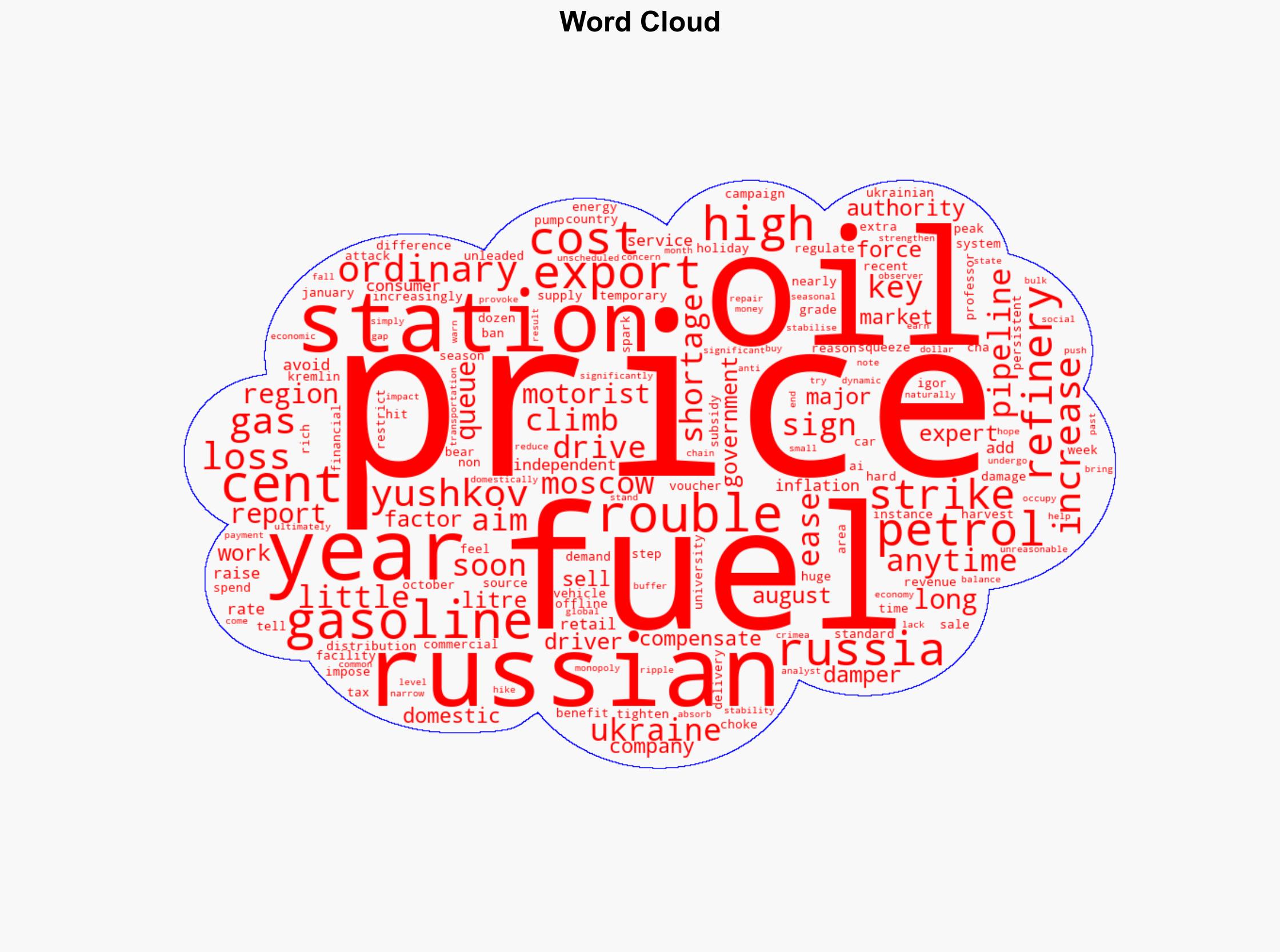

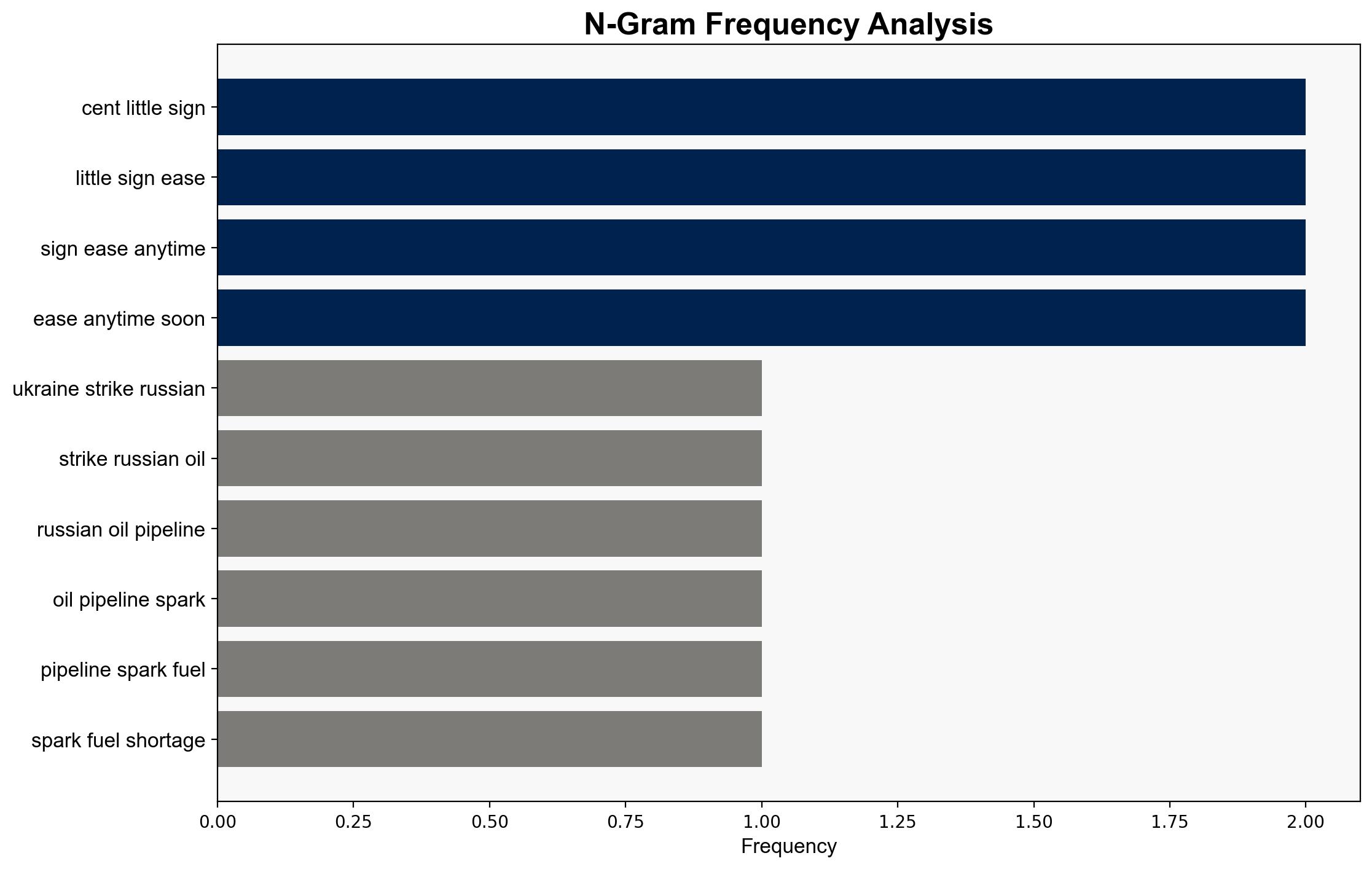

Ukraine strikes on Russian oil pipelines spark fuel shortages drive up pump prices – CNA

Published on: 2025-09-29

Intelligence Report: Ukraine strikes on Russian oil pipelines spark fuel shortages drive up pump prices – CNA

1. BLUF (Bottom Line Up Front)

The most supported hypothesis is that Ukraine’s strikes on Russian oil infrastructure are strategically aimed at disrupting Russia’s economic stability by targeting a key revenue source, leading to domestic fuel shortages and price hikes. Confidence level: Moderate. Recommended action: Monitor further disruptions in Russian energy exports and assess potential impacts on regional stability and global markets.

2. Competing Hypotheses

1. **Hypothesis A**: Ukraine’s strikes are primarily intended to weaken Russia’s economic position by targeting its oil infrastructure, thereby causing domestic fuel shortages and price increases to strain the Russian economy.

2. **Hypothesis B**: The fuel shortages and price hikes are primarily due to internal Russian economic policies and market dynamics, with Ukrainian strikes serving as a secondary exacerbating factor.

Using ACH 2.0, Hypothesis A is better supported due to the direct correlation between targeted strikes and immediate fuel shortages, as well as the strategic intent to disrupt Russian revenue streams.

3. Key Assumptions and Red Flags

– **Assumptions**: Hypothesis A assumes that Ukraine has the capability and intent to effectively target Russian oil infrastructure. Hypothesis B assumes that Russian economic policies are the primary driver of current fuel issues.

– **Red Flags**: Lack of detailed data on the extent of damage from Ukrainian strikes. Potential bias in attributing economic issues solely to external factors without considering internal inefficiencies.

– **Deception Indicators**: Russian narratives may downplay the impact of Ukrainian strikes to maintain public confidence.

4. Implications and Strategic Risks

– **Economic**: Prolonged fuel shortages could lead to increased inflation and economic instability in Russia, affecting global oil markets.

– **Geopolitical**: Escalation in Ukraine’s targeting of Russian infrastructure could provoke retaliatory actions, increasing regional tensions.

– **Psychological**: Domestic dissatisfaction in Russia may rise due to economic strain, potentially impacting public support for government policies.

5. Recommendations and Outlook

- Enhance monitoring of Russian energy export disruptions and assess potential impacts on global oil prices.

- Engage in diplomatic efforts to de-escalate tensions between Ukraine and Russia to prevent further economic destabilization.

- Scenario Projections:

- Best: Stabilization of fuel prices through effective Russian countermeasures and diplomatic resolutions.

- Worst: Escalation of strikes leading to significant economic downturn and increased geopolitical tensions.

- Most Likely: Continued sporadic disruptions with gradual adaptation by Russian markets.

6. Key Individuals and Entities

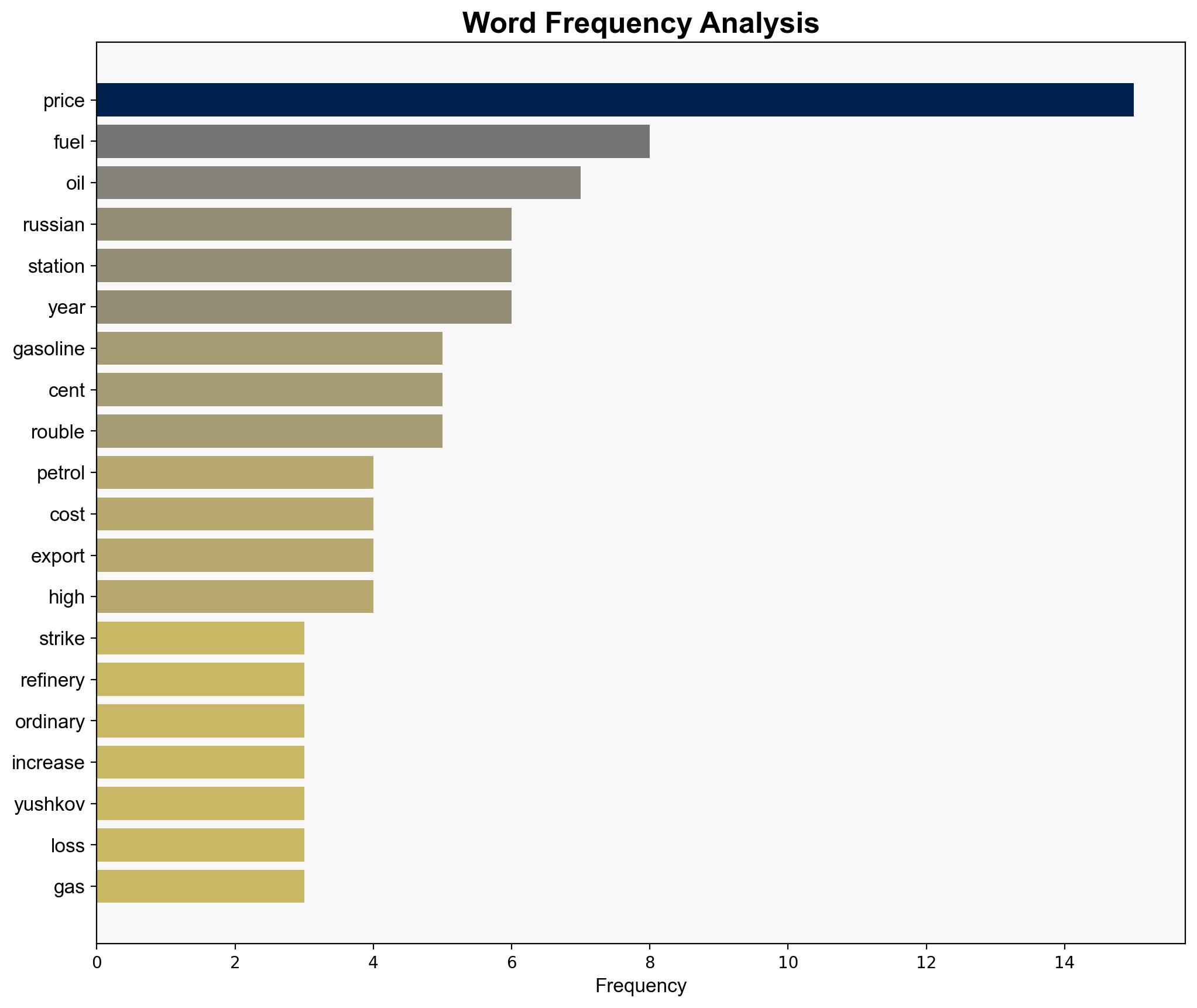

– Igor Yushkov: Professor at Financial University under the Russian government, providing expert analysis on the economic impact.

7. Thematic Tags

national security threats, economic instability, regional focus, energy security