Gold builds on historic rally soars past US4000 an ounce for first time – CNA

Published on: 2025-10-08

Intelligence Report: Gold builds on historic rally soars past US4000 an ounce for first time – CNA

1. BLUF (Bottom Line Up Front)

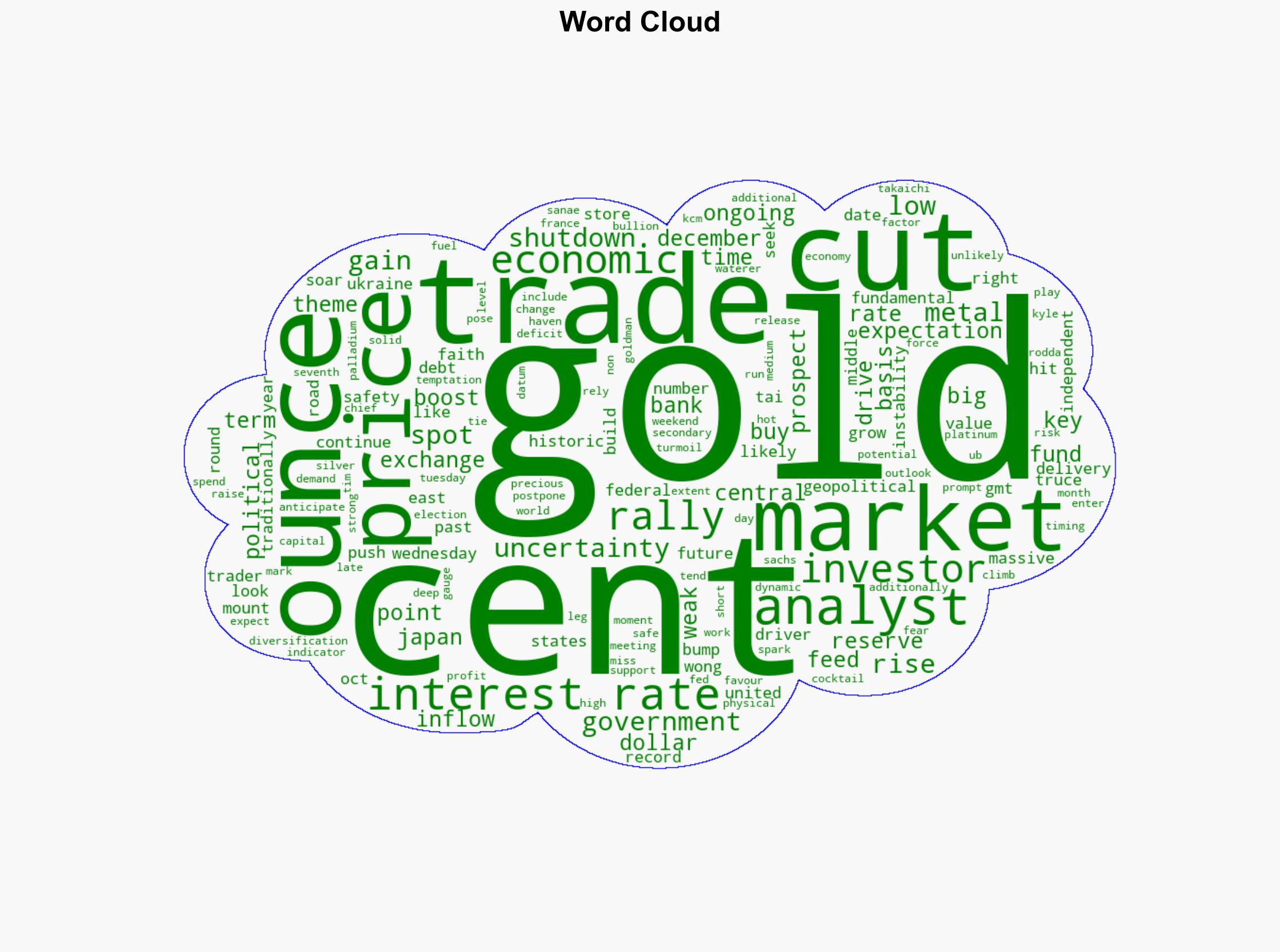

The recent surge in gold prices past $4,000 an ounce is primarily driven by economic and geopolitical uncertainties, coupled with expectations of interest rate cuts by the Federal Reserve. The most supported hypothesis suggests that these factors will continue to drive gold prices upward in the short to medium term. Confidence level: Moderate. Recommended action: Monitor central bank policies and geopolitical developments closely to anticipate further movements in gold prices.

2. Competing Hypotheses

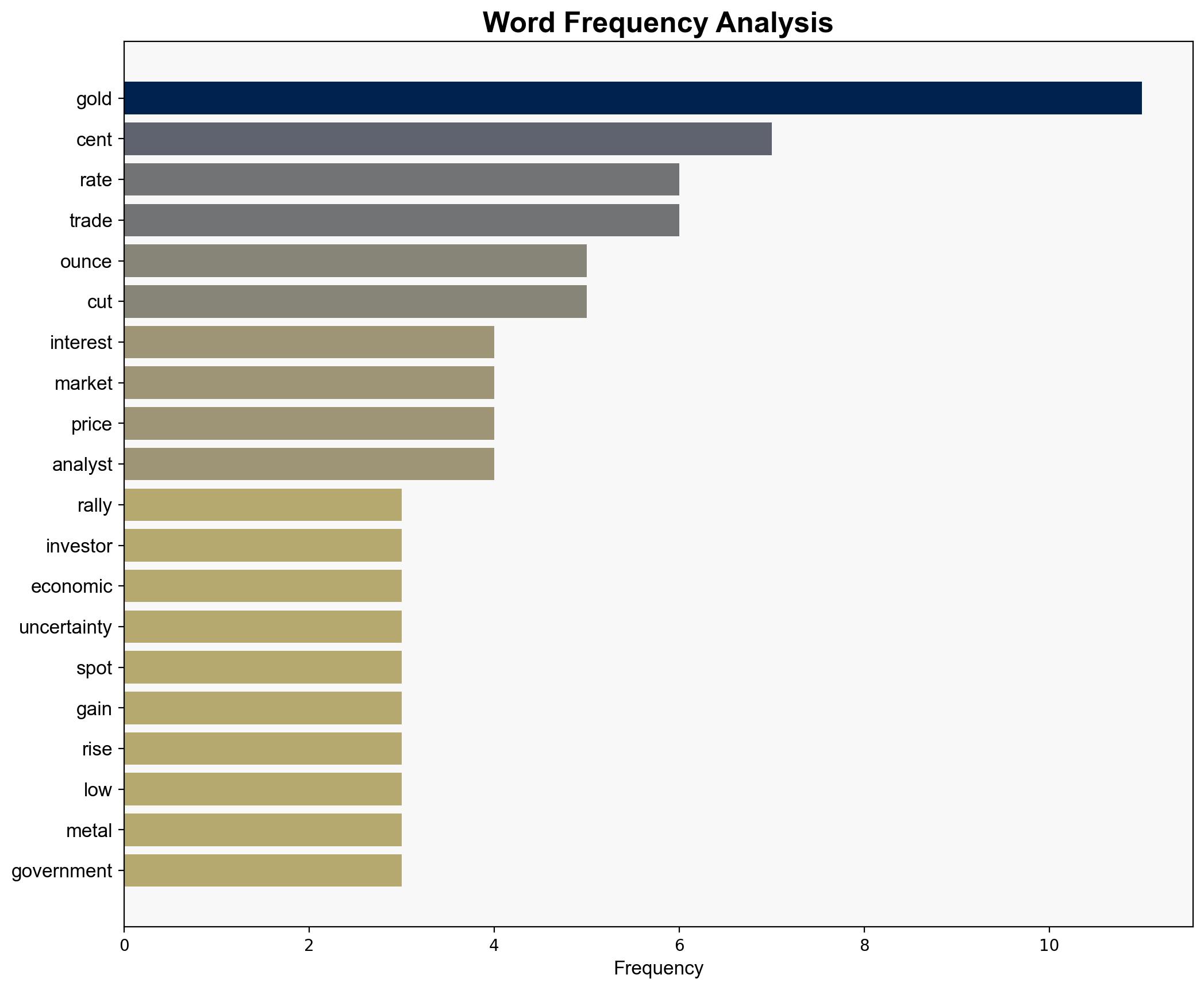

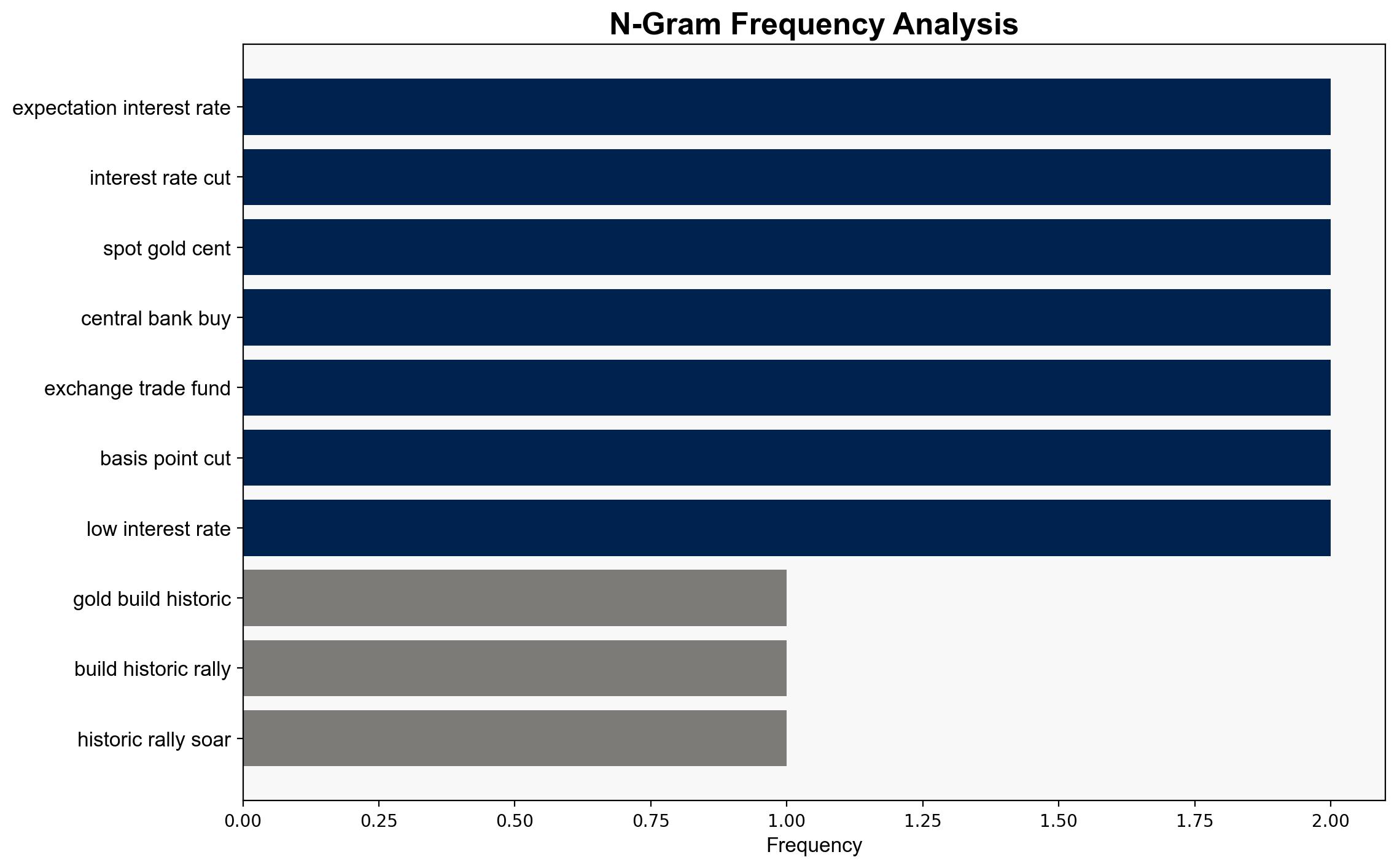

1. **Hypothesis A**: The surge in gold prices is primarily driven by investor demand for safe-haven assets due to mounting economic and geopolitical uncertainties, such as the Middle East conflict and the ongoing situation in Ukraine. This demand is further fueled by expectations of interest rate cuts by the Federal Reserve.

2. **Hypothesis B**: The increase in gold prices is largely speculative, driven by market dynamics such as central bank buying and inflows into gold exchange-traded funds, rather than fundamental economic factors. This hypothesis suggests that the rally may not be sustainable in the long term.

Using ACH 2.0, Hypothesis A is better supported due to the alignment of multiple factors such as geopolitical tensions, economic uncertainties, and central bank policies that traditionally boost gold as a safe-haven asset.

3. Key Assumptions and Red Flags

– **Assumptions**:

– Continued geopolitical instability will sustain demand for gold.

– The Federal Reserve will proceed with interest rate cuts as anticipated.

– **Red Flags**:

– Potential over-reliance on non-government data due to the U.S. government shutdown.

– Speculative trading could lead to volatility and a potential correction in gold prices.

– **Blind Spots**:

– Unexpected geopolitical resolutions or economic data releases could alter current trends.

4. Implications and Strategic Risks

– **Economic**: Prolonged high gold prices could impact global markets, affecting currencies and commodity trading.

– **Geopolitical**: Continued instability in key regions could exacerbate demand for safe-haven assets, influencing global economic policies.

– **Psychological**: Investor sentiment may shift rapidly, leading to increased market volatility.

5. Recommendations and Outlook

- Monitor central bank announcements and geopolitical developments to anticipate further movements in gold prices.

- Consider hedging strategies for portfolios exposed to gold price fluctuations.

- Scenario-based projections:

- Best: Geopolitical tensions ease, leading to a stabilization of gold prices.

- Worst: Escalation of conflicts and economic downturns drive prices higher, causing market instability.

- Most Likely: Continued moderate increase in gold prices driven by ongoing uncertainties and central bank policies.

6. Key Individuals and Entities

– Tim Waterer

– Kyle Rodda

– Goldman Sachs

– UBS

7. Thematic Tags

economic uncertainty, geopolitical instability, central bank policies, market dynamics