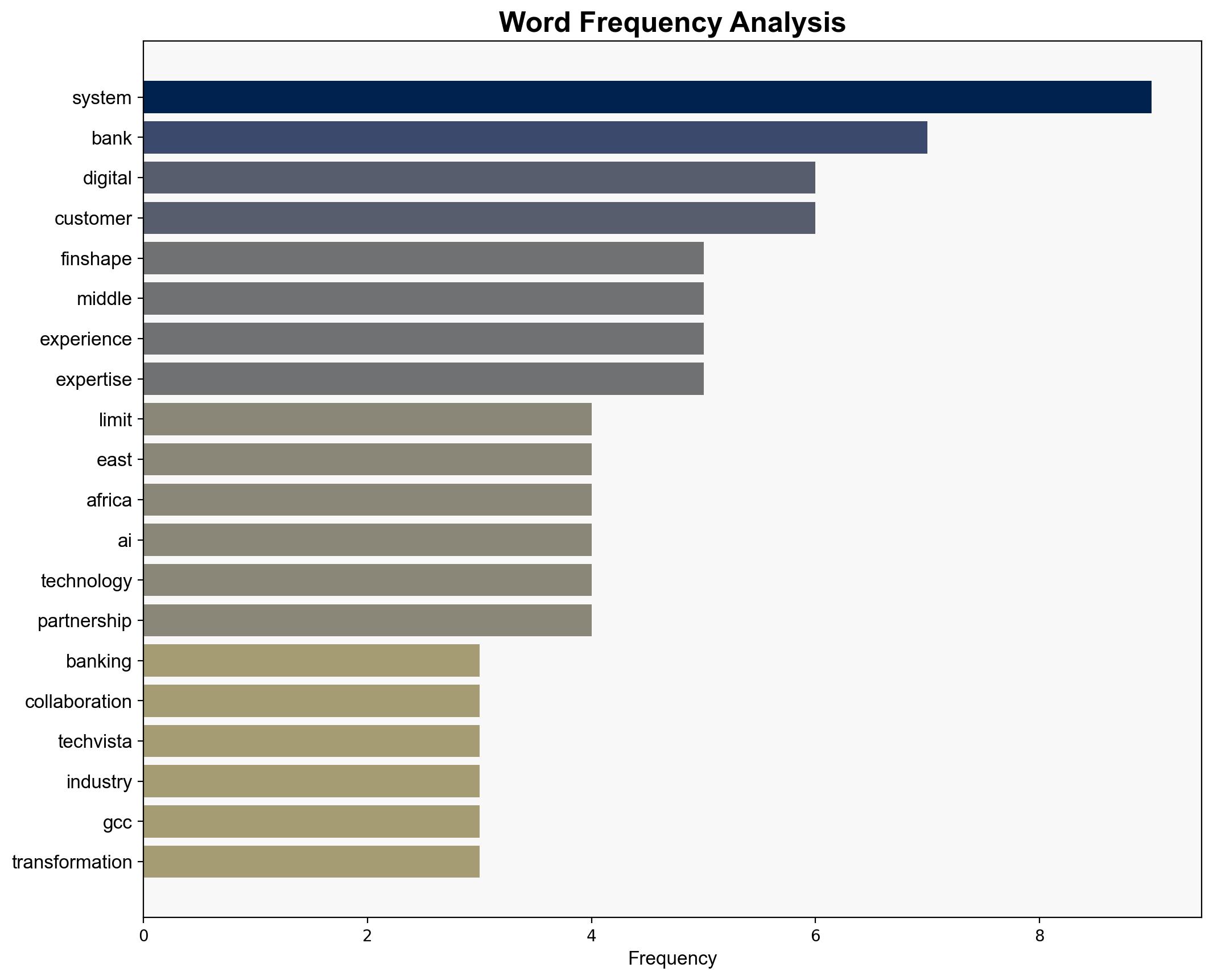

Finshape partners with Systems Limited to enhance GCC digital banking – Retailbankerinternational.com

Published on: 2025-10-16

Intelligence Report: Finshape partners with Systems Limited to enhance GCC digital banking – Retailbankerinternational.com

1. BLUF (Bottom Line Up Front)

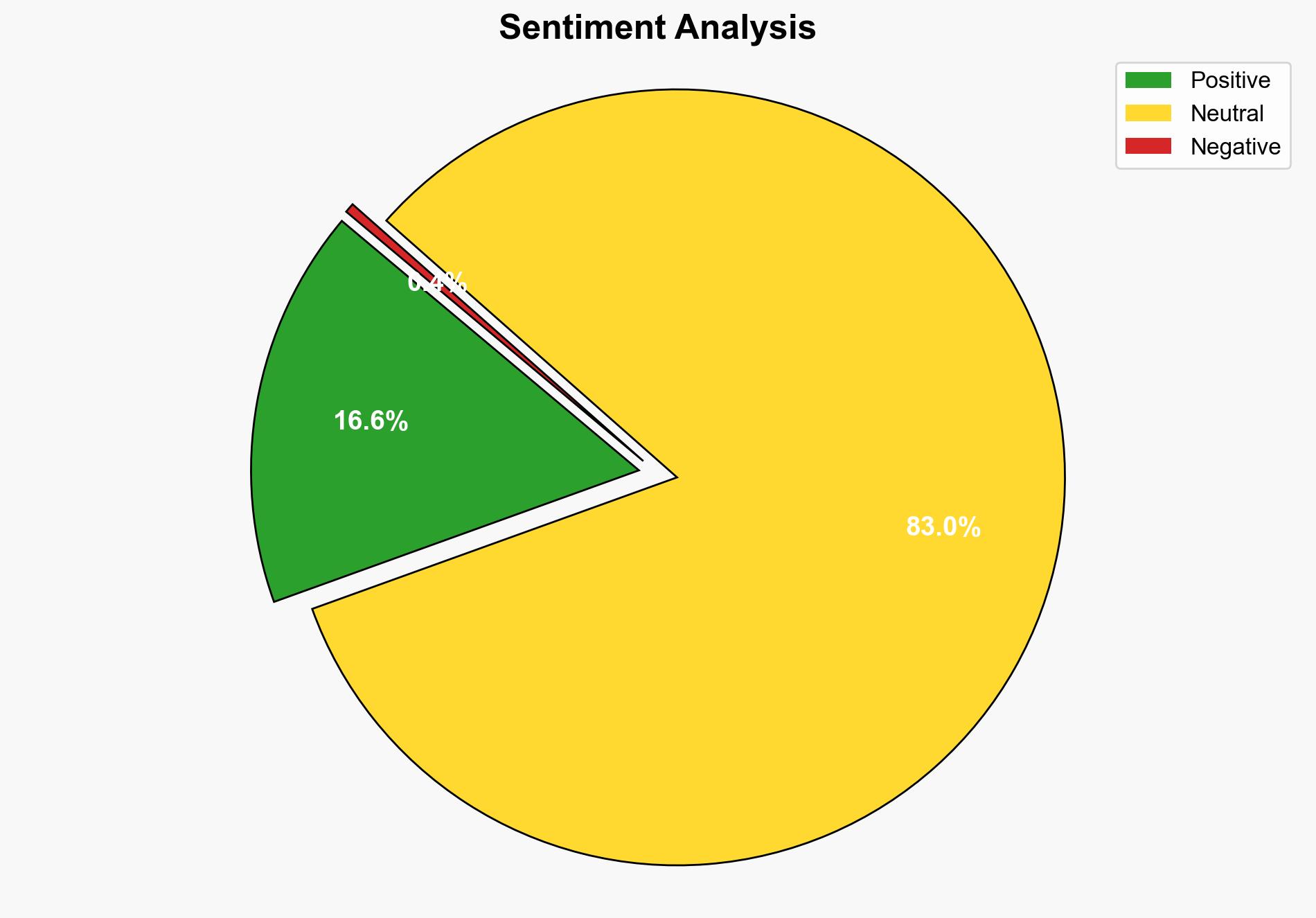

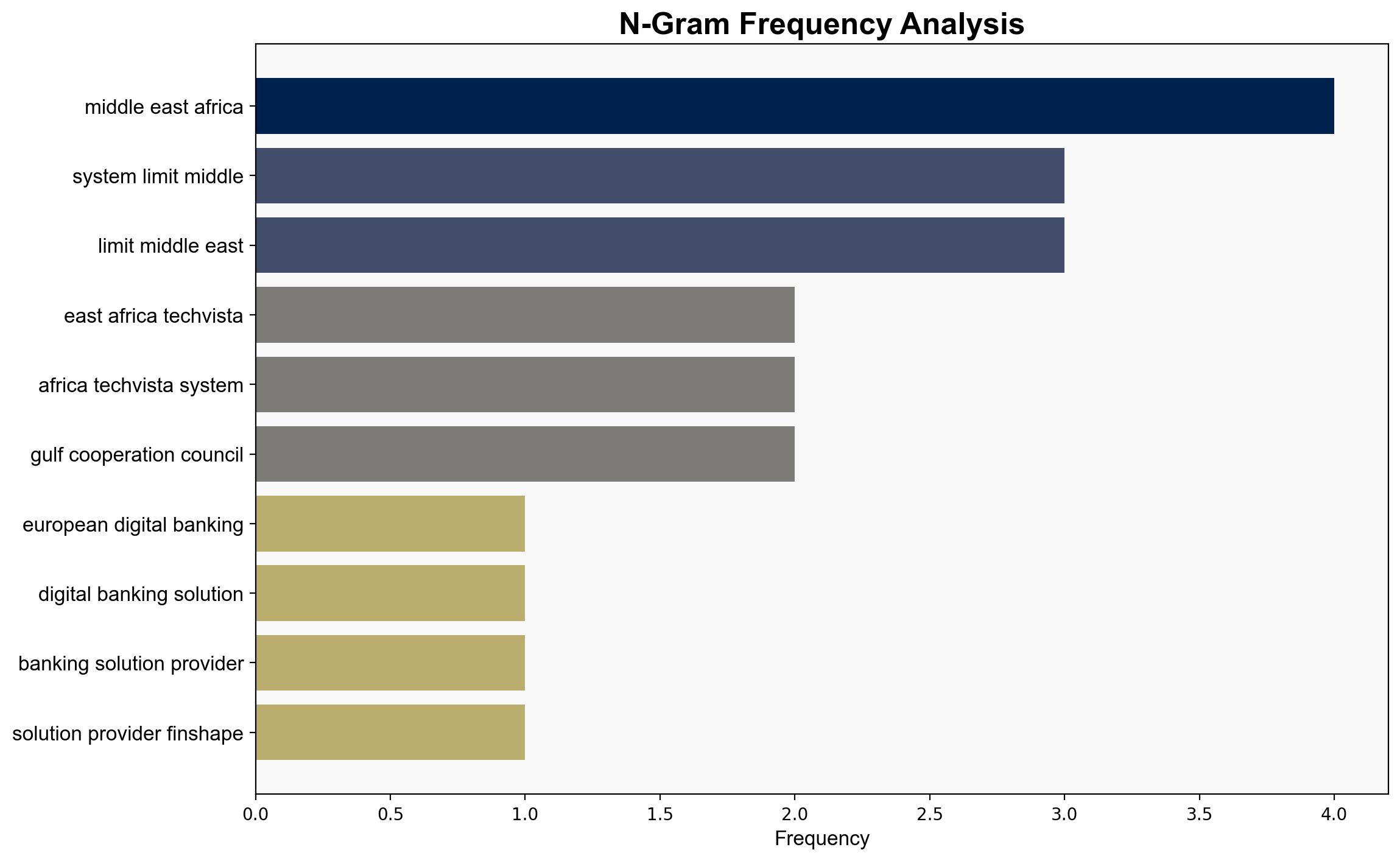

The strategic partnership between Finshape and Systems Limited aims to revolutionize digital banking in the GCC region by leveraging AI-driven solutions and local expertise. The most supported hypothesis suggests this collaboration will significantly enhance customer experience and operational efficiency for banks in the region. Confidence level: Moderate. Recommended action: Monitor the partnership’s progress and assess its impact on regional banking competitiveness and technological adoption.

2. Competing Hypotheses

1. **Hypothesis A**: The partnership will successfully transform GCC digital banking by integrating AI and local expertise, leading to improved customer experiences and increased market agility.

2. **Hypothesis B**: The partnership will face significant challenges due to regulatory hurdles, cultural differences, and potential resistance from established banking entities, limiting its impact.

Using ACH 2.0, Hypothesis A is better supported due to the strategic alignment of both companies’ expertise and the growing demand for digital transformation in the GCC banking sector. However, Hypothesis B cannot be dismissed entirely due to potential regulatory and cultural barriers.

3. Key Assumptions and Red Flags

– **Assumptions**: The partnership assumes a seamless integration of AI technologies and local expertise. It also presumes regulatory environments will be conducive to digital transformation.

– **Red Flags**: Potential overestimation of the ease of integration and underestimation of regulatory challenges. Lack of detailed information on how cultural differences will be managed.

4. Implications and Strategic Risks

– **Economic**: Successful implementation could enhance the competitiveness of GCC banks, attracting more customers and investments.

– **Cyber**: Increased reliance on AI and digital platforms may elevate cybersecurity risks, necessitating robust security measures.

– **Geopolitical**: Strengthening digital infrastructure in the GCC could shift regional power dynamics, influencing global banking trends.

– **Psychological**: Customer trust in digital banking solutions may vary, impacting adoption rates.

5. Recommendations and Outlook

- Monitor regulatory developments in the GCC to anticipate potential challenges.

- Encourage partnerships with local tech firms to enhance cultural integration and acceptance.

- Scenario-based projections:

- Best: Rapid adoption and integration lead to a significant market share increase.

- Worst: Regulatory and cultural barriers stall progress, resulting in minimal impact.

- Most Likely: Gradual adoption with moderate success, contingent on overcoming initial hurdles.

6. Key Individuals and Entities

– Alain Vansnick (Finshape Partnership Director)

– Khurram Majeed (Systems Limited General Manager)

7. Thematic Tags

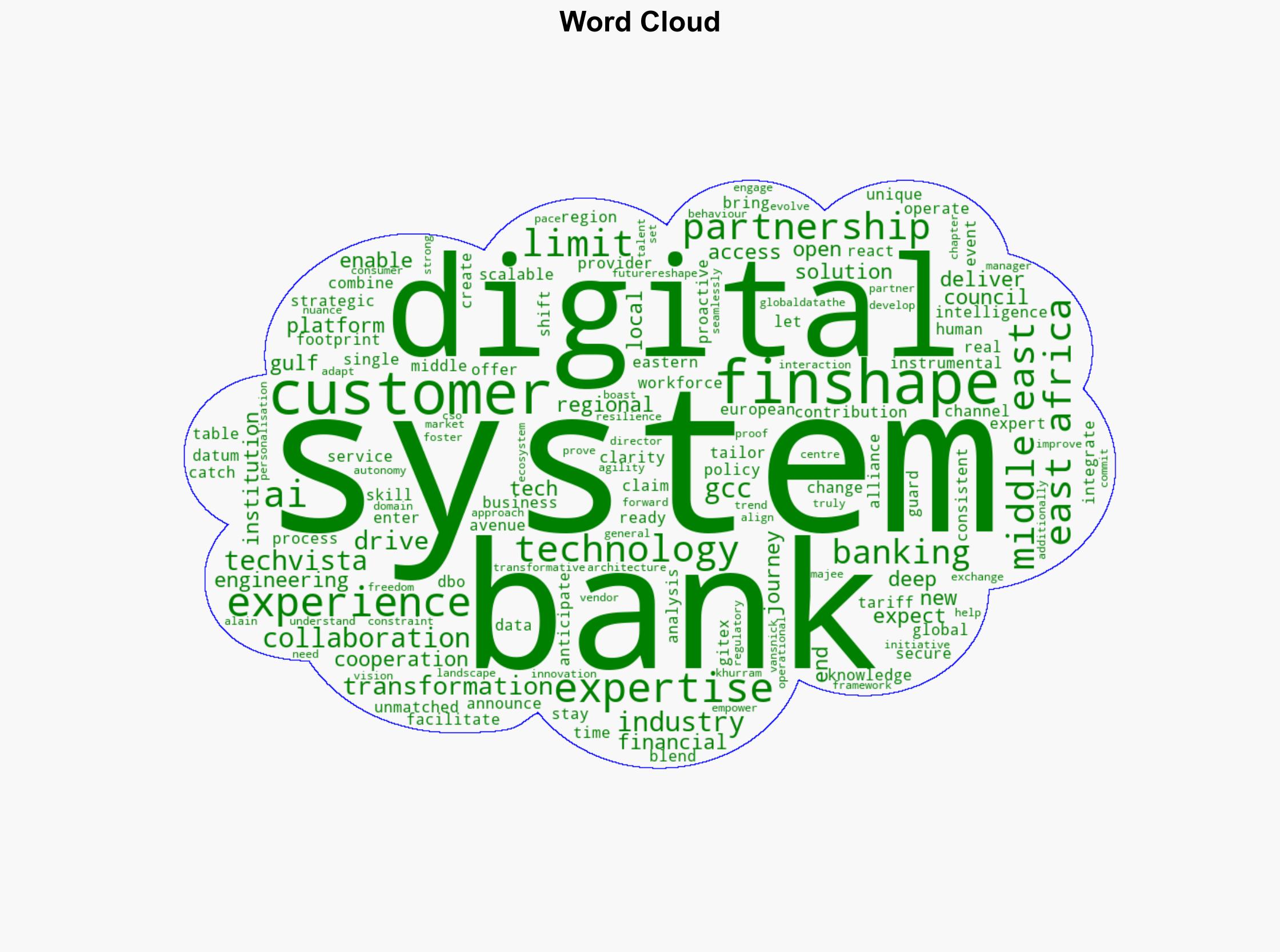

digital transformation, AI integration, GCC banking, regulatory challenges, cultural adaptation