Stable crude oil prices increasing refinery margins in third quarter of 2025 – Eia.gov

Published on: 2025-10-06

Intelligence Report: Stable crude oil prices increasing refinery margins in third quarter of 2025 – Eia.gov

1. BLUF (Bottom Line Up Front)

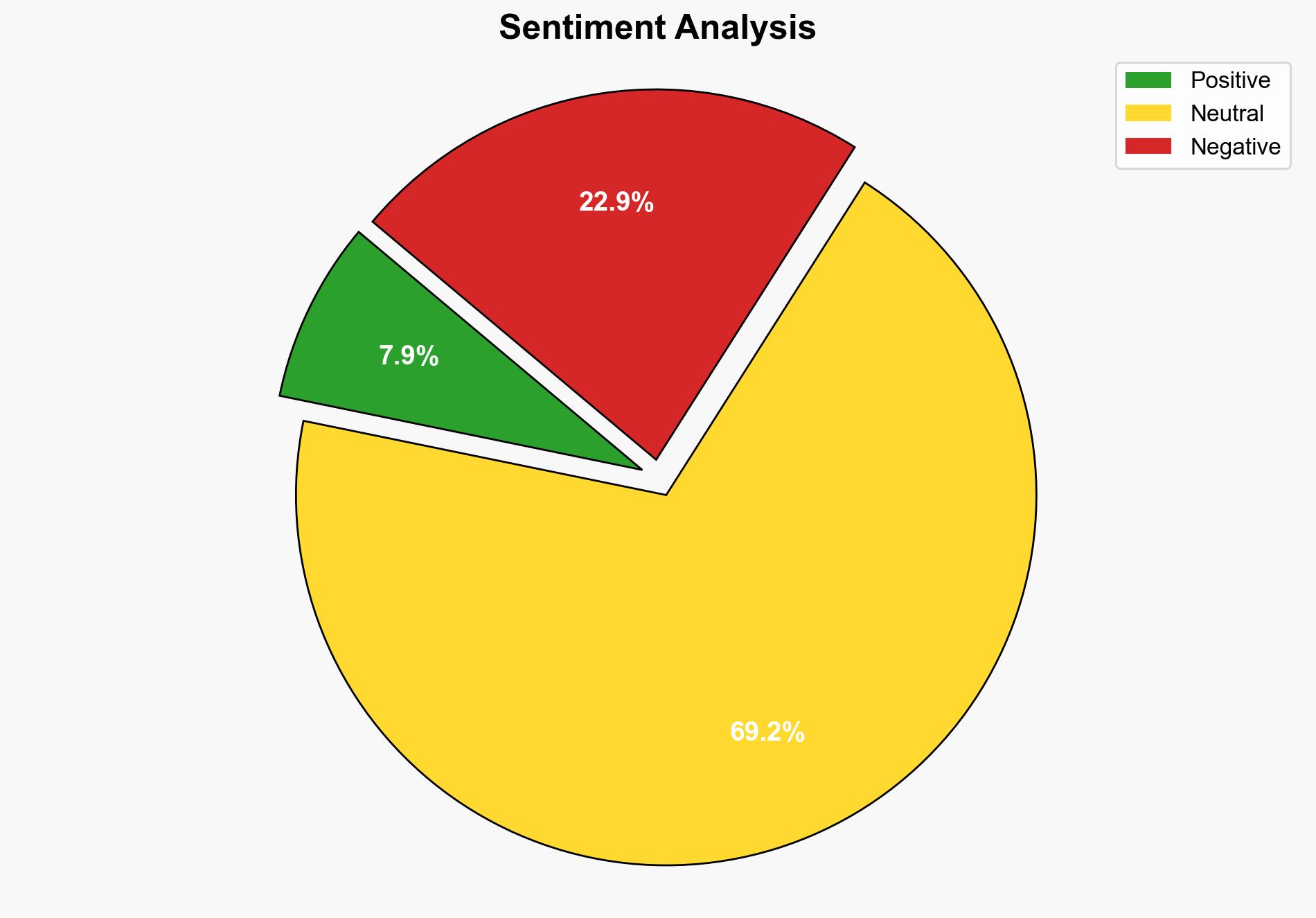

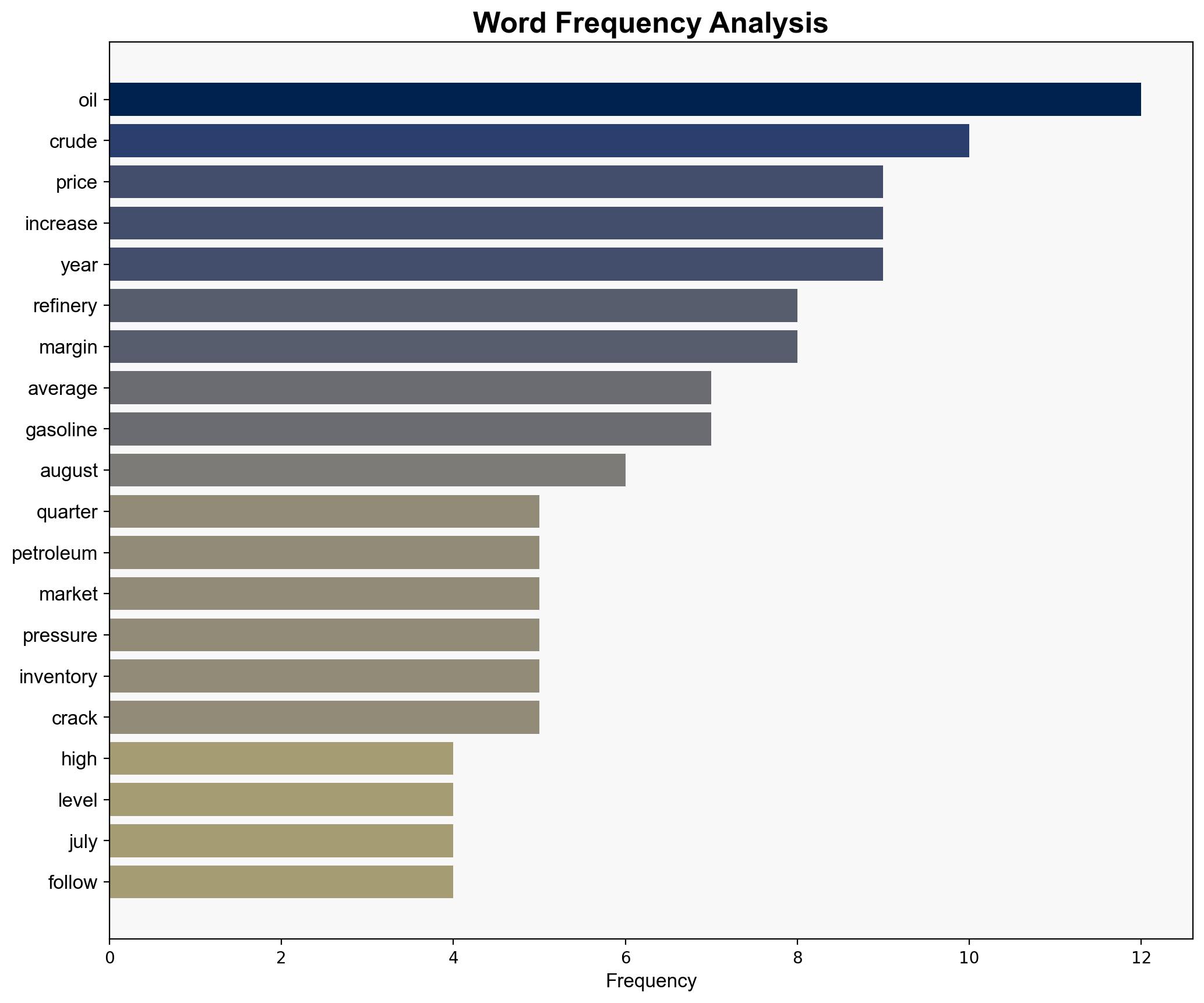

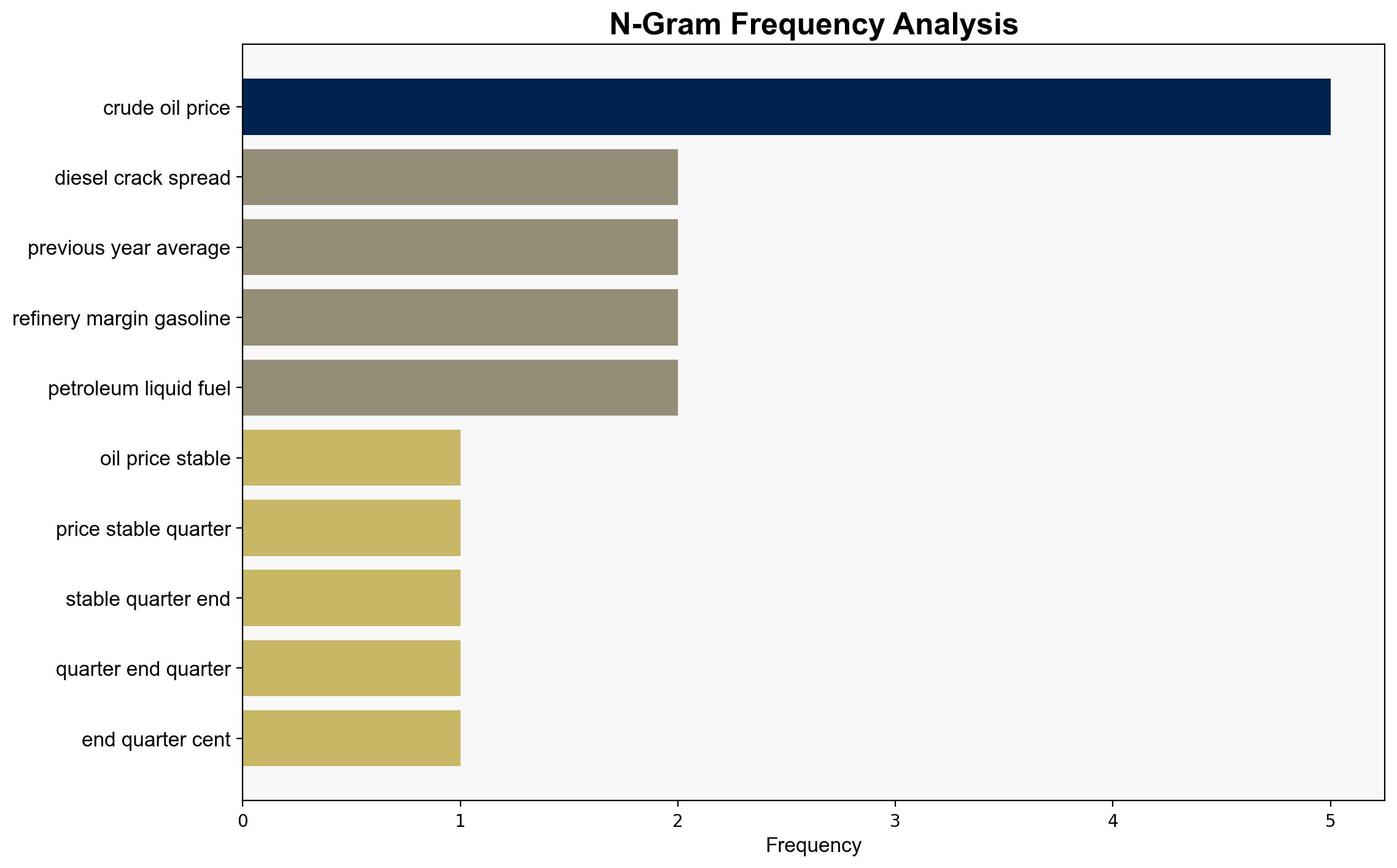

The analysis suggests that stable crude oil prices, despite geopolitical tensions, have led to increased refinery margins in the third quarter of 2025. The most supported hypothesis is that geopolitical factors and strategic production adjustments by OPEC are maintaining price stability, which benefits refinery margins. Confidence level: Moderate. Recommended action: Monitor geopolitical developments and OPEC production strategies closely to anticipate shifts in crude oil prices and refinery margins.

2. Competing Hypotheses

1. **Hypothesis A**: Stable crude oil prices are primarily due to OPEC’s strategic production increases, which offset geopolitical tensions and maintain market balance. This stability has allowed refinery margins to increase.

2. **Hypothesis B**: The increase in refinery margins is mainly due to geopolitical tensions causing disruptions in supply chains, leading to temporary price stability and increased margins as refineries capitalize on market volatility.

Using ACH 2.0, Hypothesis A is better supported as OPEC’s production adjustments are a deliberate strategy to counteract geopolitical tensions, whereas Hypothesis B assumes instability that is not fully reflected in the current price stability.

3. Key Assumptions and Red Flags

– **Assumptions**:

– OPEC has the capacity and willingness to adjust production effectively.

– Geopolitical tensions will not escalate to disrupt global supply significantly.

– **Red Flags**:

– Potential underestimation of geopolitical risks, such as further escalations in the Middle East or Russia-Ukraine conflict.

– Overreliance on OPEC’s ability to stabilize prices amid diverse geopolitical pressures.

4. Implications and Strategic Risks

– **Economic**: Stable crude prices support refinery profitability but may mask underlying vulnerabilities in the supply chain.

– **Geopolitical**: Continued tensions in the Middle East and Eastern Europe could lead to sudden market disruptions.

– **Psychological**: Market confidence may be fragile, with rapid shifts in sentiment possible if geopolitical tensions escalate.

5. Recommendations and Outlook

- Enhance monitoring of geopolitical developments, particularly in the Middle East and Eastern Europe, to anticipate potential disruptions.

- Engage with OPEC members to understand future production strategies and potential impacts on global oil prices.

- Scenario-based projections:

- Best: Continued price stability with gradual margin increases.

- Worst: Major geopolitical escalation leading to significant supply disruptions and price volatility.

- Most Likely: Moderate price stability with periodic fluctuations due to geopolitical developments.

6. Key Individuals and Entities

– OPEC member states

– Geopolitical actors in the Middle East and Eastern Europe

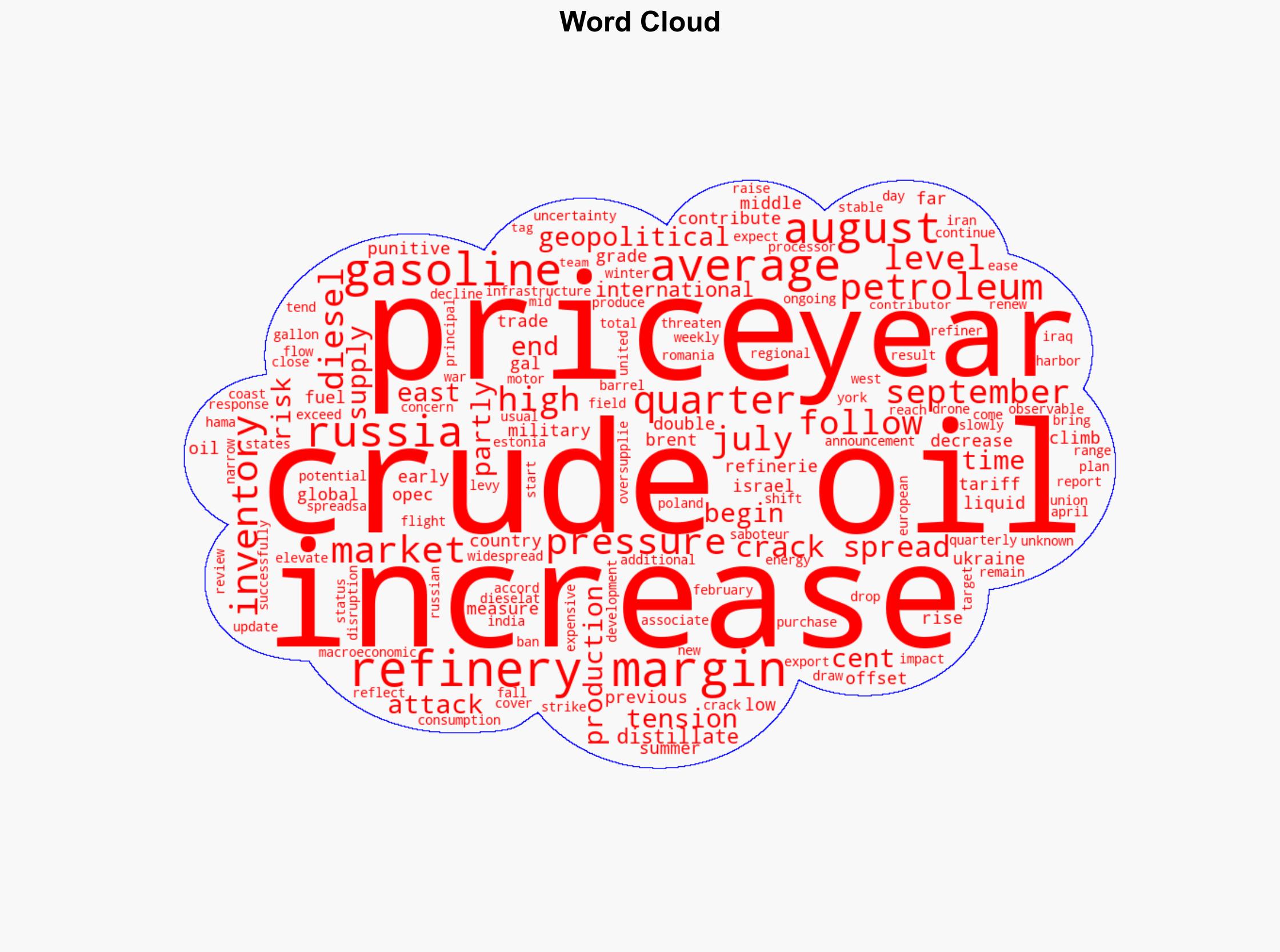

7. Thematic Tags

national security threats, geopolitical stability, energy market dynamics, OPEC strategies