SEC Commissioner Speaks on Regulatory Harmonization Efforts – Columbia.edu

Published on: 2025-09-30

Intelligence Report: SEC Commissioner Speaks on Regulatory Harmonization Efforts – Columbia.edu

1. BLUF (Bottom Line Up Front)

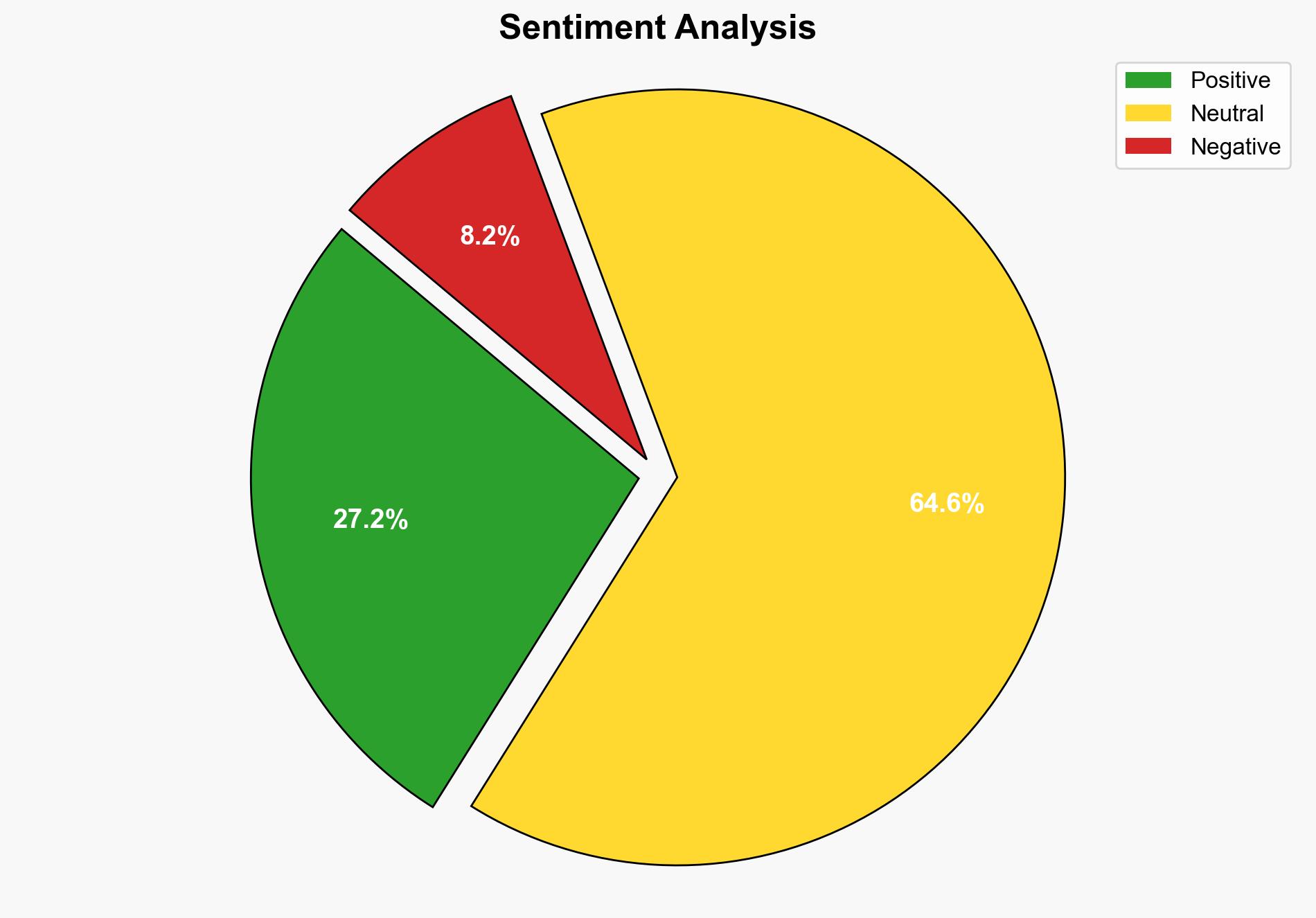

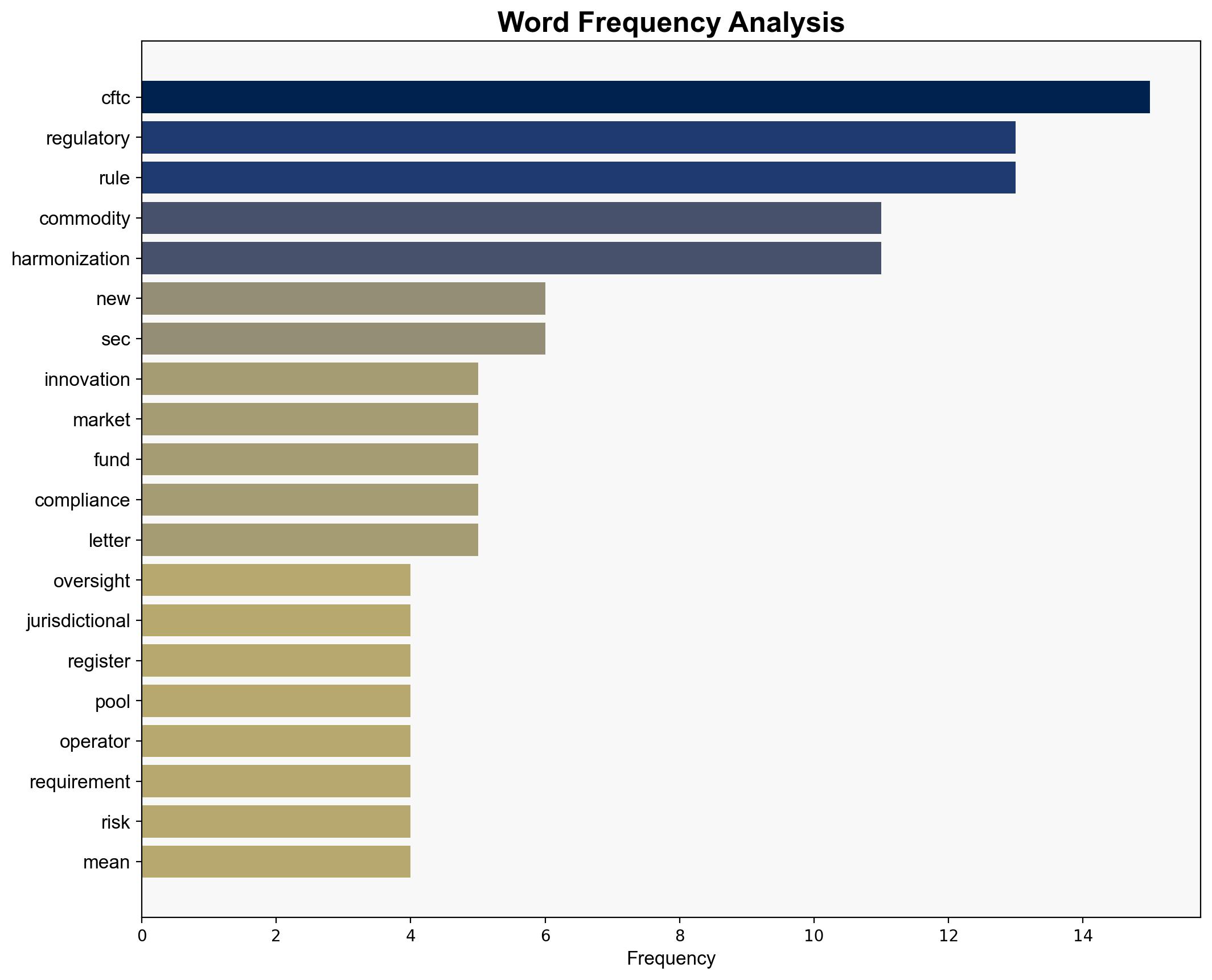

The most supported hypothesis is that the SEC and CFTC are struggling to harmonize regulations due to overlapping jurisdictions and differing priorities, leading to inefficiencies and increased compliance costs. Confidence level: Moderate. Recommended action: Encourage inter-agency collaboration to streamline regulatory processes and reduce duplication.

2. Competing Hypotheses

1. The SEC and CFTC are effectively working towards regulatory harmonization, which will ultimately lead to a more efficient oversight framework for innovative financial products.

2. The SEC and CFTC are experiencing significant challenges in harmonizing regulations, resulting in overlapping jurisdictions, increased compliance costs, and potential market inefficiencies.

Using the Analysis of Competing Hypotheses (ACH) 2.0, hypothesis two is better supported. The source text highlights ongoing issues such as jurisdictional overlaps and duplicative requirements, which suggest that effective harmonization is not yet achieved.

3. Key Assumptions and Red Flags

– Assumption: Both agencies have the capacity and willingness to collaborate effectively.

– Red Flag: The mention of “jurisdictional land grab” suggests possible inter-agency rivalry, which could impede cooperation.

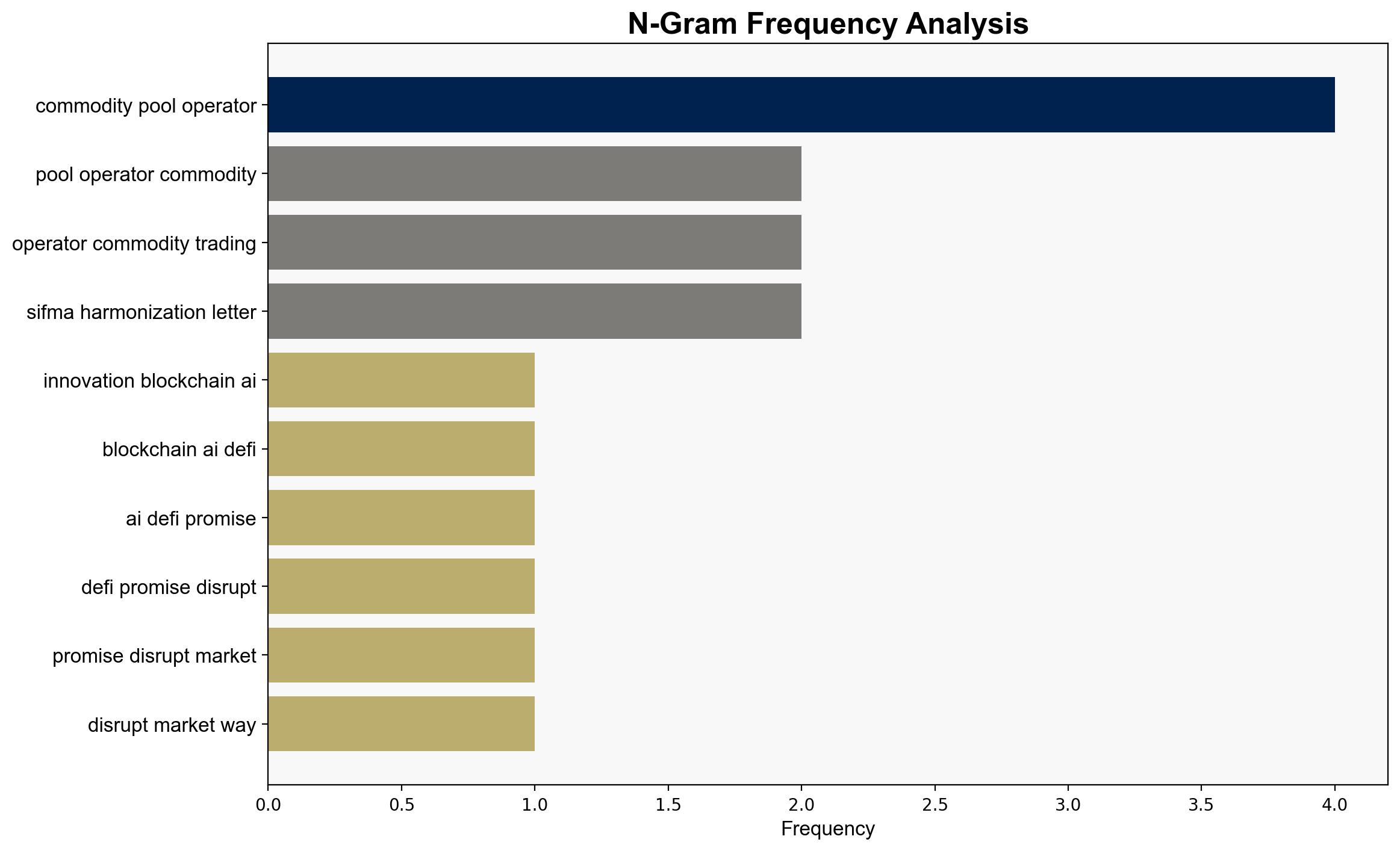

– Blind Spot: The potential impact of technological advancements on regulatory frameworks is not fully addressed.

4. Implications and Strategic Risks

– Economic: Increased compliance costs could deter investment in innovative financial products, affecting market growth.

– Cyber: As financial products become more complex, the risk of cyber vulnerabilities increases, necessitating robust regulatory oversight.

– Geopolitical: Inefficient regulation could weaken the U.S. financial sector’s global competitiveness.

– Psychological: Investor confidence may be undermined by perceived regulatory inefficiencies.

5. Recommendations and Outlook

- Encourage SEC and CFTC to establish a joint task force to streamline regulatory processes and reduce duplication.

- Develop a unified regulatory framework that adapts to technological advancements in the financial sector.

- Scenario Projections:

- Best: Successful harmonization leads to a robust, efficient regulatory environment, boosting investor confidence.

- Worst: Continued regulatory fragmentation results in market inefficiencies and reduced global competitiveness.

- Most Likely: Incremental progress towards harmonization with ongoing challenges in aligning agency priorities.

6. Key Individuals and Entities

– SEC

– CFTC

7. Thematic Tags

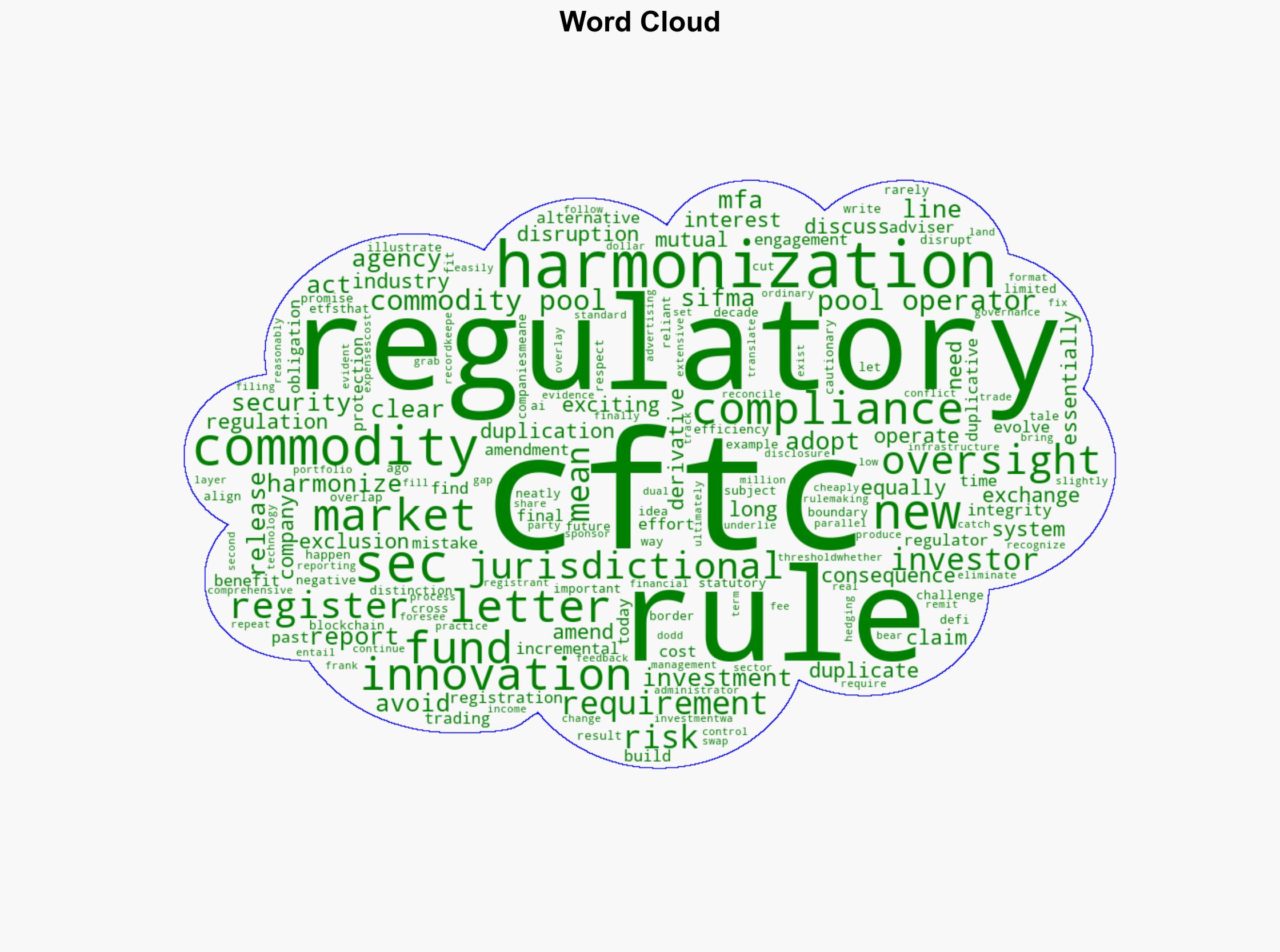

regulatory harmonization, financial innovation, compliance costs, inter-agency collaboration