There Are Three Major Tailwinds for Cryptos Next Rally Says Galaxy Digitals Alex Thorn – CoinDesk

Published on: 2025-10-19

Intelligence Report: There Are Three Major Tailwinds for Cryptos Next Rally Says Galaxy Digitals Alex Thorn – CoinDesk

1. BLUF (Bottom Line Up Front)

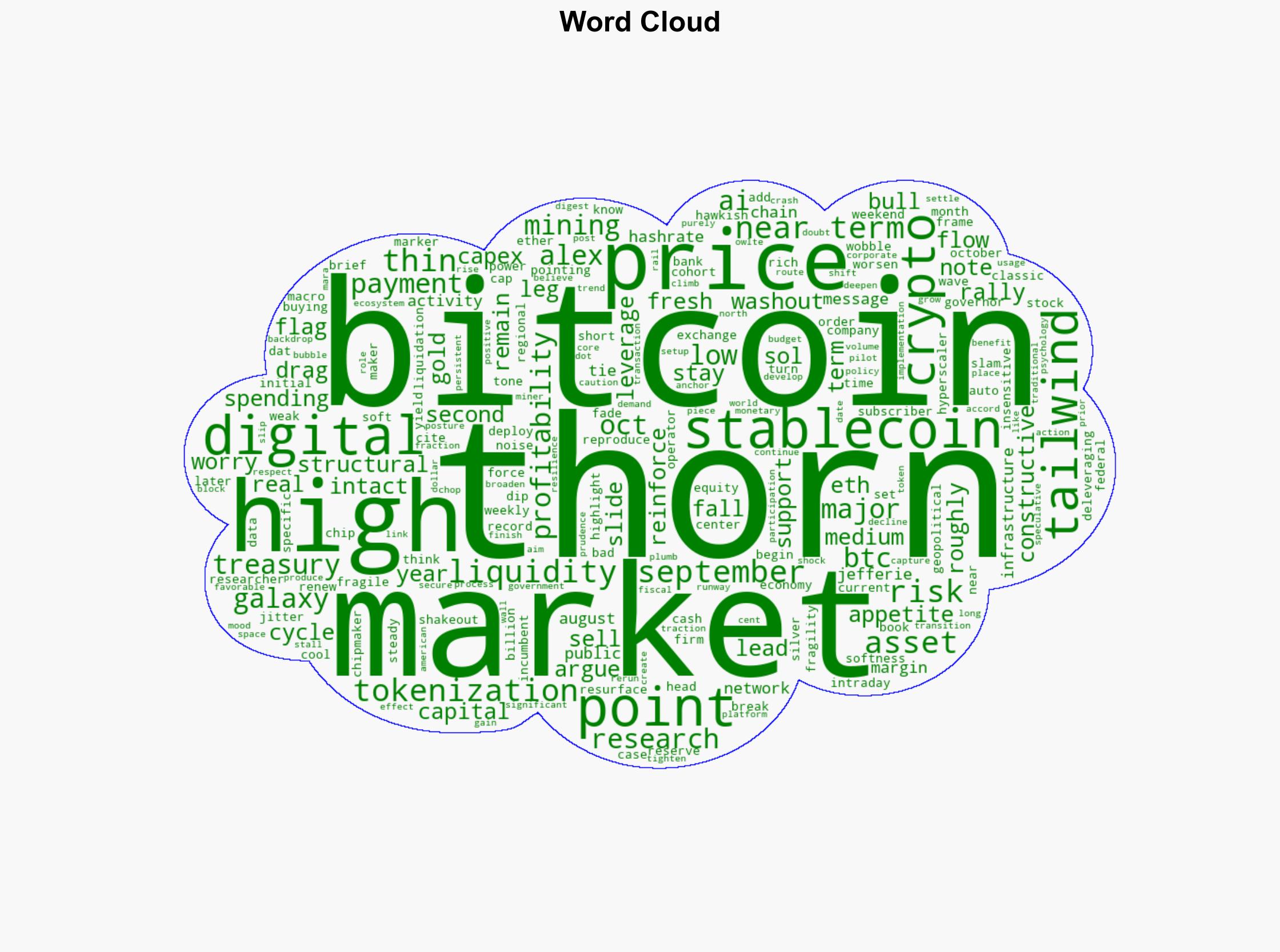

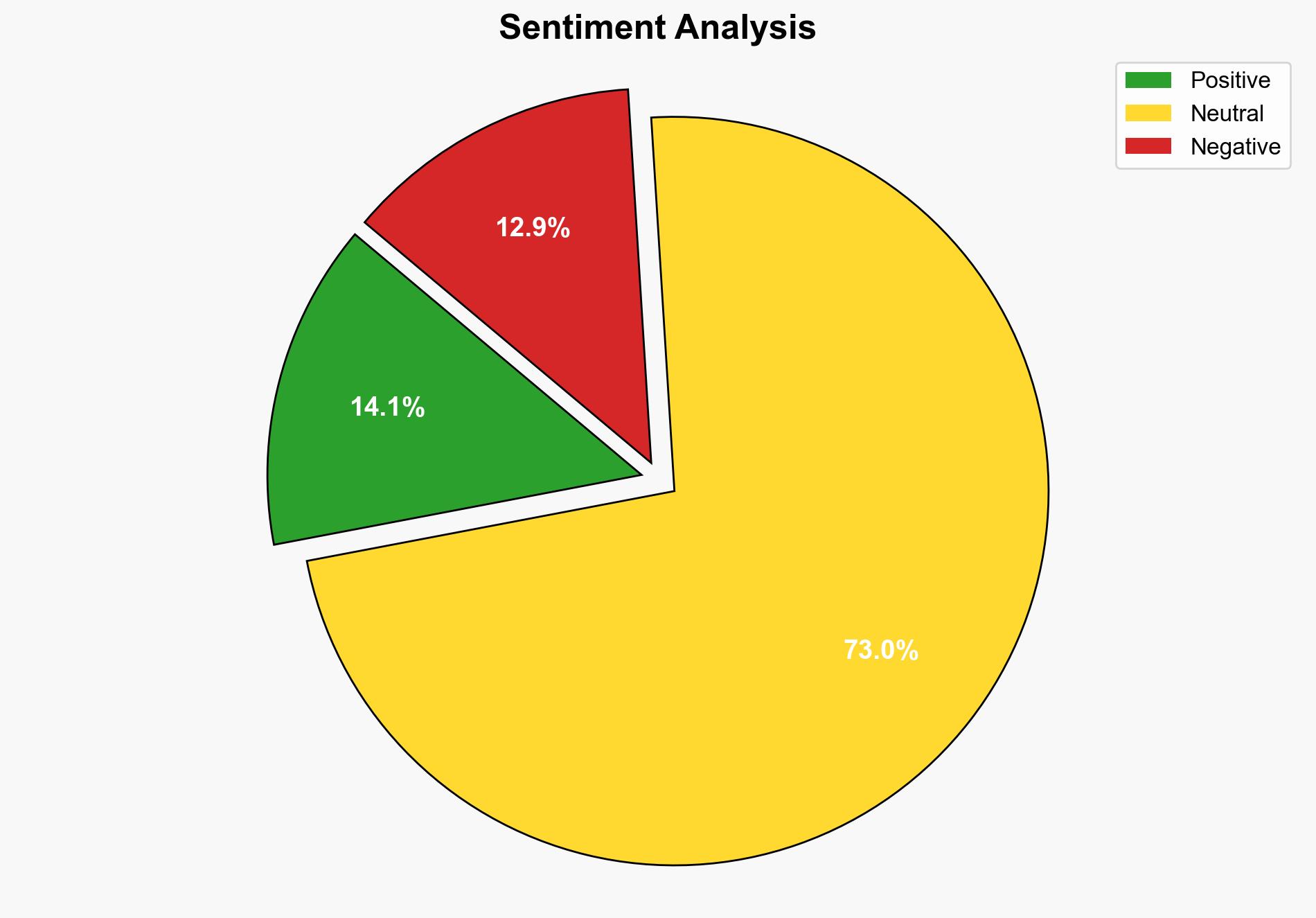

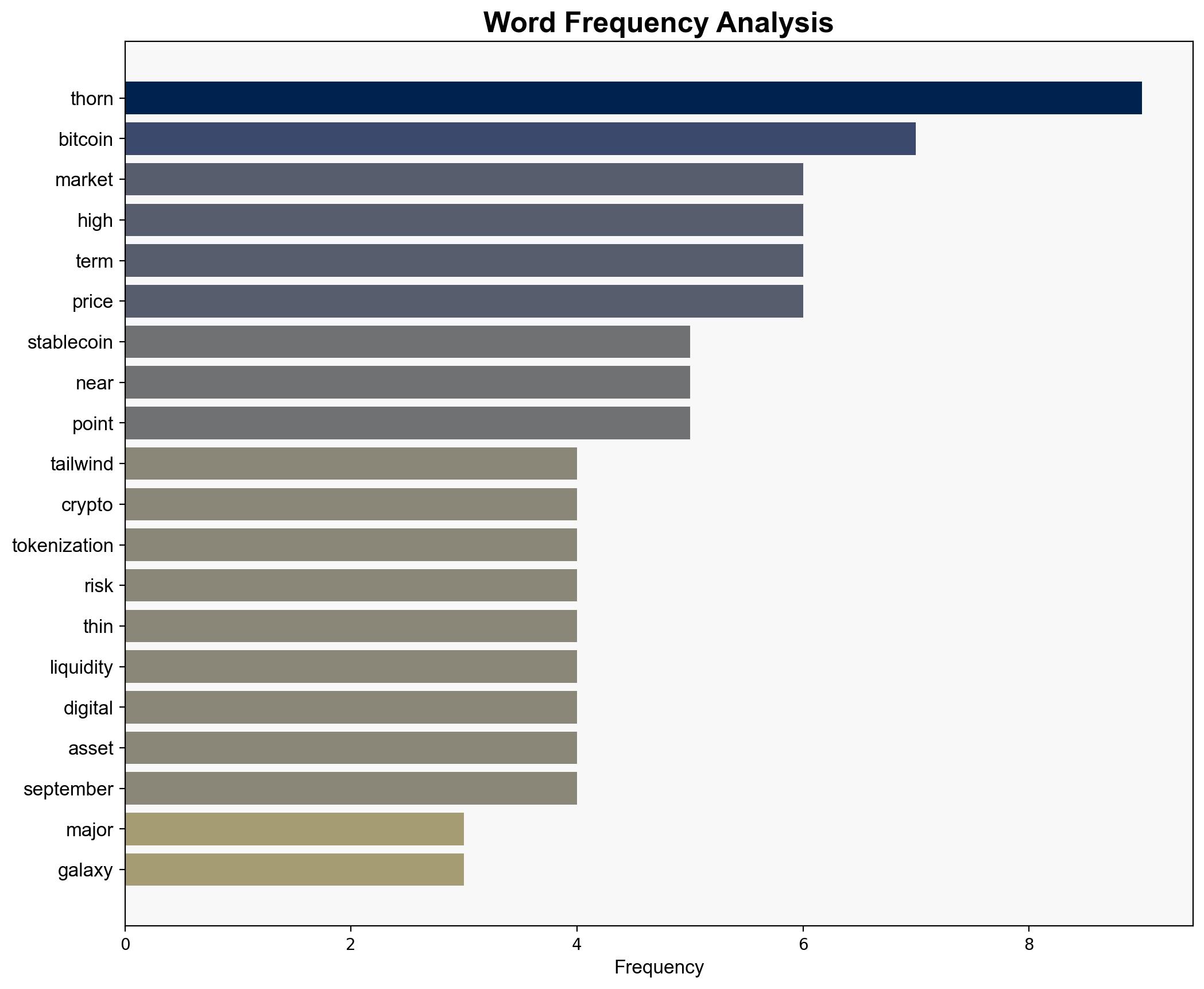

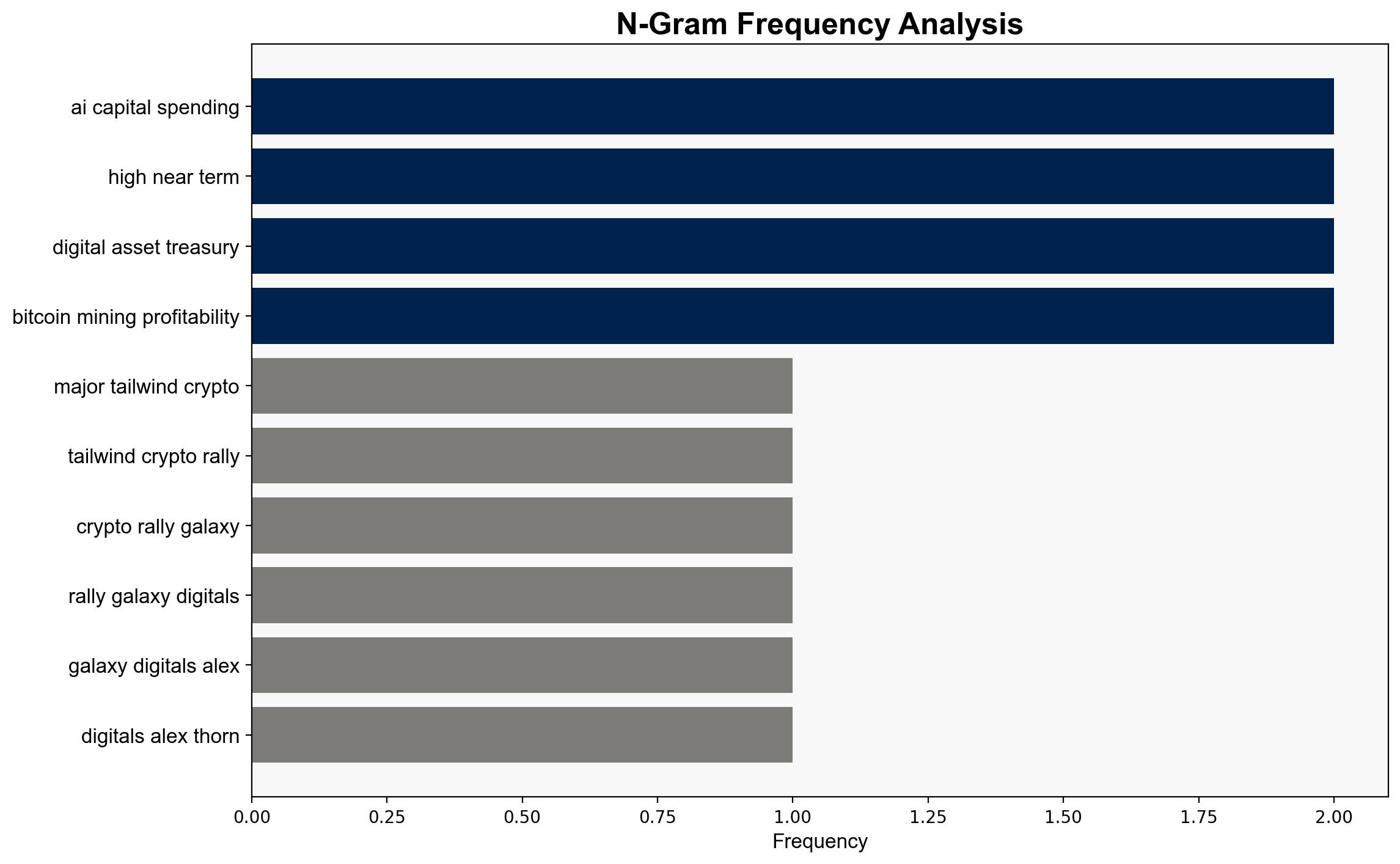

The most supported hypothesis is that the structural bull market for cryptocurrencies remains intact, driven by AI capital expenditure, stablecoin tokenization, and market resilience despite recent volatility. Confidence level is moderate due to existing market fragility and macroeconomic uncertainties. Recommended action is to monitor market developments closely while preparing for potential investment opportunities in AI and stablecoin sectors.

2. Competing Hypotheses

1. **Hypothesis A**: The structural bull market for cryptocurrencies is intact, supported by AI capital expenditure, stablecoin tokenization, and market resilience. This hypothesis suggests that despite recent market volatility, these factors will drive a near-term rally.

2. **Hypothesis B**: The cryptocurrency market is experiencing a temporary stabilization, but underlying fragilities such as thin liquidity, macroeconomic pressures, and geopolitical risks could lead to further downturns. This hypothesis posits that the current tailwinds are insufficient to sustain a long-term rally.

Using ACH 2.0, Hypothesis A is better supported due to the identified structural factors and ongoing developments in AI and stablecoin sectors, which provide a foundation for future growth.

3. Key Assumptions and Red Flags

– **Assumptions**:

– AI capital expenditure and stablecoin tokenization will continue to grow.

– Current market volatility is a temporary phase rather than a long-term trend.

– **Red Flags**:

– Potential overestimation of AI and stablecoin impacts.

– Ignoring macroeconomic and geopolitical risks that could undermine market stability.

– Lack of consideration for regulatory changes affecting cryptocurrency markets.

4. Implications and Strategic Risks

– **Economic**: A sustained rally could attract more institutional investment, increasing market stability.

– **Cyber**: Increased digital asset activity may heighten cybersecurity threats.

– **Geopolitical**: Geopolitical tensions could impact global financial markets, affecting cryptocurrency valuations.

– **Psychological**: Investor sentiment remains fragile, with potential for rapid shifts due to market news or geopolitical events.

5. Recommendations and Outlook

- **Mitigate Risks**: Diversify investments to hedge against potential market downturns and geopolitical risks.

- **Exploit Opportunities**: Focus on sectors with strong growth potential, such as AI and stablecoin technologies.

- **Scenario Projections**:

– **Best Case**: Continued growth in AI and stablecoin sectors leads to a sustained cryptocurrency rally.

– **Worst Case**: Macroeconomic and geopolitical pressures cause a significant market downturn.

– **Most Likely**: Moderate growth with intermittent volatility as markets adjust to new economic realities.

6. Key Individuals and Entities

– Alex Thorn

– Galaxy Digital

7. Thematic Tags

national security threats, cybersecurity, economic stability, cryptocurrency market trends