Fintechs hail RBIs new digital payments authentication framework – BusinessLine

Published on: 2025-09-27

Intelligence Report: Fintechs hail RBIs new digital payments authentication framework – BusinessLine

1. BLUF (Bottom Line Up Front)

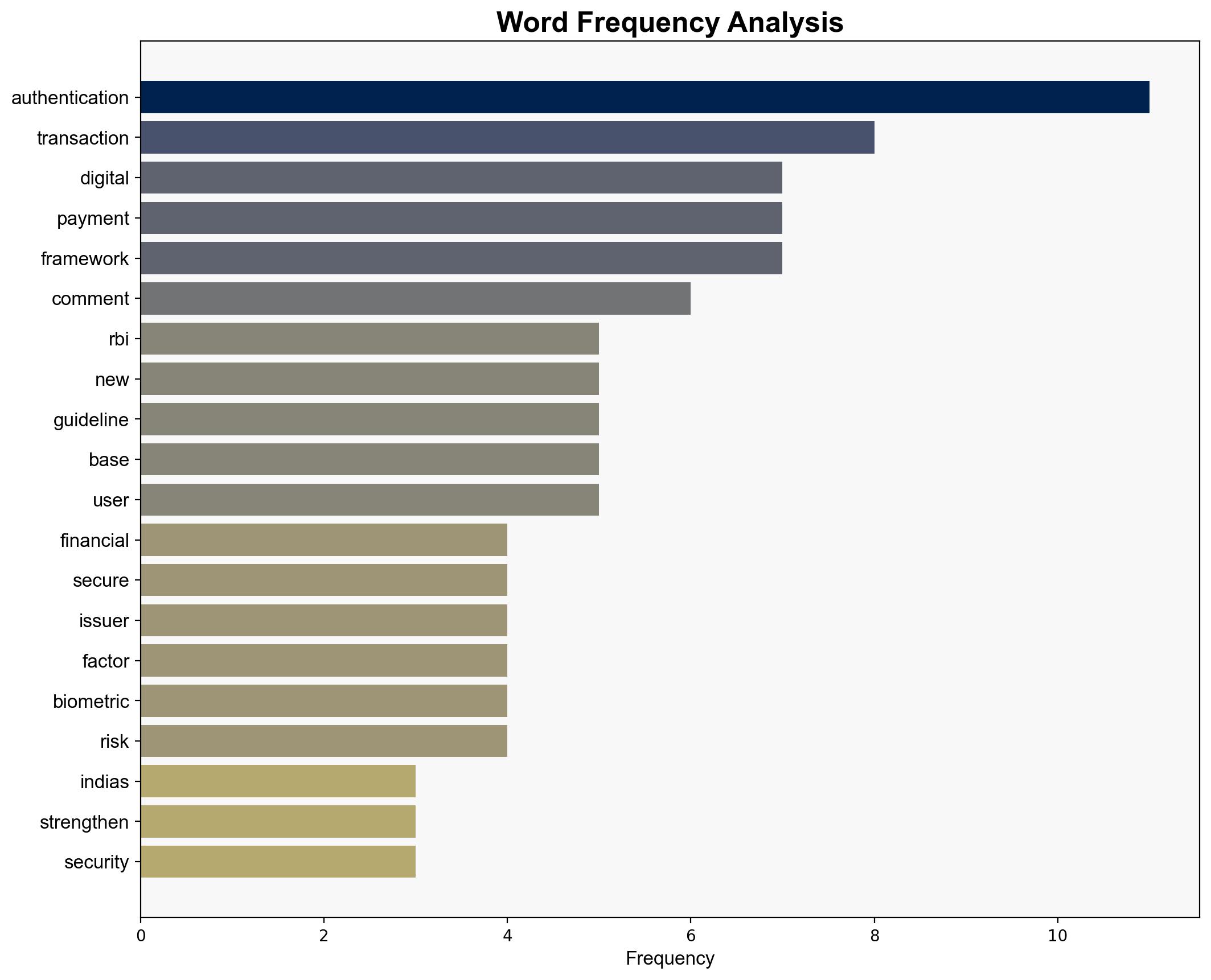

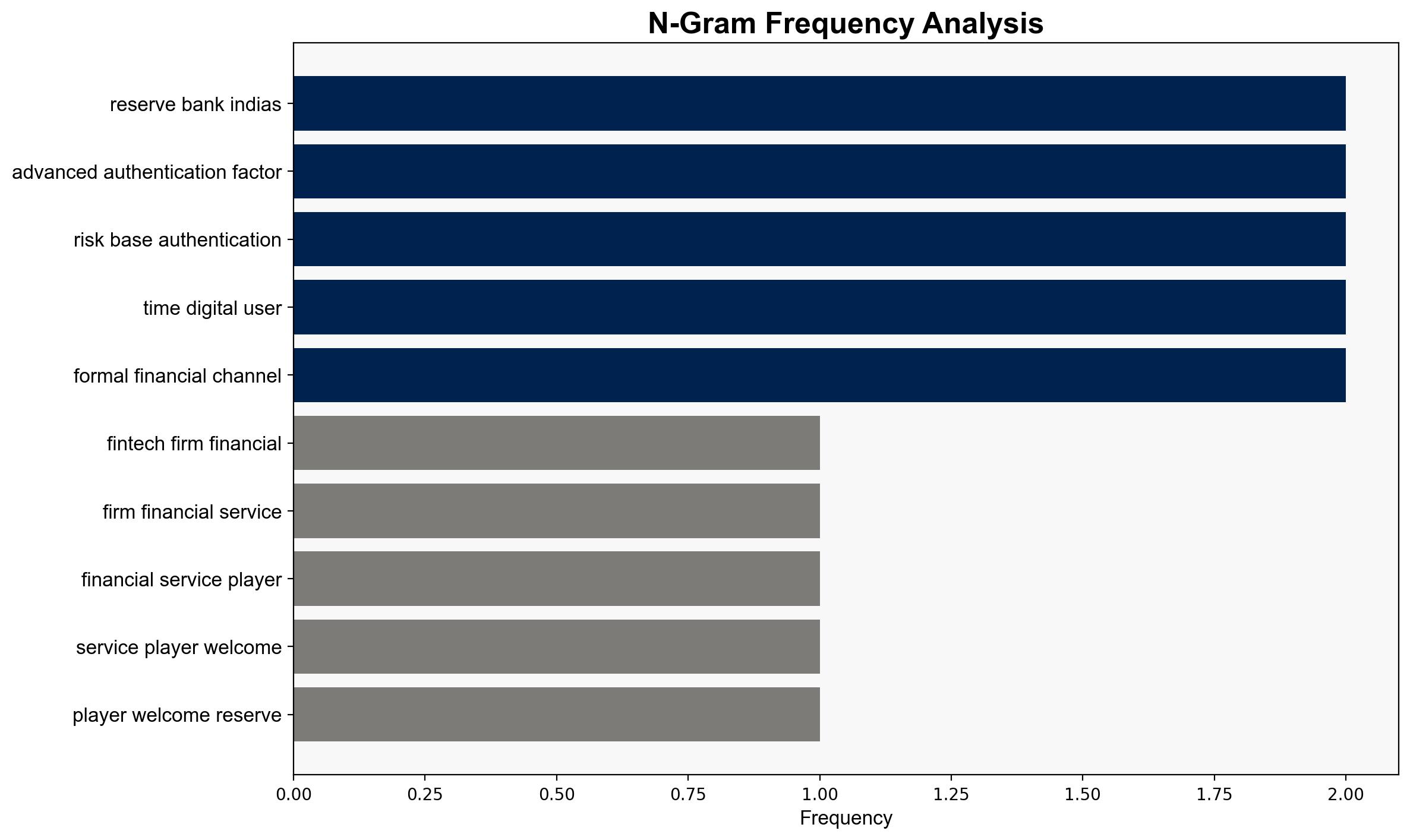

The new digital payments authentication framework by the Reserve Bank of India (RBI) is likely to enhance security and consumer trust in digital transactions. The most supported hypothesis is that this framework will accelerate financial inclusion and position India as a leader in digital payment security standards. Confidence Level: High. Recommended action: Monitor implementation and adoption rates, and assess impacts on transaction security and user trust.

2. Competing Hypotheses

1. **Hypothesis A**: The RBI’s new authentication framework will significantly enhance digital transaction security, leading to increased consumer trust and accelerated financial inclusion.

2. **Hypothesis B**: The framework may face implementation challenges, such as technological adoption barriers and resistance from stakeholders, which could delay its intended benefits.

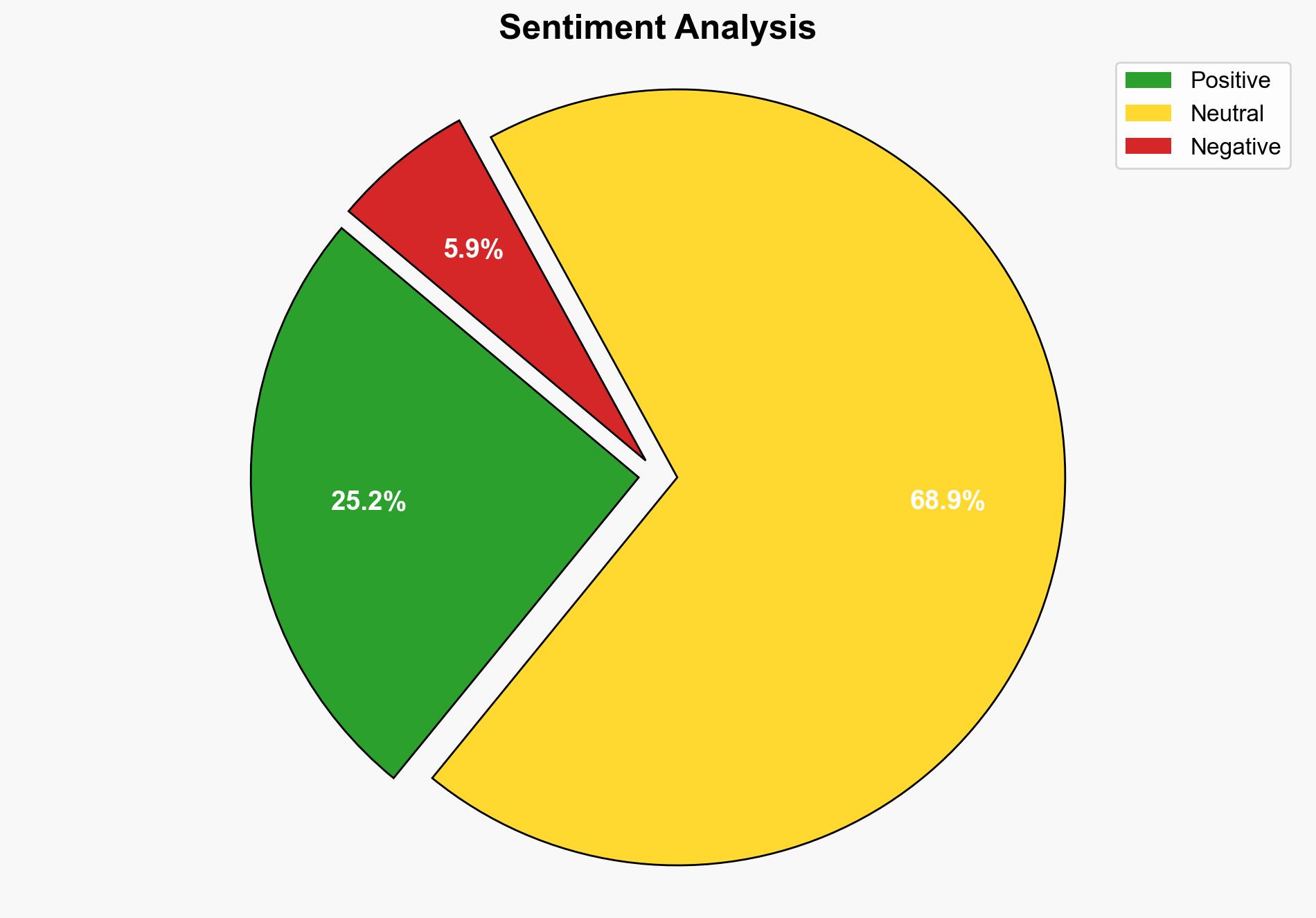

Using ACH 2.0, Hypothesis A is better supported by the industry’s positive reception and the framework’s alignment with global security standards. However, Hypothesis B remains plausible given potential resistance and technological hurdles.

3. Key Assumptions and Red Flags

– **Assumptions**:

– The framework’s technological requirements are feasible for all stakeholders.

– Consumers will readily adapt to new authentication methods.

– **Red Flags**:

– Lack of detailed implementation timelines.

– Potential underestimation of rural and semi-urban areas’ technological readiness.

4. Implications and Strategic Risks

– **Economic**: Enhanced security could boost digital transaction volumes, benefiting the fintech sector.

– **Cyber**: Increased reliance on digital systems may attract more sophisticated cyber threats.

– **Geopolitical**: India’s leadership in digital payment security could influence global standards.

– **Psychological**: Consumer trust may increase, but initial resistance to change could occur.

5. Recommendations and Outlook

- Conduct regular assessments of the framework’s impact on transaction security and consumer trust.

- Engage with stakeholders to address technological adoption challenges, particularly in rural areas.

- Scenario Projections:

- Best: Seamless adoption leads to a secure and inclusive digital payment ecosystem.

- Worst: Implementation challenges result in delayed benefits and increased cyber threats.

- Most Likely: Gradual adoption with initial resistance, followed by increased trust and transaction volumes.

6. Key Individuals and Entities

– Shailesh Paul

– Sunil Yadav

– Wibmo

– Satin Creditcare Network Ltd

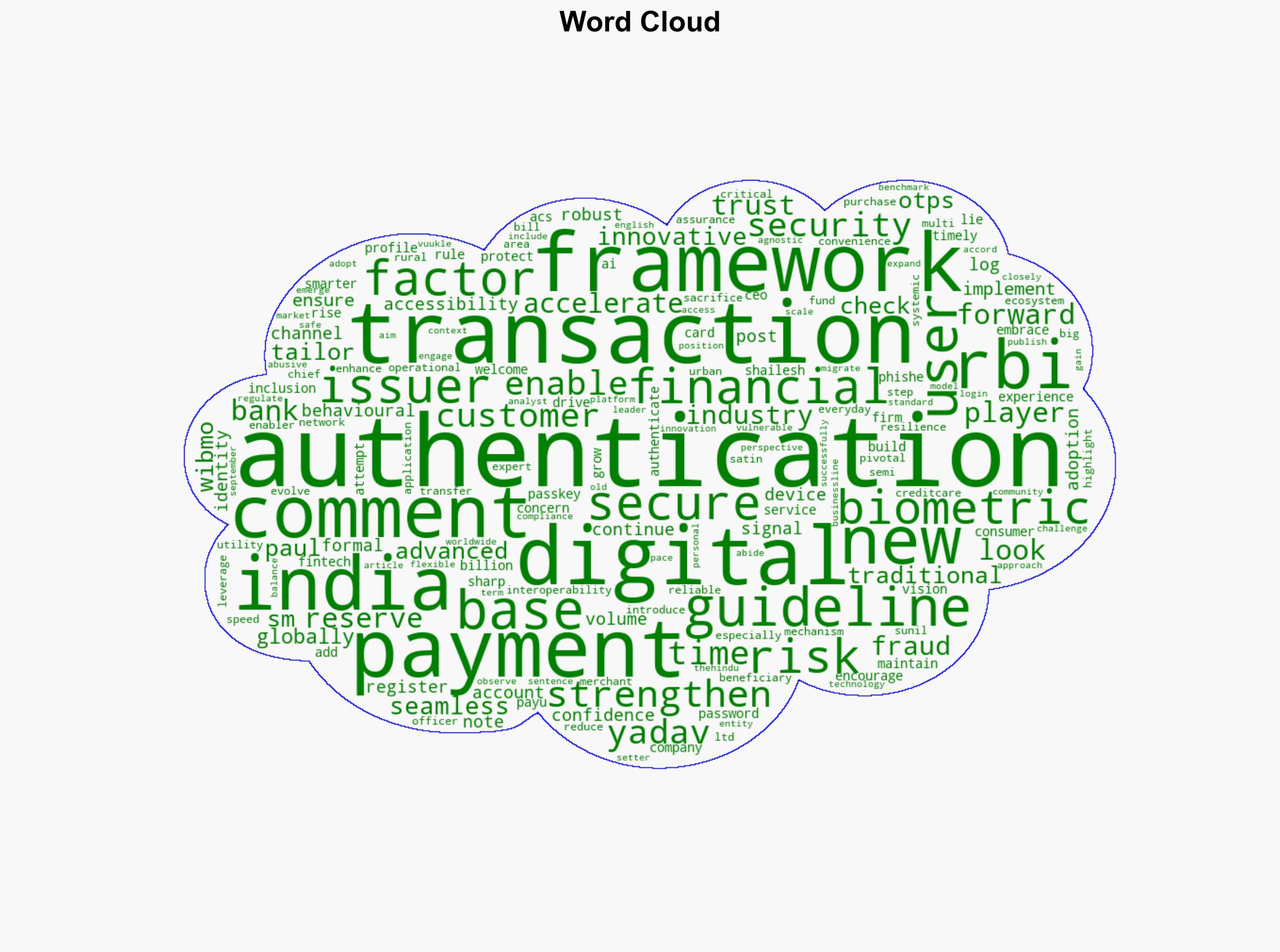

7. Thematic Tags

cybersecurity, financial inclusion, digital payments, India, fintech