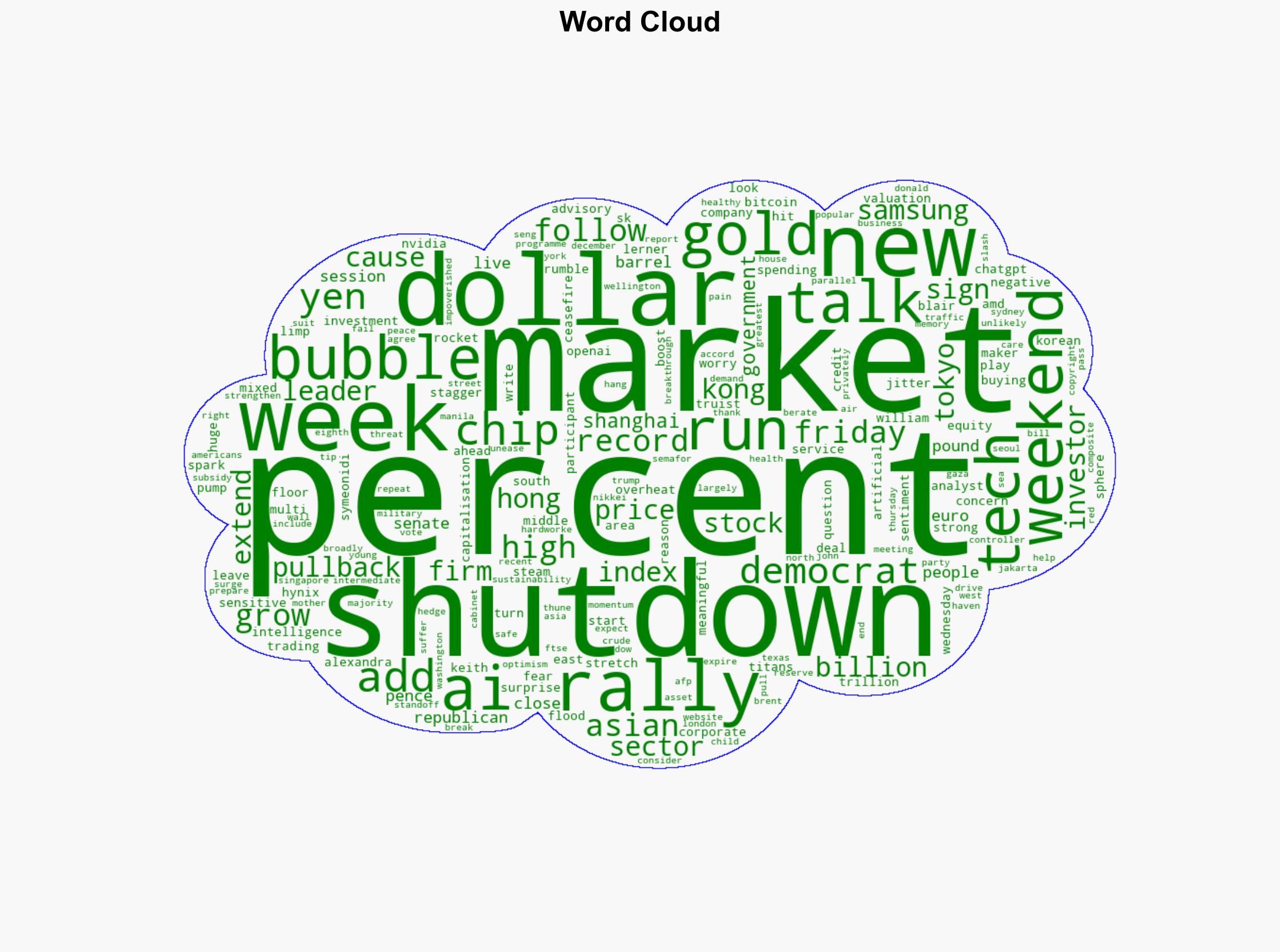

Asian Markets Limp Into Weekend As AI Bubble Fears Grow – International Business Times

Published on: 2025-10-10

Intelligence Report: Asian Markets Limp Into Weekend As AI Bubble Fears Grow – International Business Times

1. BLUF (Bottom Line Up Front)

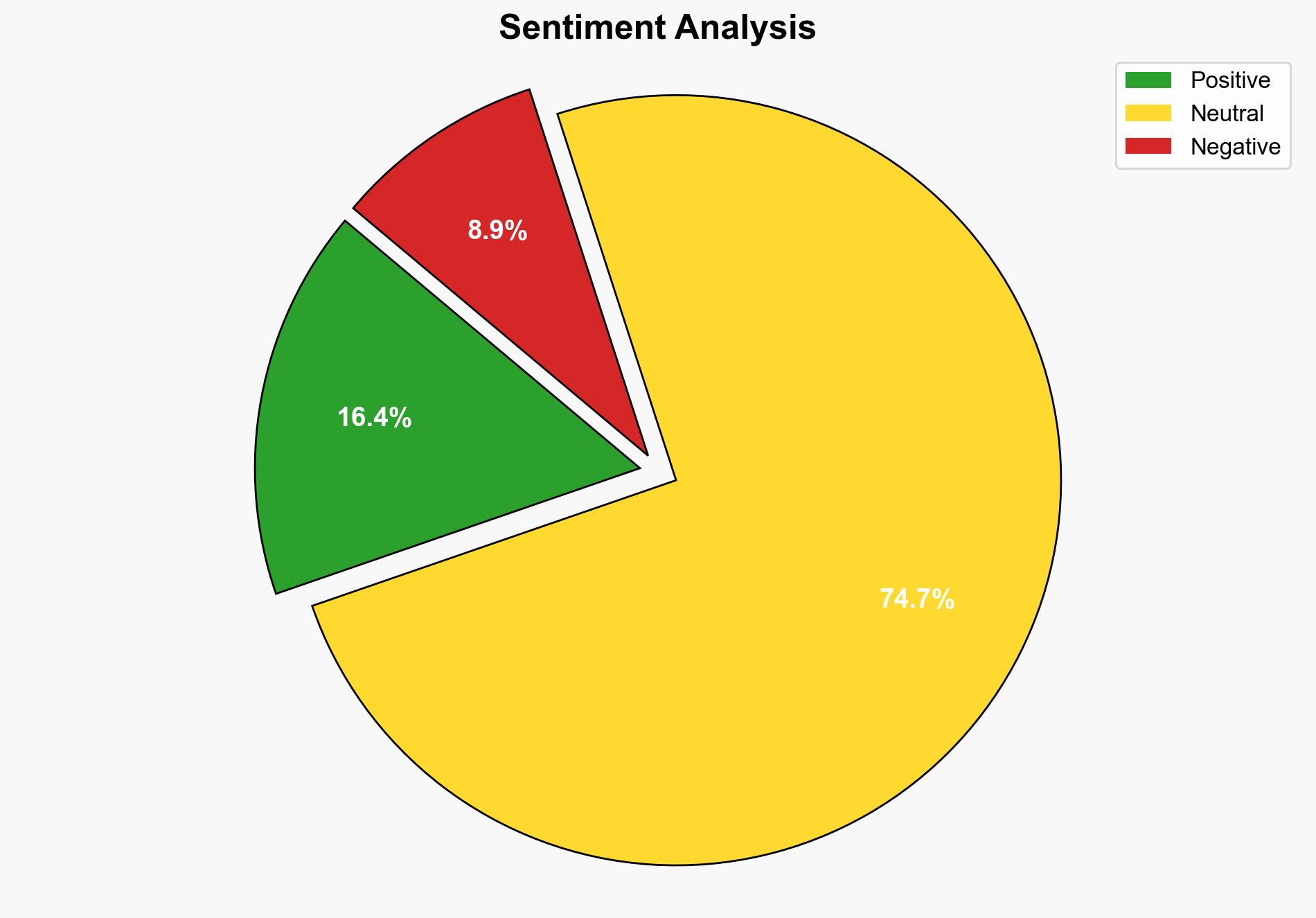

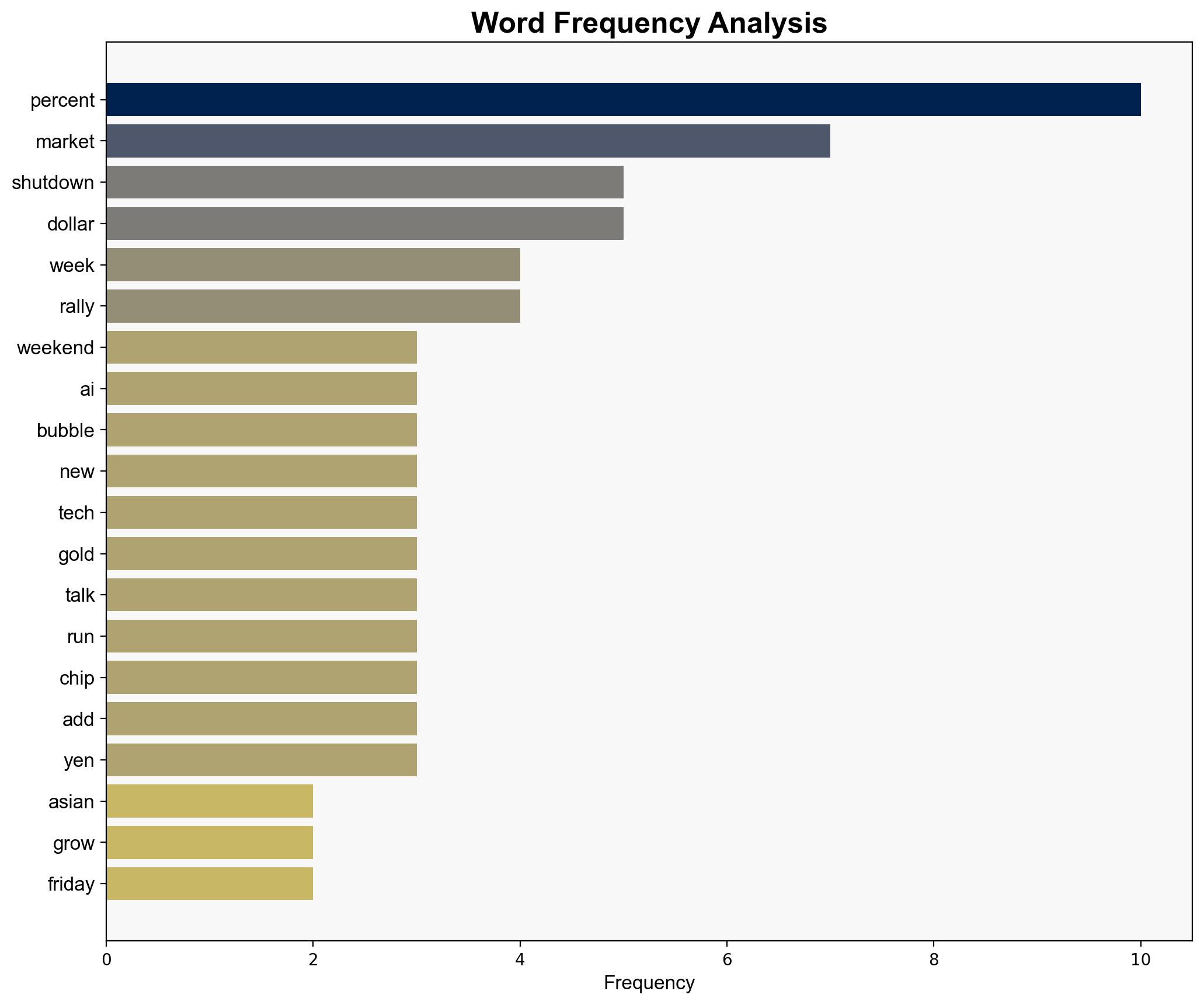

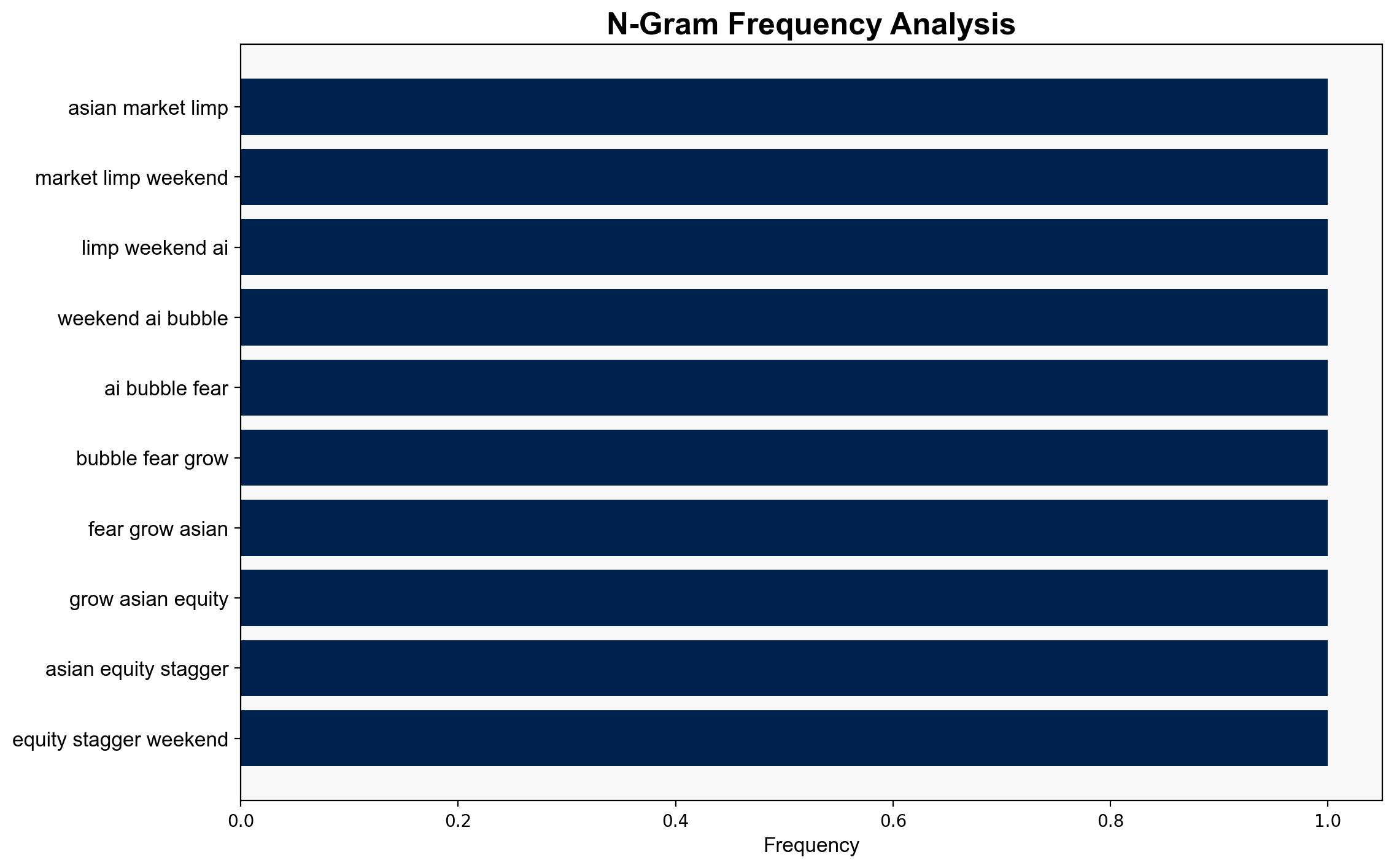

The strategic judgment indicates a moderate confidence level that the Asian markets are experiencing volatility due to fears of an AI investment bubble. The most supported hypothesis suggests that while AI investments are driving market growth, there is a significant risk of a market correction. It is recommended to closely monitor AI sector developments and investor sentiment, and to consider hedging strategies to mitigate potential financial losses.

2. Competing Hypotheses

1. **Hypothesis A**: The current market volatility is primarily driven by fears of an AI investment bubble, as rapid capital influx into AI technologies has led to unsustainable valuations.

2. **Hypothesis B**: The market volatility is a result of broader geopolitical and economic uncertainties, including Middle East tensions and potential U.S. government shutdown, with AI sector concerns being a secondary factor.

Using ACH 2.0, Hypothesis A is better supported due to the direct correlation between AI investments and market movements, as evidenced by the significant capital influx into AI firms and the resulting market reactions.

3. Key Assumptions and Red Flags

– **Assumptions**: It is assumed that AI sector growth is the primary driver of market trends. Another assumption is that geopolitical events have a secondary impact.

– **Red Flags**: The potential for confirmation bias exists if analysts focus solely on AI without considering broader economic factors. The lack of detailed data on investor behavior and sentiment is a concern.

– **Inconsistent Data**: The report lacks specific data on the scale of AI investments relative to other market influences.

4. Implications and Strategic Risks

The potential for an AI bubble poses significant economic risks, including a market correction that could impact global financial stability. Geopolitical tensions and economic uncertainties, such as a U.S. government shutdown, could exacerbate market volatility. There is also a risk of psychological impact on investors, leading to panic selling.

5. Recommendations and Outlook

- Monitor AI sector developments and investor sentiment closely to anticipate market shifts.

- Implement hedging strategies to protect against potential market corrections.

- Scenario-based projections:

- **Best Case**: AI sector stabilizes, and geopolitical tensions ease, leading to market recovery.

- **Worst Case**: AI bubble bursts, combined with geopolitical crises, causing a significant market downturn.

- **Most Likely**: Continued volatility with periodic corrections as markets adjust to AI sector dynamics and geopolitical developments.

6. Key Individuals and Entities

– **Nvidia**: Key player in the AI sector, recently reaching a trillion-dollar market capitalization.

– **Samsung and SK Hynix**: South Korean firms involved in significant AI chip investments.

– **John Thune**: Mentioned in the context of U.S. political developments affecting market sentiment.

7. Thematic Tags

national security threats, cybersecurity, economic volatility, AI investment, geopolitical tensions