Robust consumption bulwark against external shocks FM Sitharaman – The Times of India

Published on: 2025-10-04

Intelligence Report: Robust consumption bulwark against external shocks FM Sitharaman – The Times of India

1. BLUF (Bottom Line Up Front)

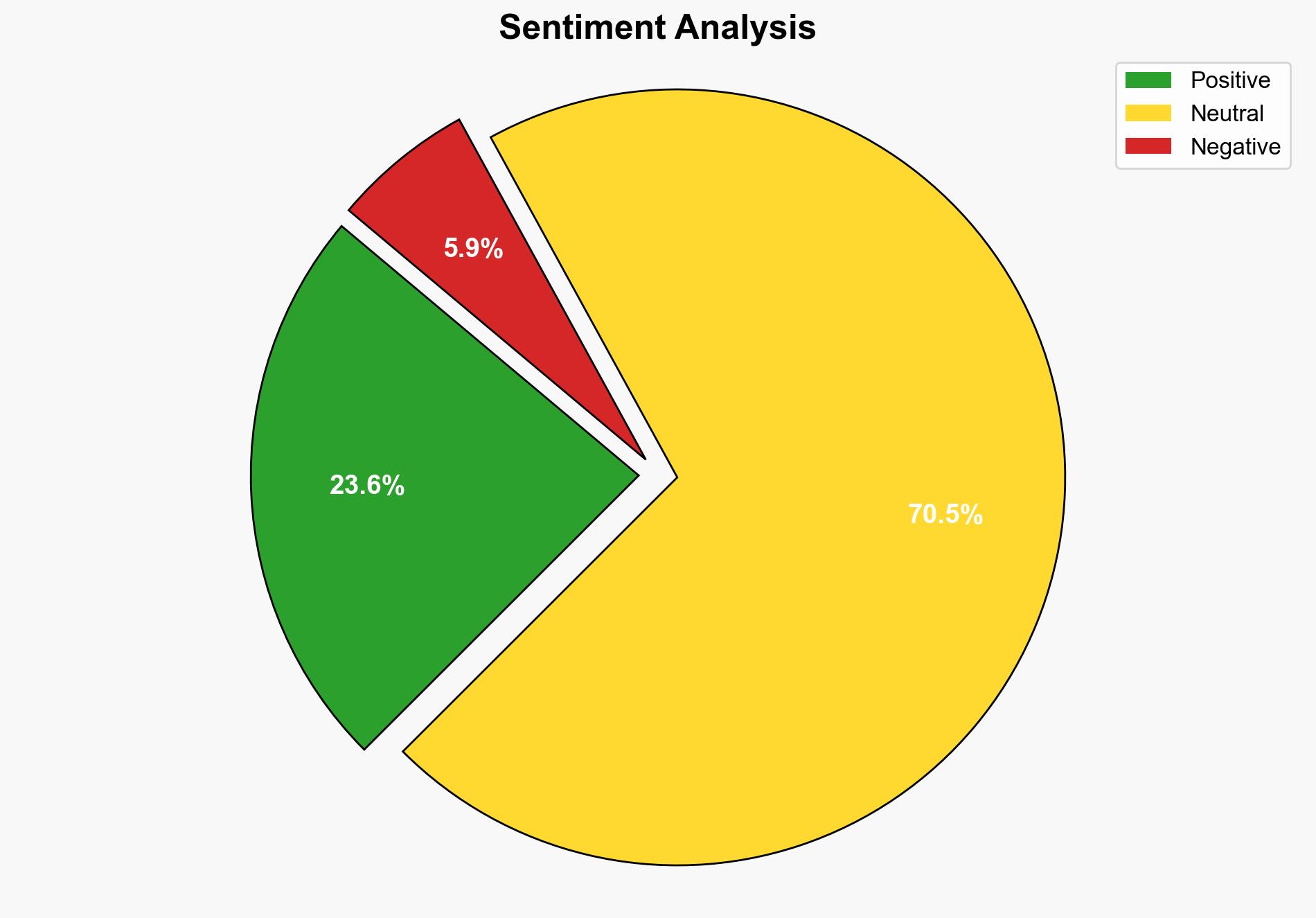

The most supported hypothesis is that India is strategically positioning itself to mitigate external economic shocks through domestic consumption and strategic reforms. This is supported by the emphasis on fiscal consolidation, capital expenditure, and economic reforms. Confidence Level: Moderate. Recommended action includes enhancing domestic economic policies and fostering international partnerships to strengthen resilience.

2. Competing Hypotheses

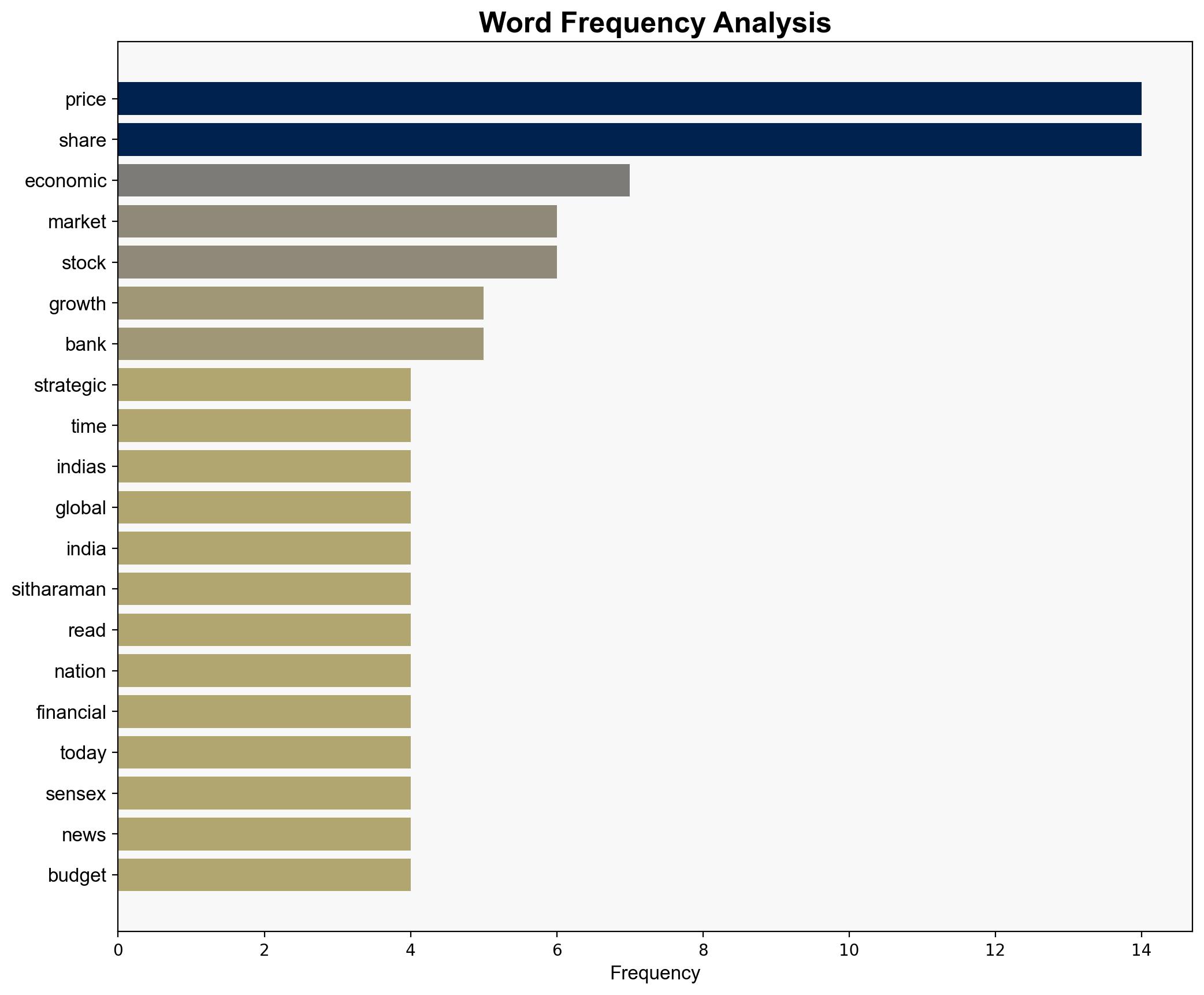

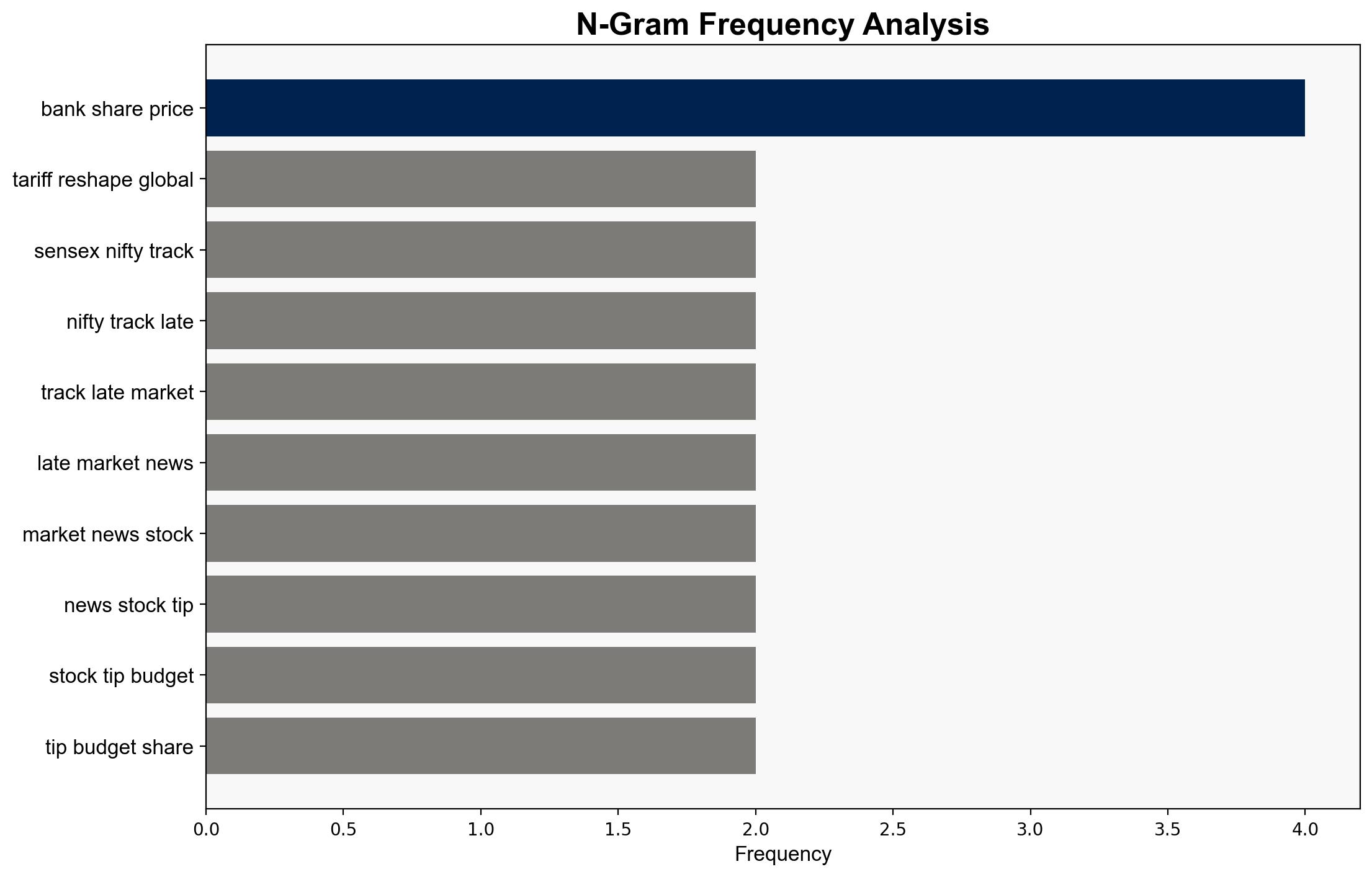

1. **Hypothesis A**: India is effectively using domestic consumption and strategic reforms to shield its economy from external shocks. This includes fiscal consolidation, capital expenditure, and reforms aimed at improving business ease and financial inclusion.

2. **Hypothesis B**: India’s economic resilience is overstated, and the country remains vulnerable to external shocks due to geopolitical tensions, tariffs, and global supply chain disruptions. The reforms and domestic consumption are insufficient to fully insulate the economy.

Using ACH 2.0, Hypothesis A is better supported due to the detailed mention of strategic reforms and economic indicators showing growth, such as the RBI’s projections and recent GDP growth figures.

3. Key Assumptions and Red Flags

– **Assumptions**: Hypothesis A assumes that domestic consumption and reforms are sufficient to counteract external pressures. Hypothesis B assumes that external factors will outweigh domestic efforts.

– **Red Flags**: The potential over-reliance on domestic consumption as a buffer without addressing external dependencies. Lack of detailed data on how reforms directly mitigate specific external threats.

– **Blind Spots**: The impact of global financial system innovations, like stablecoins, on India’s economic strategy is not fully explored.

4. Implications and Strategic Risks

– **Economic Risks**: Continued geopolitical tensions and tariff impositions could disrupt India’s growth trajectory despite domestic efforts.

– **Geopolitical Risks**: Strategic independence may be challenged by global alliances and economic pressures.

– **Cascading Threats**: Failure to adapt to global financial innovations could lead to exclusion from emerging monetary architectures, impacting economic stability.

5. Recommendations and Outlook

- Enhance domestic economic policies to further strengthen resilience against external shocks.

- Foster international partnerships to diversify economic dependencies and mitigate geopolitical risks.

- Scenario Projections:

- Best: Successful adaptation to global financial changes, leading to robust economic growth.

- Worst: Geopolitical tensions and tariff wars severely impact economic stability.

- Most Likely: Moderate growth with ongoing challenges from external pressures.

6. Key Individuals and Entities

– Nirmala Sitharaman (Finance Minister of India)

– Reserve Bank of India (RBI)

7. Thematic Tags

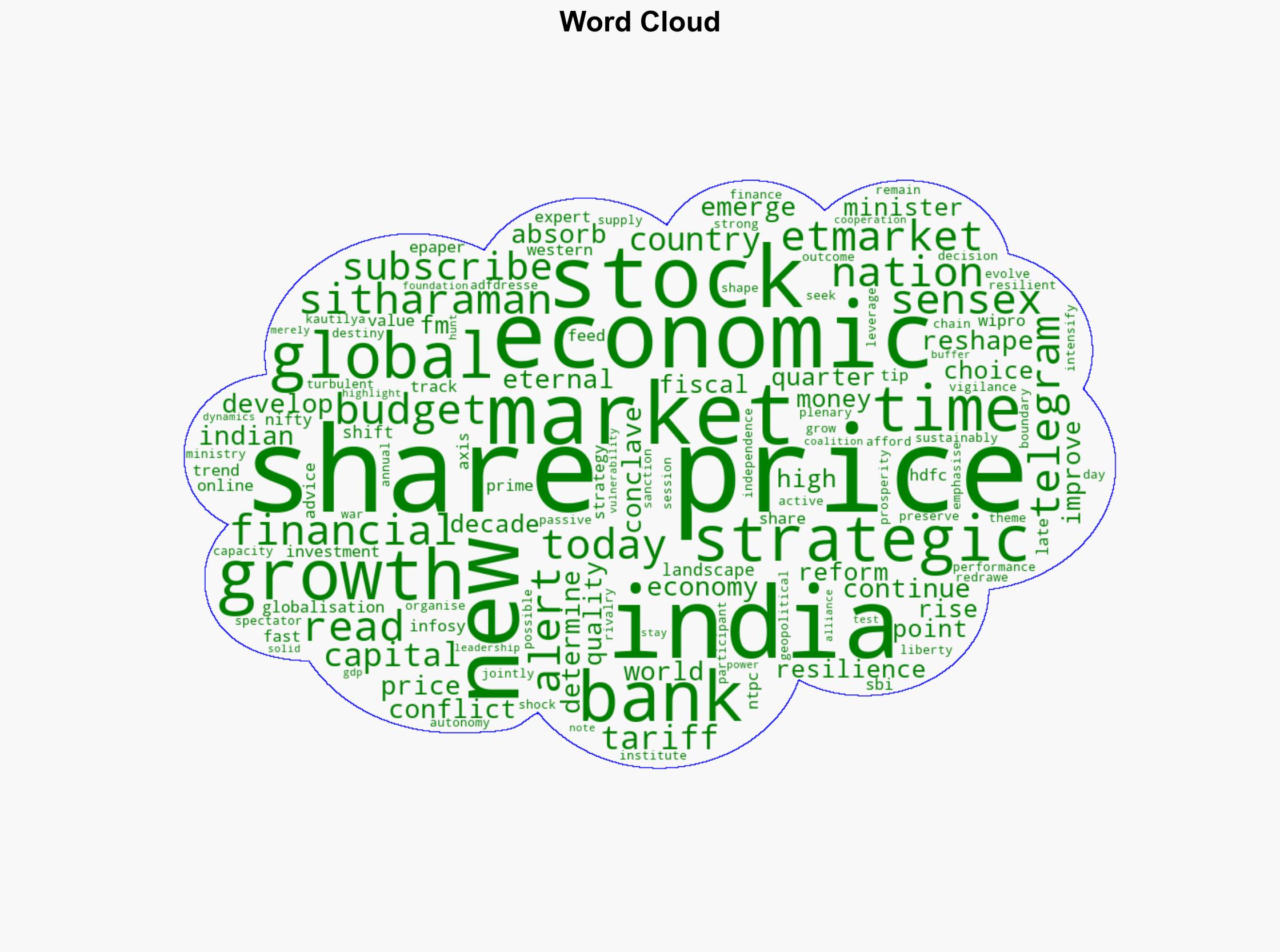

national security threats, economic resilience, geopolitical strategy, fiscal policy