Oil prices fall as risk premium fades after Gaza deal – RTE

Published on: 2025-10-10

Intelligence Report: Oil prices fall as risk premium fades after Gaza deal – RTE

1. BLUF (Bottom Line Up Front)

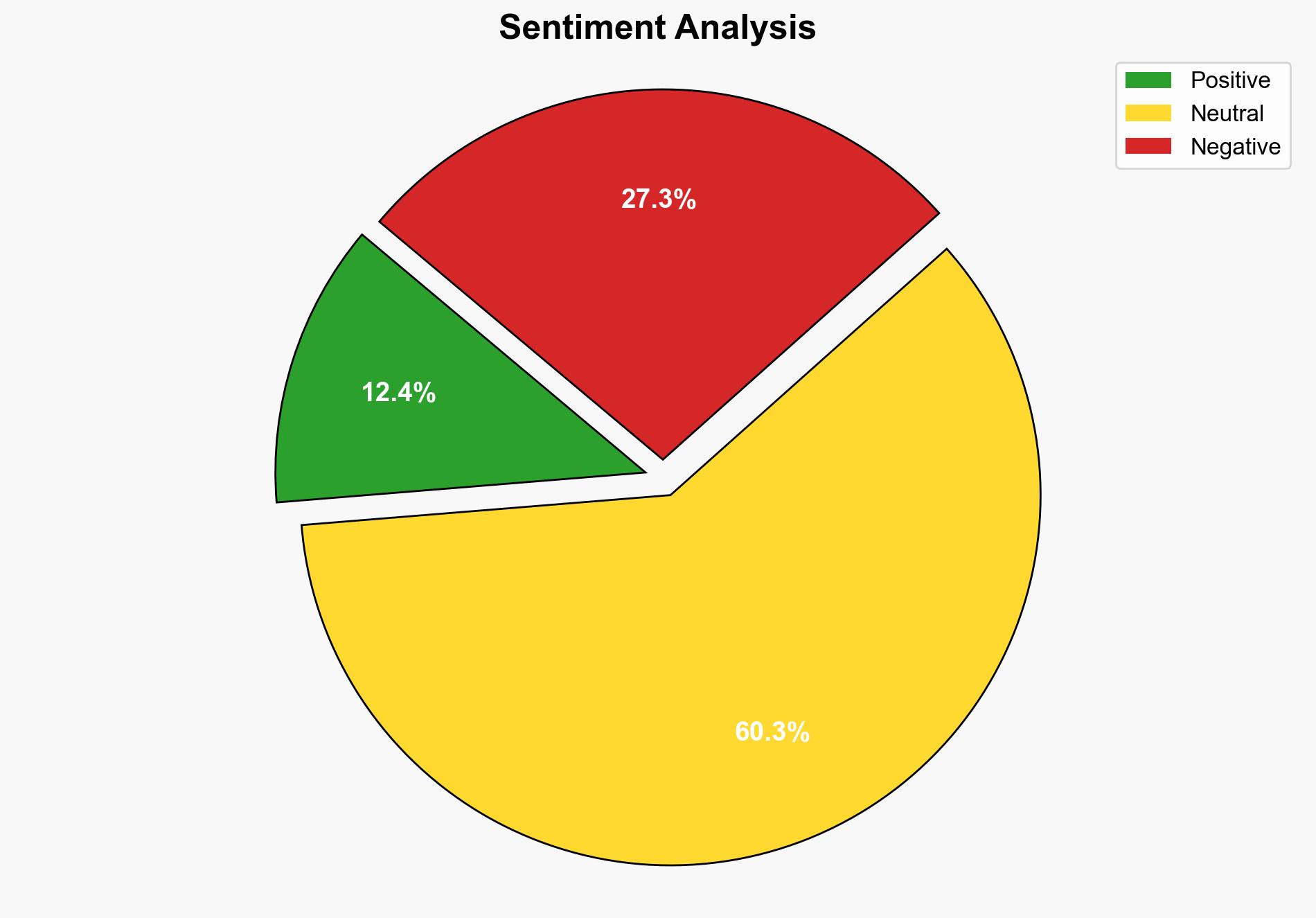

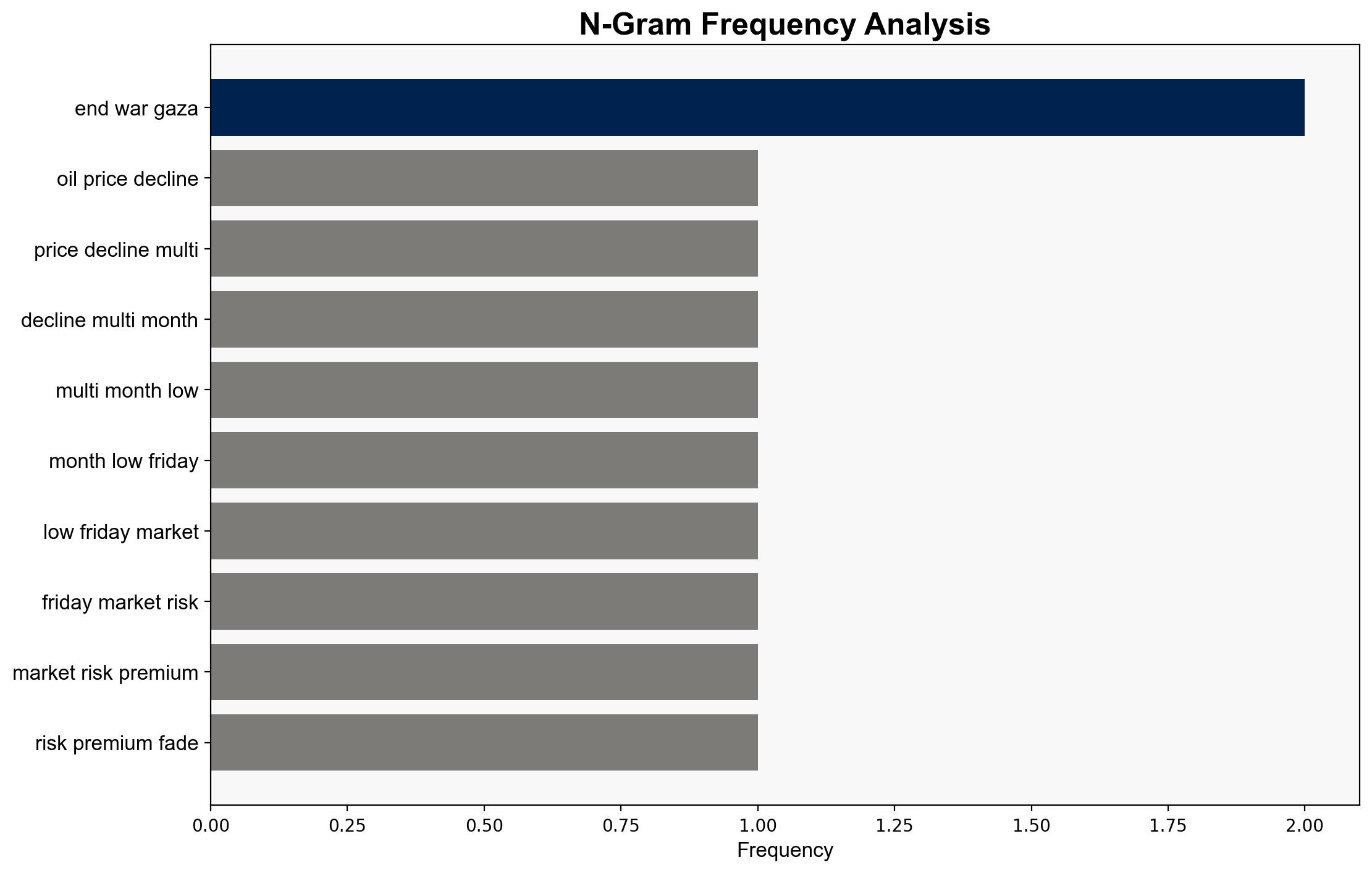

The most supported hypothesis is that the recent decline in oil prices is primarily due to the fading risk premium following the ceasefire agreement between Israel and Hamas. This assessment is made with moderate confidence, considering the potential for geopolitical volatility in the region. It is recommended to monitor the situation closely for any signs of renewed conflict or disruptions in oil supply routes.

2. Competing Hypotheses

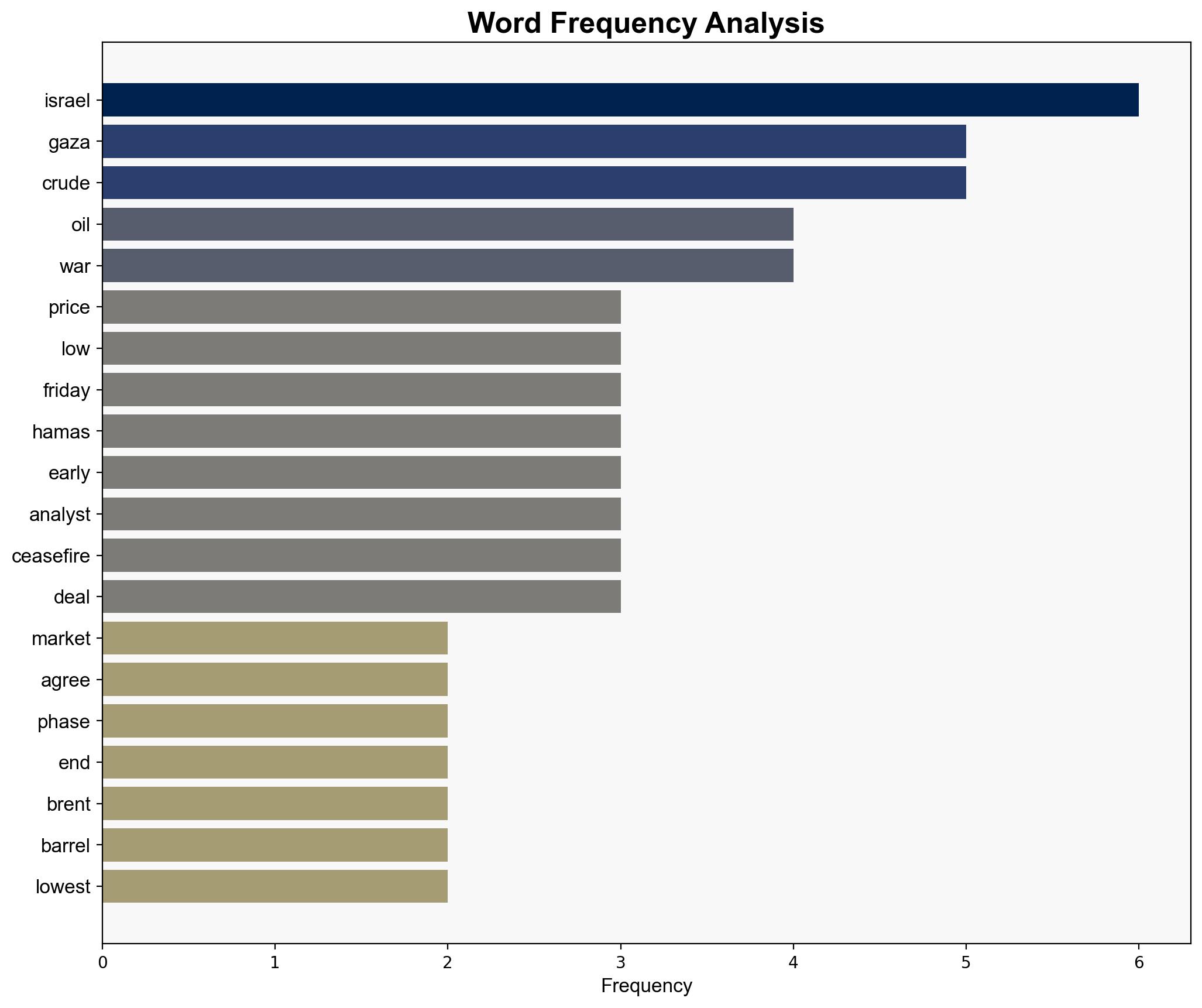

1. **Hypothesis A**: The decline in oil prices is primarily driven by the fading risk premium associated with the Israel-Hamas ceasefire, reducing fears of regional conflict impacting oil supply routes.

2. **Hypothesis B**: The decline in oil prices is primarily due to an anticipated increase in oil supply, as OPEC and its allies plan to unwind production cuts, leading to market expectations of oversupply.

Using the Analysis of Competing Hypotheses (ACH) 2.0, Hypothesis A is better supported by the immediate context of the ceasefire and its direct impact on market sentiment. Hypothesis B, while plausible, is less supported by the immediate timing of the price drop.

3. Key Assumptions and Red Flags

– **Assumptions**: It is assumed that the ceasefire will hold and that there will be no immediate resurgence of hostilities. It is also assumed that OPEC’s production decisions will proceed as planned.

– **Red Flags**: Any renewed conflict in the region or disruptions in oil transit routes could quickly reverse the current trend. Additionally, if OPEC’s production increases do not materialize as expected, this could alter market dynamics.

4. Implications and Strategic Risks

The ceasefire reduces immediate geopolitical risks, potentially stabilizing oil markets. However, the situation remains fragile, with risks of escalation if the ceasefire fails. Economic implications include potential impacts on global oil prices, influencing inflation and economic growth in oil-dependent economies. Geopolitical risks include the possibility of renewed conflict affecting regional stability and global energy security.

5. Recommendations and Outlook

- Monitor the ceasefire’s durability and any developments in the Israel-Hamas relationship.

- Track OPEC’s production decisions and market reactions to anticipate further price movements.

- Scenario Projections:

- Best Case: Ceasefire holds, OPEC manages production effectively, leading to stable oil prices.

- Worst Case: Ceasefire collapses, leading to regional conflict and oil supply disruptions, causing price spikes.

- Most Likely: Ceasefire holds with occasional tensions, OPEC gradually increases production, stabilizing prices at a moderate level.

6. Key Individuals and Entities

– Bjarne Schieldrop

– Daniel Hynes

– President Donald Trump

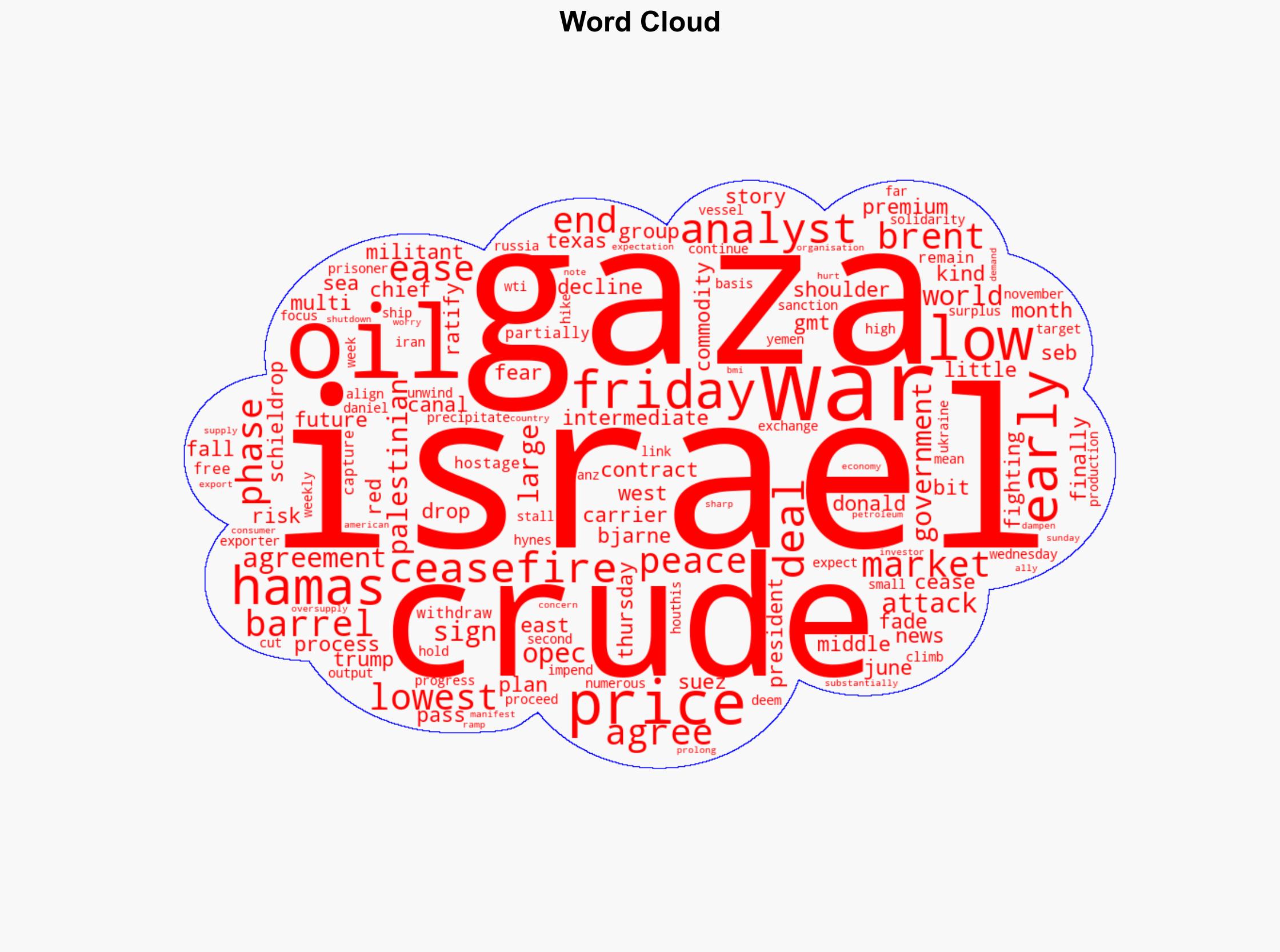

7. Thematic Tags

national security threats, geopolitical stability, energy markets, Middle East conflict