Chinas Golden Week Momentum Meets US Tariff Tensions Before APEC Summit – FX Empire

Published on: 2025-10-07

Intelligence Report: Chinas Golden Week Momentum Meets US Tariff Tensions Before APEC Summit – FX Empire

1. BLUF (Bottom Line Up Front)

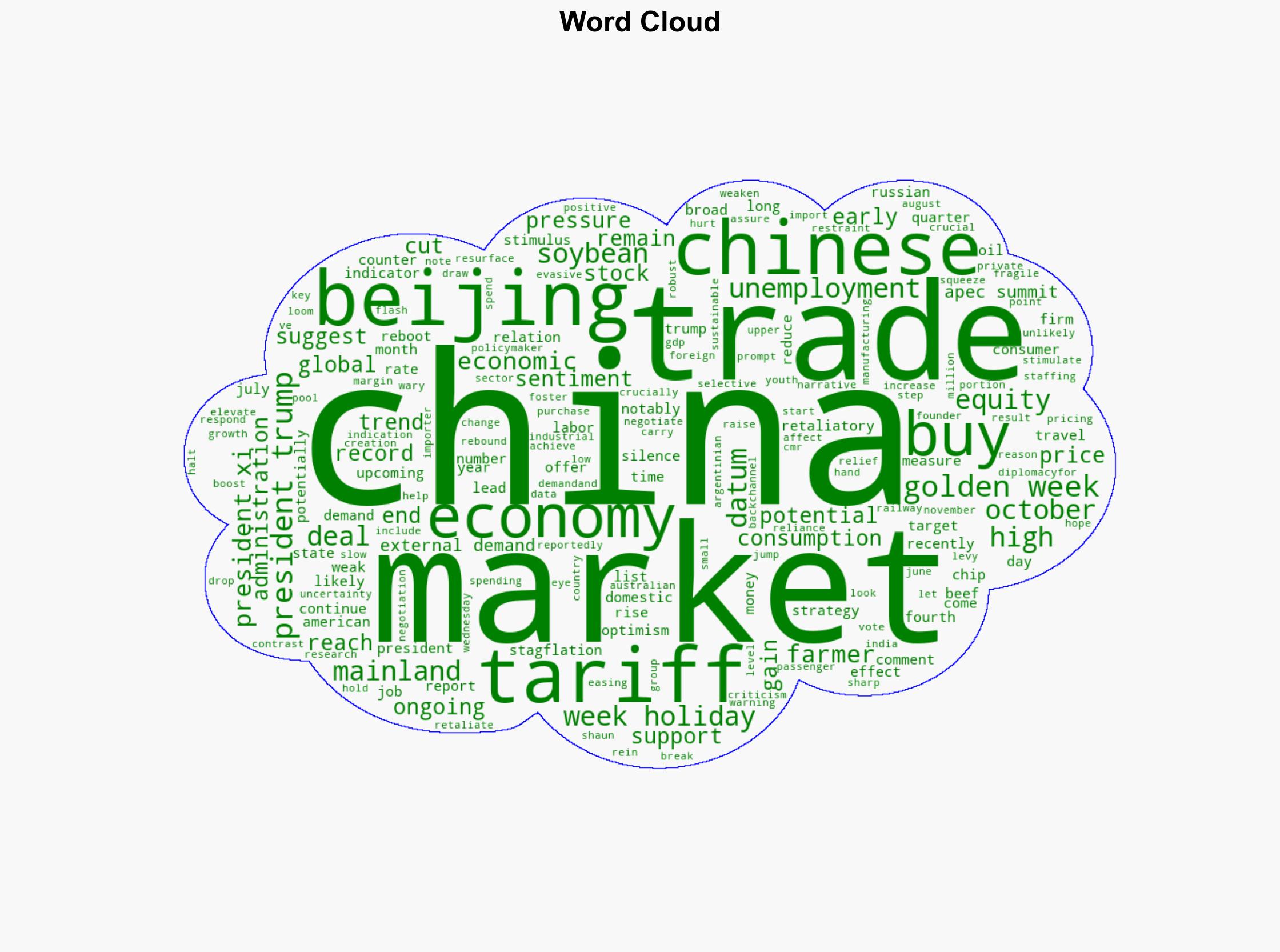

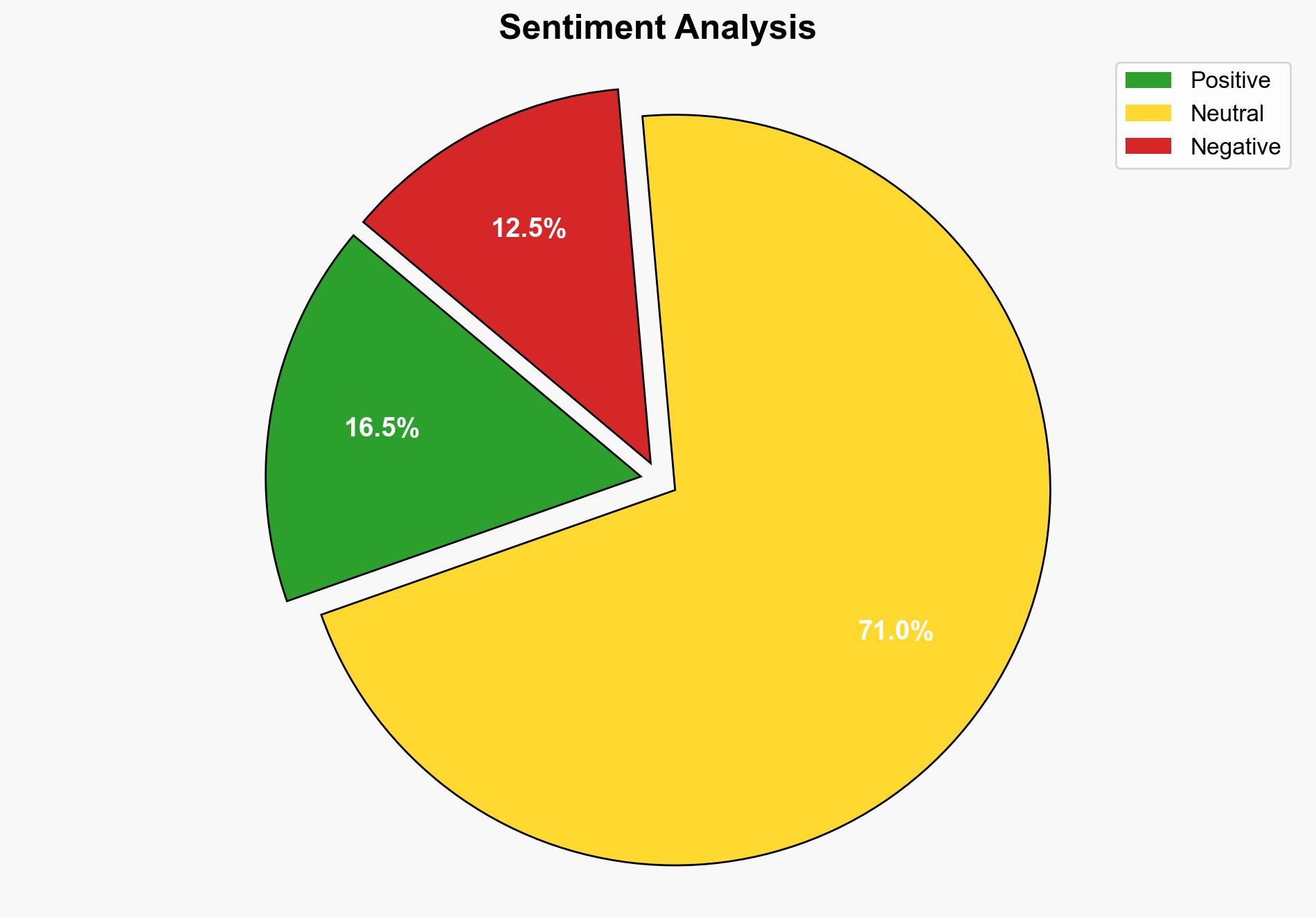

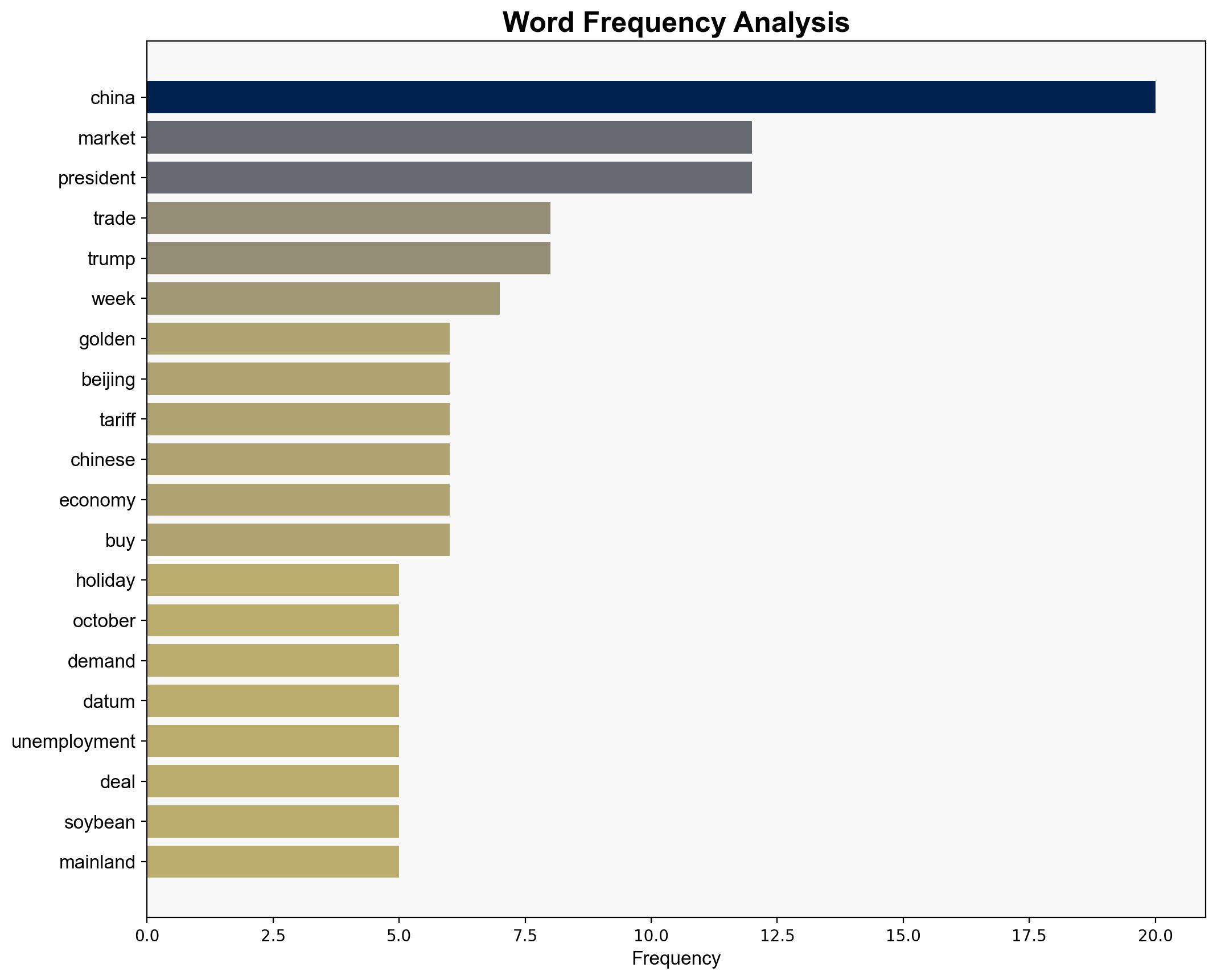

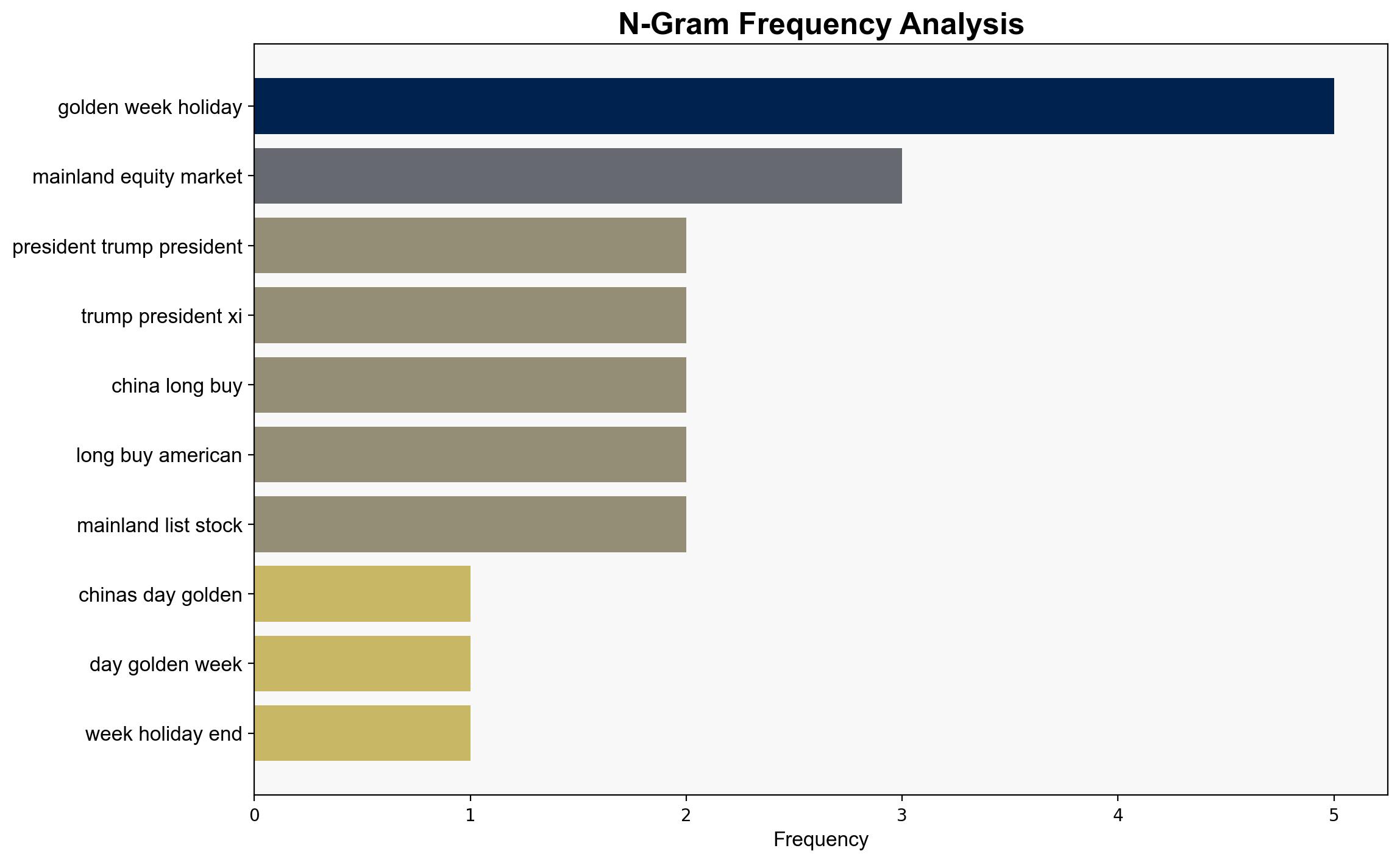

The analysis suggests a moderate confidence level that China’s economic momentum from the Golden Week could be undermined by ongoing US tariff tensions, affecting both domestic and international economic stability. The most supported hypothesis is that China will pursue a strategic trade agreement at the APEC Summit to mitigate tariff impacts, leveraging its economic indicators as a negotiation tool. Recommended action includes monitoring APEC Summit outcomes closely and preparing for potential shifts in trade policies.

2. Competing Hypotheses

Hypothesis 1: China will leverage the positive economic indicators from Golden Week to negotiate a favorable trade deal with the US at the APEC Summit, aiming to reduce tariffs and stabilize its economy.

Hypothesis 2: Despite positive indicators, underlying economic pressures will prevent China from achieving significant concessions at the APEC Summit, leading to continued economic strain and potential escalation of trade tensions.

Using ACH 2.0, Hypothesis 1 is better supported by the recent rebound in private consumption and the strategic timing of the APEC Summit. However, Hypothesis 2 cannot be dismissed due to ongoing unemployment challenges and external demand weaknesses.

3. Key Assumptions and Red Flags

Assumptions include the belief that positive economic indicators will translate into stronger negotiation leverage for China. A red flag is the potential overestimation of the Golden Week’s impact on long-term economic trends. Additionally, the assumption that the US will be receptive to negotiations may overlook domestic political pressures.

4. Implications and Strategic Risks

The primary risk is that failure to secure a trade deal could exacerbate economic pressures in China, leading to increased unemployment and social unrest. Geopolitically, prolonged tensions could destabilize regional markets and affect global supply chains. The psychological impact on investor sentiment could lead to market volatility.

5. Recommendations and Outlook

- Monitor APEC Summit developments for shifts in trade policy and potential agreements.

- Prepare contingency plans for continued trade tensions, including diversification of supply chains.

- Scenario Projections:

- Best Case: Successful trade negotiations lead to tariff reductions and economic stabilization.

- Worst Case: Breakdown in talks results in increased tariffs and economic downturn.

- Most Likely: Partial agreements with limited immediate impact, maintaining status quo tensions.

6. Key Individuals and Entities

– President Xi Jinping

– President Donald Trump

– Shaun Rein, China Market Research Group

7. Thematic Tags

national security threats, economic stability, trade negotiations, regional focus