Oil falls as OPEC plans to further increase output – The Times of India

Published on: 2025-09-30

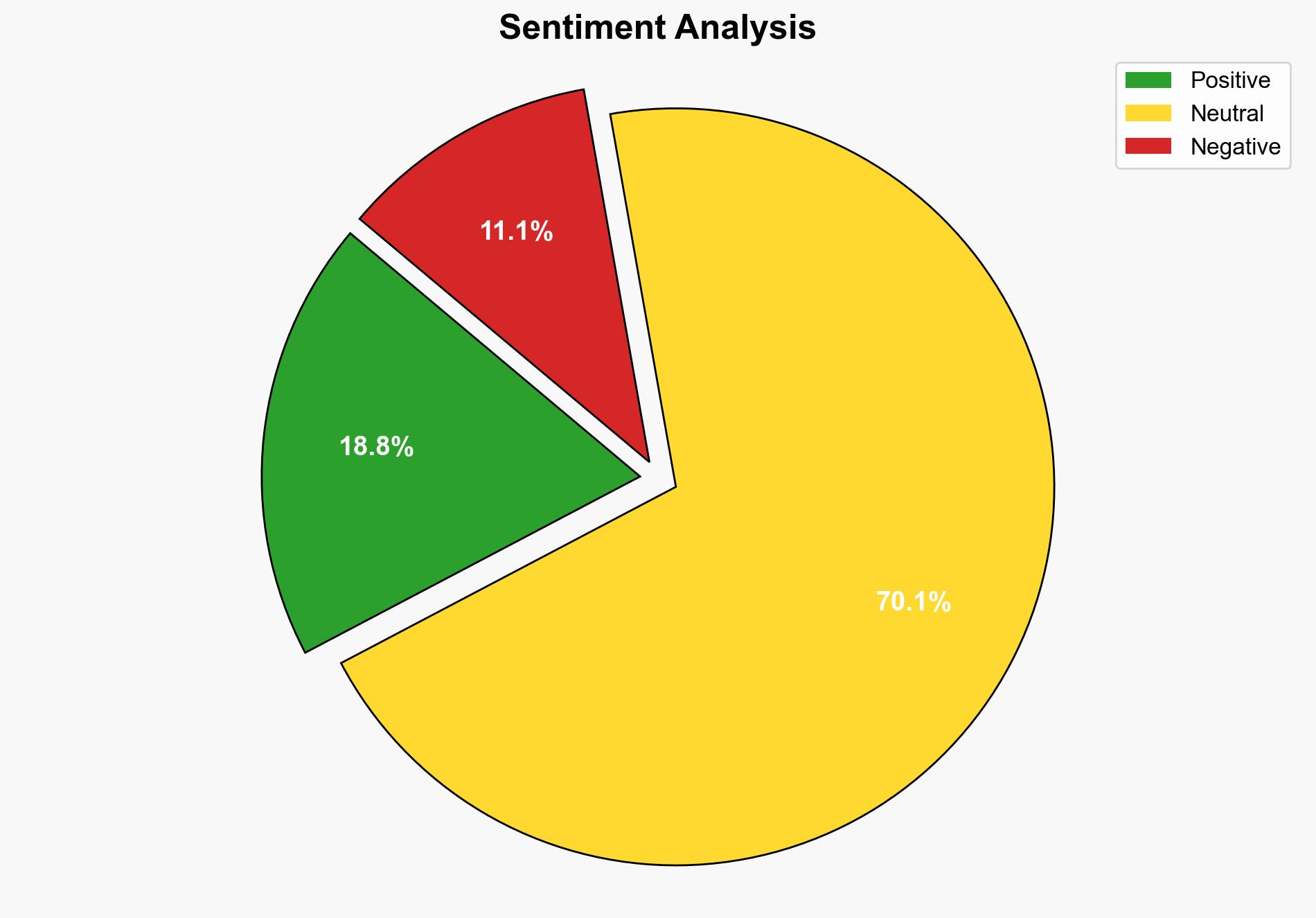

Intelligence Report: Oil falls as OPEC plans to further increase output – The Times of India

1. BLUF (Bottom Line Up Front)

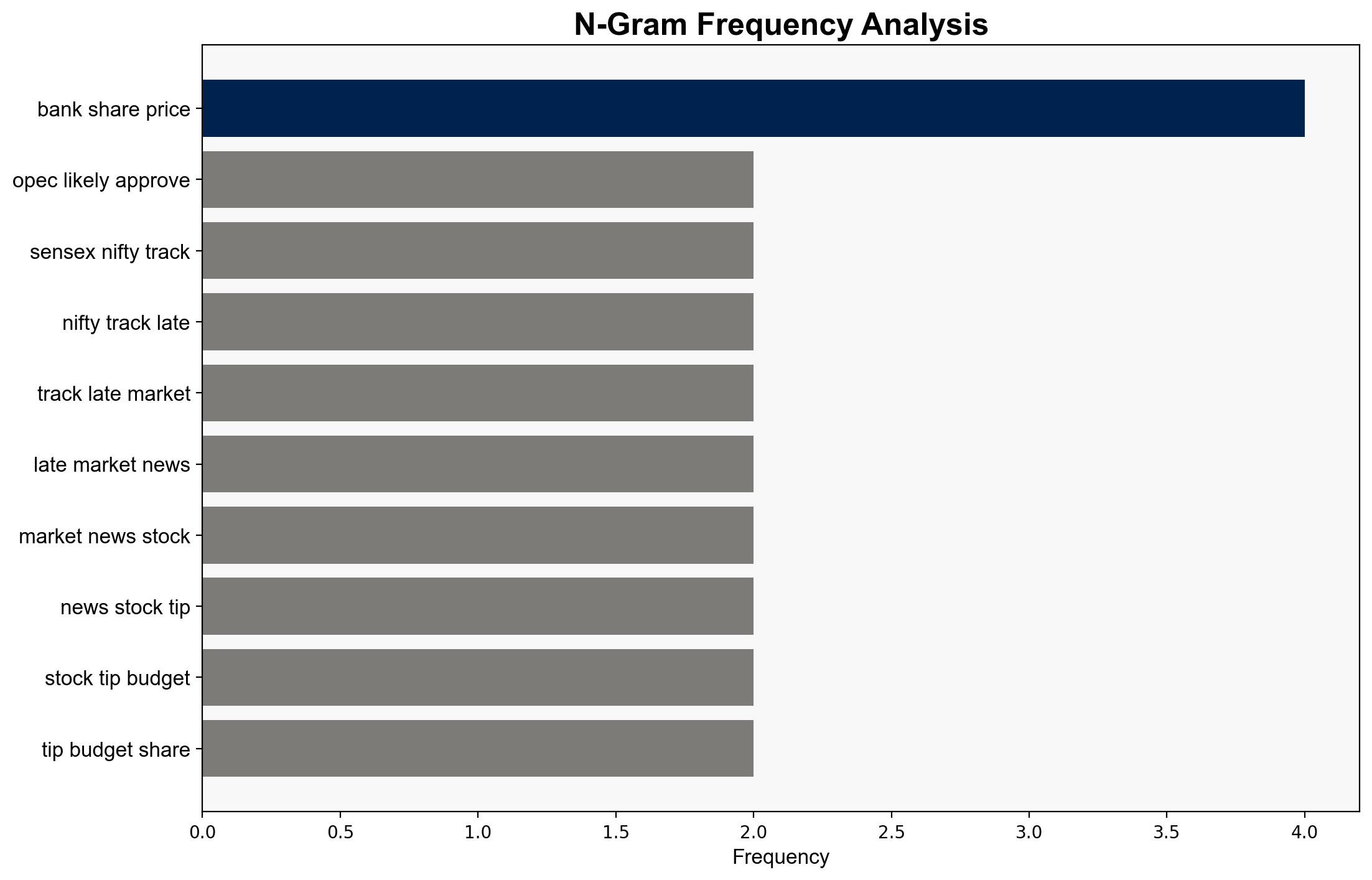

The most supported hypothesis is that OPEC’s decision to increase oil production will lead to a short-term decrease in oil prices, with a medium confidence level. This is based on the current market reaction and historical patterns of supply and demand dynamics. It is recommended to monitor geopolitical developments and potential disruptions in oil supply chains, particularly from regions like Iraq and Russia, to anticipate further market volatility.

2. Competing Hypotheses

1. **Hypothesis A**: OPEC’s decision to increase oil production will lead to a sustained decrease in oil prices due to oversupply in the market.

– **Supporting Evidence**: The immediate drop in oil prices following the announcement; historical precedence of price drops with increased production.

– **Contradictory Evidence**: Potential geopolitical disruptions that could limit supply, such as conflicts in the Middle East or sanctions on Russia.

2. **Hypothesis B**: The decrease in oil prices is temporary, and prices will rebound due to geopolitical tensions and potential supply disruptions.

– **Supporting Evidence**: Ongoing geopolitical tensions, such as Ukraine-Russia conflict and instability in the Middle East.

– **Contradictory Evidence**: Current market trends showing a decline in demand due to economic slowdowns in major economies.

3. Key Assumptions and Red Flags

– **Assumptions**: Assumes that OPEC’s production increase will be fully realized and that geopolitical tensions will not escalate further.

– **Red Flags**: Potential underestimation of geopolitical risks; reliance on historical patterns without accounting for new market dynamics such as renewable energy adoption.

– **Blind Spots**: Lack of detailed analysis on the impact of economic sanctions on oil-exporting countries.

4. Implications and Strategic Risks

– **Economic Risks**: A sustained drop in oil prices could impact economies heavily reliant on oil exports, leading to economic instability.

– **Geopolitical Risks**: Increased tensions in oil-producing regions could lead to supply disruptions, counteracting OPEC’s production increase.

– **Market Risks**: Volatility in oil prices could affect global financial markets, impacting investments and economic growth.

5. Recommendations and Outlook

- Monitor geopolitical developments closely, particularly in the Middle East and Eastern Europe, to anticipate potential supply disruptions.

- Engage with OPEC and key oil-producing countries to understand their production strategies and intentions.

- Prepare for scenario-based projections:

- **Best Case**: Stabilization of oil prices with minimal geopolitical disruptions.

- **Worst Case**: Escalation of geopolitical tensions leading to significant supply disruptions and price spikes.

- **Most Likely**: Short-term price volatility with gradual stabilization as markets adjust to new supply levels.

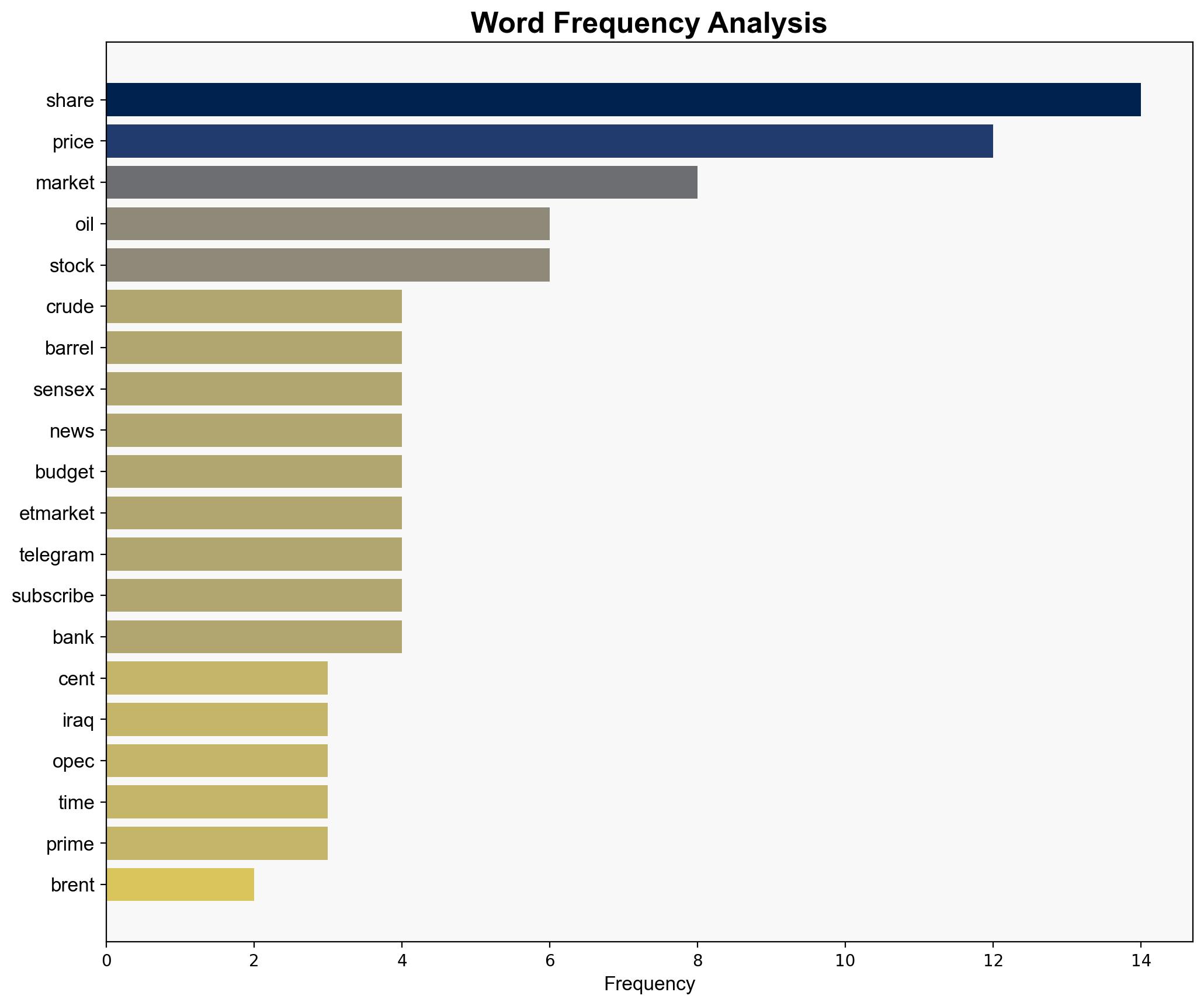

6. Key Individuals and Entities

– Tony Sycamore

– Ed Meir

– OPEC

– Kurdistan Regional Government

7. Thematic Tags

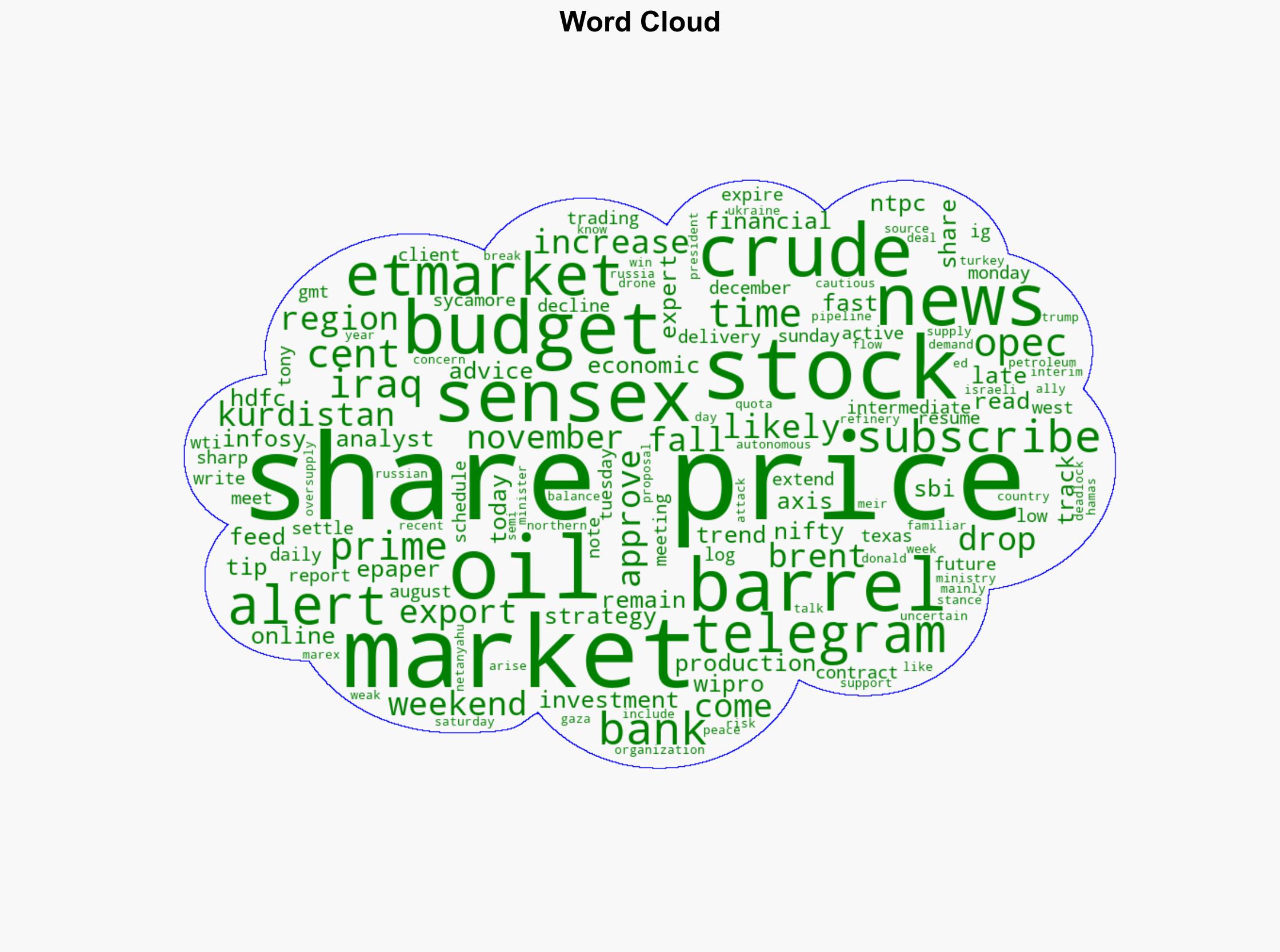

national security threats, economic stability, geopolitical tensions, energy markets