India Well-Positioned For Equity Upside Bitcoin Gold Strong Hedge Says BlackRock’s Ben Powell – Ndtvprofit.com

Published on: 2025-10-06

Intelligence Report: India Well-Positioned For Equity Upside Bitcoin Gold Strong Hedge Says BlackRock’s Ben Powell – Ndtvprofit.com

1. BLUF (Bottom Line Up Front)

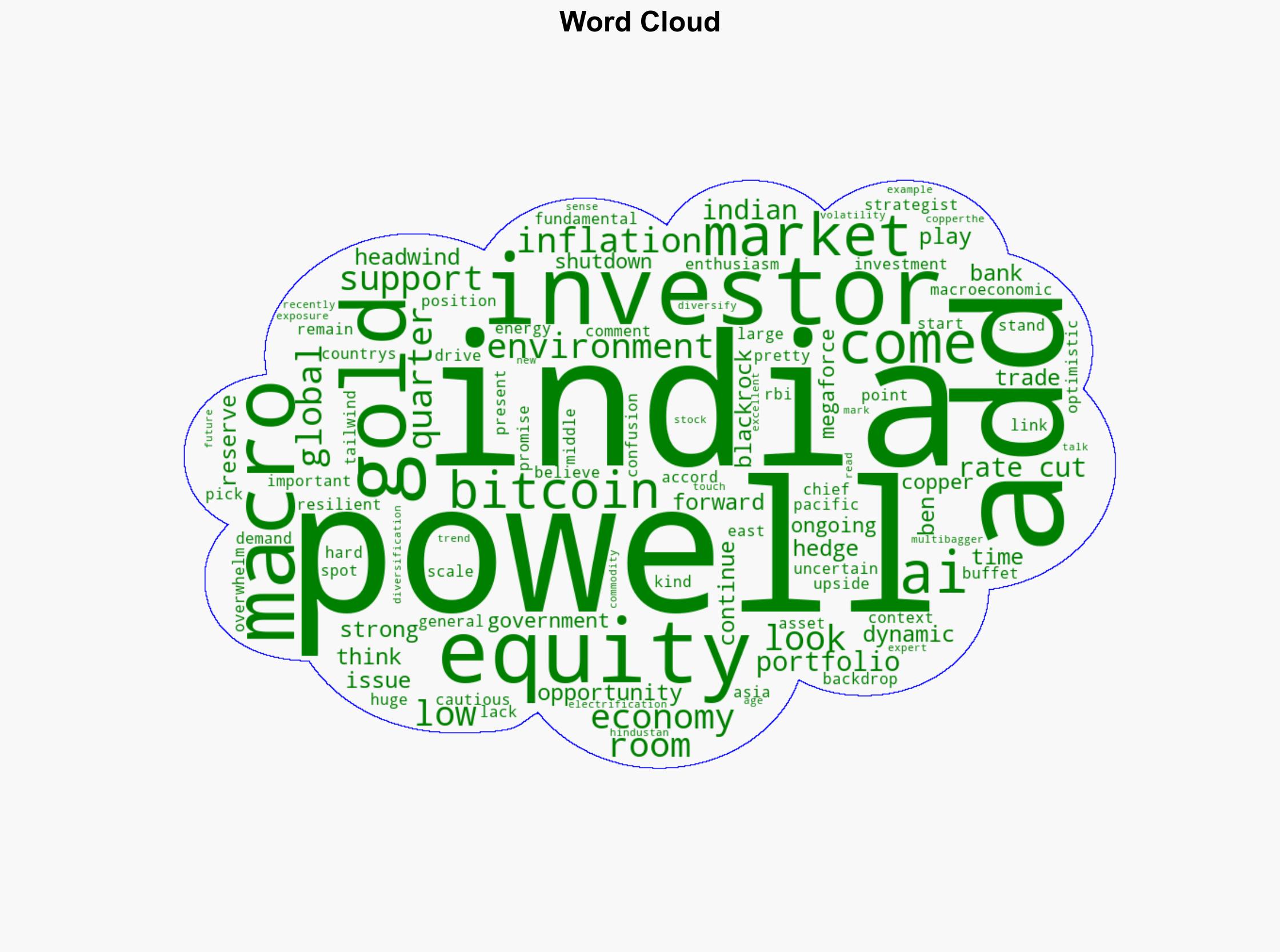

India’s macroeconomic environment, characterized by low inflation and potential rate cuts, presents a promising opportunity for equity investment. This is supported by BlackRock’s Ben Powell, who also highlights the strategic value of diversifying portfolios with assets like gold and Bitcoin. The most supported hypothesis is that India’s economic fundamentals will attract increased investor interest, despite global uncertainties. Confidence Level: Moderate. Recommended Action: Monitor India’s policy changes and global economic trends to optimize investment strategies.

2. Competing Hypotheses

1. **Hypothesis A**: India’s strong macroeconomic fundamentals and potential for rate cuts will lead to significant equity market growth, attracting global investors.

2. **Hypothesis B**: Despite India’s promising economic indicators, global trade dynamics and investor caution will limit substantial equity market growth in the near term.

Using Bayesian Scenario Modeling, Hypothesis A is more supported due to the explicit mention of low inflation and potential rate cuts, which are strong indicators of economic growth. Hypothesis B, while plausible, lacks specific counter-evidence in the source.

3. Key Assumptions and Red Flags

– **Assumptions**: The assumption that low inflation and potential rate cuts will directly translate to equity market growth. Assumes global investors will prioritize India’s market over others.

– **Red Flags**: Lack of detailed analysis on how global trade dynamics might counteract India’s economic strengths. No mention of potential geopolitical risks or domestic policy changes that could affect the market.

4. Implications and Strategic Risks

– **Economic**: If India’s economic policies align with Powell’s outlook, there could be a significant influx of foreign investment, boosting the equity market.

– **Geopolitical**: Unforeseen geopolitical tensions or trade disputes could undermine investor confidence.

– **Psychological**: Investor sentiment may be swayed by global economic narratives, overshadowing India’s positive indicators.

5. Recommendations and Outlook

- Monitor Reserve Bank of India’s policy announcements for rate cuts and adjust investment strategies accordingly.

- Consider diversifying portfolios with gold and Bitcoin as hedges against volatility.

- Scenario Projections:

- Best: Rapid equity market growth driven by favorable economic policies and investor confidence.

- Worst: Global economic downturn negates India’s economic advantages, leading to stagnant or declining equity markets.

- Most Likely: Moderate growth in India’s equity market, tempered by cautious global investor sentiment.

6. Key Individuals and Entities

– Ben Powell

– BlackRock

7. Thematic Tags

economic growth, investment strategy, global trade dynamics, portfolio diversification