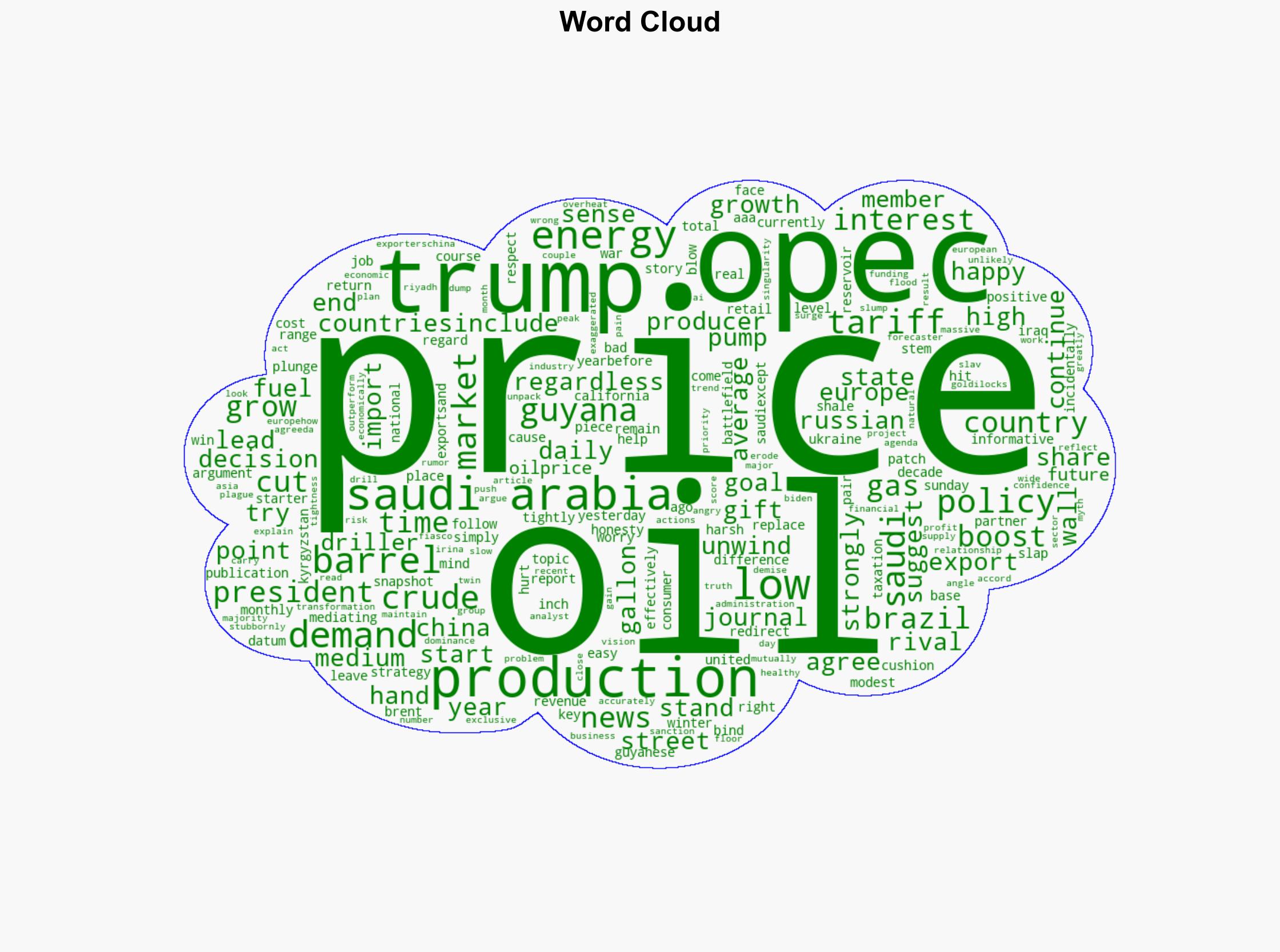

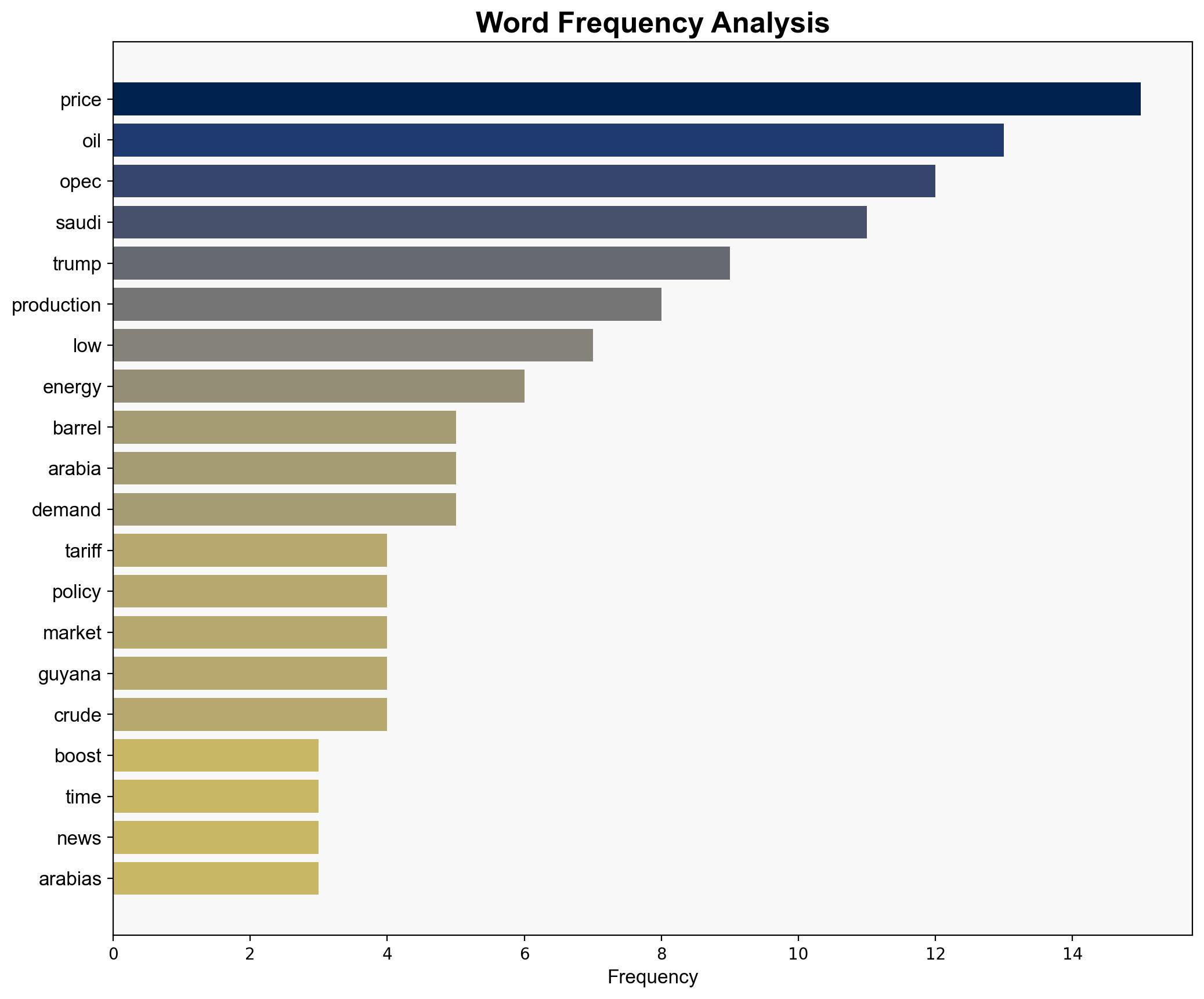

Low Oil Prices Saudi Gift to Trump or Ticking Bomb – OilPrice.com

Published on: 2025-10-07

Intelligence Report: Low Oil Prices Saudi Gift to Trump or Ticking Bomb – OilPrice.com

1. BLUF (Bottom Line Up Front)

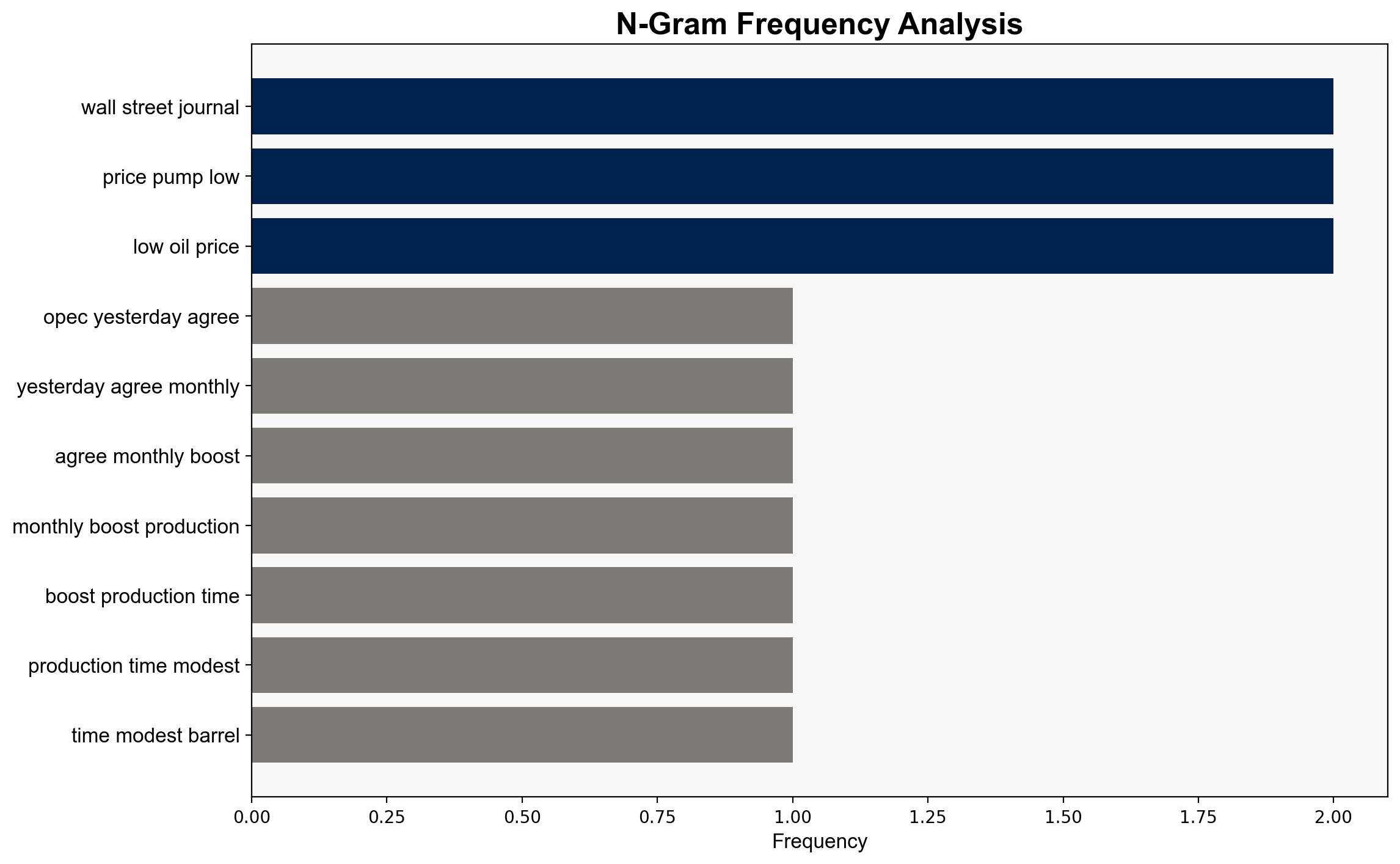

The most supported hypothesis is that Saudi Arabia’s decision to increase oil production is primarily aimed at regaining market share and maintaining influence in global energy markets, rather than directly supporting U.S. political interests. Confidence level: Moderate. Recommended action: Monitor OPEC production strategies and U.S.-Saudi diplomatic engagements for shifts that might impact global energy stability.

2. Competing Hypotheses

1. **Hypothesis A**: Saudi Arabia’s increased oil production is a strategic move to support U.S. interests, particularly benefiting the Trump administration by keeping fuel prices low and easing geopolitical tensions.

2. **Hypothesis B**: The production increase is primarily driven by Saudi Arabia’s need to regain market share and counteract the economic impacts of low oil prices on its Vision 2030 economic transformation plan.

Using ACH 2.0, Hypothesis B is better supported due to the broader context of Saudi economic needs and the strategic importance of maintaining market share in the face of emerging competitors like Brazil and Guyana.

3. Key Assumptions and Red Flags

– **Assumptions**: Hypothesis A assumes a direct correlation between Saudi oil policy and U.S. political interests, which may overestimate the influence of U.S. politics on Saudi decisions. Hypothesis B assumes that market share and economic transformation are the primary drivers of Saudi policy.

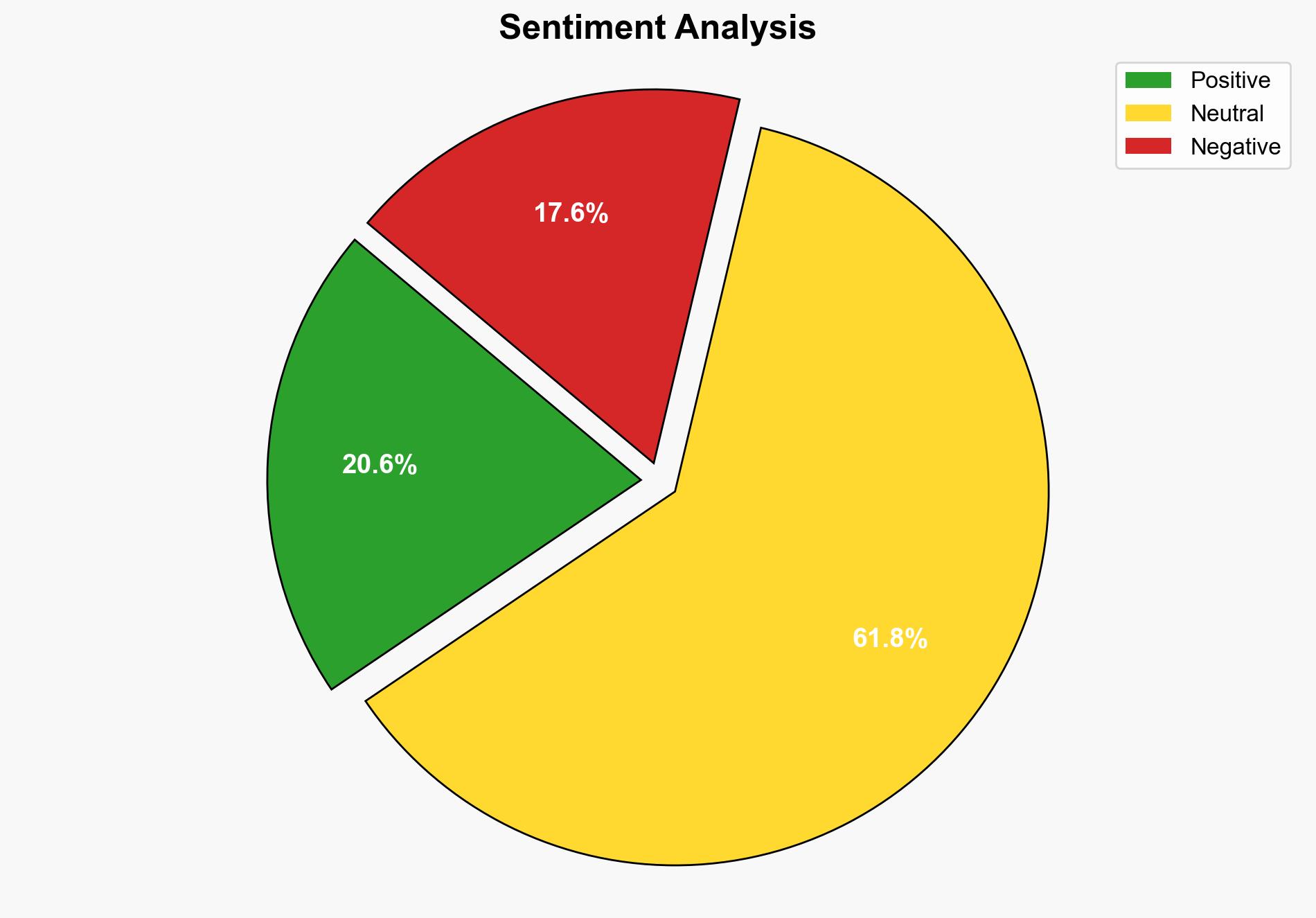

– **Red Flags**: The narrative that Saudi actions are a “gift” to Trump lacks concrete evidence and may reflect cognitive bias or political spin. The absence of detailed data on internal Saudi economic pressures is a blind spot.

4. Implications and Strategic Risks

– **Economic Risks**: Prolonged low oil prices could destabilize economies reliant on oil exports, including Russia and OPEC members, potentially leading to geopolitical instability.

– **Geopolitical Risks**: Increased competition in oil markets could exacerbate tensions among major producers, impacting global alliances and trade relations.

– **Strategic Risks**: Misinterpretation of Saudi intentions could lead to policy missteps by other nations, affecting energy security and diplomatic relations.

5. Recommendations and Outlook

- Monitor OPEC’s production decisions and market share strategies to anticipate shifts in global oil dynamics.

- Engage in diplomatic dialogues with Saudi Arabia to understand their long-term economic goals and potential impacts on global energy markets.

- Scenario Projections:

- Best Case: Stabilization of oil prices supports global economic recovery without major geopolitical disruptions.

- Worst Case: Prolonged low prices lead to economic crises in oil-dependent nations, sparking regional conflicts.

- Most Likely: Gradual market adjustments with intermittent price volatility as producers balance production and market share.

6. Key Individuals and Entities

– Saudi Arabia

– OPEC

– U.S. Administration

– Emerging oil producers (Brazil, Guyana)

7. Thematic Tags

national security threats, energy markets, geopolitical strategy, economic stability