Bitcoin Miners Rally in Pre-Market as Sector Nears 90B Market Cap – CoinDesk

Published on: 2025-10-10

Intelligence Report: Bitcoin Miners Rally in Pre-Market as Sector Nears 90B Market Cap – CoinDesk

1. BLUF (Bottom Line Up Front)

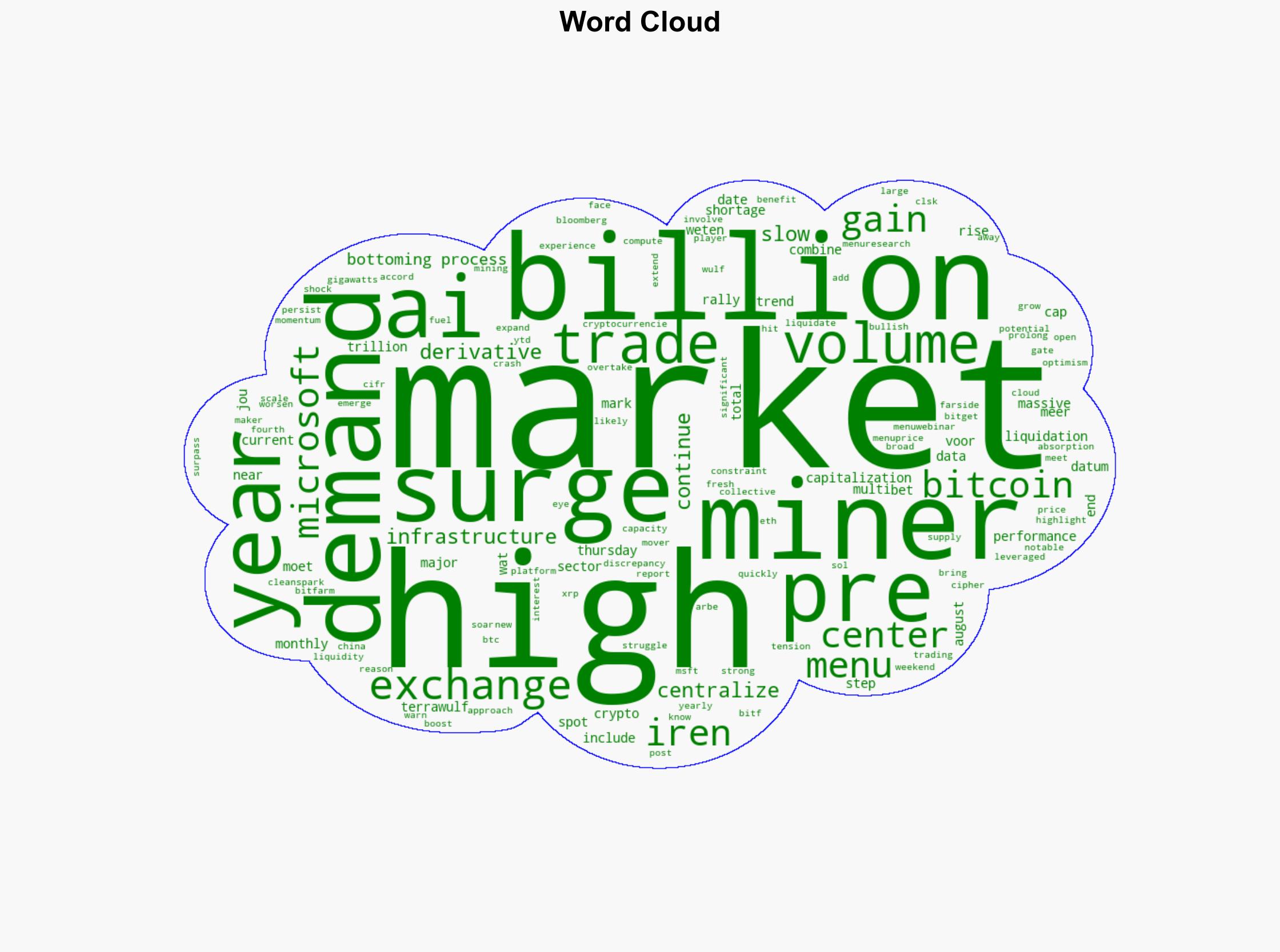

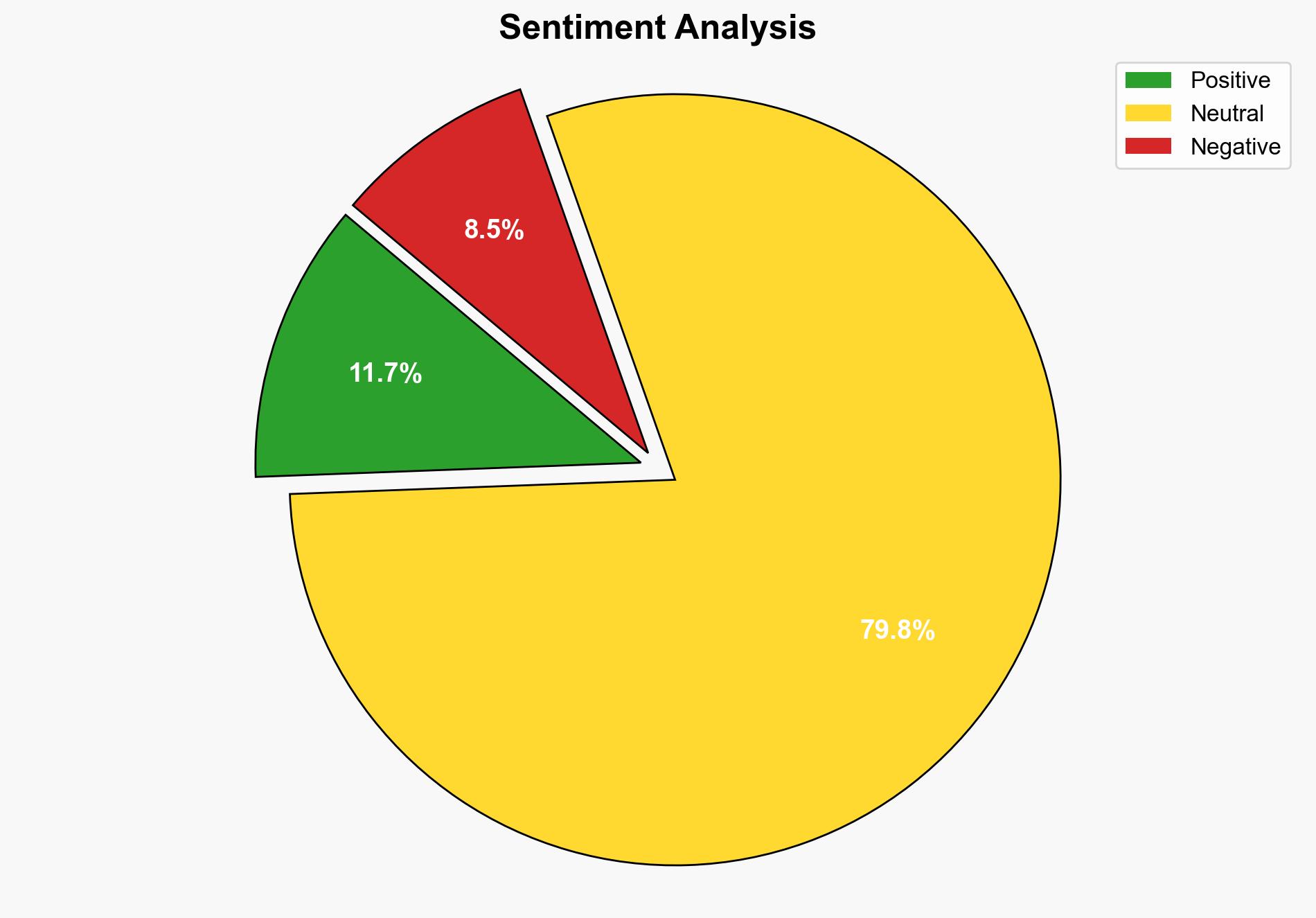

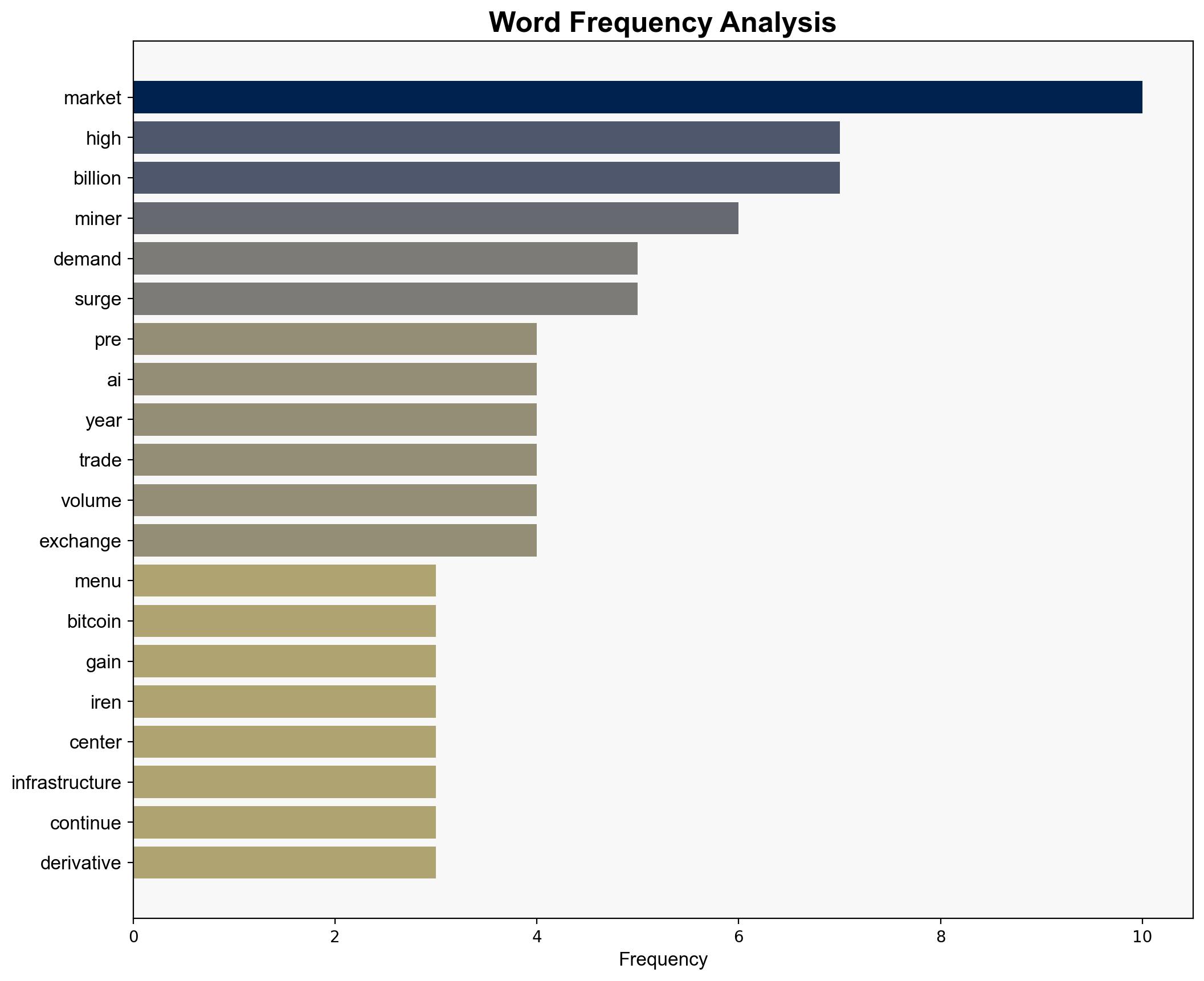

The Bitcoin mining sector is experiencing a significant pre-market rally, potentially driven by increased demand for high-performance computing and AI infrastructure. The most supported hypothesis suggests that this growth is sustainable, fueled by strategic expansions into AI data centers. However, potential risks include market volatility and infrastructure constraints. Confidence level: Moderate. Recommended action: Monitor infrastructure developments and market trends to anticipate shifts in mining operations and investment opportunities.

2. Competing Hypotheses

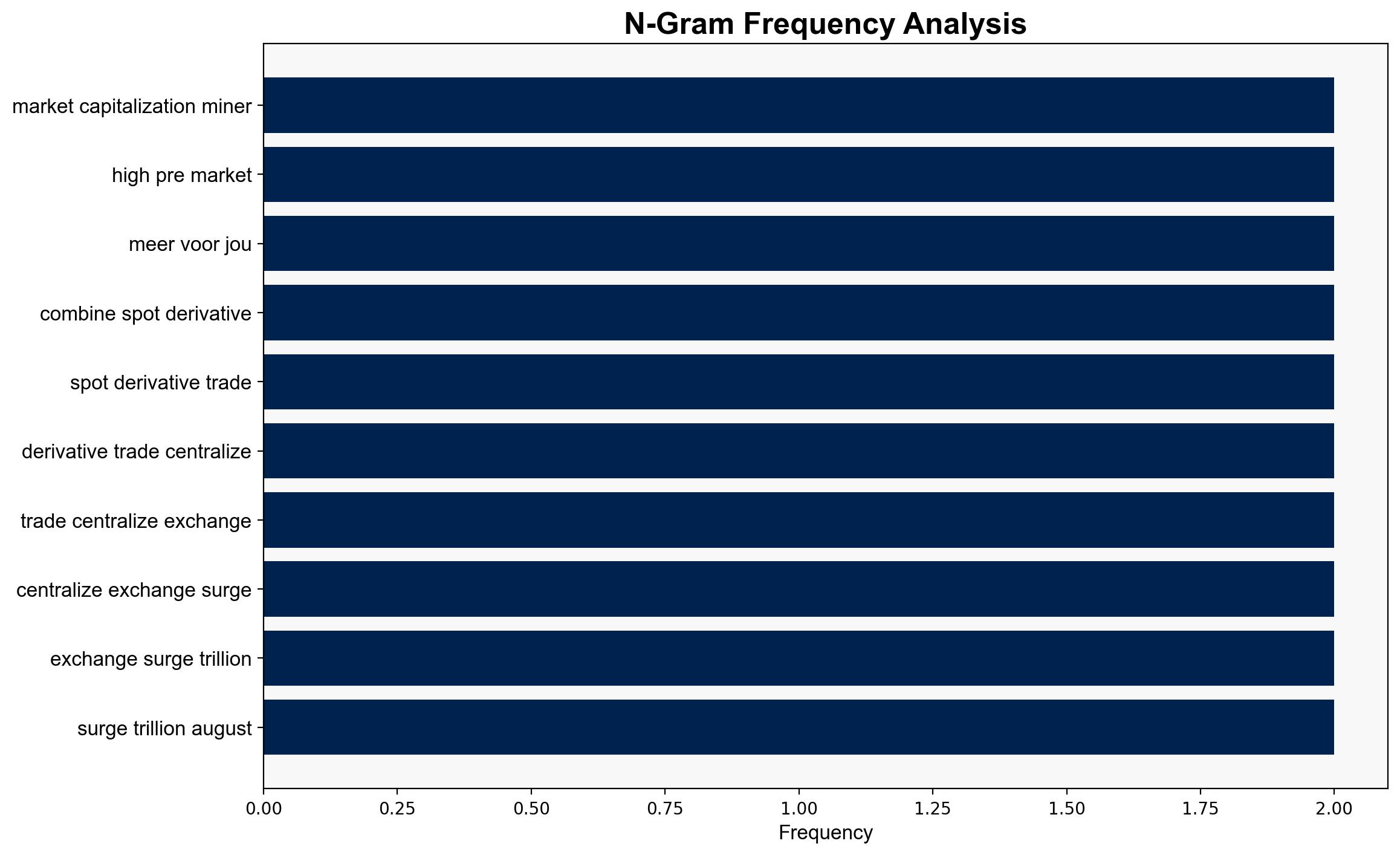

1. **Hypothesis A**: The rally in Bitcoin miners is primarily driven by increased demand for AI and high-performance computing infrastructure, which miners are capitalizing on by expanding their operations into AI data centers.

2. **Hypothesis B**: The rally is a temporary market reaction driven by speculative trading and does not reflect a sustainable trend in the Bitcoin mining sector.

Using ACH 2.0, Hypothesis A is better supported by the evidence of persistent infrastructure demand and strategic expansion efforts by miners. Hypothesis B is weakened by the lack of evidence for purely speculative trading as the primary driver.

3. Key Assumptions and Red Flags

– **Assumptions**:

– Hypothesis A assumes that the demand for AI infrastructure will continue to grow and that miners can effectively transition into this space.

– Hypothesis B assumes that market dynamics are primarily driven by speculative trading without underlying strategic shifts.

– **Red Flags**:

– Potential overestimation of miners’ ability to pivot to AI infrastructure.

– Lack of detailed data on the proportion of speculative trading versus strategic investment.

4. Implications and Strategic Risks

– **Economic**: Sustained growth in the mining sector could lead to increased investment and innovation in AI and high-performance computing.

– **Cyber**: Expansion into AI infrastructure may expose miners to new cybersecurity threats.

– **Geopolitical**: Increased infrastructure demands could strain global supply chains, impacting geopolitical stability.

– **Psychological**: Market volatility may affect investor confidence and lead to rapid shifts in market dynamics.

5. Recommendations and Outlook

- Monitor infrastructure development and AI integration by Bitcoin miners to identify strategic investment opportunities.

- Prepare for potential cybersecurity threats associated with AI infrastructure expansion.

- Scenario-based projections:

- Best: Miners successfully integrate AI infrastructure, leading to sustained growth and innovation.

- Worst: Market volatility and infrastructure constraints lead to a significant downturn.

- Most Likely: Gradual growth with periodic market corrections as miners adapt to new demands.

6. Key Individuals and Entities

– Iren

– Terrawulf

– Cipher Mining

– CleanSpark

– Bitfarm

– Microsoft

7. Thematic Tags

economic trends, cybersecurity, AI infrastructure, market volatility