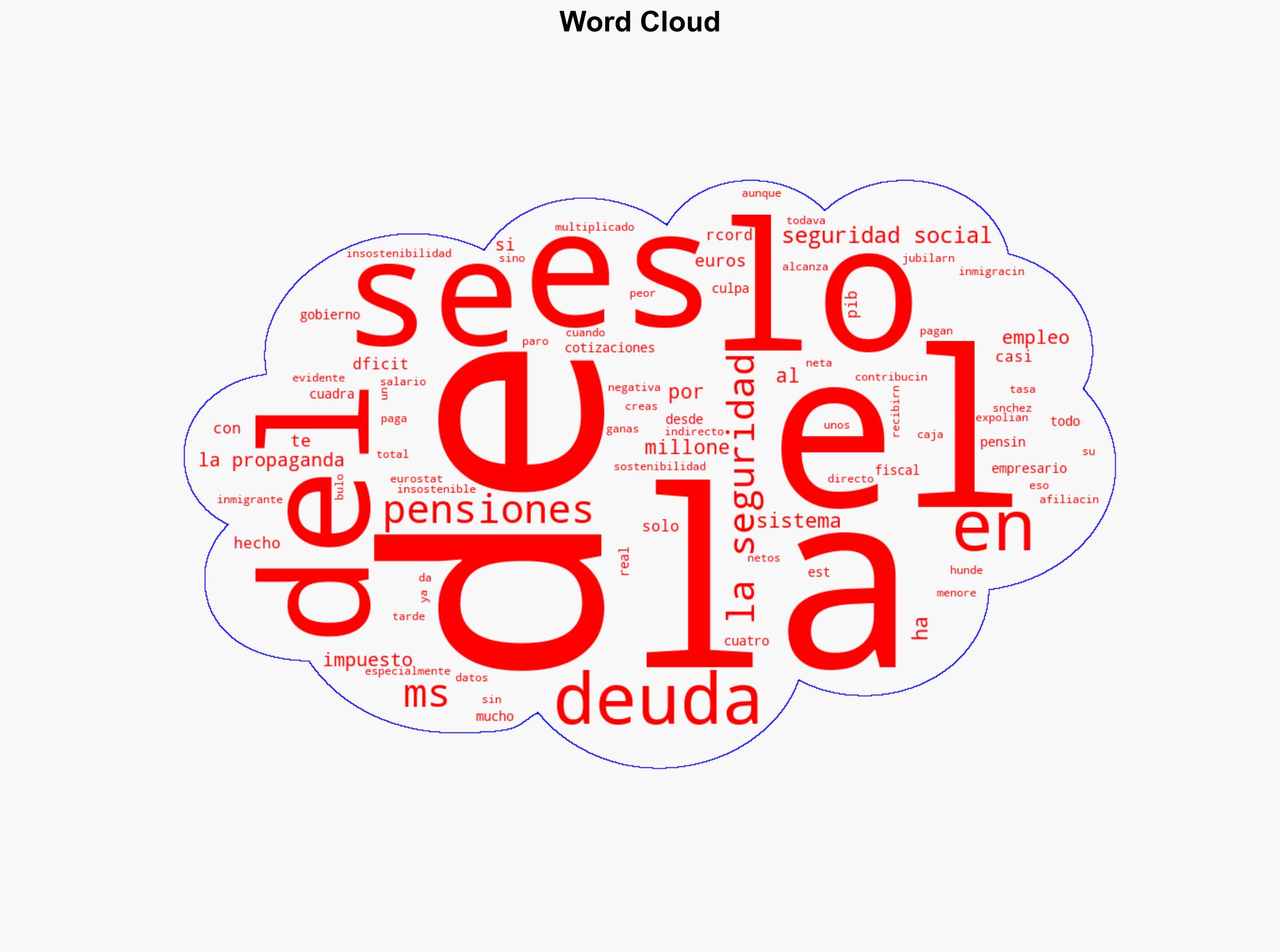

Un sistema de pensiones completamente insostenible – Elespanol.com

Published on: 2025-10-04

Intelligence Report: Un sistema de pensiones completamente insostenible – Elespanol.com

1. BLUF (Bottom Line Up Front)

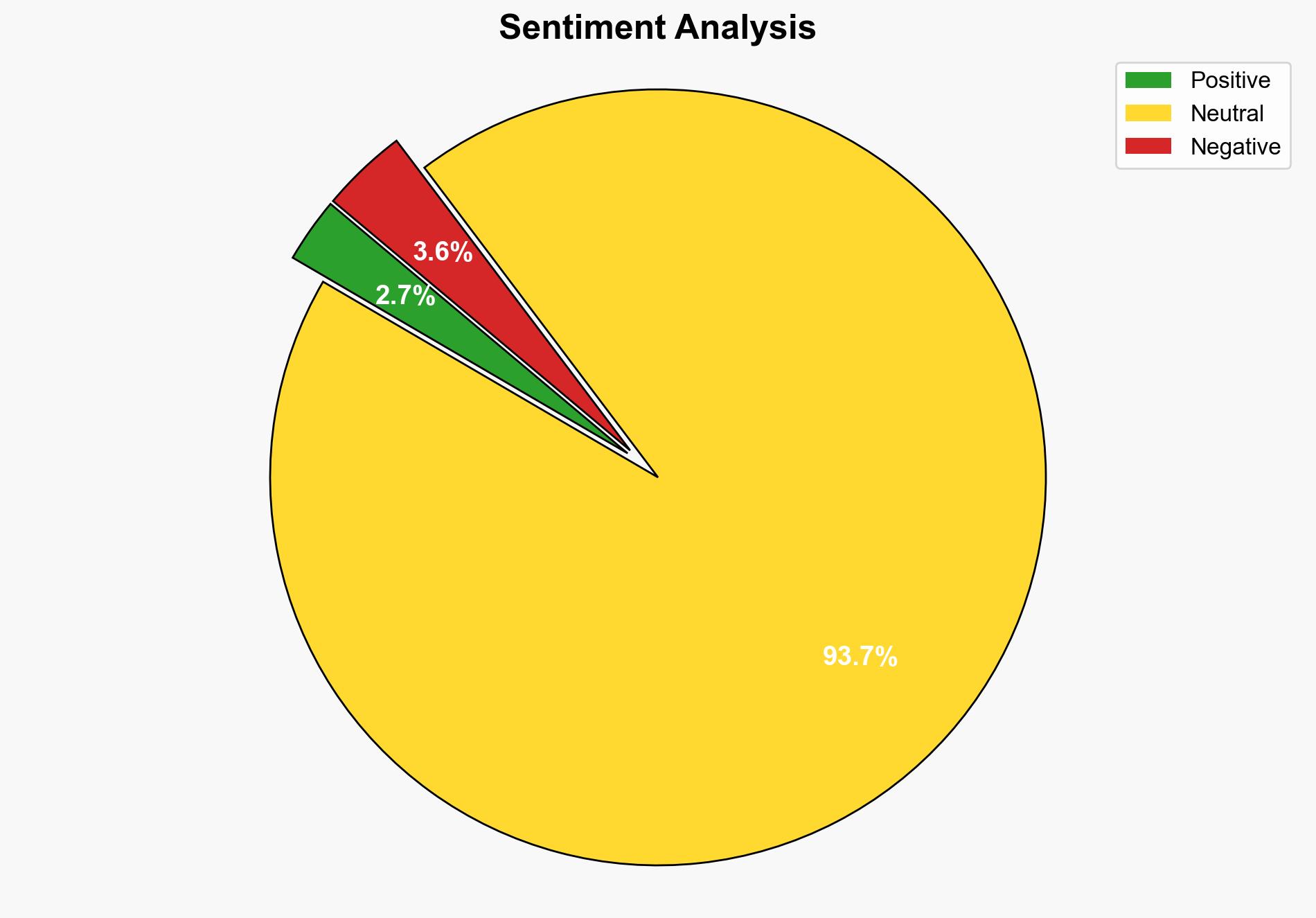

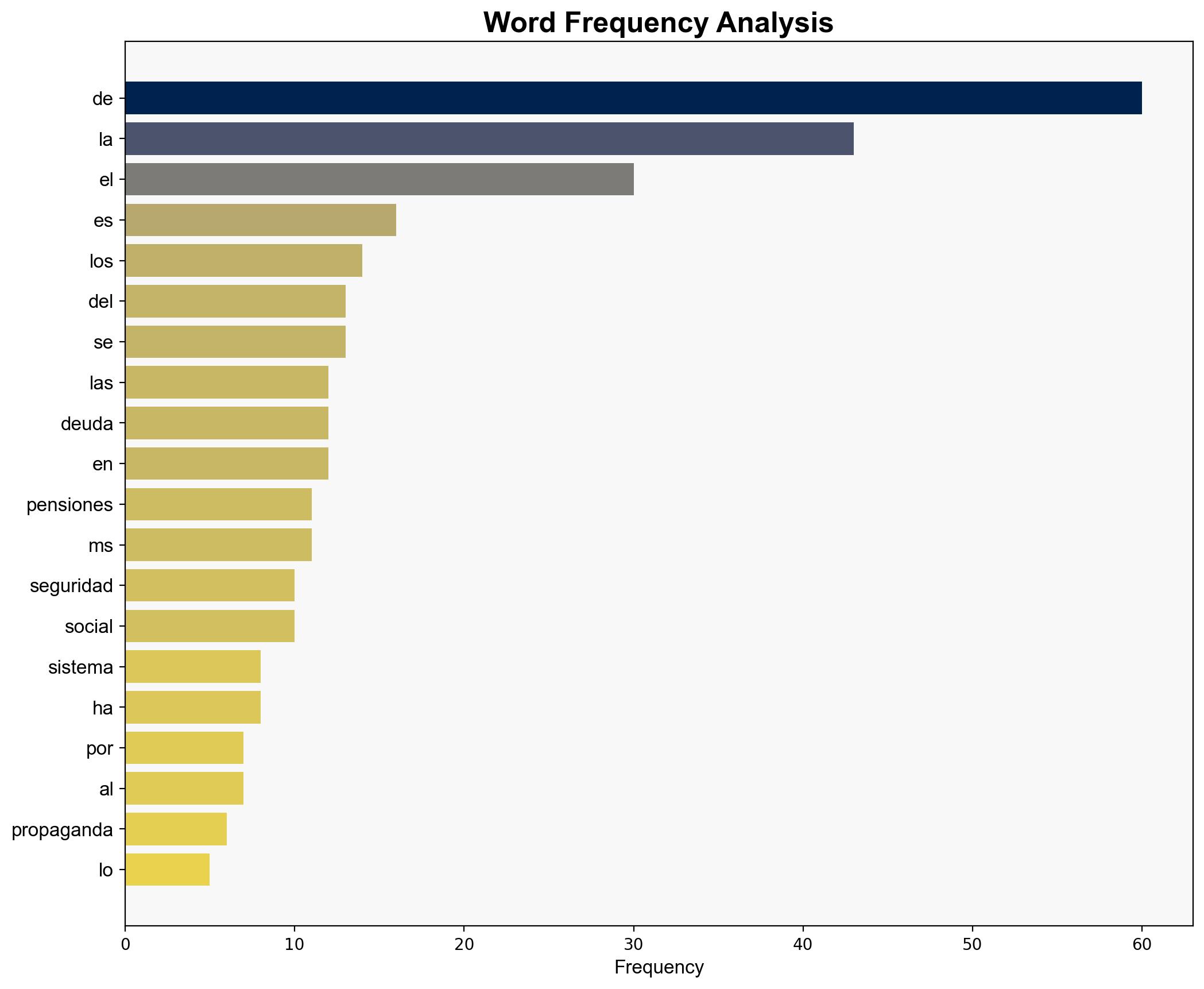

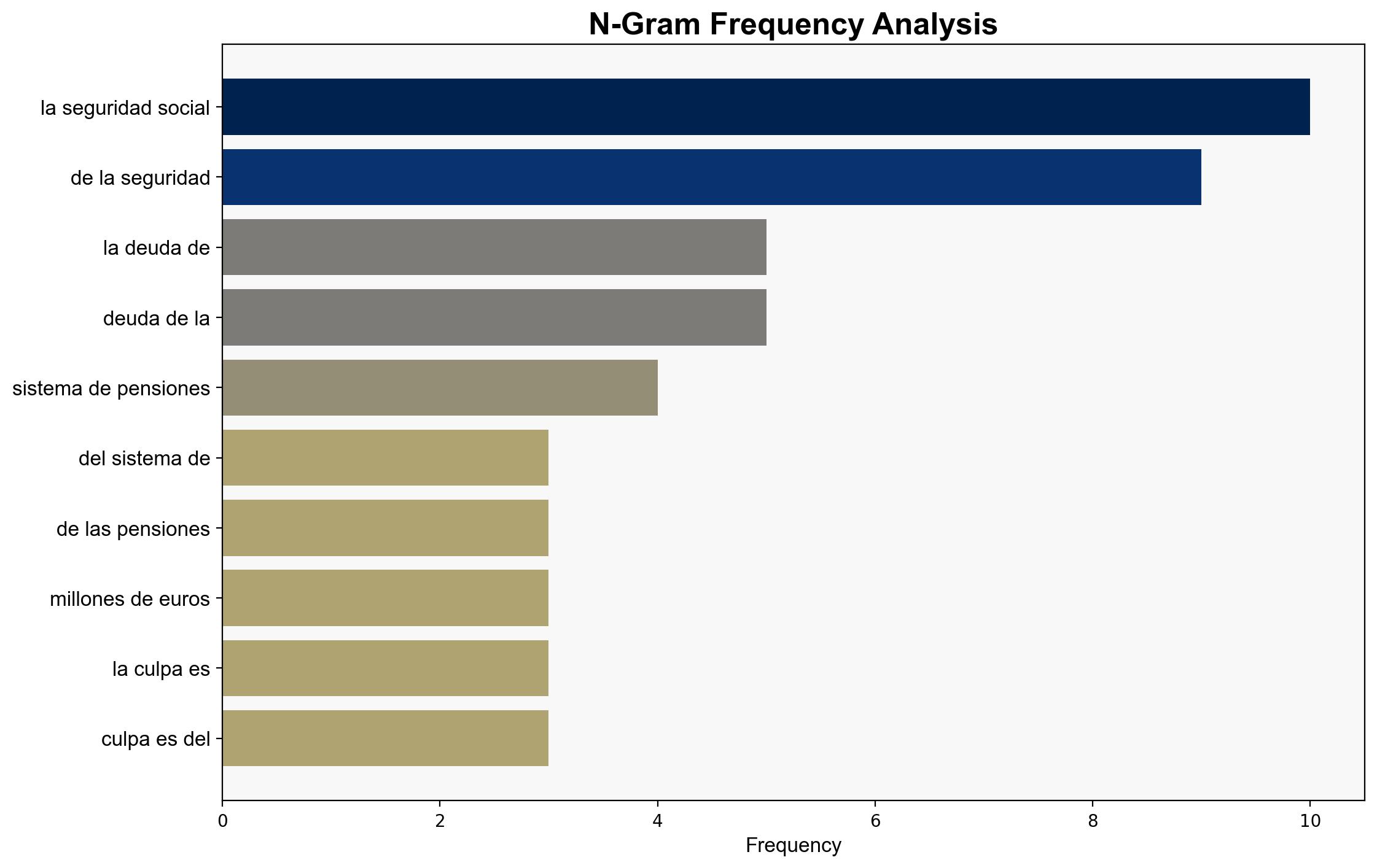

The analysis suggests that the Spanish pension system is facing significant sustainability challenges. The most supported hypothesis is that current policies are exacerbating the system’s financial instability. Confidence level: Moderate. Recommended action: Immediate policy review and reform to address structural deficits and demographic challenges.

2. Competing Hypotheses

1. **Hypothesis A**: The pension system’s sustainability issues are primarily due to policy decisions that have increased debt and fiscal pressure, making the system more unsustainable.

2. **Hypothesis B**: The sustainability issues are largely driven by demographic changes and economic factors, such as an aging population and insufficient economic growth, rather than policy decisions alone.

Using ACH 2.0, Hypothesis A is better supported by the evidence, which highlights increased debt and fiscal measures that have not addressed the core issues of the pension system.

3. Key Assumptions and Red Flags

– **Assumptions**: It is assumed that policy decisions directly impact the fiscal health of the pension system. Another assumption is that demographic trends are predictable and can be mitigated through policy.

– **Red Flags**: The reliance on debt to cover pension deficits is unsustainable. There is a potential bias in attributing blame solely to policy without considering broader economic factors.

– **Inconsistent Data**: Discrepancies in reported fiscal data and projections could indicate manipulation or misinterpretation of statistics.

4. Implications and Strategic Risks

– **Economic Risks**: Continued reliance on debt could lead to a fiscal crisis, affecting Spain’s broader economic stability.

– **Geopolitical Risks**: Economic instability may weaken Spain’s position in the EU and affect its ability to influence regional policies.

– **Social Risks**: Increasing taxes and reducing benefits could lead to public unrest and decreased trust in government institutions.

5. Recommendations and Outlook

- Conduct a comprehensive review of pension policies to identify and implement sustainable reforms.

- Explore alternative funding mechanisms, such as public-private partnerships, to reduce reliance on debt.

- Scenario Projections:

- **Best Case**: Successful reform leads to a balanced pension system with sustainable funding.

- **Worst Case**: Failure to reform results in a fiscal crisis and significant social unrest.

- **Most Likely**: Partial reforms provide temporary relief but do not fully address long-term sustainability.

6. Key Individuals and Entities

– **Pedro Sánchez**: Mentioned in the context of policy decisions impacting the pension system.

– **Instituto Juan de Mariana**: Cited for highlighting the fiscal challenges of the pension system.

7. Thematic Tags

economic stability, fiscal policy, demographic challenges, public finance