Oil Holds Sharp Drop With Focus on Gaza Plan and Global Supply – Financial Post

Published on: 2025-10-10

Intelligence Report: Oil Holds Sharp Drop With Focus on Gaza Plan and Global Supply – Financial Post

1. BLUF (Bottom Line Up Front)

The most supported hypothesis is that global oil prices are primarily influenced by geopolitical tensions and trade uncertainties, with a confidence level of medium. It is recommended to monitor geopolitical developments closely, particularly in the Middle East and U.S.-China relations, to anticipate further market volatility.

2. Competing Hypotheses

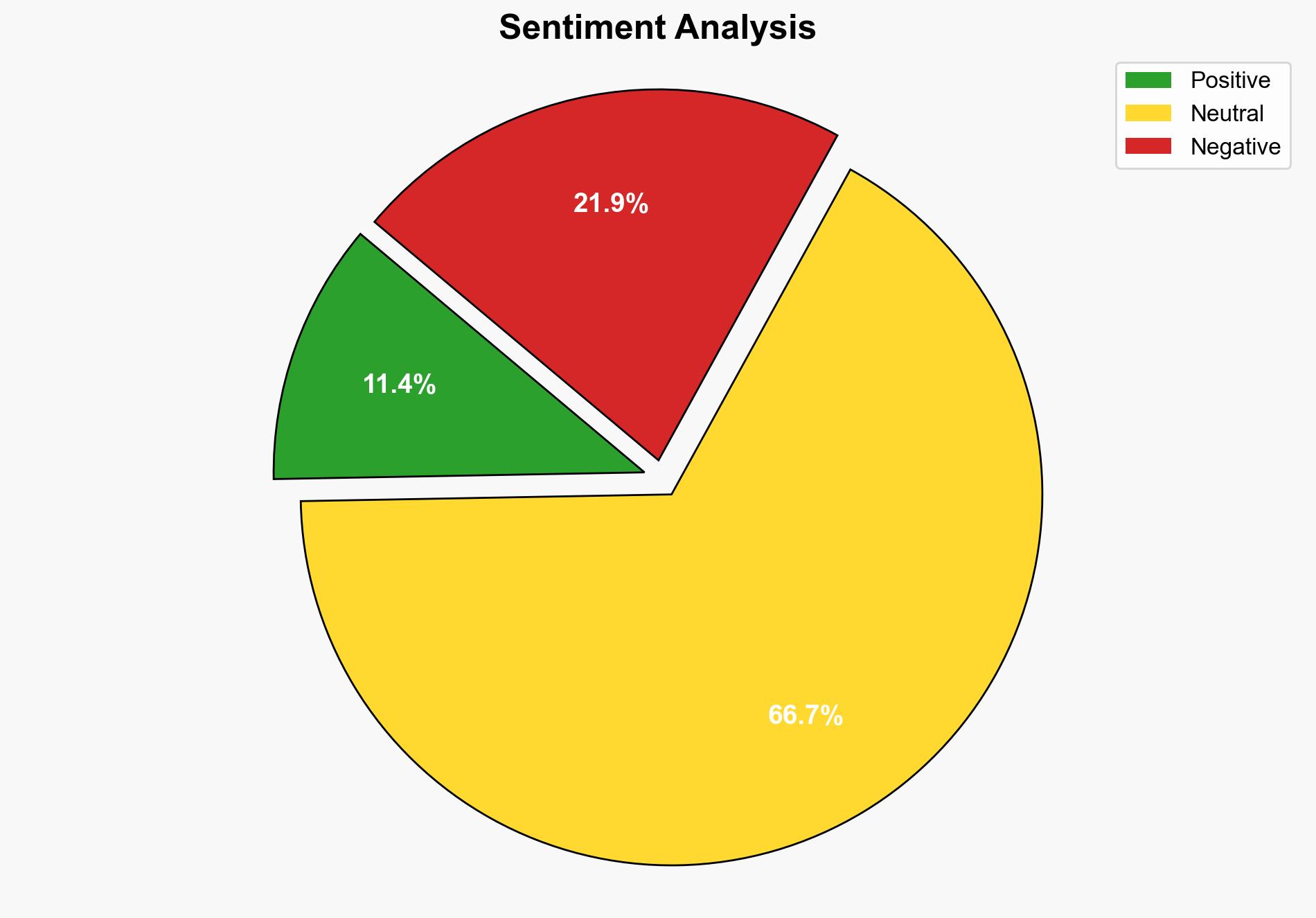

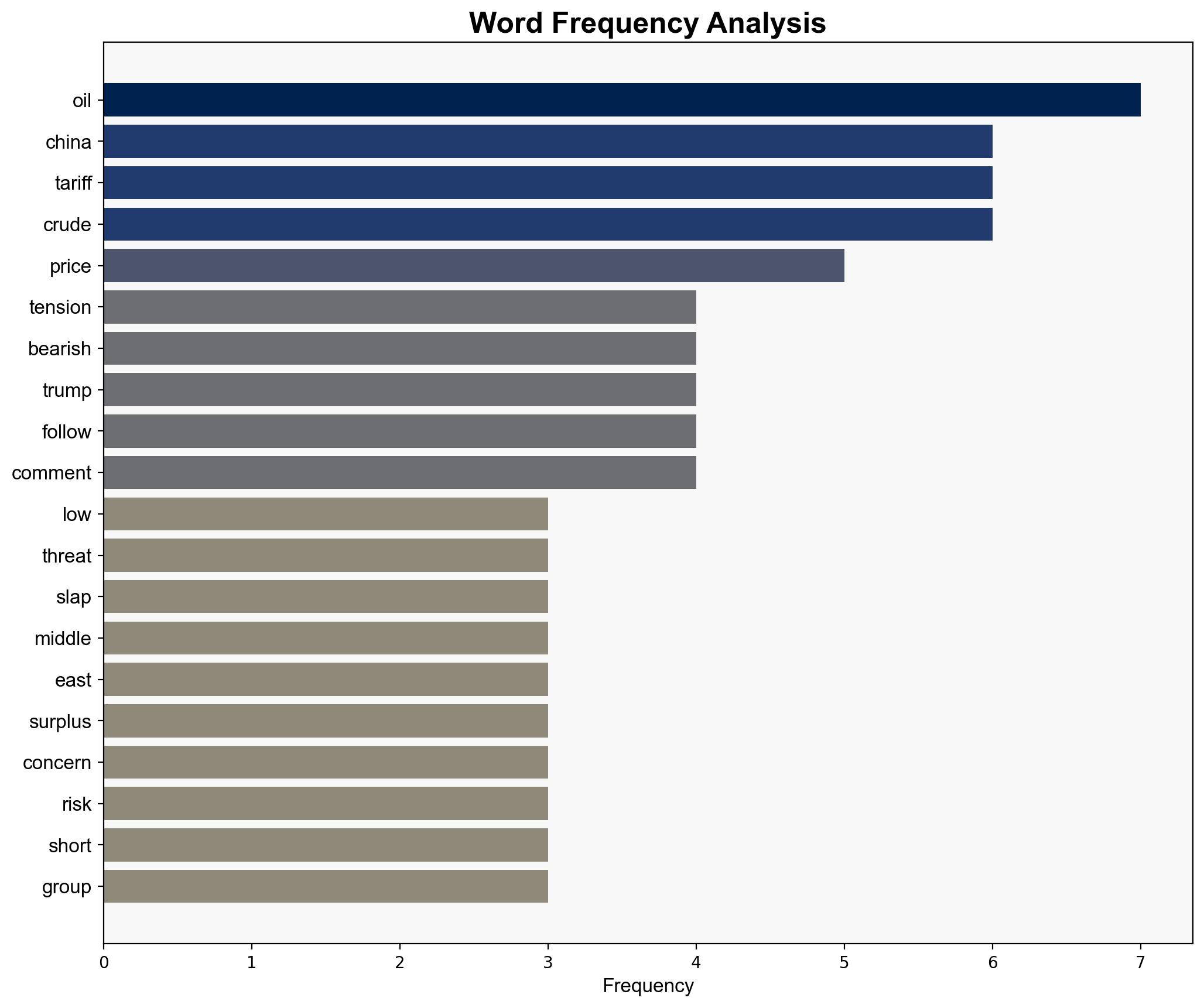

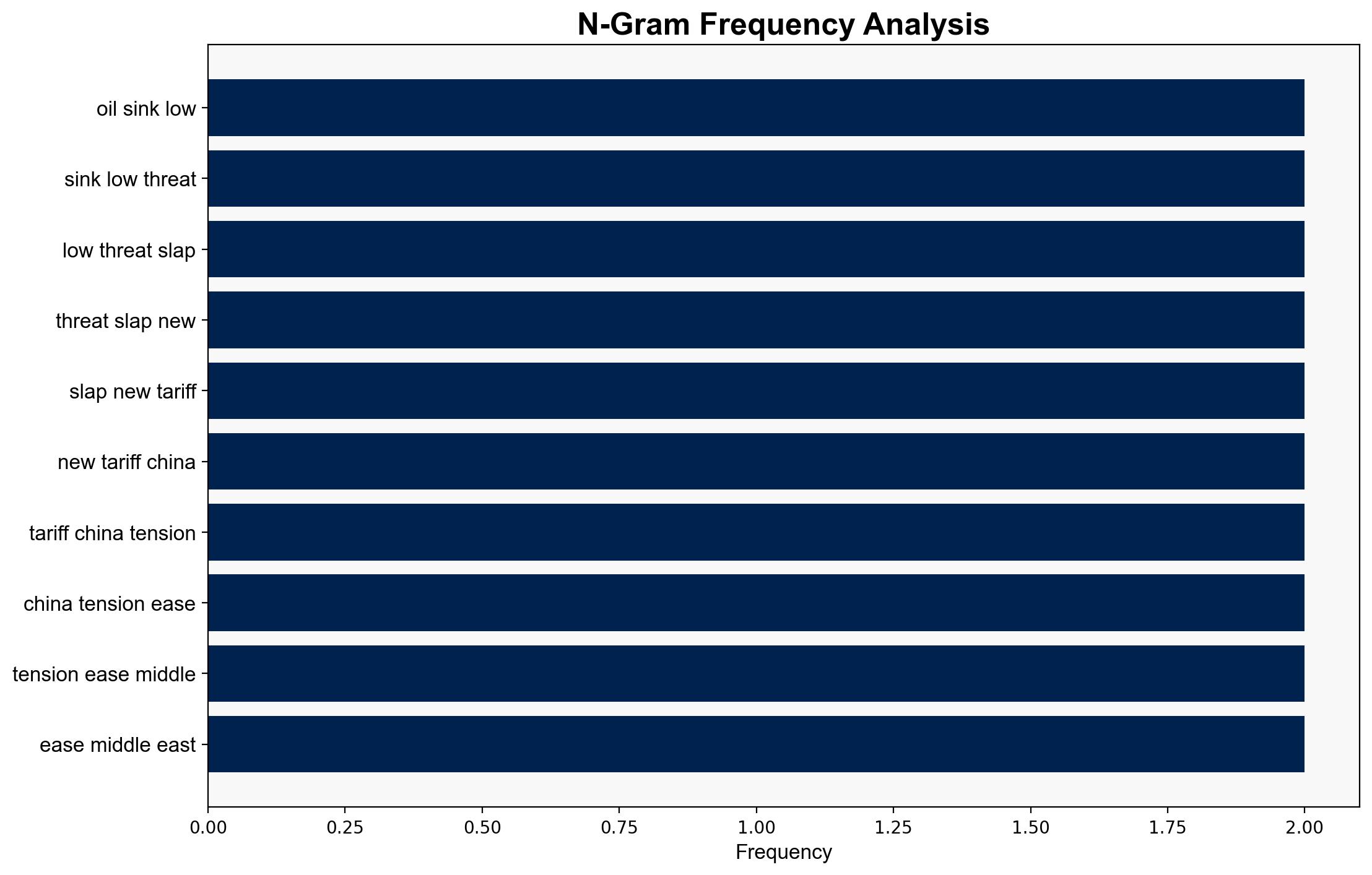

1. **Hypothesis A**: The decline in oil prices is primarily driven by geopolitical tensions in the Middle East and trade uncertainties between the U.S. and China. This hypothesis suggests that the potential for increased tariffs and retaliatory measures, along with instability in the Middle East, are creating a bearish outlook for oil markets.

2. **Hypothesis B**: The decline in oil prices is mainly due to a global supply surplus and market dynamics, independent of geopolitical factors. This hypothesis posits that increased production quotas by OPEC and other oil-producing nations are leading to an oversupply, which is the primary driver of the price drop.

Using ACH 2.0, Hypothesis A is better supported due to the immediate impact of geopolitical news on market sentiment and the historical precedence of such events influencing oil prices significantly.

3. Key Assumptions and Red Flags

– **Assumptions**: Hypothesis A assumes that geopolitical events have a direct and significant impact on oil prices. Hypothesis B assumes that market fundamentals, such as supply and demand, are the primary drivers.

– **Red Flags**: The potential for rapid de-escalation in U.S.-China trade tensions or unexpected resolutions in the Middle East could quickly invalidate Hypothesis A. Conversely, any significant production cuts by OPEC could challenge Hypothesis B.

– **Blind Spots**: The analysis may overlook the impact of technological advancements in oil extraction and alternative energy sources, which could also influence market dynamics.

4. Implications and Strategic Risks

– **Economic**: Prolonged low oil prices could impact oil-dependent economies, leading to broader economic instability.

– **Geopolitical**: Escalation in the Middle East or a breakdown in U.S.-China trade negotiations could exacerbate market volatility.

– **Psychological**: Market sentiment could shift rapidly based on news cycles, leading to increased volatility and risk aversion among investors.

5. Recommendations and Outlook

- **Mitigation**: Diversify energy investments to hedge against market volatility. Consider strategic reserves to buffer against supply disruptions.

- **Opportunities**: Monitor for buying opportunities if geopolitical tensions ease, potentially leading to a market rebound.

- **Scenario Projections**:

– **Best Case**: Rapid resolution of trade tensions and stabilization in the Middle East lead to a recovery in oil prices.

– **Worst Case**: Escalation of conflicts and trade wars result in prolonged market instability and economic downturns.

– **Most Likely**: Continued volatility with periodic fluctuations based on geopolitical developments and market adjustments.

6. Key Individuals and Entities

– Donald Trump

– Xi Jinping

– John Kilduff

– Rebecca Babin

7. Thematic Tags

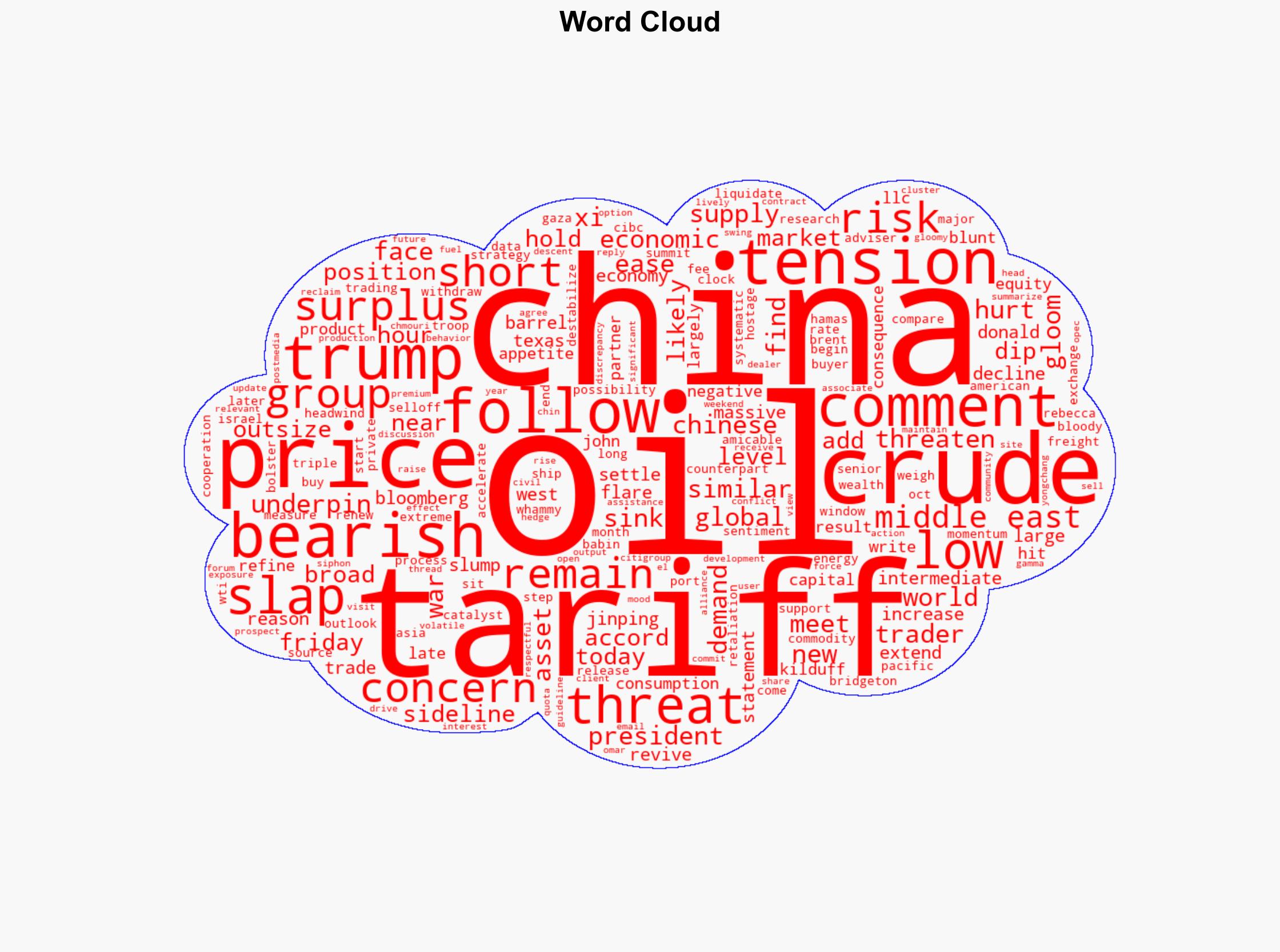

national security threats, geopolitical tensions, trade wars, oil market dynamics