SP 500’s torrid rally seen having more fuel left from AI US Fed – The Times of India

Published on: 2025-10-09

Intelligence Report: SP 500’s torrid rally seen having more fuel left from AI US Fed – The Times of India

1. BLUF (Bottom Line Up Front)

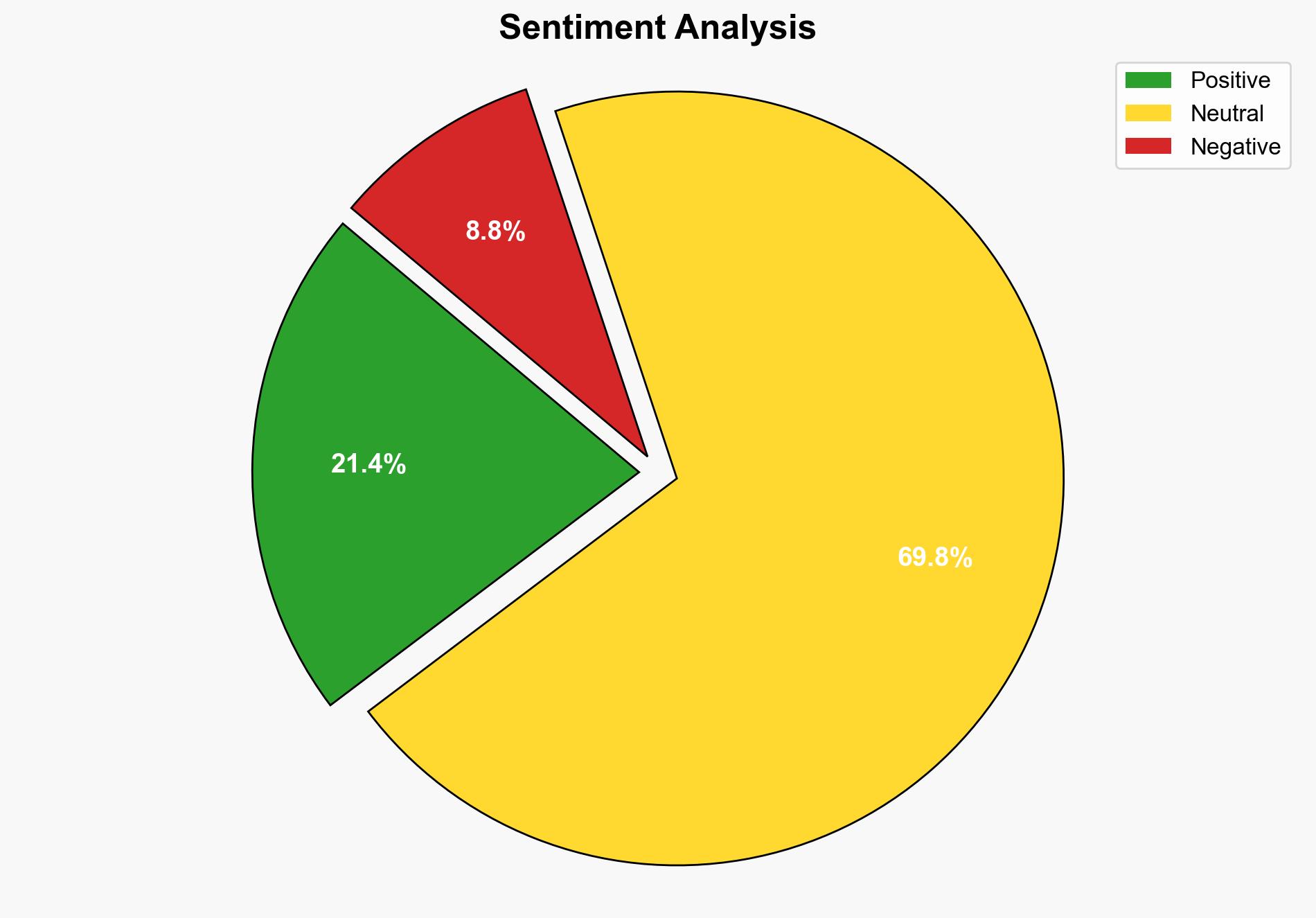

The SP 500 rally is likely to continue in the short term, driven by AI advancements and Federal Reserve policies. However, economic uncertainties and geopolitical tensions present significant risks. Confidence Level: Moderate. Recommended action: Monitor economic indicators and geopolitical developments closely to adjust investment strategies accordingly.

2. Competing Hypotheses

Hypothesis 1: The SP 500 rally will sustain due to continued AI-driven demand and supportive Federal Reserve policies.

Hypothesis 2: The rally is unsustainable and will face a correction due to overvaluation and economic uncertainties, including trade tensions and potential government shutdowns.

Using the Analysis of Competing Hypotheses (ACH) 2.0, Hypothesis 1 is better supported by current data, including AI demand and Federal Reserve interest rate policies. However, Hypothesis 2 remains plausible given the potential for economic disruptions.

3. Key Assumptions and Red Flags

Assumptions:

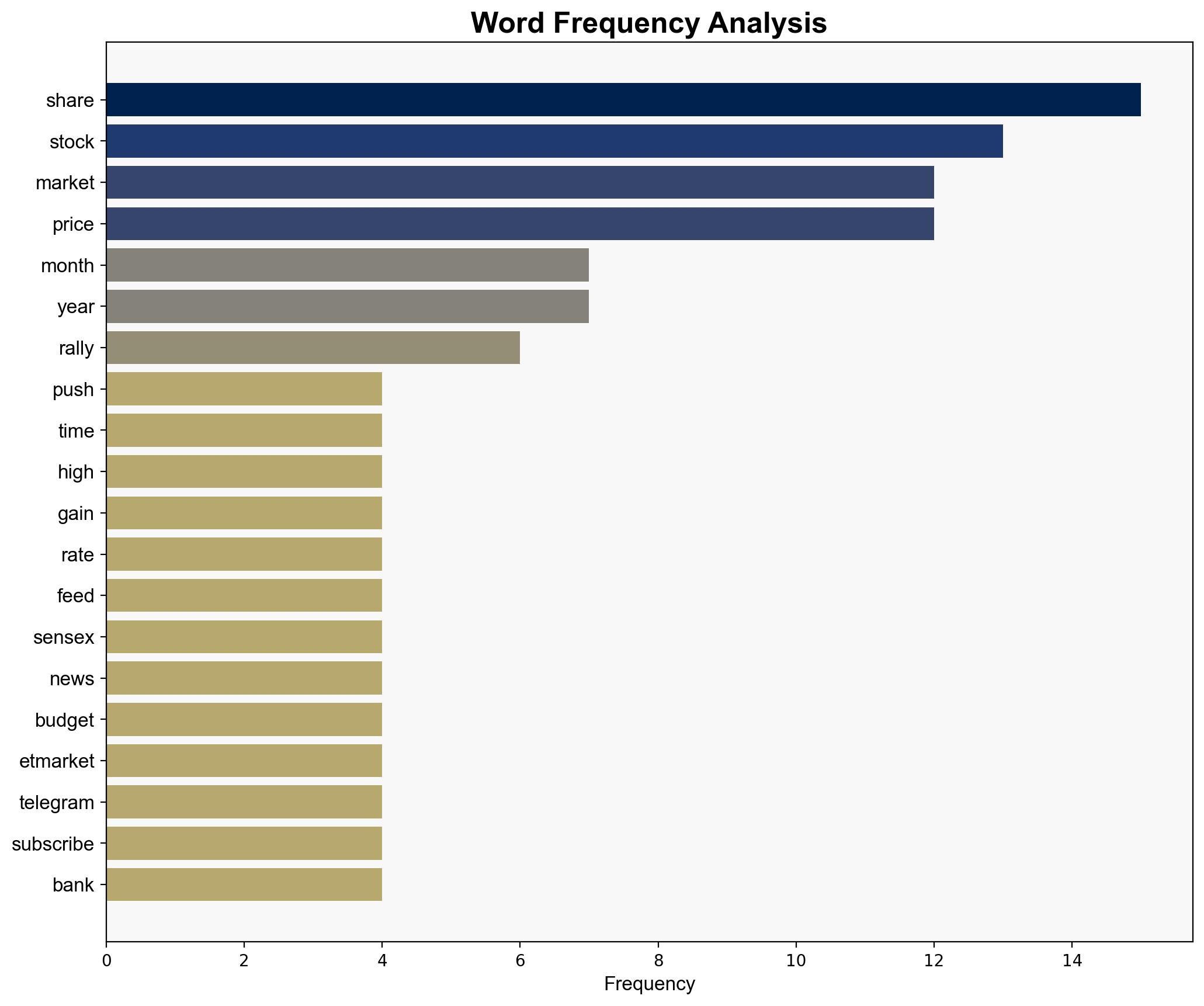

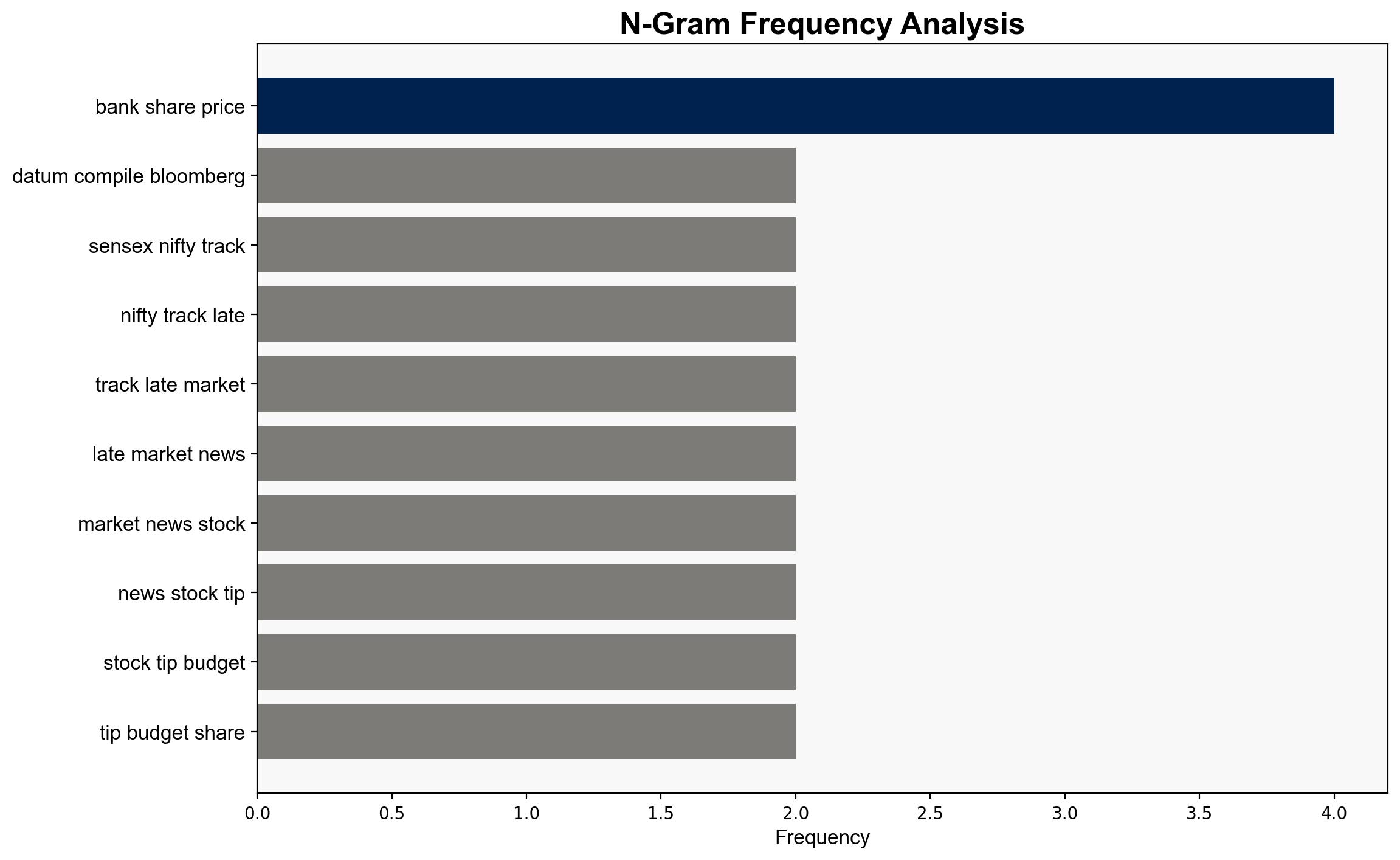

– AI demand will continue to drive market growth.

– Federal Reserve policies will remain supportive of market expansion.

Red Flags:

– Overvaluation of tech stocks could lead to a market correction.

– Economic indicators such as labor market data and trade tensions could disrupt the rally.

– Potential government shutdowns and tariff impacts are not fully accounted for in current market optimism.

4. Implications and Strategic Risks

The continuation of the rally could lead to increased investor confidence and economic growth. However, a sudden correction could trigger a broader market downturn, impacting global economies. Geopolitical tensions, particularly related to trade wars, could exacerbate economic vulnerabilities.

5. Recommendations and Outlook

- Monitor AI sector developments and Federal Reserve announcements for early indicators of market shifts.

- Prepare for potential market corrections by diversifying investments and considering hedging strategies.

- Scenario Projections:

- Best Case: Continued rally with stable economic growth and resolved trade tensions.

- Worst Case: Market correction triggered by economic downturn and geopolitical conflicts.

- Most Likely: Short-term rally with potential volatility due to economic and geopolitical factors.

6. Key Individuals and Entities

– Nick Giacoumakis

– Adam Sarhan

– JPMorgan Chase

– Goldman Sachs Group

– Nvidia Corp

– Advanced Micro Devices

– Intel Corp

7. Thematic Tags

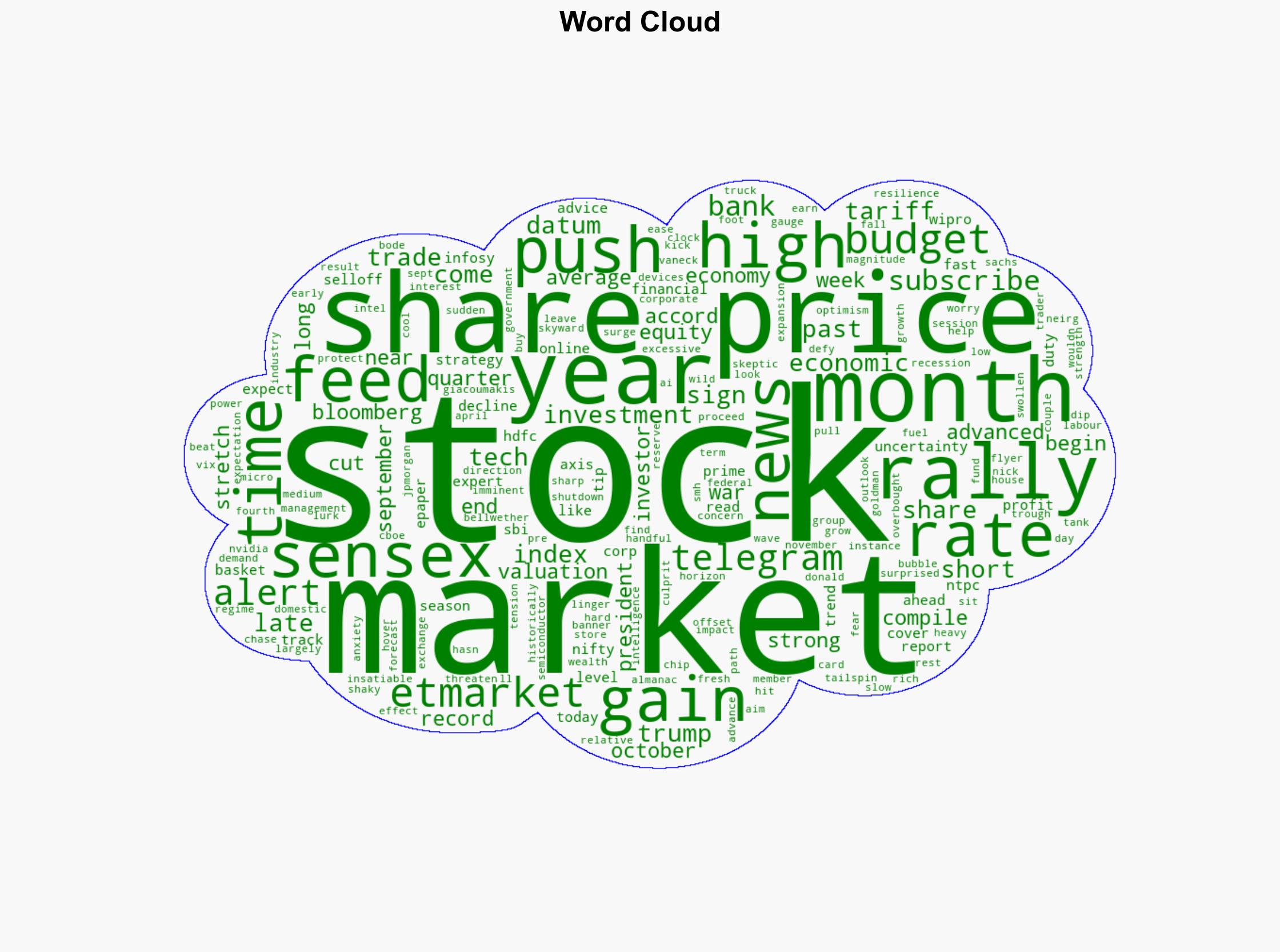

economic trends, market analysis, AI impact, Federal Reserve policy, trade tensions, geopolitical risks