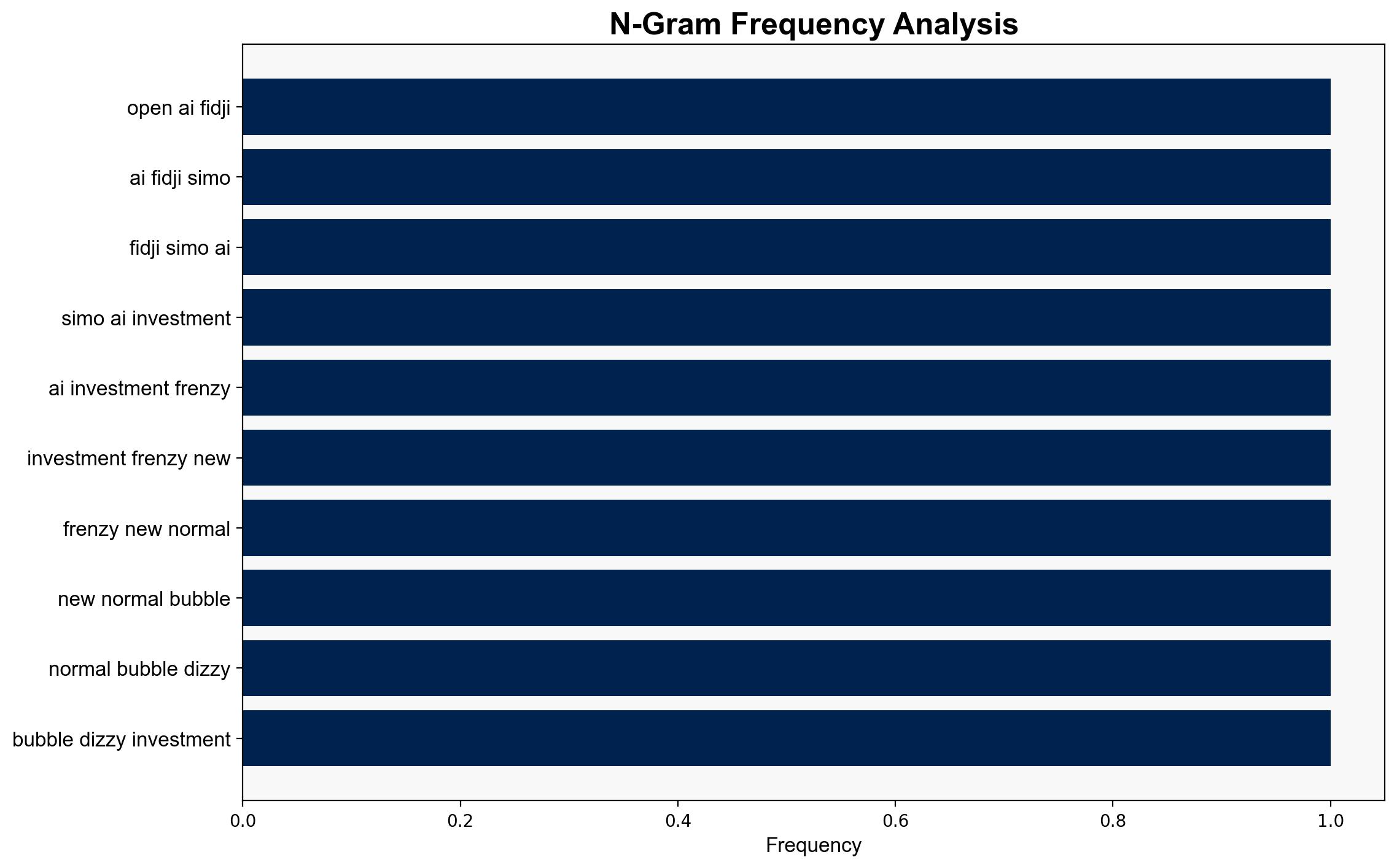

Open AI’s Fidji Simo Says AI Investment Frenzy ‘New Normal’ Not Bubble – International Business Times

Published on: 2025-10-07

Intelligence Report: Open AI’s Fidji Simo Says AI Investment Frenzy ‘New Normal’ Not Bubble – International Business Times

1. BLUF (Bottom Line Up Front)

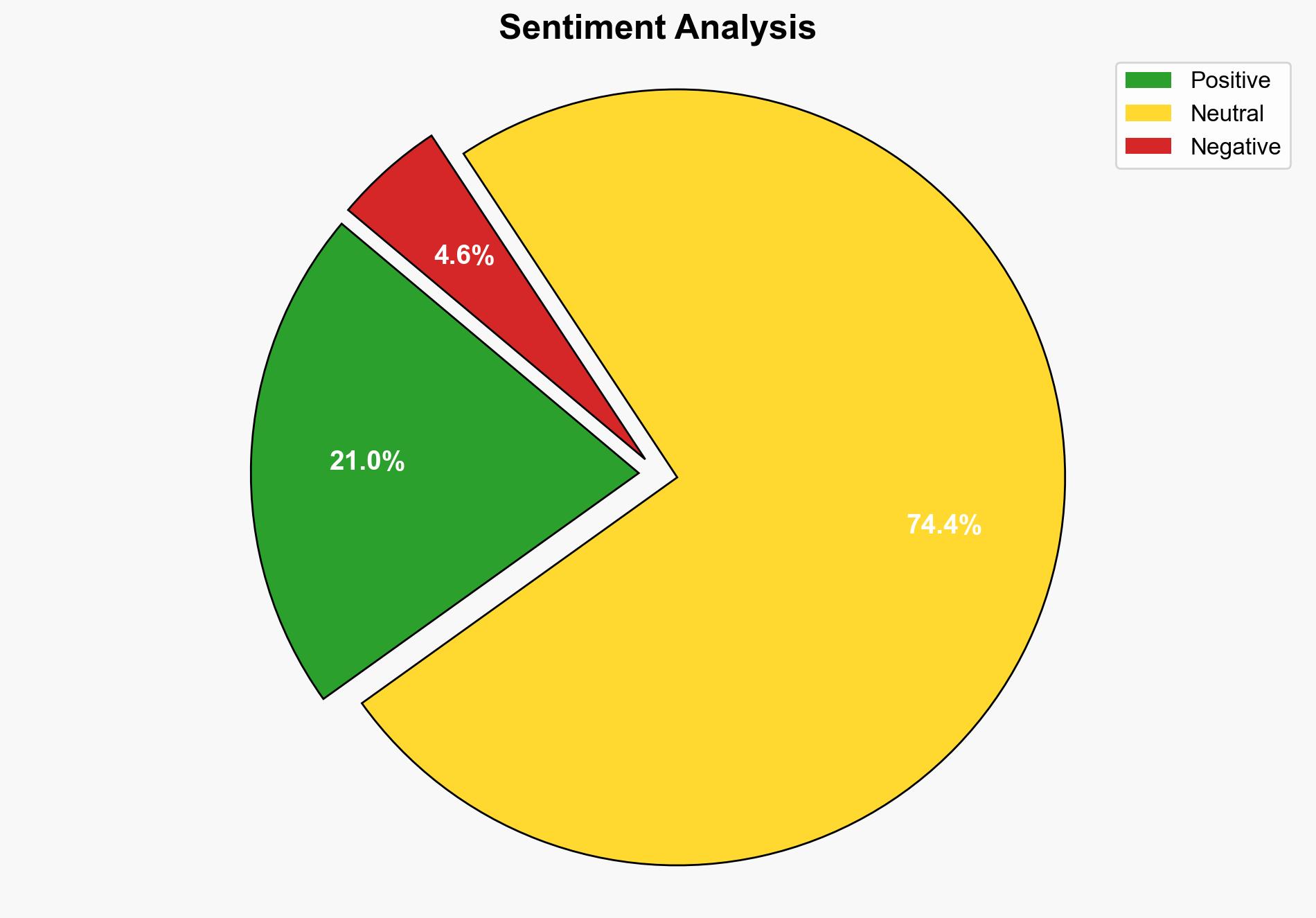

The strategic judgment is that the current AI investment surge is more likely a ‘new normal’ rather than a bubble, with a moderate confidence level. The recommendation is to closely monitor AI market dynamics and regulatory developments to ensure balanced growth and innovation.

2. Competing Hypotheses

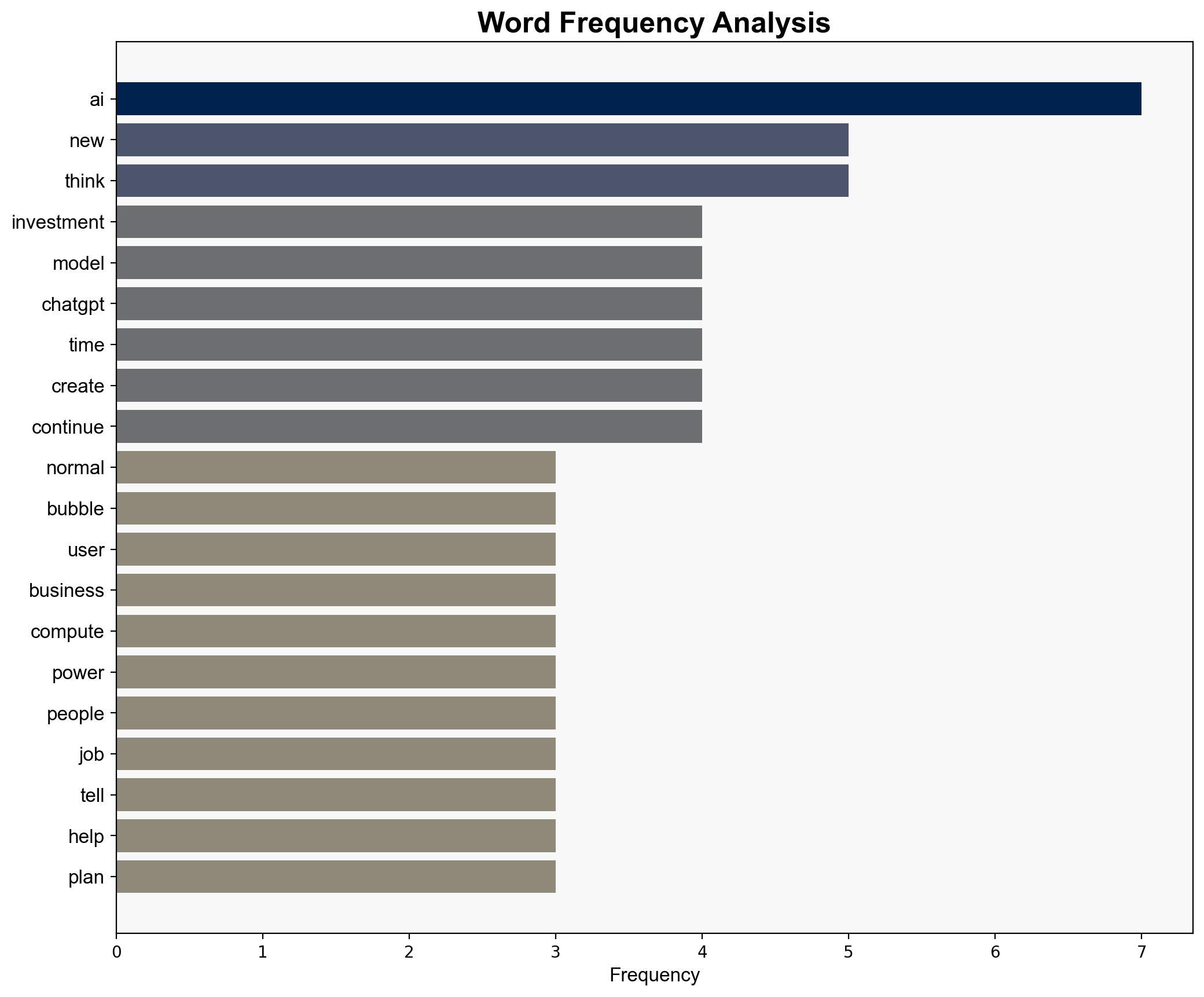

Hypothesis 1: The AI investment surge represents a sustainable ‘new normal’ driven by genuine demand and technological advancements.

Hypothesis 2: The AI investment surge is a speculative bubble that may burst due to overvaluation and unsustainable growth expectations.

Using the Analysis of Competing Hypotheses (ACH) 2.0, Hypothesis 1 is better supported due to the alignment of current investments with increasing demand for AI applications and infrastructure, as indicated by Fidji Simo’s comments on user demand and technological needs.

3. Key Assumptions and Red Flags

Assumptions:

– The demand for AI applications will continue to grow.

– Technological advancements will keep pace with investment levels.

Red Flags:

– Over-reliance on current demand projections without considering potential market saturation.

– Lack of consideration for regulatory impacts that could slow growth.

Potential cognitive bias includes confirmation bias in interpreting current investment trends as sustainable without considering historical parallels with past tech bubbles.

4. Implications and Strategic Risks

The implications of a ‘new normal’ include sustained economic growth in the AI sector, potential job creation, and increased global competition. However, if this is a bubble, there could be significant economic repercussions, including loss of investor confidence and market instability. Geopolitical risks involve the race for AI supremacy, particularly between democratic and authoritarian states, impacting global power dynamics.

5. Recommendations and Outlook

- Monitor AI market trends and regulatory changes to anticipate shifts in investment dynamics.

- Encourage balanced investment strategies that consider both innovation and risk mitigation.

- Scenario Projections:

- Best Case: Sustained growth with balanced regulation fostering innovation.

- Worst Case: Market crash due to overvaluation and regulatory clampdowns.

- Most Likely: Gradual stabilization with periodic fluctuations as the market adjusts.

6. Key Individuals and Entities

Fidji Simo, Sam Altman

7. Thematic Tags

economic stability, technological innovation, regulatory impact, global competition