China Expands Rare Earth Export Controls To Target Semiconductor Defense Users – Slashdot.org

Published on: 2025-10-10

Intelligence Report: China Expands Rare Earth Export Controls To Target Semiconductor Defense Users – Slashdot.org

1. BLUF (Bottom Line Up Front)

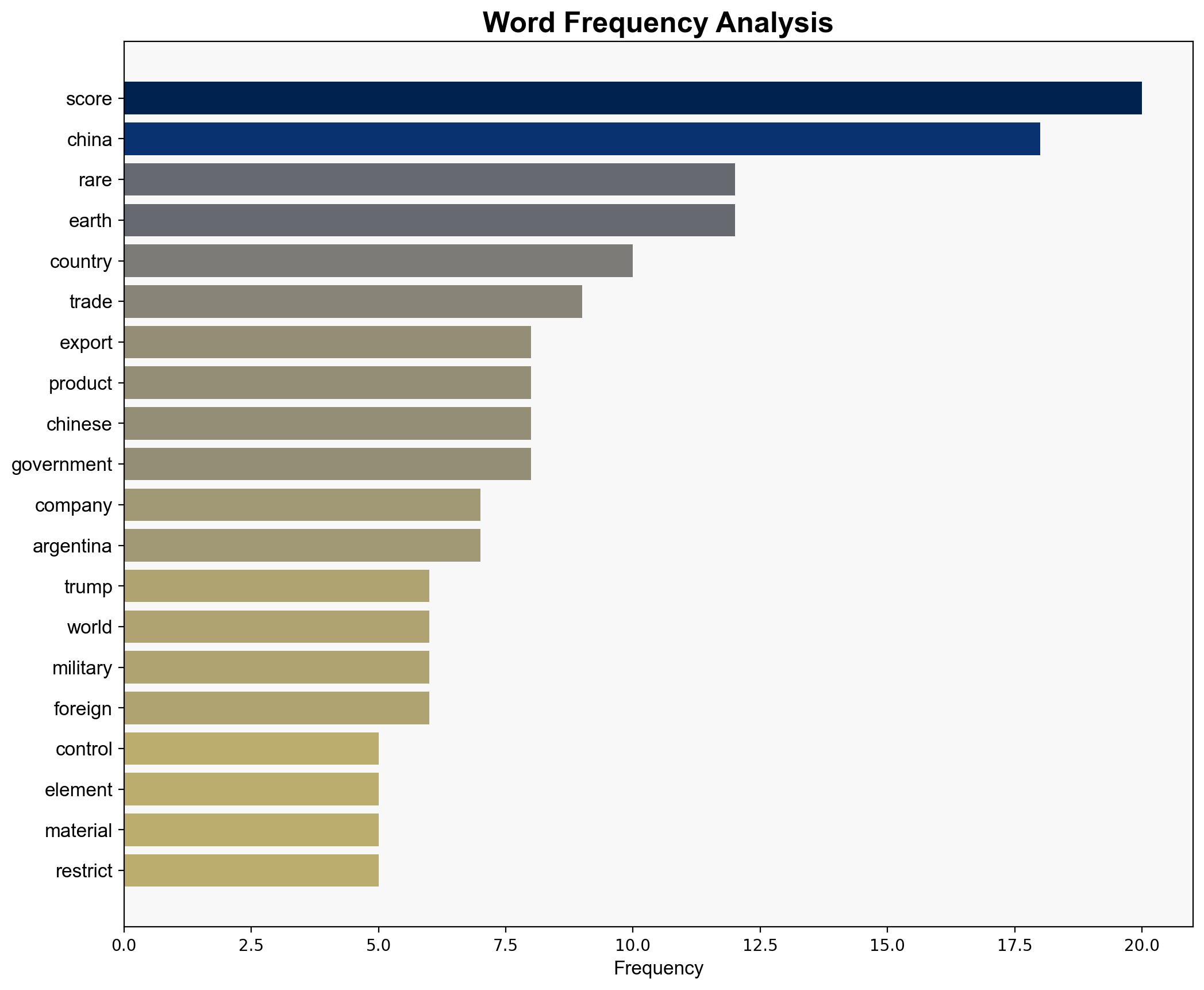

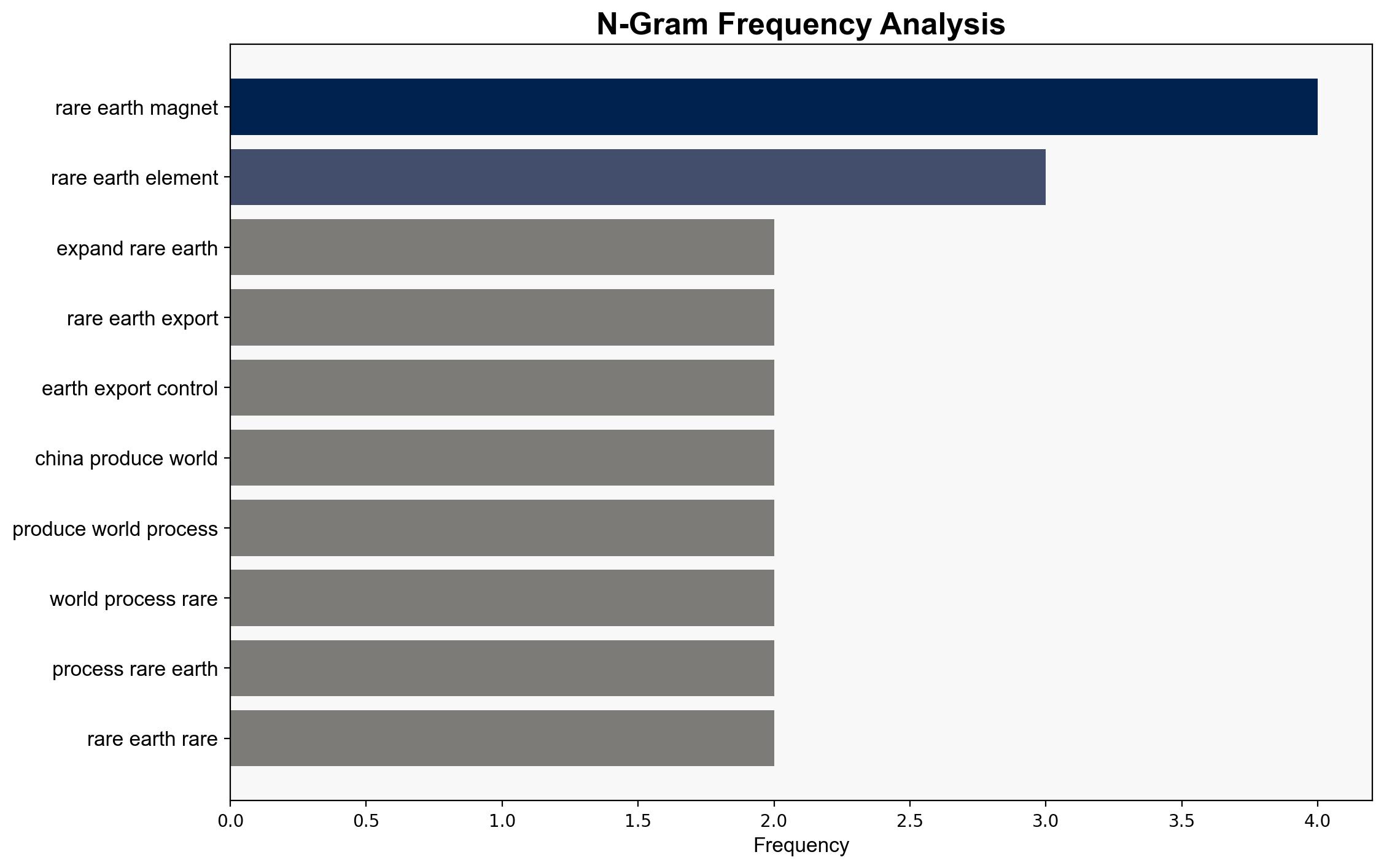

China’s expansion of rare earth export controls is strategically aimed at leveraging its dominance in the rare earth market to exert pressure on countries reliant on these materials, particularly in the semiconductor and defense sectors. The most supported hypothesis is that China is using these controls as a geopolitical tool to counter U.S. and allied policies. Confidence Level: Moderate. Recommended action includes diversifying supply chains and increasing domestic production capabilities.

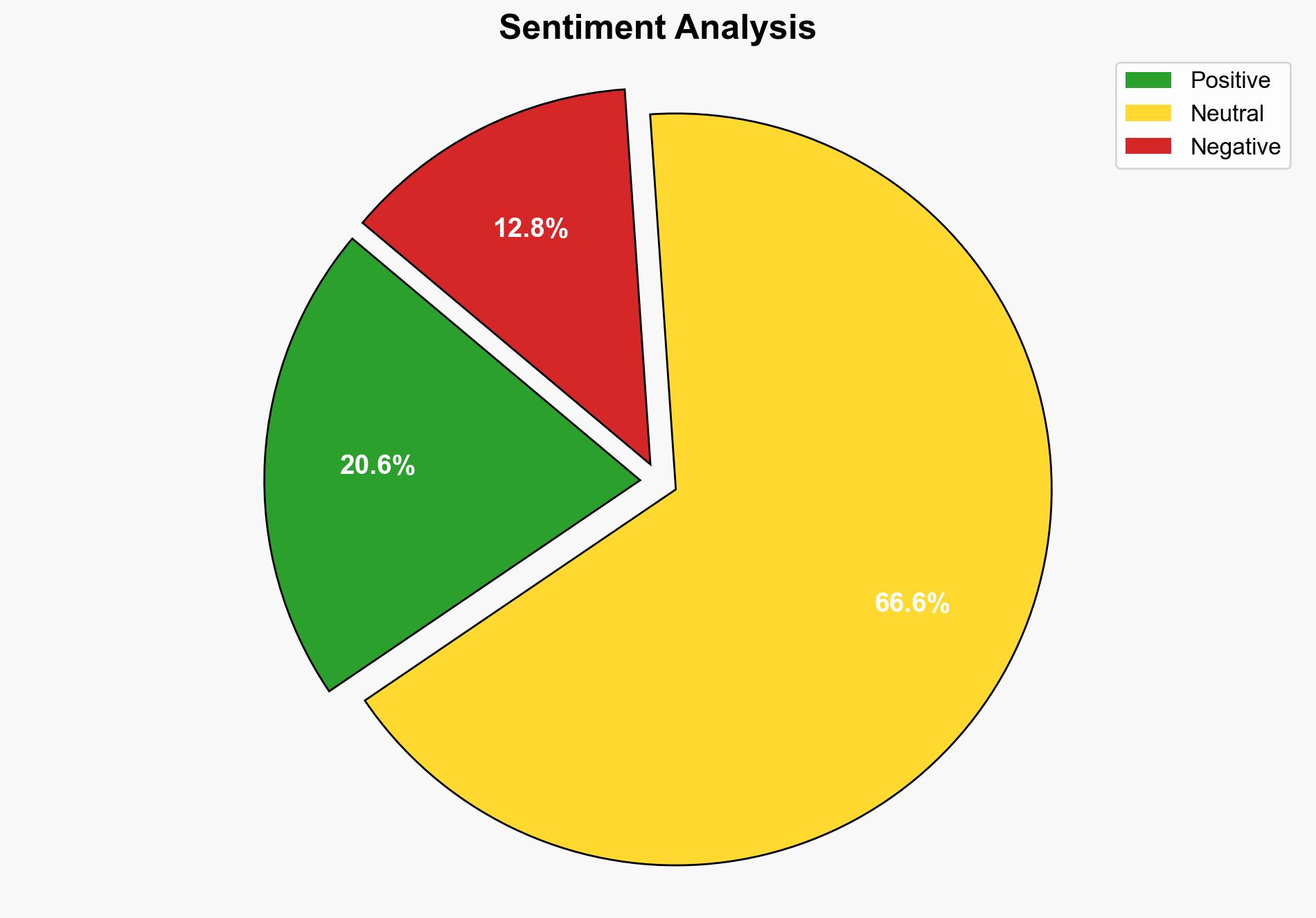

2. Competing Hypotheses

1. **Geopolitical Leverage Hypothesis**: China is expanding rare earth export controls to use its market dominance as a geopolitical tool against the U.S. and its allies, particularly in the semiconductor and defense sectors. This move is intended to counteract U.S. policies perceived as hostile, such as export restrictions on semiconductor technology to China.

2. **Economic Protectionism Hypothesis**: The expansion of export controls is primarily economically motivated, aiming to boost domestic industries by ensuring that rare earth resources are used to enhance China’s own technological capabilities and reduce dependency on foreign technology.

3. Key Assumptions and Red Flags

– **Assumptions**: The Geopolitical Leverage Hypothesis assumes that China prioritizes geopolitical influence over immediate economic gain. The Economic Protectionism Hypothesis assumes that China is primarily focused on internal economic growth and technological independence.

– **Red Flags**: Lack of transparency in China’s decision-making process and potential underestimation of global supply chain resilience. The possibility of China using export controls as a retaliatory measure against specific countries or companies is not fully explored.

– **Blind Spots**: The potential for international collaboration to counteract China’s control over rare earths is not considered.

4. Implications and Strategic Risks

The expansion of export controls could lead to increased tensions between China and countries reliant on rare earths, particularly the U.S. and its allies. This may escalate into broader trade conflicts or prompt accelerated efforts to develop alternative supply chains. The risk of economic disruption in industries dependent on rare earths, such as semiconductors and defense, is significant. Cyber and industrial espionage risks may increase as countries seek to mitigate supply chain vulnerabilities.

5. Recommendations and Outlook

- **Mitigation Actions**: Encourage investment in alternative rare earth sources, including domestic mining and recycling initiatives. Strengthen international alliances to develop a coordinated response to China’s export controls.

- **Scenario-Based Projections**:

– **Best Case**: Successful diversification of supply chains reduces dependency on Chinese rare earths, minimizing economic impact.

– **Worst Case**: Escalation of trade tensions leads to significant disruptions in technology and defense sectors, with potential for broader geopolitical conflict.

– **Most Likely**: Gradual adaptation by affected countries, with increased focus on technological innovation and supply chain resilience.

6. Key Individuals and Entities

– **Xi Jinping**: Central figure in China’s strategic policy decisions.

– **Donald Trump**: Mentioned in context of previous U.S.-China trade tensions.

– **Commerce Ministry**: Key entity in implementing export controls.

– **TechInsight**: Canadian tech research firm potentially affected by China’s policies.

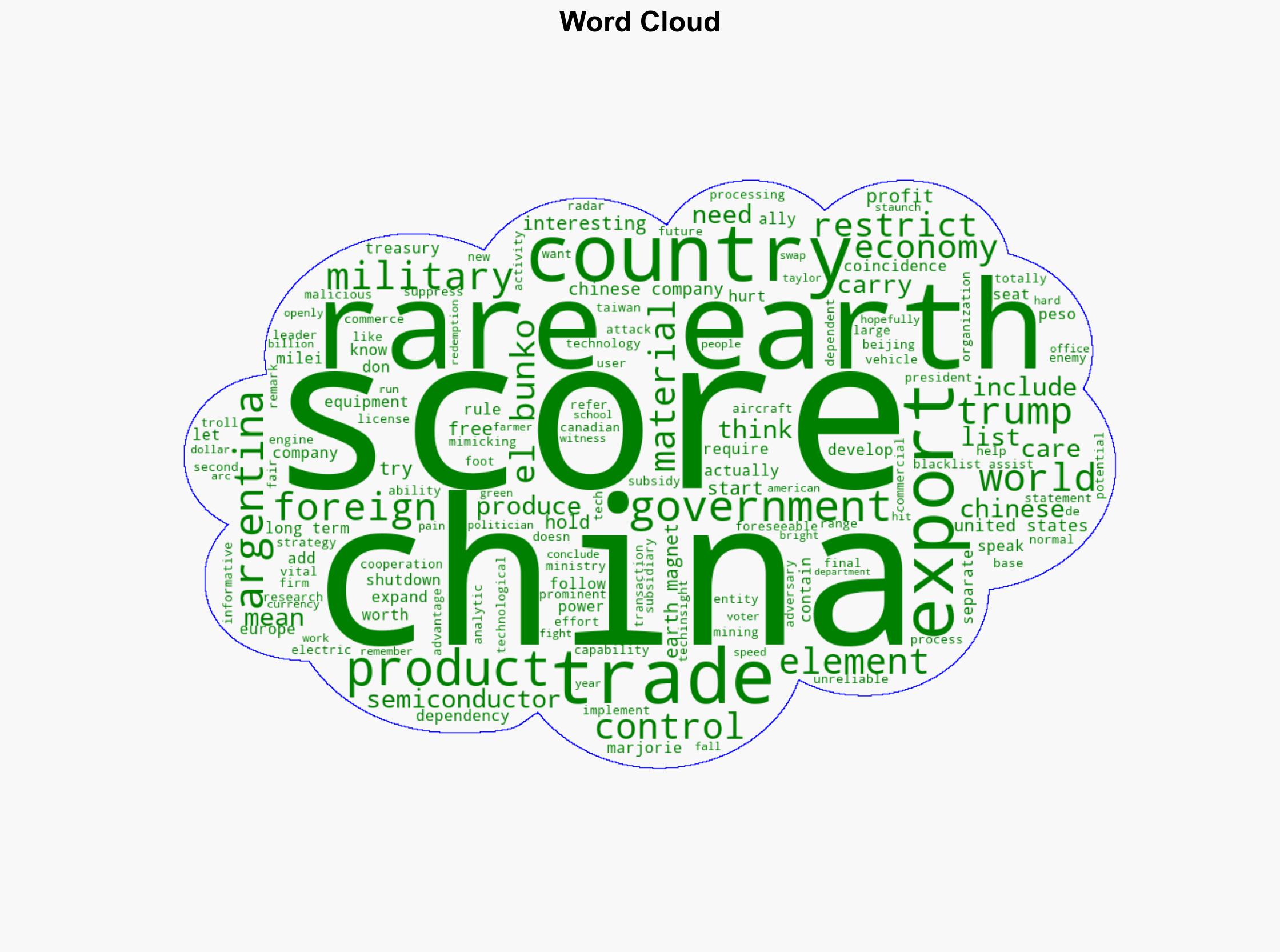

7. Thematic Tags

national security threats, economic protectionism, geopolitical strategy, supply chain resilience