In Bid To Save Shipyards US Set To Charge Fees On Chinese Ships – International Business Times

Published on: 2025-10-13

Intelligence Report: In Bid To Save Shipyards US Set To Charge Fees On Chinese Ships – International Business Times

1. BLUF (Bottom Line Up Front)

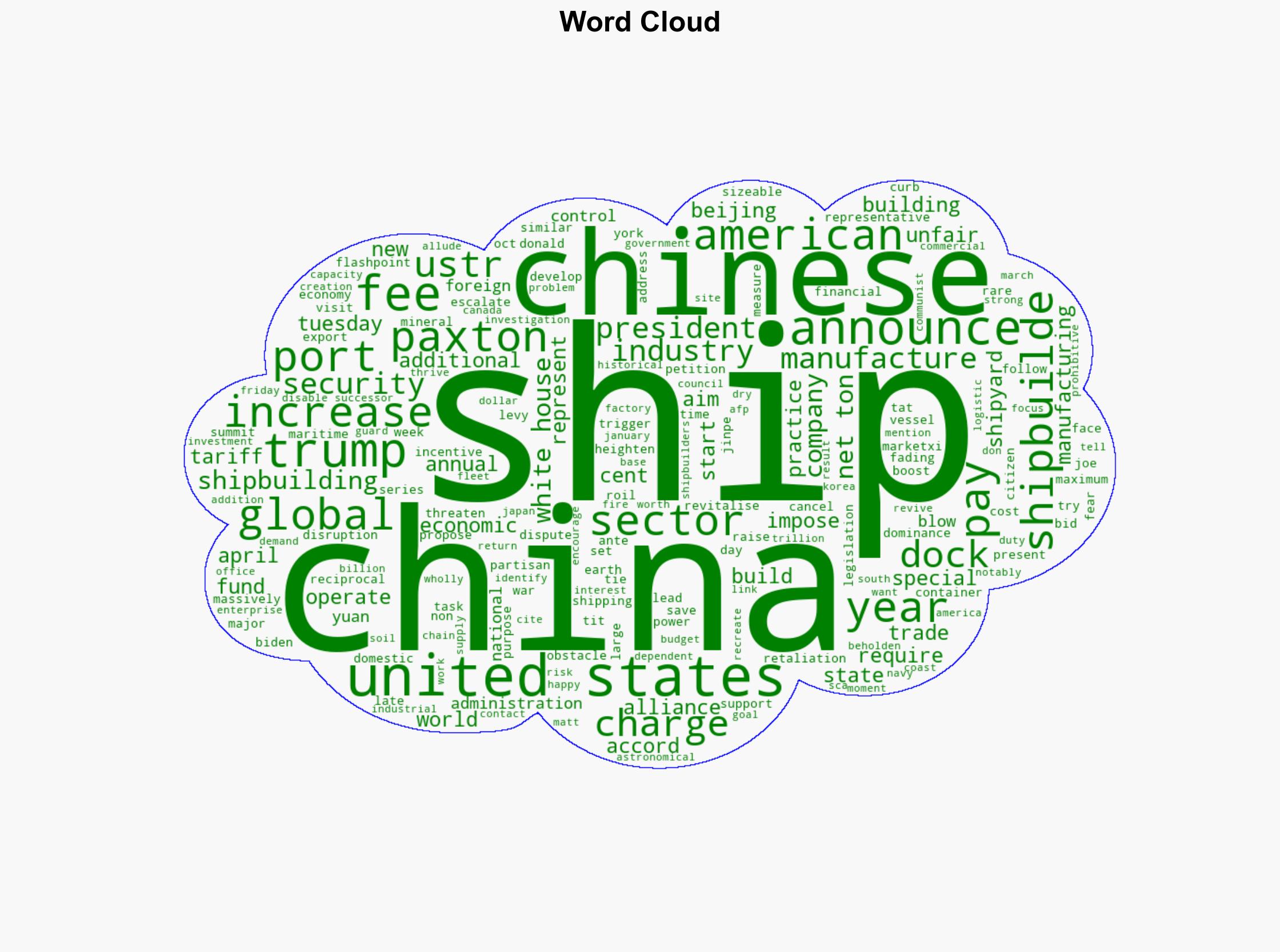

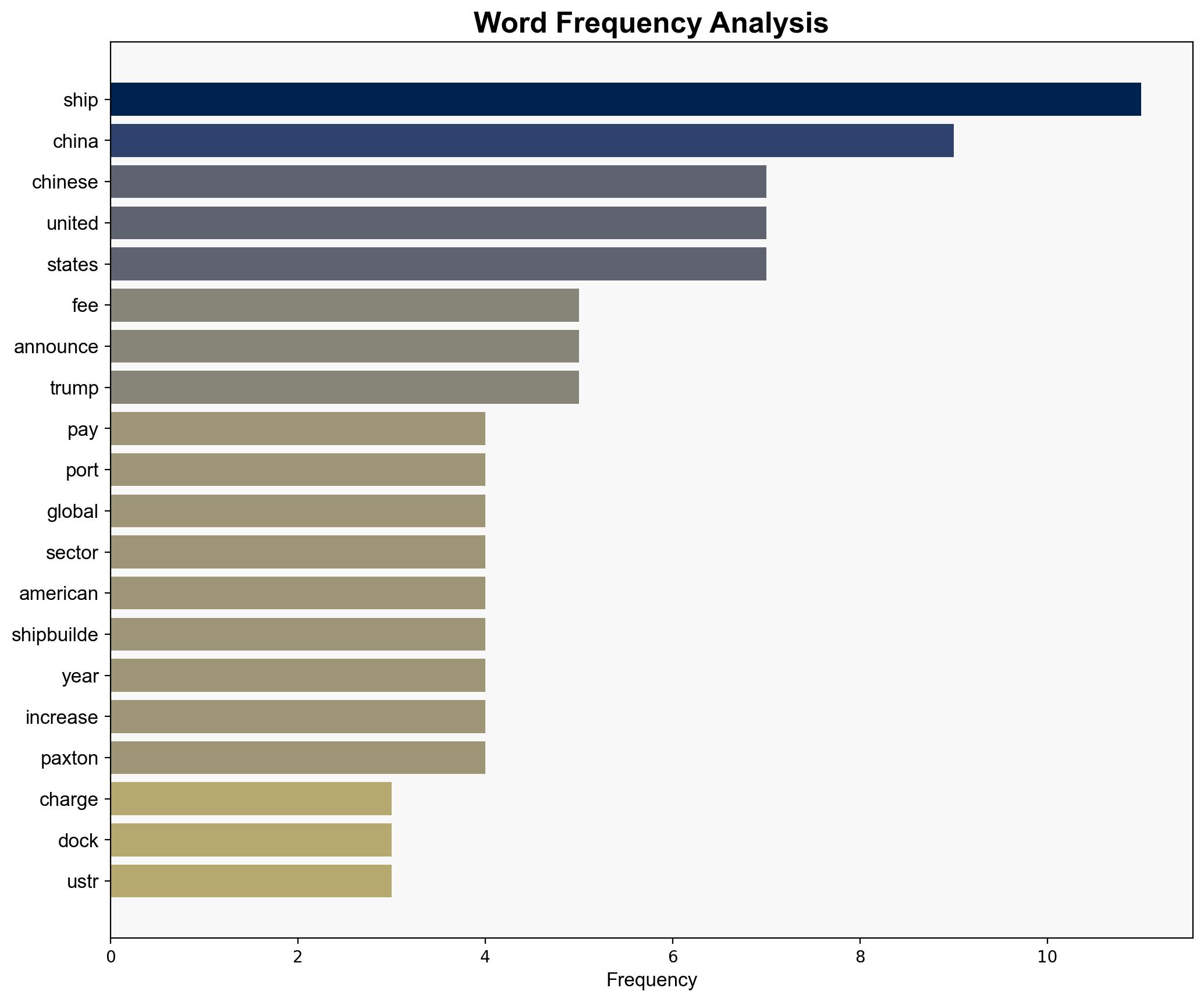

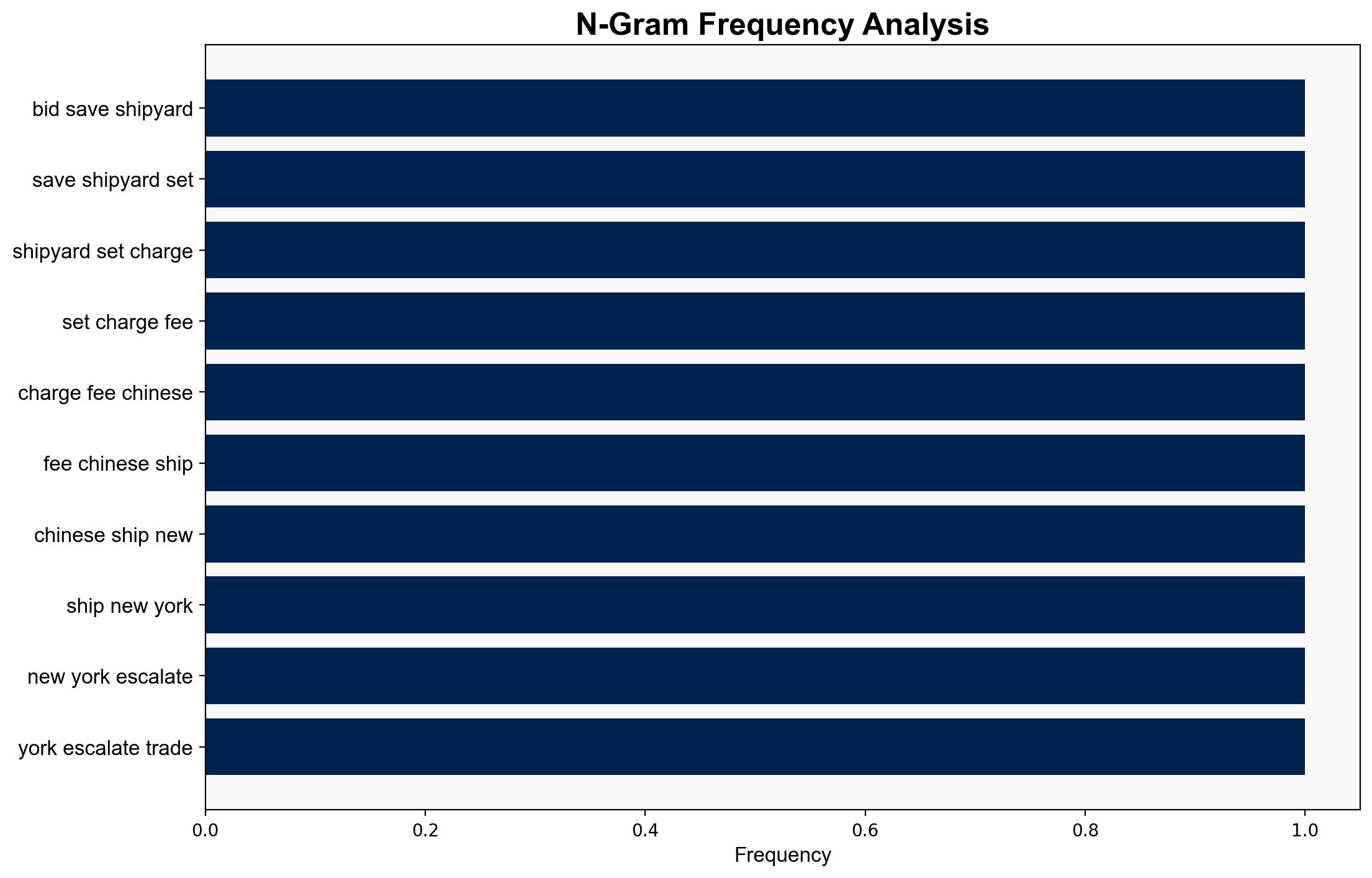

The United States’ decision to impose fees on Chinese ships docking at its ports is a strategic maneuver to bolster the domestic shipbuilding industry and counter China’s dominance in global shipping. The most supported hypothesis is that this move is primarily driven by economic and national security concerns. Confidence level: Moderate. Recommended action: Monitor China’s reciprocal measures and assess their impact on U.S. industries and global trade dynamics.

2. Competing Hypotheses

1. **Economic and National Security Strategy**: The U.S. is imposing fees on Chinese ships to protect and revitalize its shipbuilding industry, which is seen as critical to national security. This aligns with broader efforts to reduce dependency on Chinese manufacturing and strengthen domestic capabilities.

2. **Trade War Escalation Tactic**: The fees are a tactical move in the ongoing trade war, aimed at pressuring China into trade concessions. This hypothesis suggests the primary goal is to leverage economic pressure rather than directly support the shipbuilding sector.

Using ACH 2.0, the first hypothesis is better supported due to the alignment of the fee imposition with previous U.S. policies targeting industrial revitalization and national security concerns.

3. Key Assumptions and Red Flags

– **Assumptions**: The U.S. assumes that imposing fees will effectively incentivize domestic shipbuilding and that China will respond predictably within trade norms.

– **Red Flags**: The potential for China to retaliate in unexpected ways, such as targeting other U.S. industries or leveraging its control over rare earth minerals, is a significant risk.

– **Blind Spots**: The long-term impact on global shipping logistics and potential shifts in trade routes are not fully addressed.

4. Implications and Strategic Risks

– **Economic Risks**: Escalating trade tensions could disrupt global supply chains, affecting industries reliant on international shipping.

– **Geopolitical Risks**: Increased tensions may strain U.S.-China relations, impacting diplomatic efforts in other areas.

– **National Security Risks**: If China targets critical U.S. industries in retaliation, it could expose vulnerabilities in the U.S. economy.

5. Recommendations and Outlook

- Monitor China’s response and prepare contingency plans for potential retaliatory measures.

- Engage with international allies to mitigate disruptions in global trade and strengthen collective economic resilience.

- Scenario Projections:

- **Best Case**: China engages in negotiations, leading to a de-escalation of trade tensions.

- **Worst Case**: A full-scale trade war disrupts global markets, leading to economic downturns.

- **Most Likely**: Incremental retaliatory measures from China, with ongoing negotiations and periodic escalations.

6. Key Individuals and Entities

– Donald Trump

– Joe Biden

– Matt Paxton

– Alliance for American Manufacturing

– Shipbuilders Council of America

7. Thematic Tags

national security threats, economic strategy, trade war, U.S.-China relations