Maersk Shares Hit Three-month Low on Prospect of Gaza Deal Reopening Red Sea Route – gcaptain.com

Published on: 2025-10-09

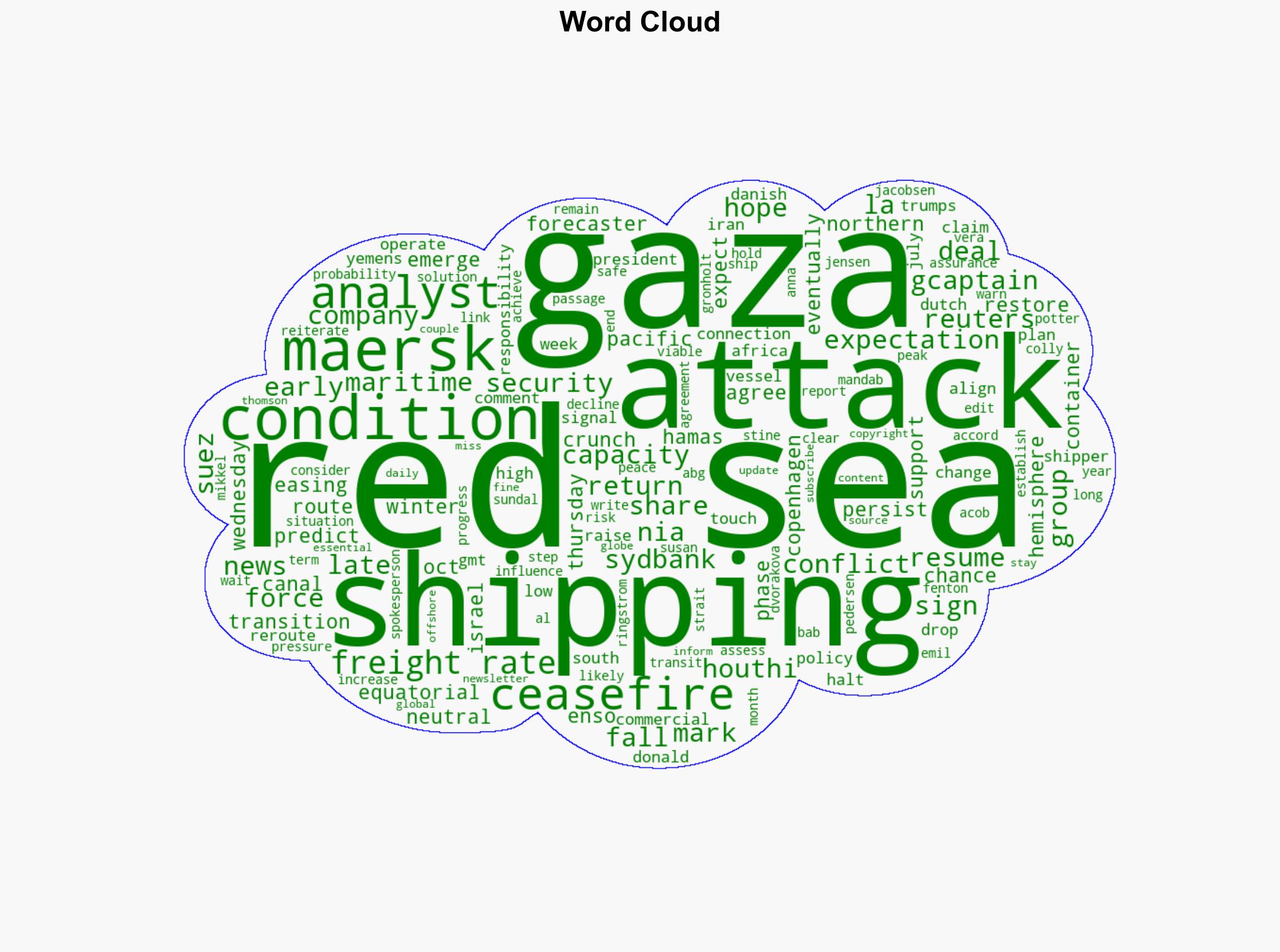

Intelligence Report: Maersk Shares Hit Three-month Low on Prospect of Gaza Deal Reopening Red Sea Route – gcaptain.com

1. BLUF (Bottom Line Up Front)

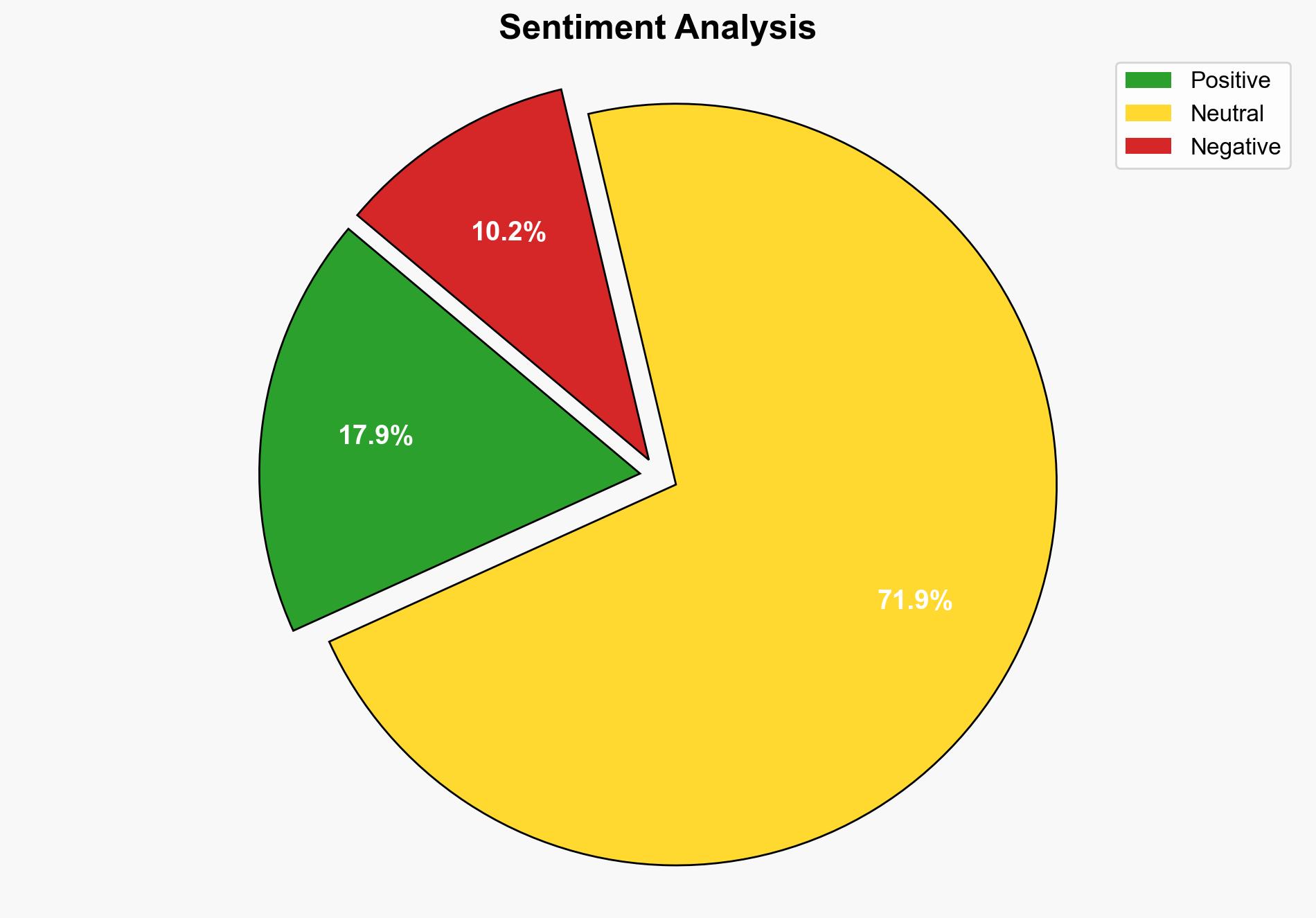

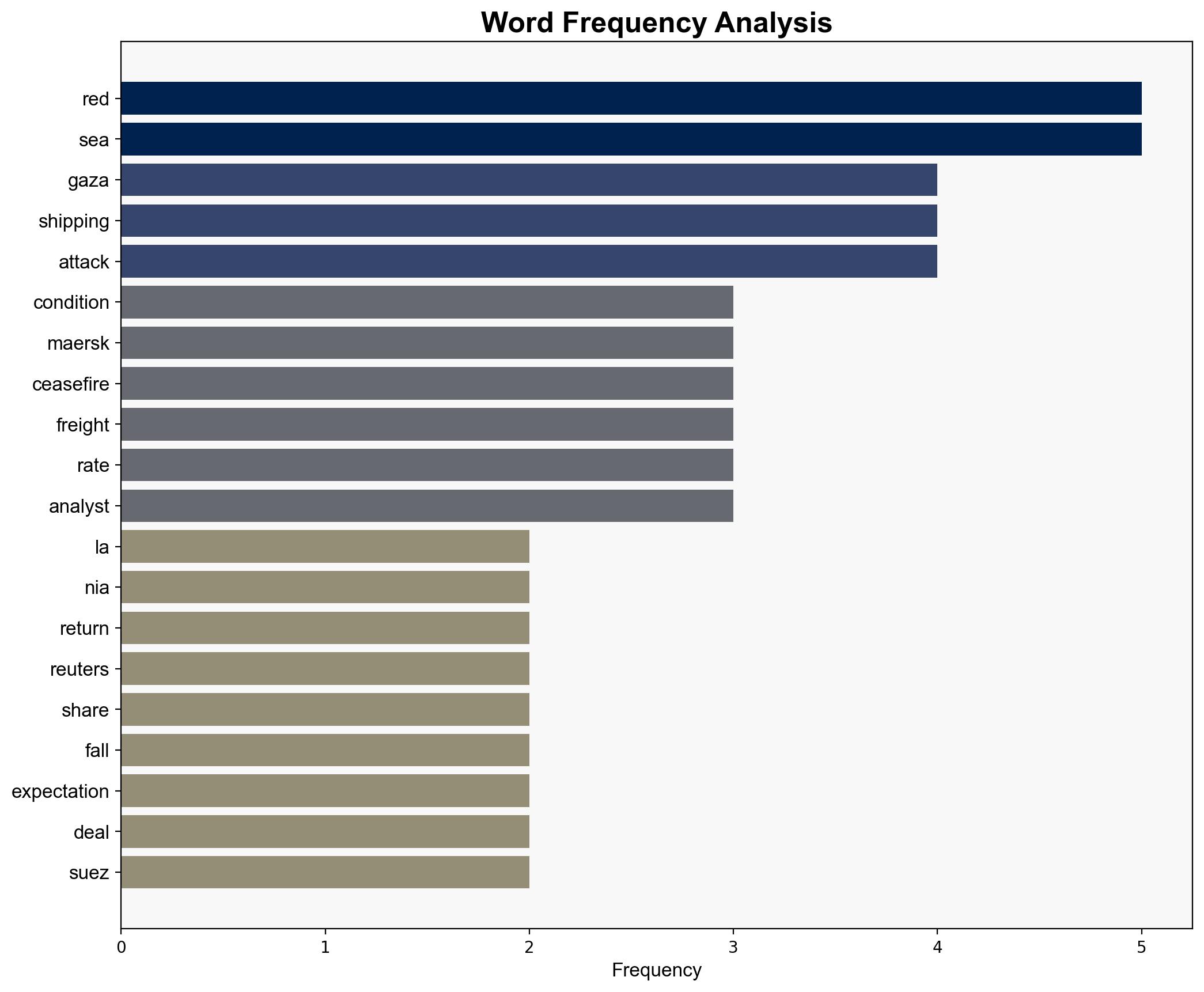

The most supported hypothesis is that the expectation of a ceasefire and reopening of the Red Sea route will lead to a temporary decline in freight rates, impacting Maersk’s share value. Confidence level: Moderate. Recommended action: Monitor geopolitical developments closely and prepare contingency plans for potential disruptions in the Red Sea.

2. Competing Hypotheses

Hypothesis 1: The decline in Maersk’s share value is primarily due to the anticipation of a ceasefire deal between Israel and Hamas, which would reopen the Red Sea route and increase shipping capacity, leading to a decrease in freight rates.

Hypothesis 2: The decline in Maersk’s share value is influenced by broader market trends and investor sentiment, with the ceasefire deal being a secondary factor.

3. Key Assumptions and Red Flags

Assumptions:

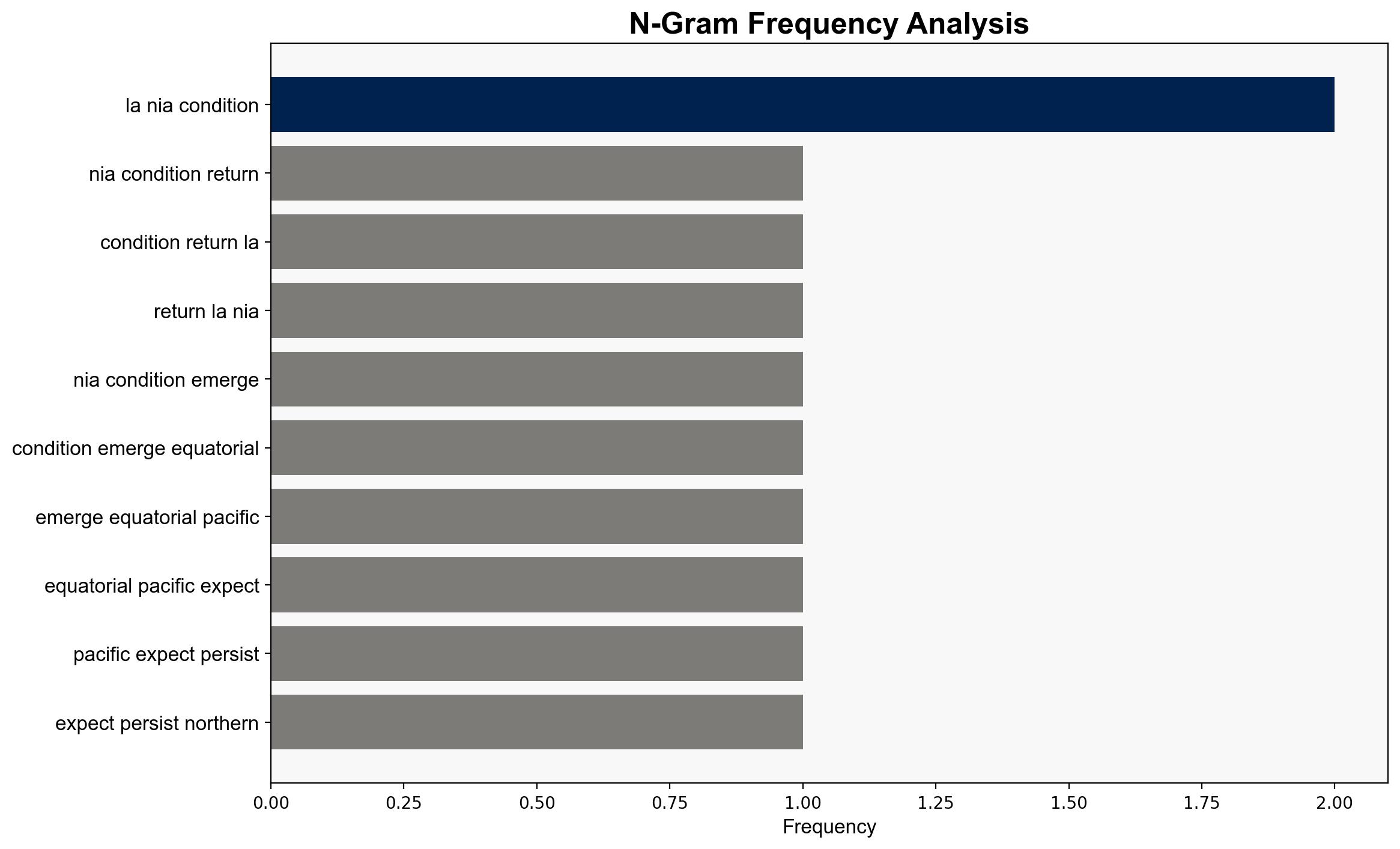

– Hypothesis 1 assumes that the ceasefire will hold and that the Red Sea route will remain open without further disruptions.

– Hypothesis 2 assumes that market trends and investor sentiment are significant enough to overshadow the impact of geopolitical developments.

Red Flags:

– The ceasefire’s durability is uncertain, and there is a risk of renewed hostilities.

– The potential for Houthi forces to resume attacks could disrupt shipping routes again.

– Lack of detailed information on investor sentiment and broader market trends.

4. Implications and Strategic Risks

The reopening of the Red Sea route could lead to increased shipping capacity, putting downward pressure on freight rates. This scenario poses economic risks for shipping companies like Maersk. Geopolitically, the situation remains volatile, with potential for escalation if the ceasefire fails. The involvement of Houthi forces adds a layer of complexity, as their actions could disrupt maritime traffic and impact global trade routes.

5. Recommendations and Outlook

- Monitor the ceasefire’s progress and any signs of renewed conflict in the region.

- Develop contingency plans for potential disruptions in the Red Sea route.

- Engage with regional stakeholders to enhance maritime security and ensure safe passage.

- Scenario Projections:

- Best Case: Ceasefire holds, Red Sea route remains open, and shipping companies adjust to new freight rates.

- Worst Case: Ceasefire collapses, renewed hostilities disrupt shipping, leading to increased costs and operational challenges.

- Most Likely: Temporary stability with periodic disruptions affecting shipping routes and freight rates.

6. Key Individuals and Entities

– Mikkel Emil Jensen (Sydbank Analyst)

– Vera Dvorakova (Reporter)

– Stine Jacobsen (Reporter)

– Anna Ringstrom (Reporter)

7. Thematic Tags

national security threats, cybersecurity, counter-terrorism, regional focus