China hits back at US ships with additional port fees – The Times of India

Published on: 2025-10-10

Intelligence Report: China hits back at US ships with additional port fees – The Times of India

1. BLUF (Bottom Line Up Front)

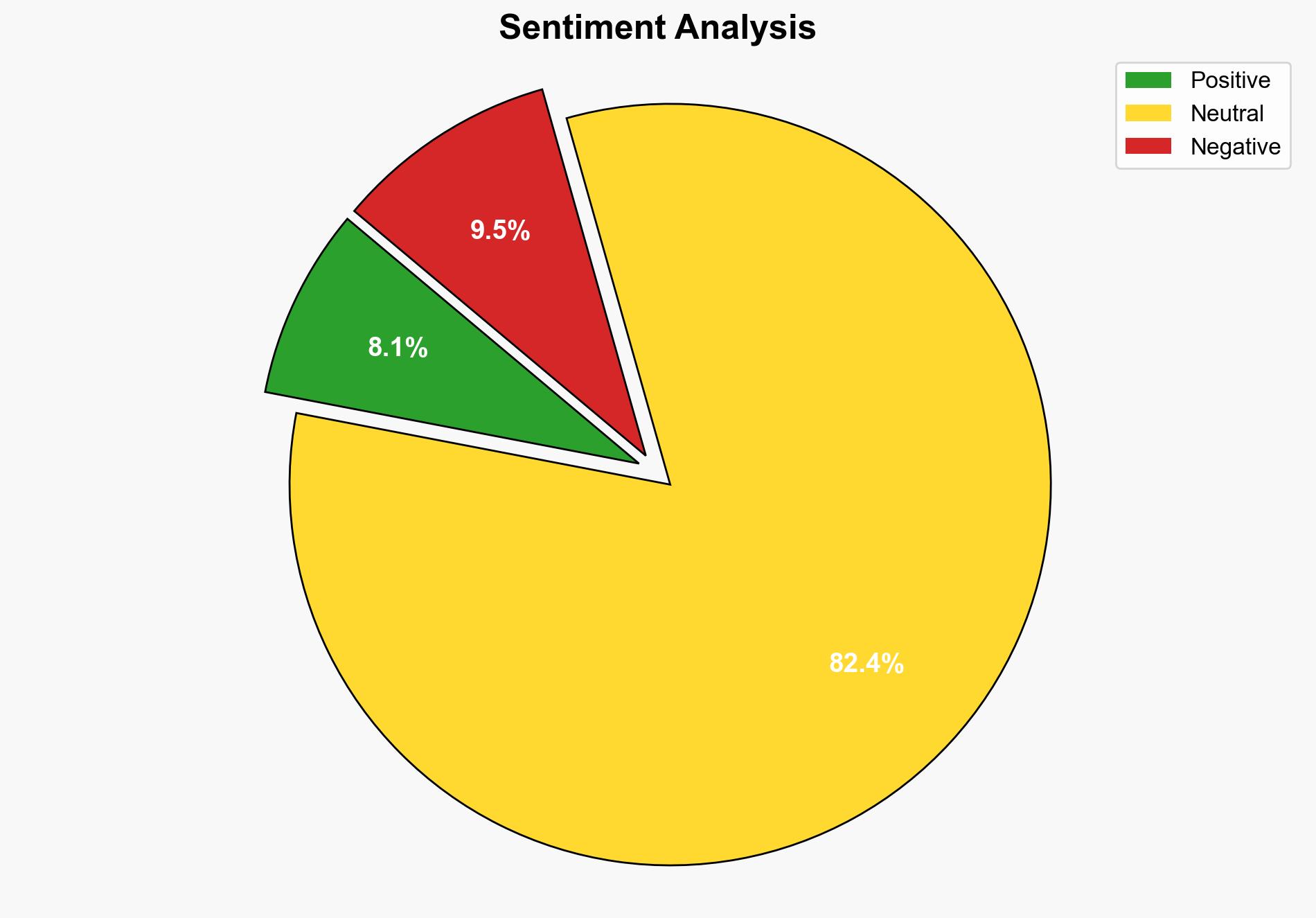

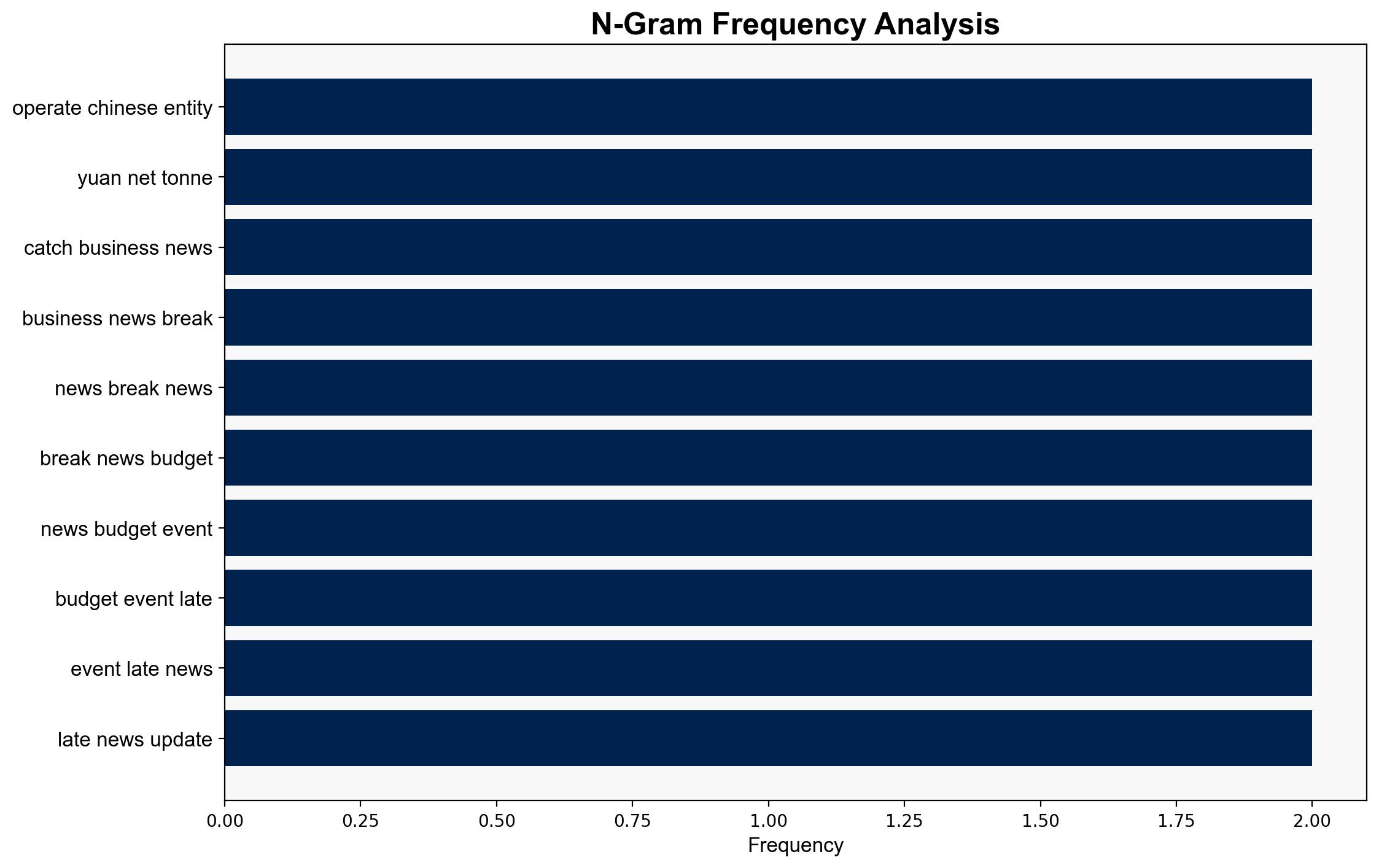

China’s imposition of additional port fees on US ships is a strategic countermeasure in response to US trade policies. The most supported hypothesis is that this action is a calculated move to exert economic pressure and influence US policy adjustments. Confidence level: Moderate. Recommended action: Engage in diplomatic negotiations to address underlying trade tensions and explore alternative shipping routes to mitigate economic impacts.

2. Competing Hypotheses

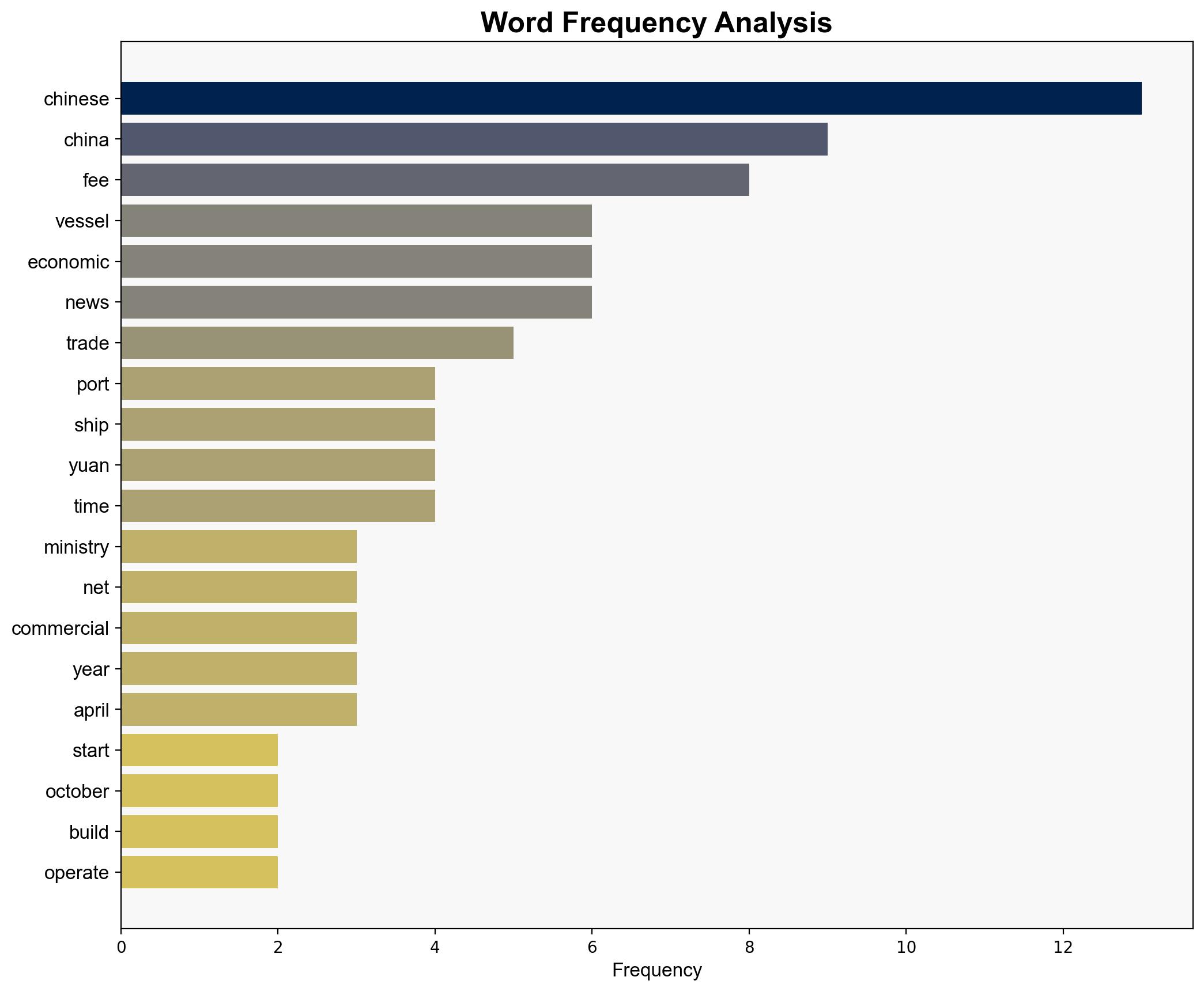

1. **Economic Retaliation Hypothesis**: China is imposing additional port fees as a direct response to US trade policies, aiming to pressure the US into reconsidering its stance on tariffs and trade restrictions.

2. **Domestic Industry Protection Hypothesis**: The fees are primarily intended to protect and bolster China’s domestic shipping and shipbuilding industries by making foreign competition less economically viable.

3. Key Assumptions and Red Flags

– **Assumptions**: The Economic Retaliation Hypothesis assumes that China believes economic pressure will lead to policy changes in the US. The Domestic Industry Protection Hypothesis assumes that the primary goal is to strengthen domestic industries rather than engage in direct economic retaliation.

– **Red Flags**: Lack of explicit statements from Chinese authorities linking the fees directly to US trade policies. Potential cognitive bias in interpreting actions as purely retaliatory without considering domestic economic strategies.

– **Inconsistent Data**: The absence of detailed financial impact assessments on US shipping companies and the broader global supply chain.

4. Implications and Strategic Risks

– **Economic Implications**: Increased shipping costs could lead to higher prices for US imports, affecting consumer markets and potentially escalating into further trade disputes.

– **Geopolitical Risks**: This move may exacerbate tensions between China and the US, potentially leading to broader geopolitical instability and impacting global trade alliances.

– **Cascading Threats**: Potential for retaliatory measures by the US, further complicating trade negotiations and impacting global economic stability.

5. Recommendations and Outlook

- Engage in diplomatic talks to de-escalate tensions and address trade imbalances.

- Explore alternative shipping routes and partnerships to reduce dependency on Chinese ports.

- Scenario Projections:

- Best Case: Successful negotiations lead to reduced fees and improved trade relations.

- Worst Case: Escalation into a full-blown trade war, severely impacting global supply chains.

- Most Likely: Continued economic tit-for-tat measures with periodic negotiations.

6. Key Individuals and Entities

– Xi Jinping

– Donald Trump

– United States Trade Representative (USTR)

7. Thematic Tags

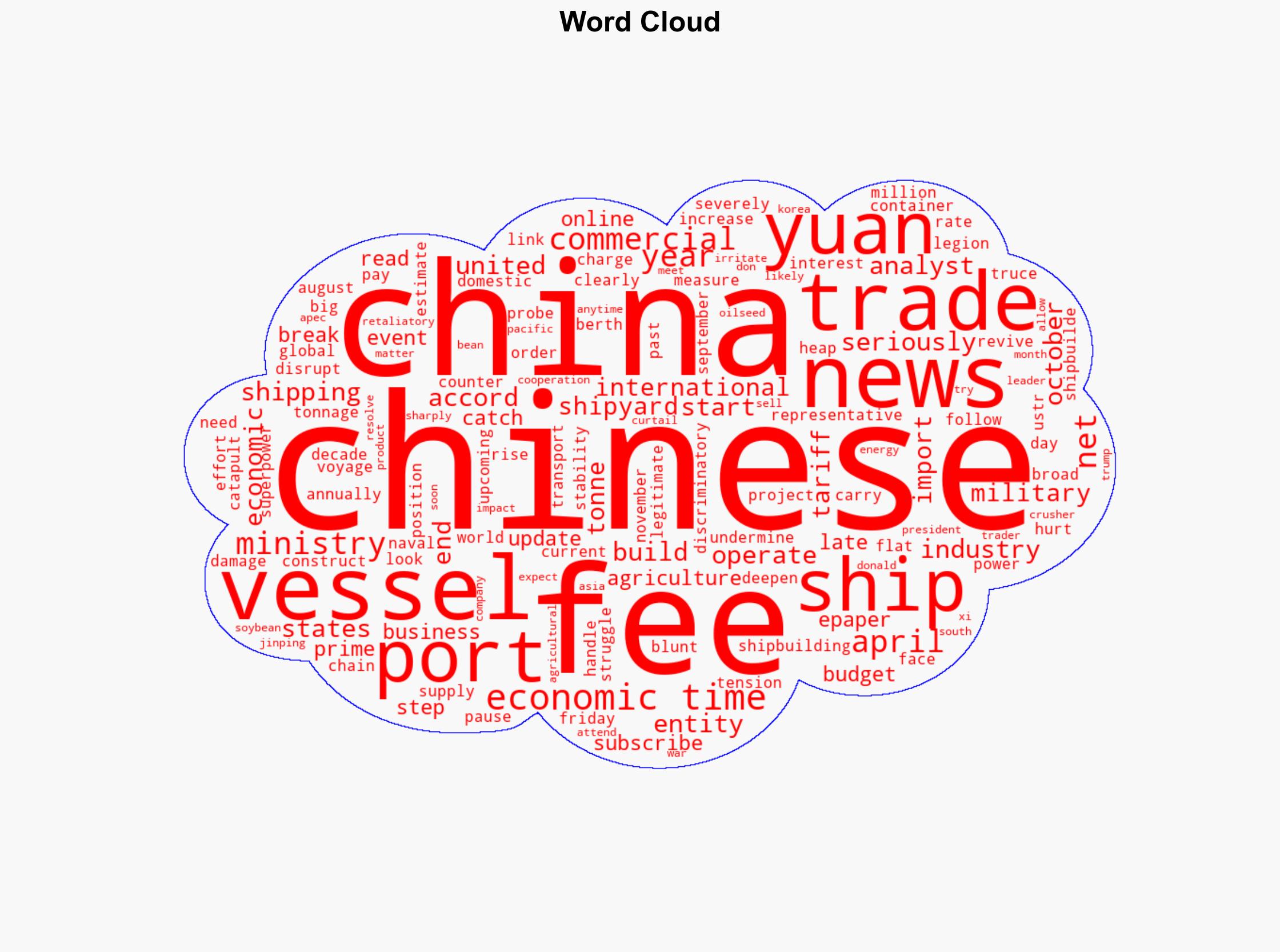

national security threats, economic retaliation, trade policy, geopolitical tensions