The need for a modern fraud prevention stack – TechRadar

Published on: 2025-10-09

Intelligence Report: The need for a modern fraud prevention stack – TechRadar

1. BLUF (Bottom Line Up Front)

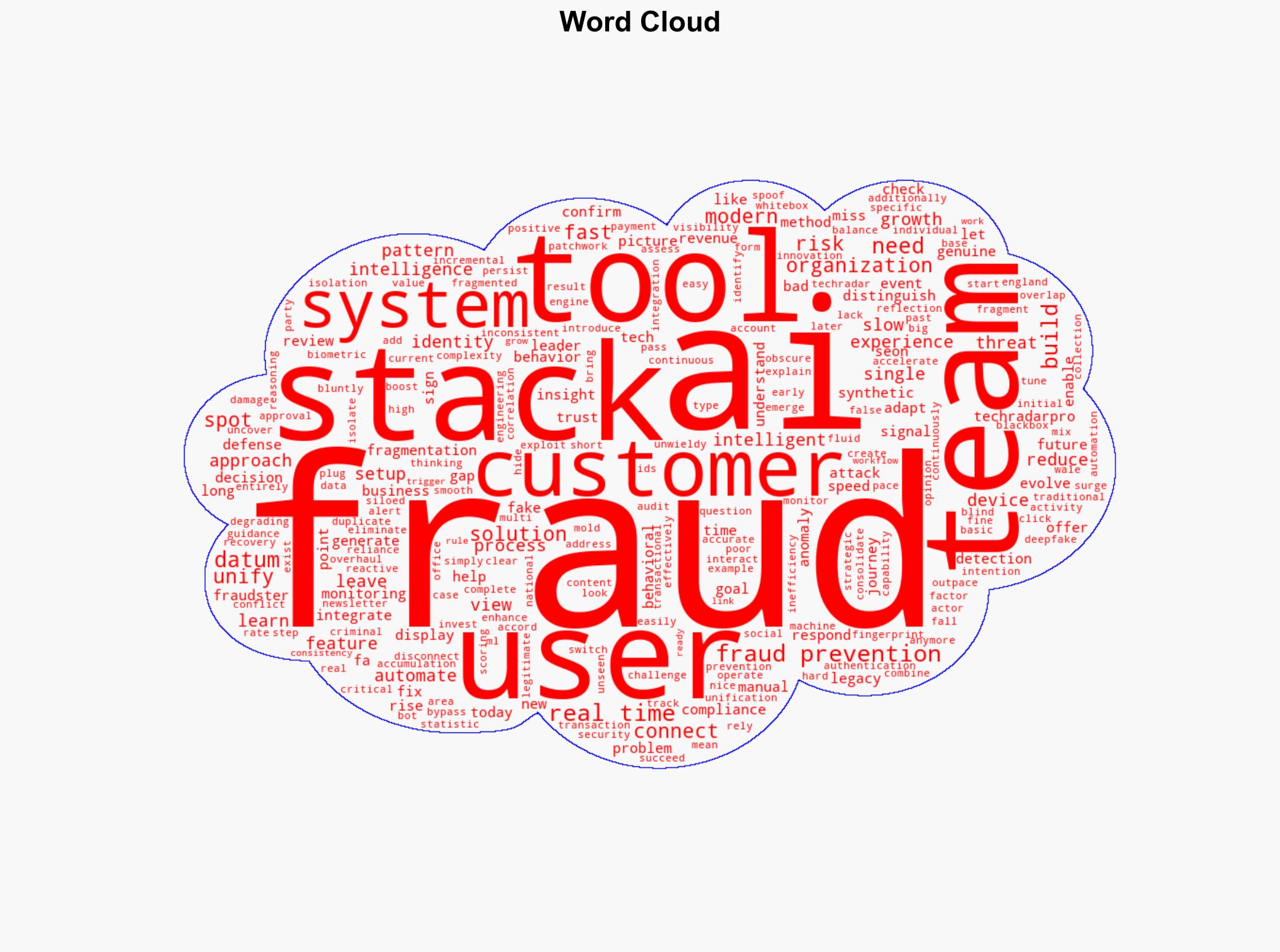

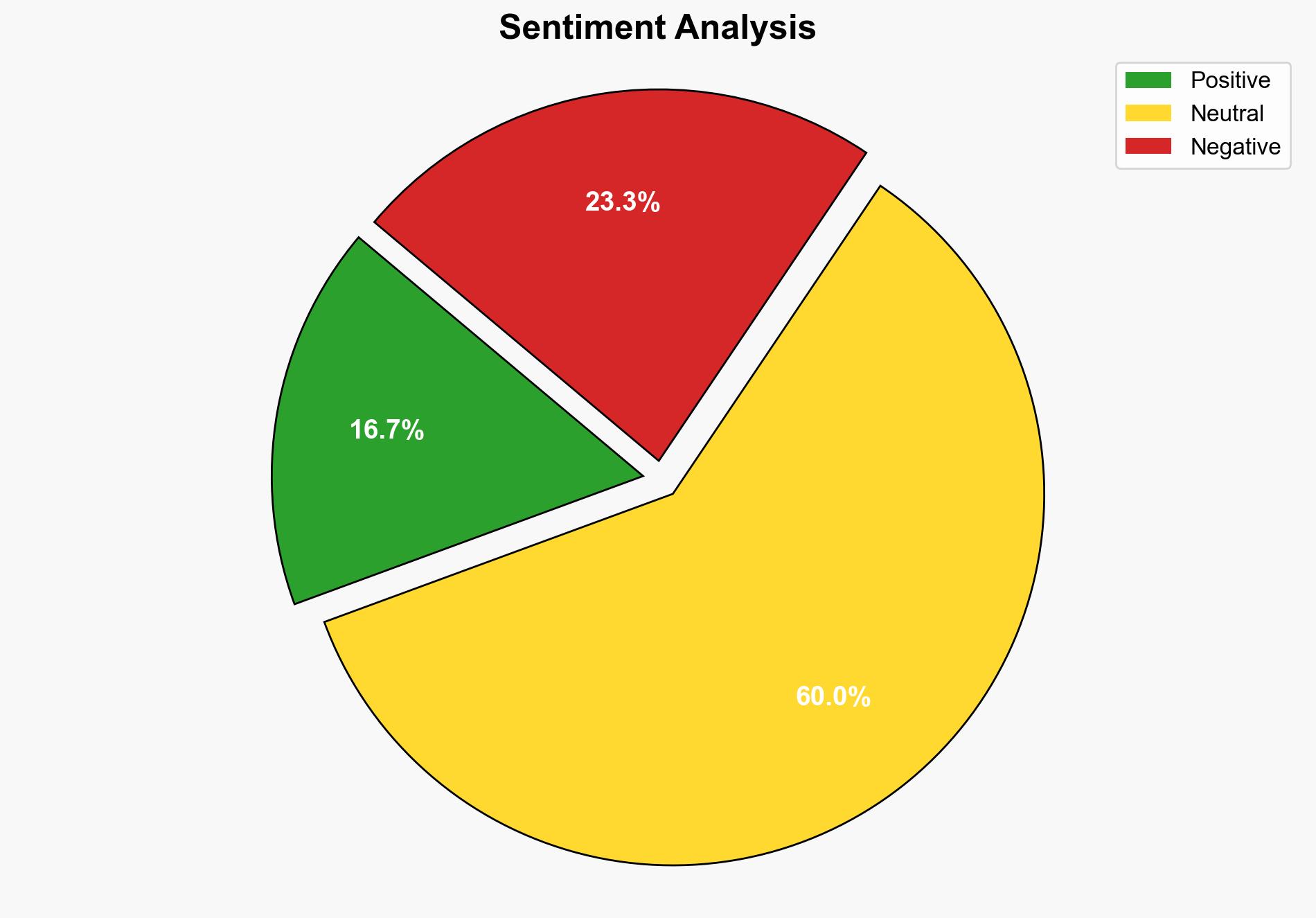

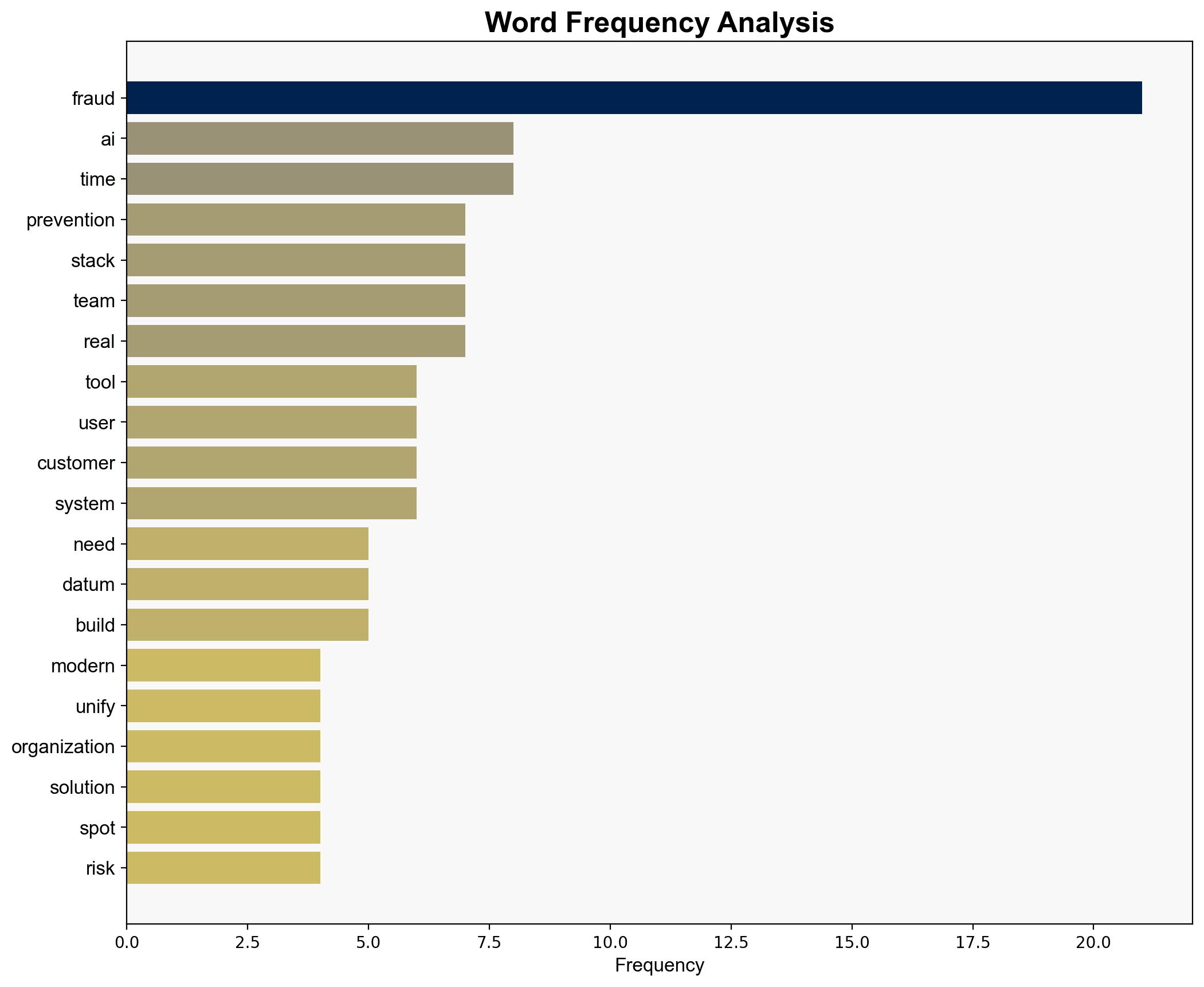

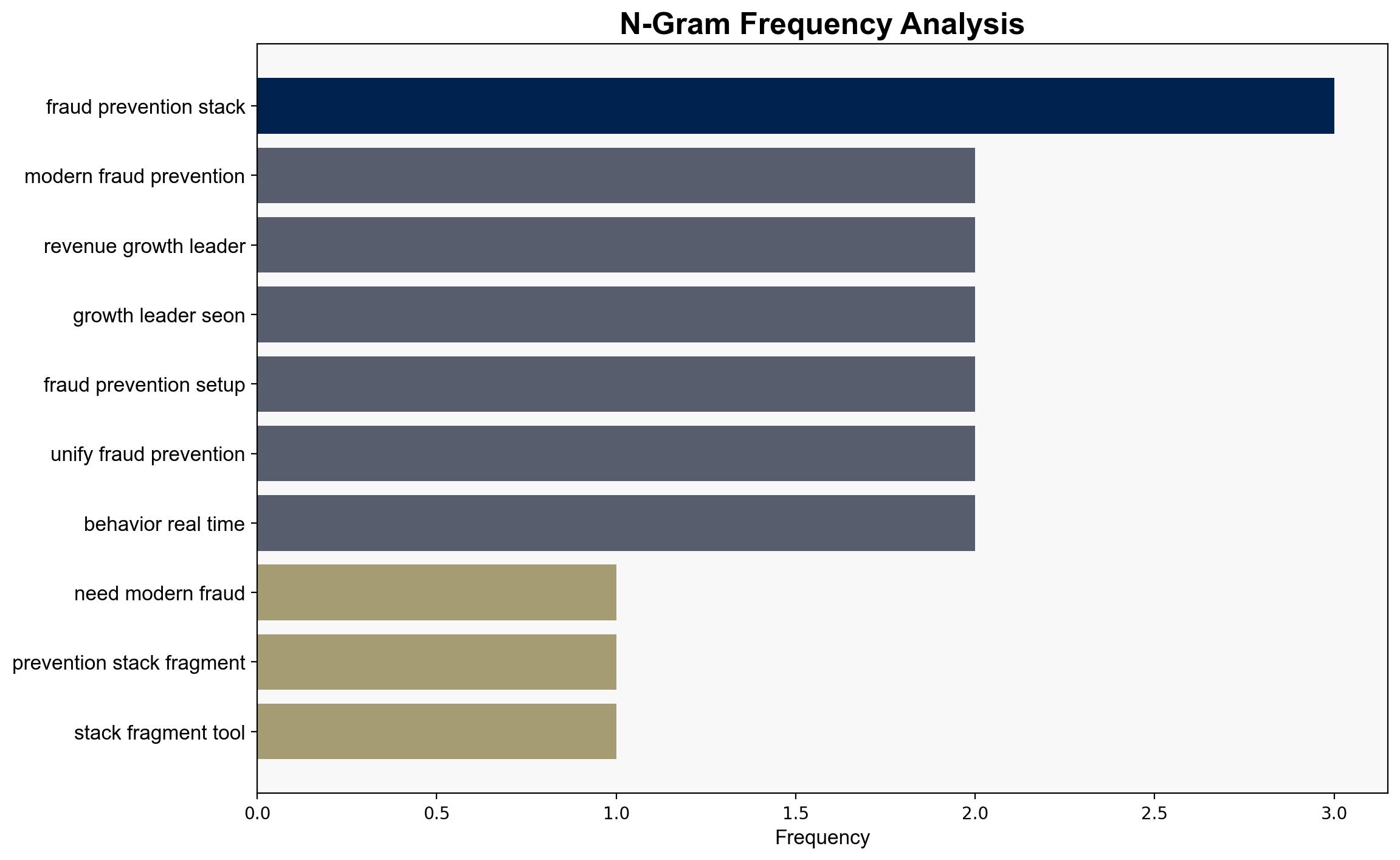

The most supported hypothesis is that organizations must transition from fragmented fraud prevention systems to a unified, AI-driven approach to effectively counter modern fraud tactics. Confidence Level: High. Recommended action is to audit current systems and invest in integrated AI solutions to enhance real-time threat detection and response capabilities.

2. Competing Hypotheses

Hypothesis 1: Organizations need to overhaul their fraud prevention systems by adopting a unified, AI-driven stack to effectively counter evolving fraud tactics.

Hypothesis 2: Incremental improvements to existing systems, such as enhancing current tools with AI capabilities, are sufficient to address modern fraud threats.

3. Key Assumptions and Red Flags

– Assumptions for Hypothesis 1: Current systems are inadequate due to their fragmented nature and inability to adapt rapidly to new threats. AI integration is assumed to provide superior detection and response.

– Assumptions for Hypothesis 2: Existing systems can be enhanced incrementally without a complete overhaul, and current tools can be adapted to meet new challenges.

– Red Flags: Potential over-reliance on AI without sufficient human oversight could lead to new vulnerabilities. The assumption that AI can seamlessly integrate with existing systems may be overly optimistic.

4. Implications and Strategic Risks

– Economic: Failure to modernize fraud prevention could lead to significant financial losses due to increased fraud incidents.

– Cyber: A fragmented system increases the risk of cyber breaches and data theft.

– Geopolitical: As fraud tactics evolve globally, organizations may face increased pressure from regulatory bodies to enhance security measures.

– Psychological: Continuous fraud incidents can erode customer trust and brand reputation.

5. Recommendations and Outlook

- Conduct a comprehensive audit of current fraud prevention systems to identify gaps and overlaps.

- Invest in AI-driven solutions that offer real-time monitoring and adaptive learning capabilities.

- Develop a phased implementation plan to transition from legacy systems to a unified stack.

- Scenario Projections:

- Best: Successful integration of AI systems leads to a significant reduction in fraud incidents.

- Worst: Incomplete integration results in system vulnerabilities and increased fraud.

- Most Likely: Gradual improvement in fraud detection as AI systems are integrated and optimized.

6. Key Individuals and Entities

– SEON (mentioned as a leader in fraud prevention solutions).

7. Thematic Tags

national security threats, cybersecurity, fraud prevention, AI integration