Trump approves tariff relief for US auto production issues new truck duties – The Times of India

Published on: 2025-10-18

Intelligence Report: Trump approves tariff relief for US auto production issues new truck duties – The Times of India

1. BLUF (Bottom Line Up Front)

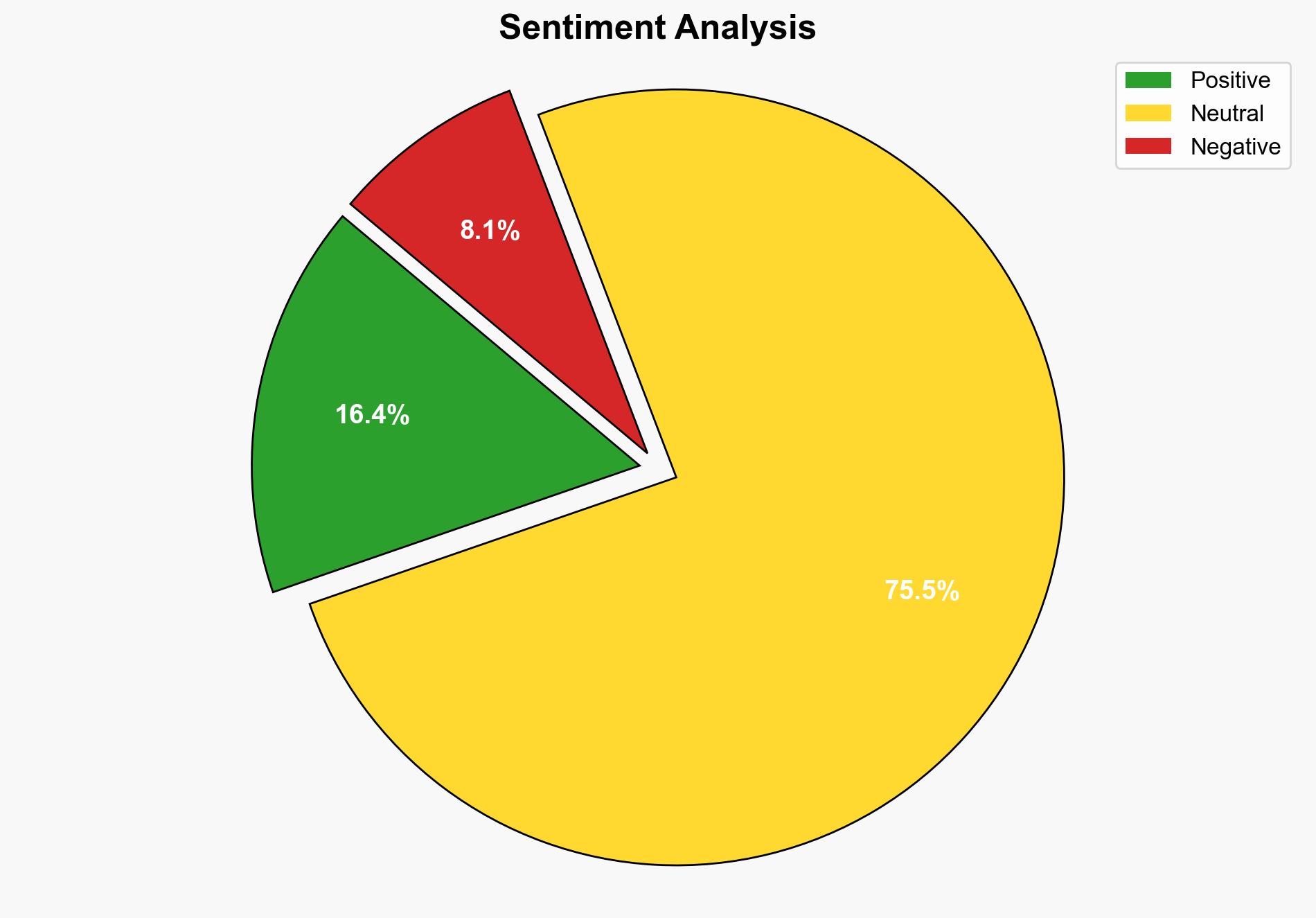

The strategic judgment is that the tariff relief and new duties are primarily aimed at incentivizing domestic auto production while protecting U.S. manufacturers from foreign competition. The most supported hypothesis is that these measures are intended to bolster the U.S. auto industry against competitive pressures from countries like Mexico, Japan, and Germany. Confidence level: Moderate. Recommended action: Monitor the economic impact on U.S. auto manufacturers and international trade relations, particularly with key allies.

2. Competing Hypotheses

1. **Hypothesis A**: The tariff relief and new duties are designed to protect U.S. national security by reducing dependency on foreign auto parts and vehicles, thereby strengthening domestic production capabilities.

2. **Hypothesis B**: The measures are primarily economic, aimed at providing a competitive edge to U.S. automakers by making foreign imports more expensive, thus encouraging local production and potentially gaining political support from domestic industries.

Using ACH 2.0, Hypothesis B is better supported due to the emphasis on economic relief and incentives for domestic production, as well as the potential political gains from supporting U.S. manufacturers.

3. Key Assumptions and Red Flags

– **Assumptions**: It is assumed that the tariffs will effectively shift production to the U.S. and that domestic manufacturers have the capacity to meet increased demand.

– **Red Flags**: Potential backlash from international trade partners, especially those mentioned as allies, could lead to retaliatory tariffs or strained relations.

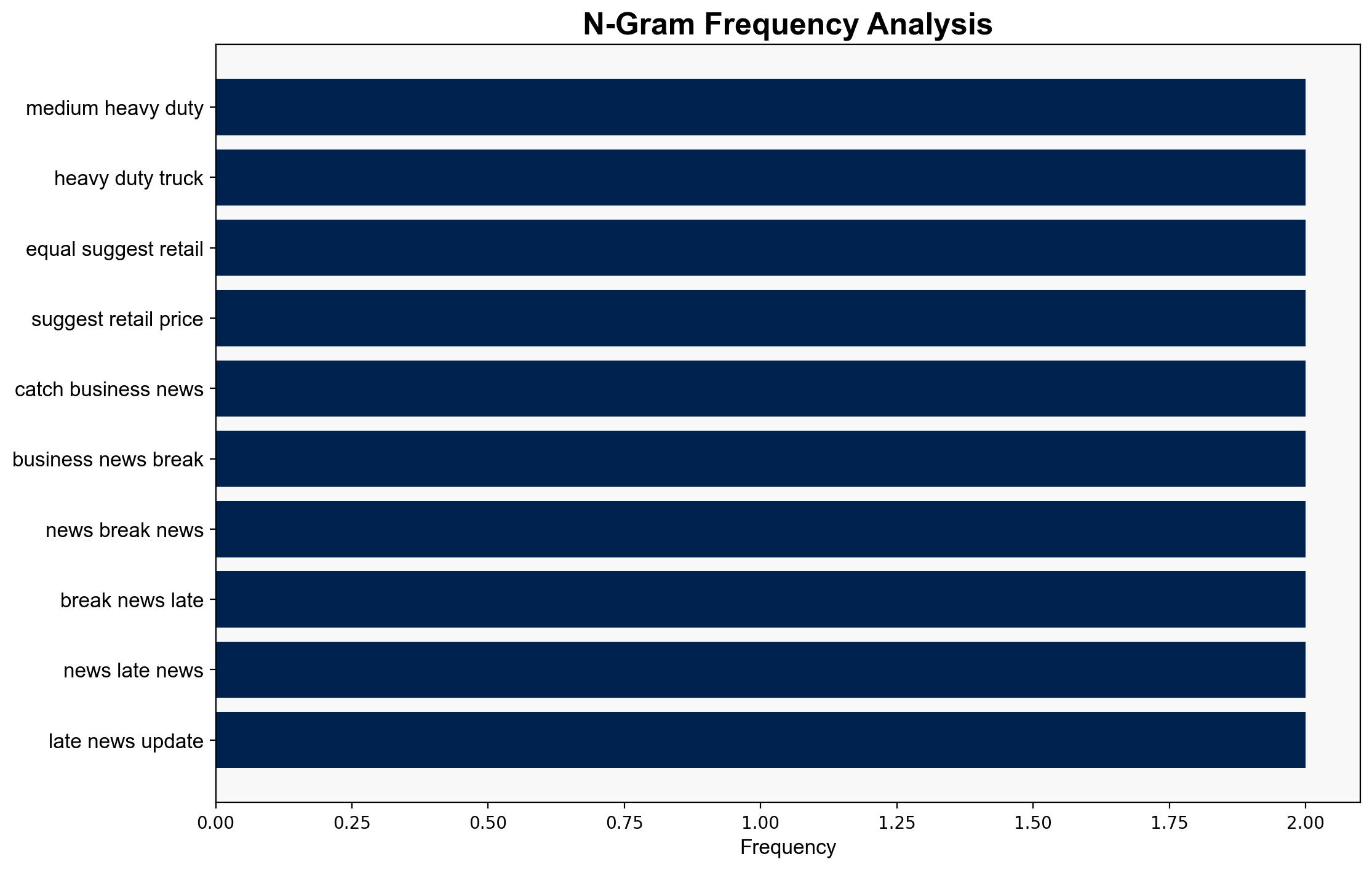

– **Blind Spots**: The long-term impact on consumer prices and the potential for supply chain disruptions are not fully addressed.

4. Implications and Strategic Risks

– **Economic Risks**: Increased production costs for U.S. manufacturers if they cannot scale efficiently. Potential for inflationary pressures on vehicle prices.

– **Geopolitical Risks**: Strained relations with Mexico, Japan, and Germany could impact broader trade negotiations and alliances.

– **Cascading Threats**: Retaliatory tariffs from affected countries could escalate into broader trade conflicts, impacting other sectors.

5. Recommendations and Outlook

- Monitor the response of international trade partners and prepare for potential retaliatory measures.

- Encourage U.S. manufacturers to increase production capacity to mitigate potential supply shortages.

- Scenario Projections:

- Best Case: U.S. manufacturers increase production, leading to job growth and strengthened domestic industry.

- Worst Case: Trade tensions escalate, leading to a trade war and significant economic downturn.

- Most Likely: Moderate increase in domestic production with some international tensions but no major trade disruptions.

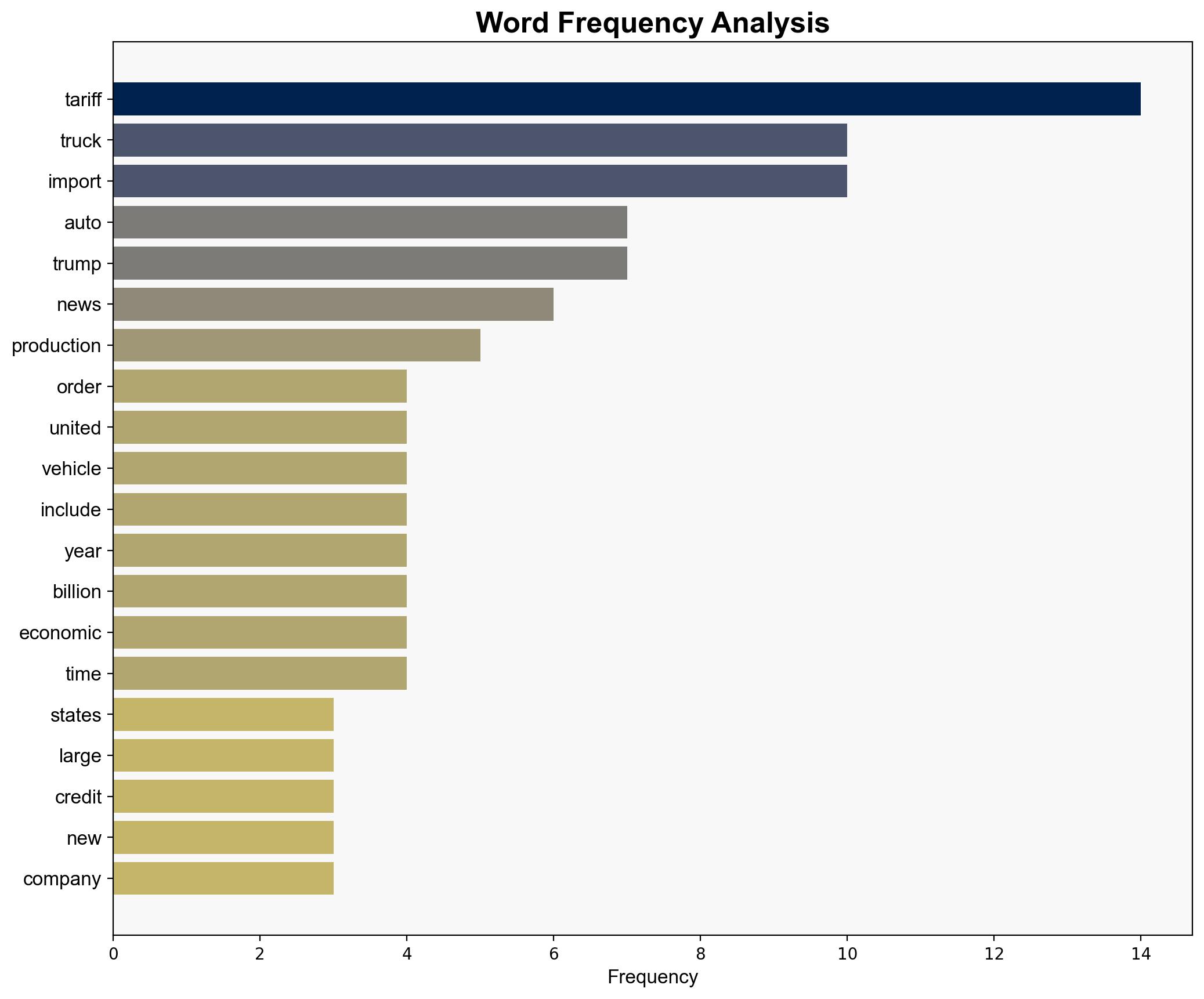

6. Key Individuals and Entities

– Donald Trump

– Jim Farley

– Bernie Moreno

– Companies: GM, Ford, Toyota, Stellantis, Honda, Tesla, Paccar, Peterbilt, Kenworth, Daimler Truck, Freightliner

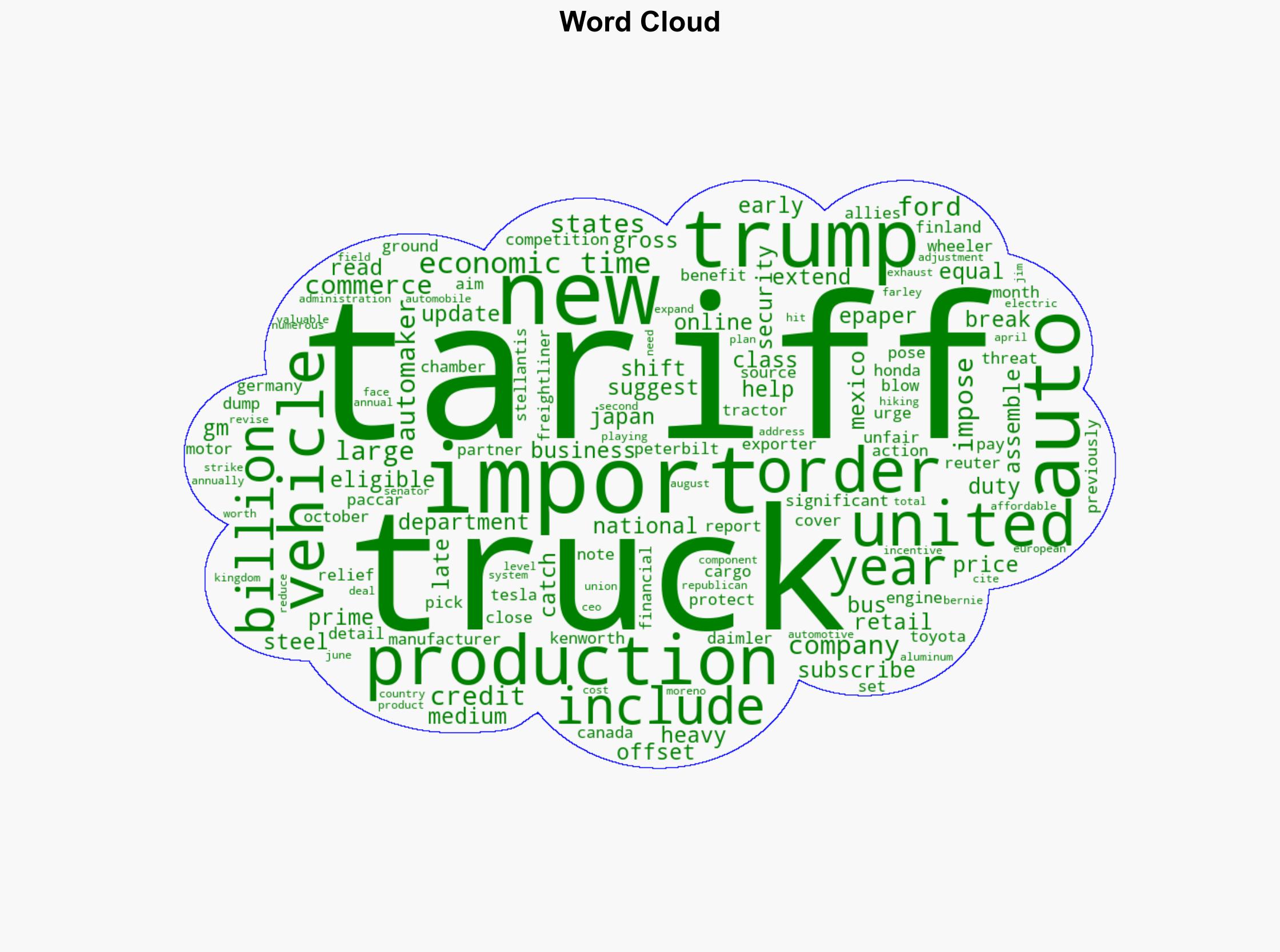

7. Thematic Tags

national security threats, economic policy, international trade, U.S. manufacturing, geopolitical strategy