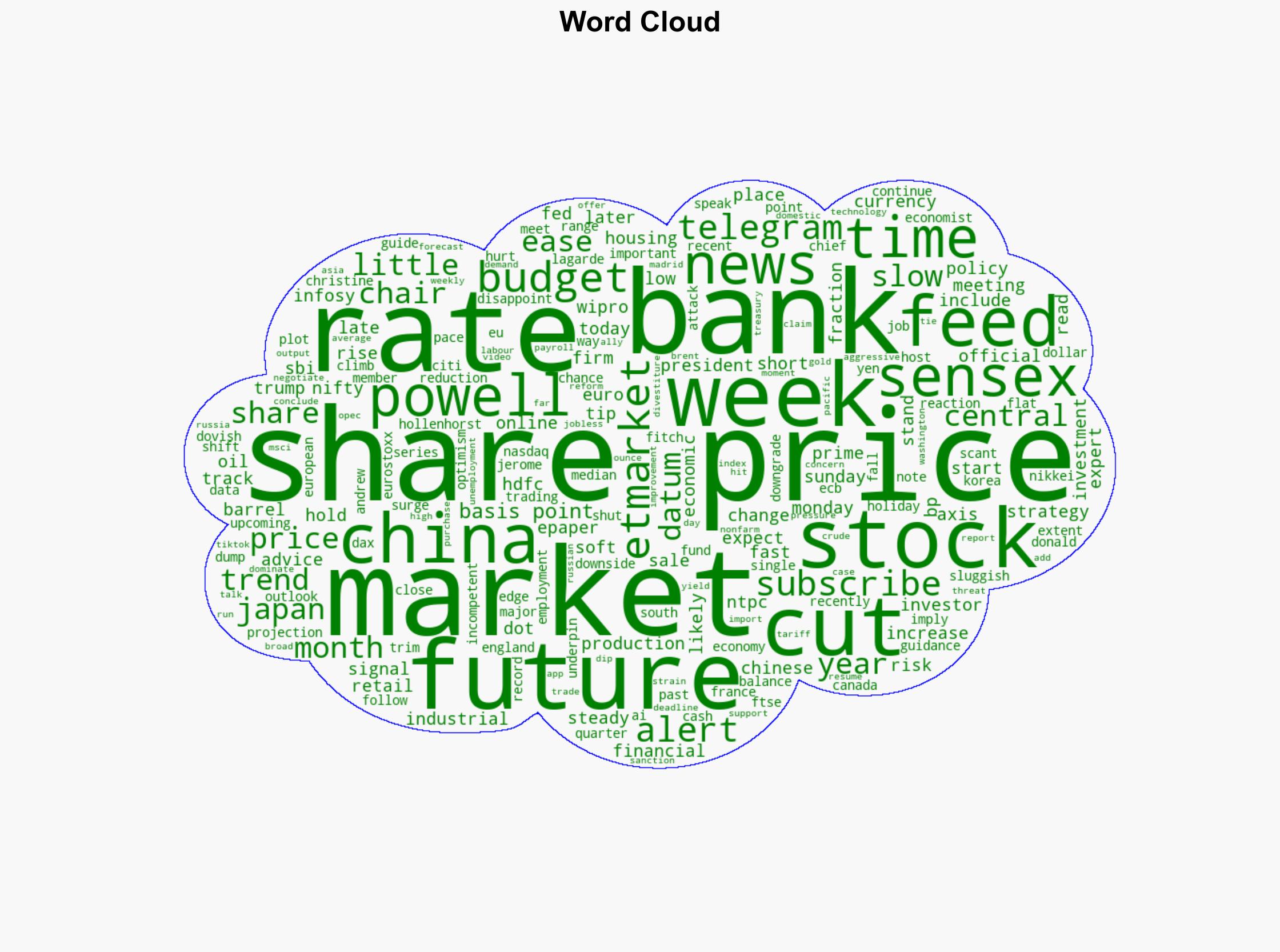

national security threats, economic stability, monetary policy, geopolitical tensions