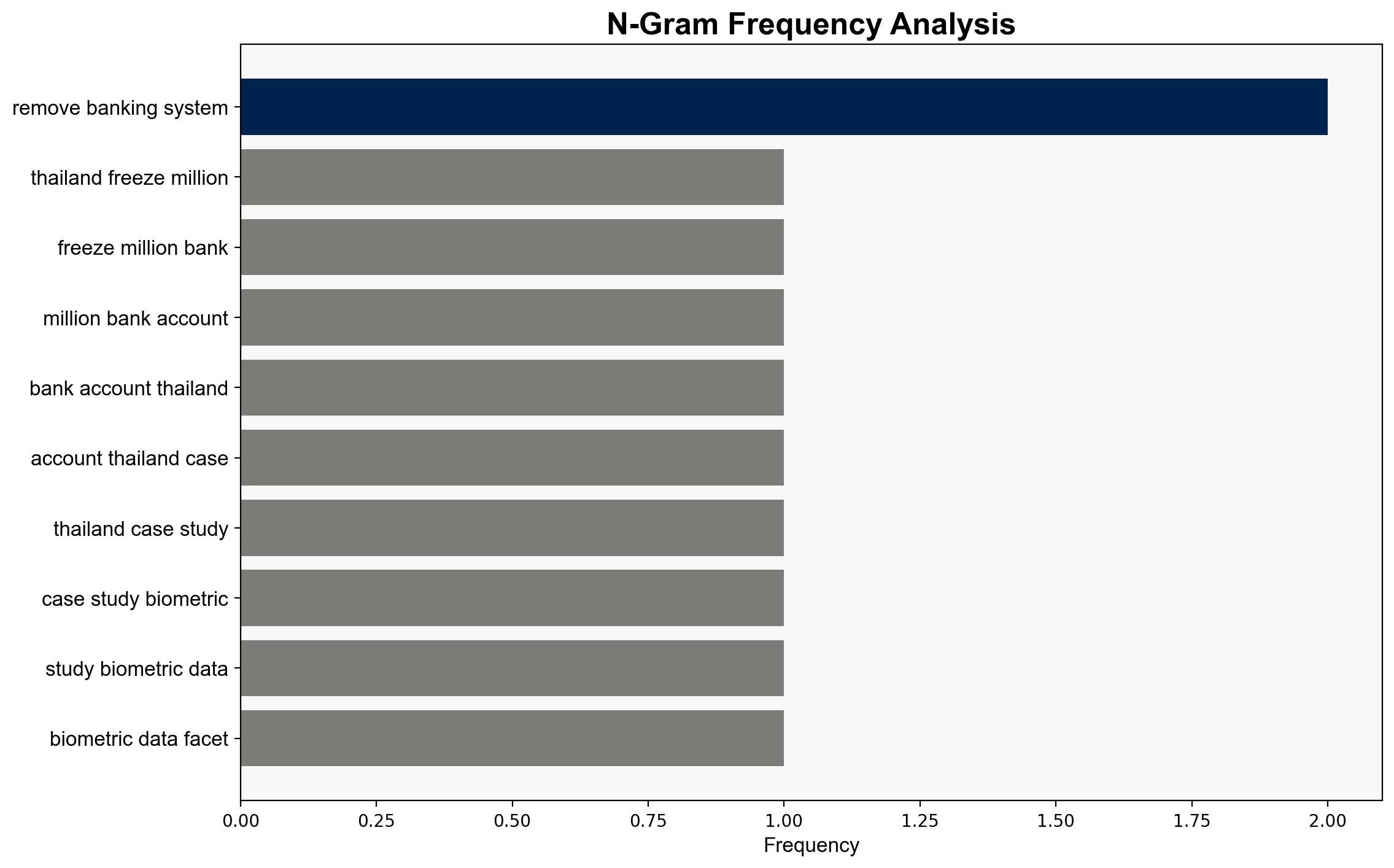

Thailand Freezes Over 3 Million Bank Accounts – Activistpost.com

Published on: 2025-09-30

Intelligence Report: Thailand Freezes Over 3 Million Bank Accounts – Activistpost.com

1. BLUF (Bottom Line Up Front)

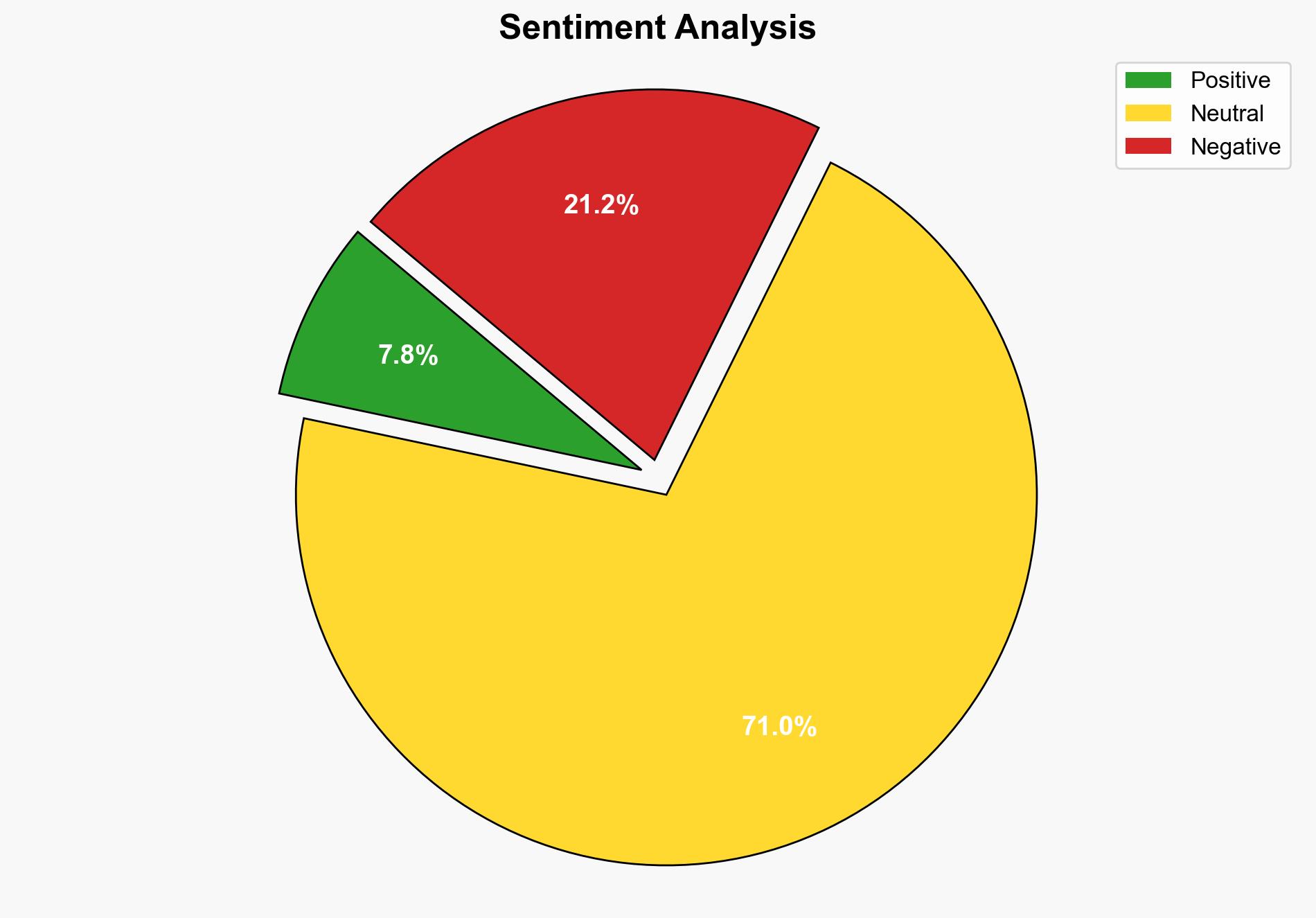

The most supported hypothesis is that the Thai government’s actions are primarily driven by a genuine attempt to combat financial fraud and money laundering, albeit with potential overreach and unintended consequences. Confidence in this hypothesis is moderate due to limited data and potential biases in the source. Recommended action includes monitoring the situation for signs of escalation and engaging with Thai authorities to understand their regulatory framework and offer technical assistance if needed.

2. Competing Hypotheses

1. **Hypothesis A**: The Thai government’s freeze on bank accounts is a strategic move to combat widespread financial fraud and money laundering, with the intention of strengthening the financial system.

2. **Hypothesis B**: The freeze is primarily a politically motivated action aimed at increasing government control over financial transactions, potentially stifling dissent and exerting power over citizens.

Using ACH 2.0, Hypothesis A is better supported due to the involvement of multiple government agencies and the stated intent to safeguard the banking sector. Hypothesis B lacks direct evidence but cannot be entirely dismissed given the potential for government overreach.

3. Key Assumptions and Red Flags

– **Assumptions**: It is assumed that the Thai government has the technical capability to accurately identify fraudulent activities and that the freeze is not indiscriminately applied.

– **Red Flags**: The sudden and large-scale nature of the account freezes suggests potential overreach or a miscalculation in risk assessment. The lack of transparency and communication from the government could indicate underlying political motives.

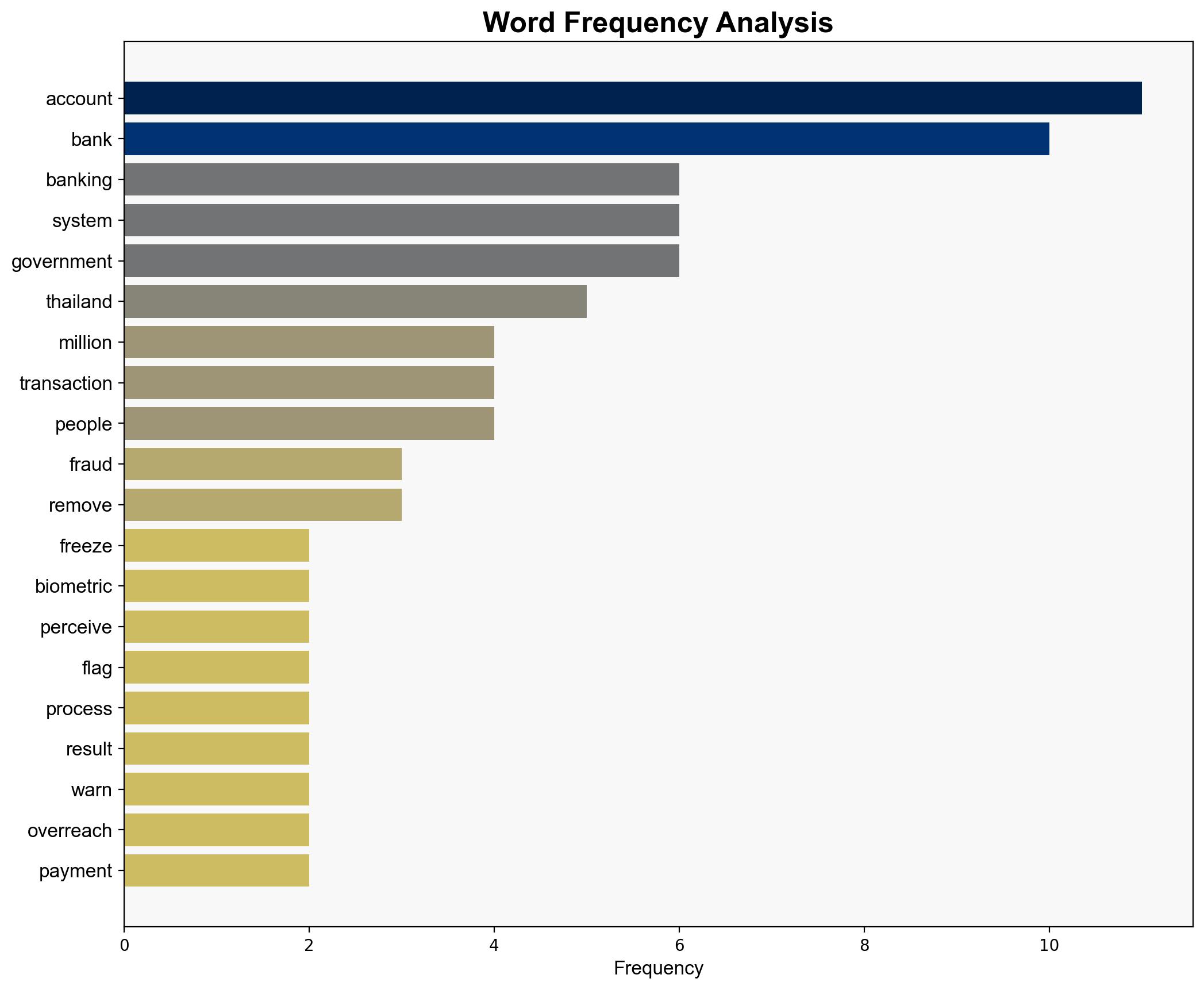

– **Blind Spots**: Limited information on the criteria used for freezing accounts and the specific role of biometric data raises questions about the accuracy and fairness of the process.

4. Implications and Strategic Risks

– **Economic Impact**: Prolonged account freezes could lead to decreased consumer confidence, reduced economic activity, and potential capital flight.

– **Cybersecurity Risks**: Increased scrutiny and data collection could expose vulnerabilities in the banking system, making it a target for cyberattacks.

– **Geopolitical Tensions**: Similar actions in neighboring countries like Vietnam suggest a regional trend that could lead to broader economic instability.

– **Psychological Effects**: Public fear and distrust in the financial system may lead to increased cash transactions and a shadow economy.

5. Recommendations and Outlook

- Engage with Thai authorities to clarify the criteria and processes involved in account freezes, offering technical assistance to ensure fair and accurate implementation.

- Monitor regional trends for similar actions in other countries, assessing potential impacts on regional stability.

- Scenario Projections:

- **Best Case**: The government successfully identifies and mitigates fraud, restoring public confidence and economic stability.

- **Worst Case**: Continued freezes lead to economic downturn, public unrest, and increased geopolitical tensions.

- **Most Likely**: Gradual resolution with some economic impact and ongoing public skepticism.

6. Key Individuals and Entities

– Darunee Saeju, Assistant Governor of the Bank of Thailand

– Bank of Thailand

– Cyber Crime Investigation Bureau

– Ministry of Digital Economy and Society

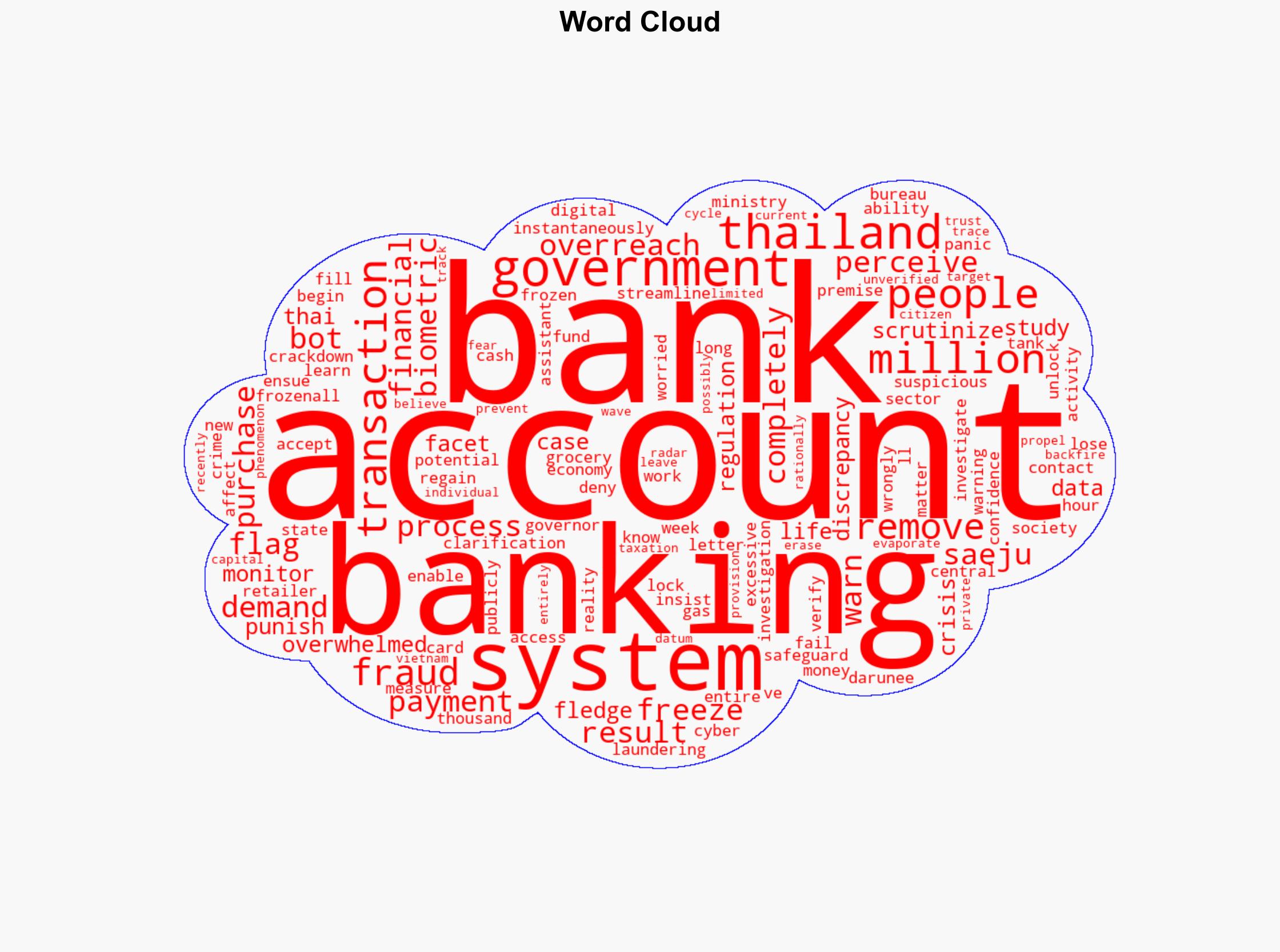

7. Thematic Tags

national security threats, cybersecurity, counter-terrorism, regional focus