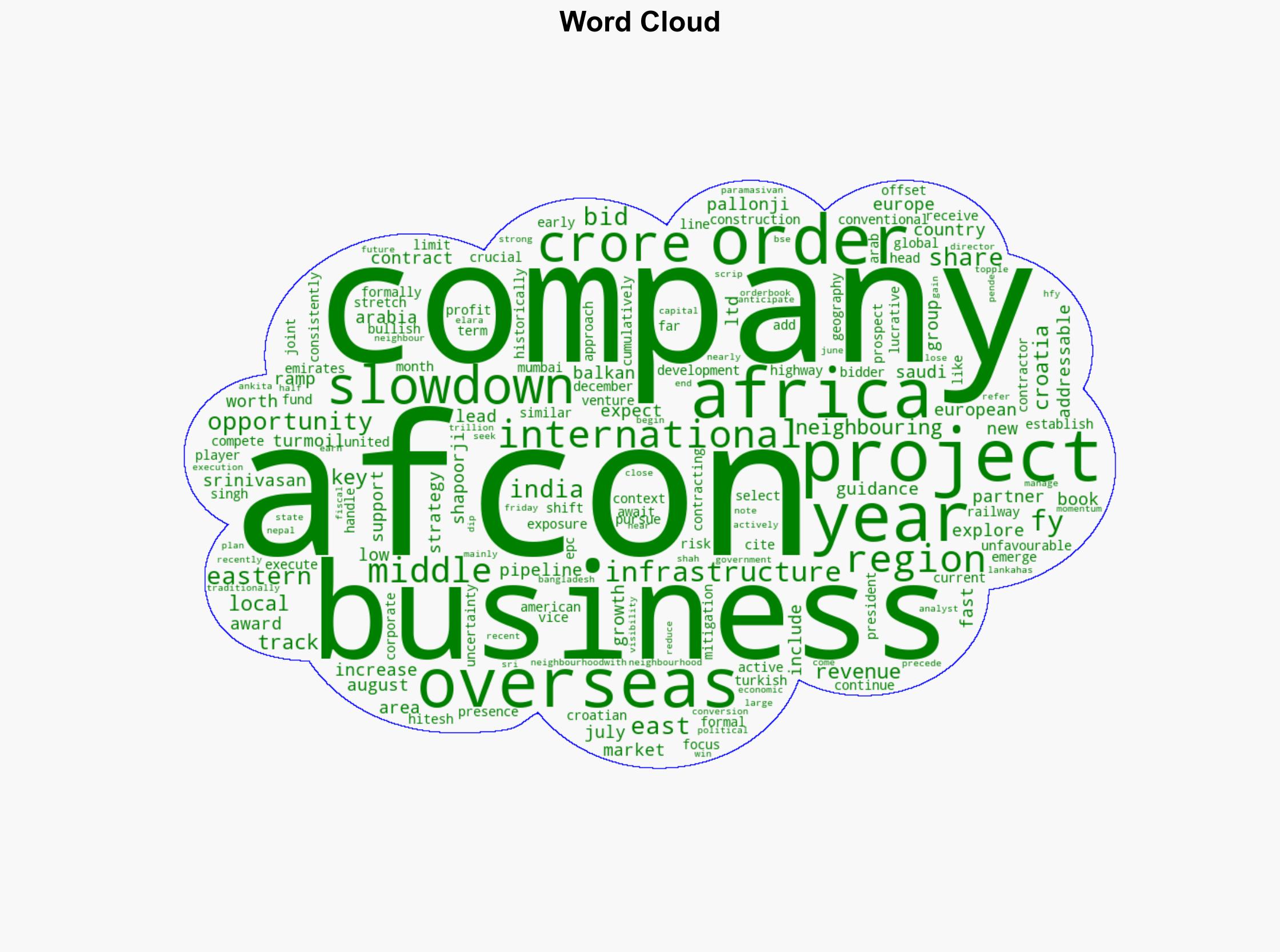

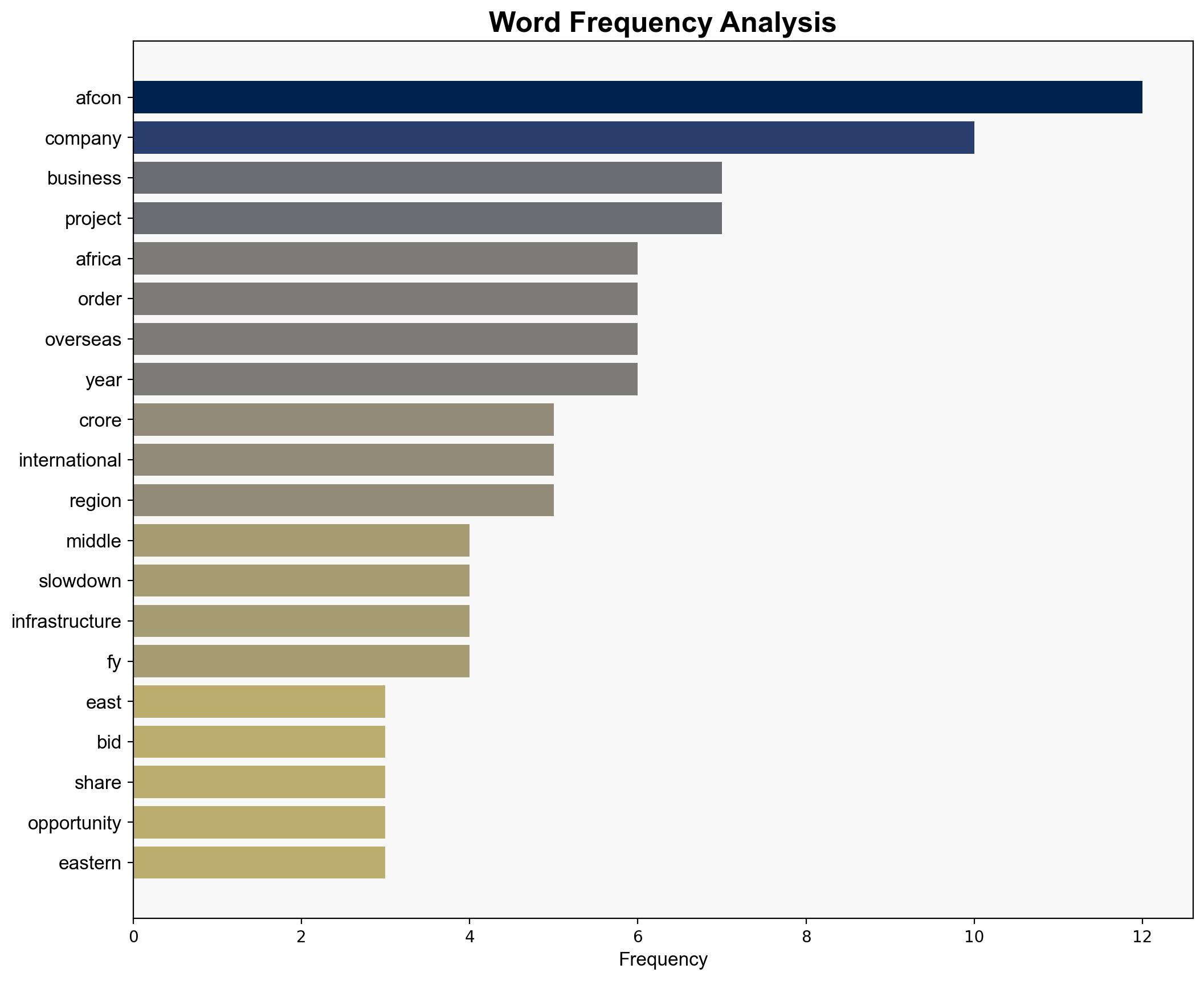

Afcons shifts focus to Europe Middle East amid Africa slowdown – Livemint

Published on: 2025-10-06

Intelligence Report: Afcons shifts focus to Europe Middle East amid Africa slowdown – Livemint

1. BLUF (Bottom Line Up Front)

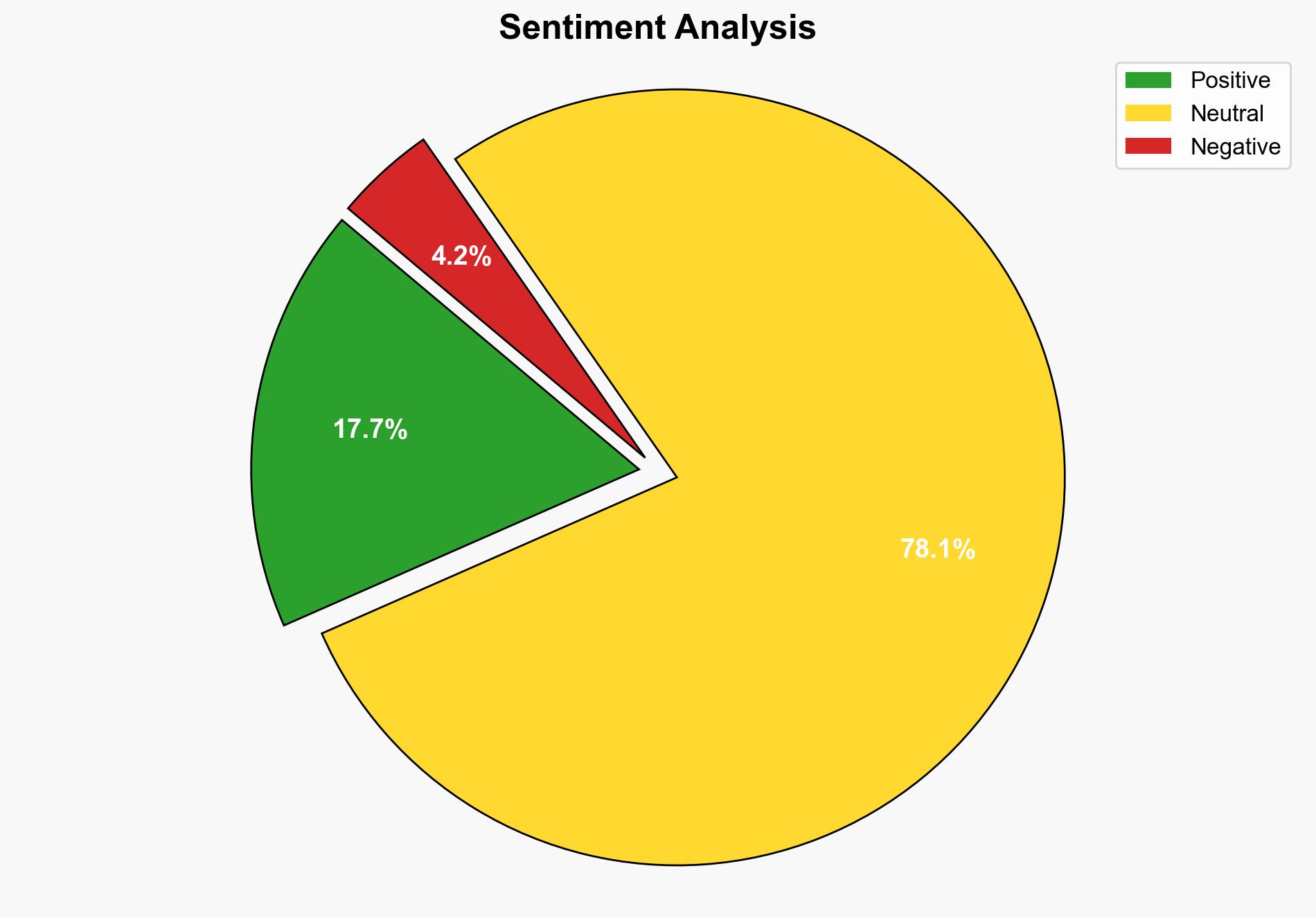

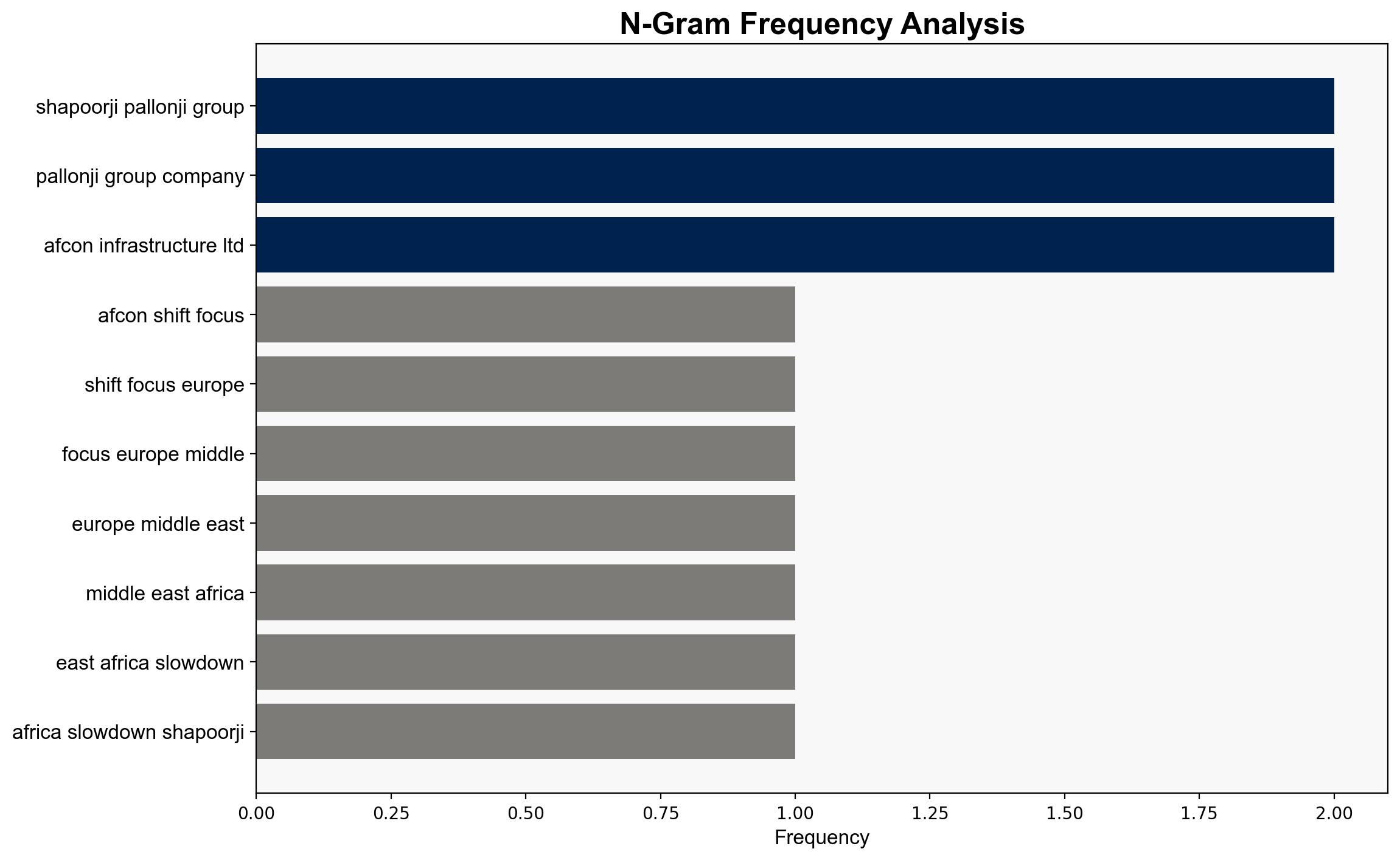

Afcons Infrastructure Ltd is strategically pivoting towards Europe and the Middle East due to a slowdown in Africa and political instability in neighboring regions. The most supported hypothesis is that Afcons aims to diversify its international portfolio to mitigate risks associated with over-reliance on unstable markets. Confidence Level: Moderate. Recommended action: Afcons should strengthen partnerships in Europe and the Middle East while maintaining flexibility to re-enter African markets when conditions improve.

2. Competing Hypotheses

Hypothesis 1: Afcons is shifting focus to Europe and the Middle East primarily to diversify its market presence and reduce dependency on Africa and neighboring regions, which are experiencing economic and political instability.

Hypothesis 2: The shift is a strategic move to capitalize on emerging opportunities in Europe and the Middle East, driven by lucrative contracts and favorable business conditions, rather than solely as a risk mitigation strategy.

Using the Analysis of Competing Hypotheses (ACH) 2.0, Hypothesis 1 is better supported by the evidence of Africa’s slowdown and political turmoil in neighboring regions, as well as Afcons’ historical strategy of seeking new markets to offset regional downturns.

3. Key Assumptions and Red Flags

Assumptions include the belief that political and economic instability in Africa and neighboring regions will persist, and that Europe and the Middle East will continue to offer stable and profitable opportunities. A red flag is the potential underestimation of competition in the European market from established players. There is also a blind spot regarding the potential for rapid stabilization in African markets, which could alter the strategic landscape.

4. Implications and Strategic Risks

The shift could lead to increased competition in Europe and the Middle East, potentially affecting profit margins. There is a risk of overextending resources in unfamiliar markets. Geopolitical tensions in the Middle East could pose additional risks. A successful pivot could enhance Afcons’ global standing, but failure to adapt to new market dynamics could result in financial setbacks.

5. Recommendations and Outlook

- Afcons should conduct thorough market analysis and risk assessments in Europe and the Middle East to ensure strategic alignment and resource allocation.

- Develop contingency plans for potential geopolitical disruptions in the Middle East.

- Scenario-based projections:

- Best Case: Successful market entry leads to increased revenue and market share.

- Worst Case: Overextension leads to financial strain and loss of competitive edge.

- Most Likely: Moderate success with gradual market penetration and revenue growth.

6. Key Individuals and Entities

Hitesh Singh, Paramasivan Srinivasan, Shapoorji Pallonji Group, Afcons Infrastructure Ltd.

7. Thematic Tags

international business strategy, market diversification, geopolitical risk, infrastructure development