Global Banks Bet Billions on India Deals Amid US Credit Jitters – Livemint

Published on: 2025-10-20

Intelligence Report: Global Banks Bet Billions on India Deals Amid US Credit Jitters – Livemint

1. BLUF (Bottom Line Up Front)

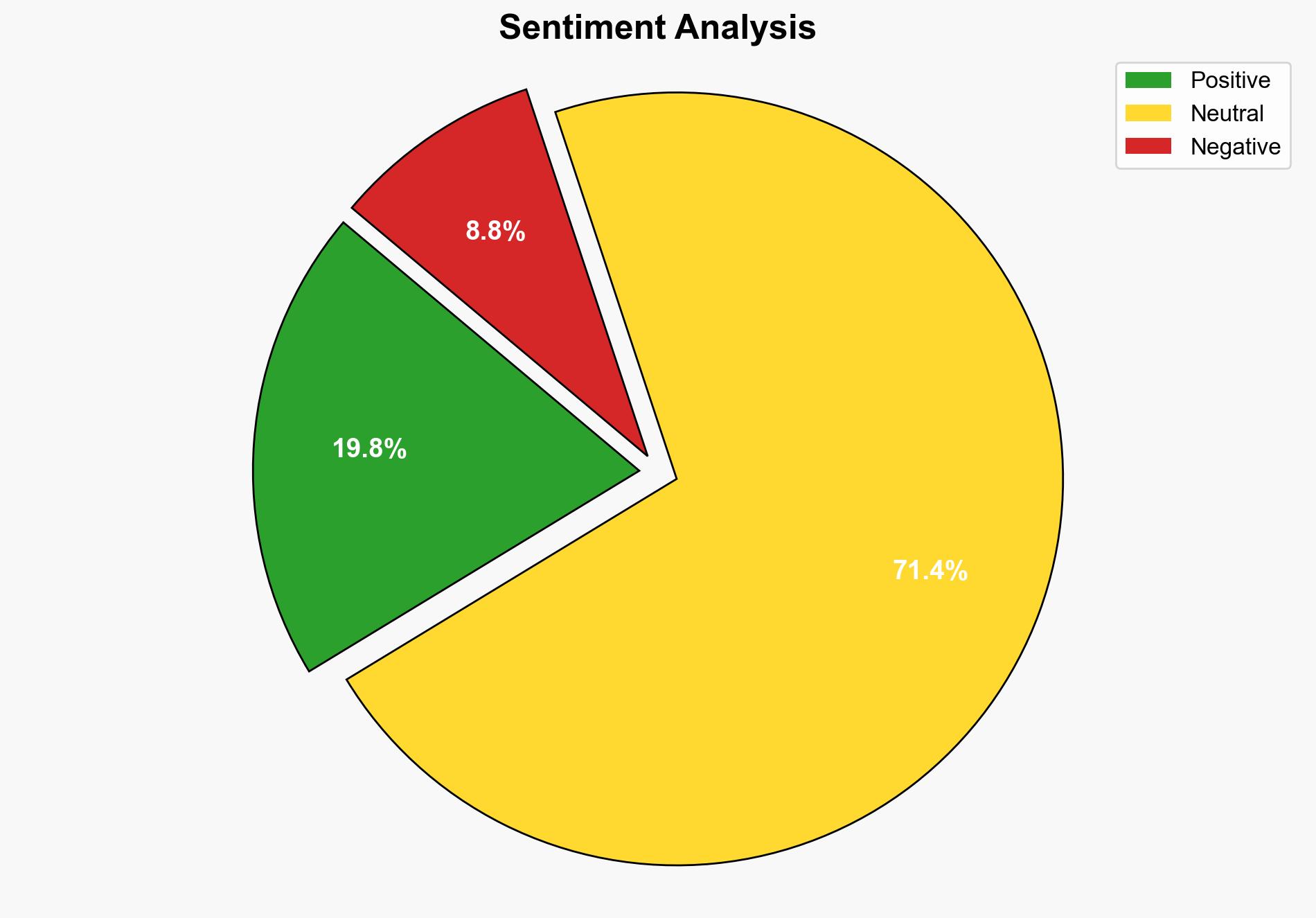

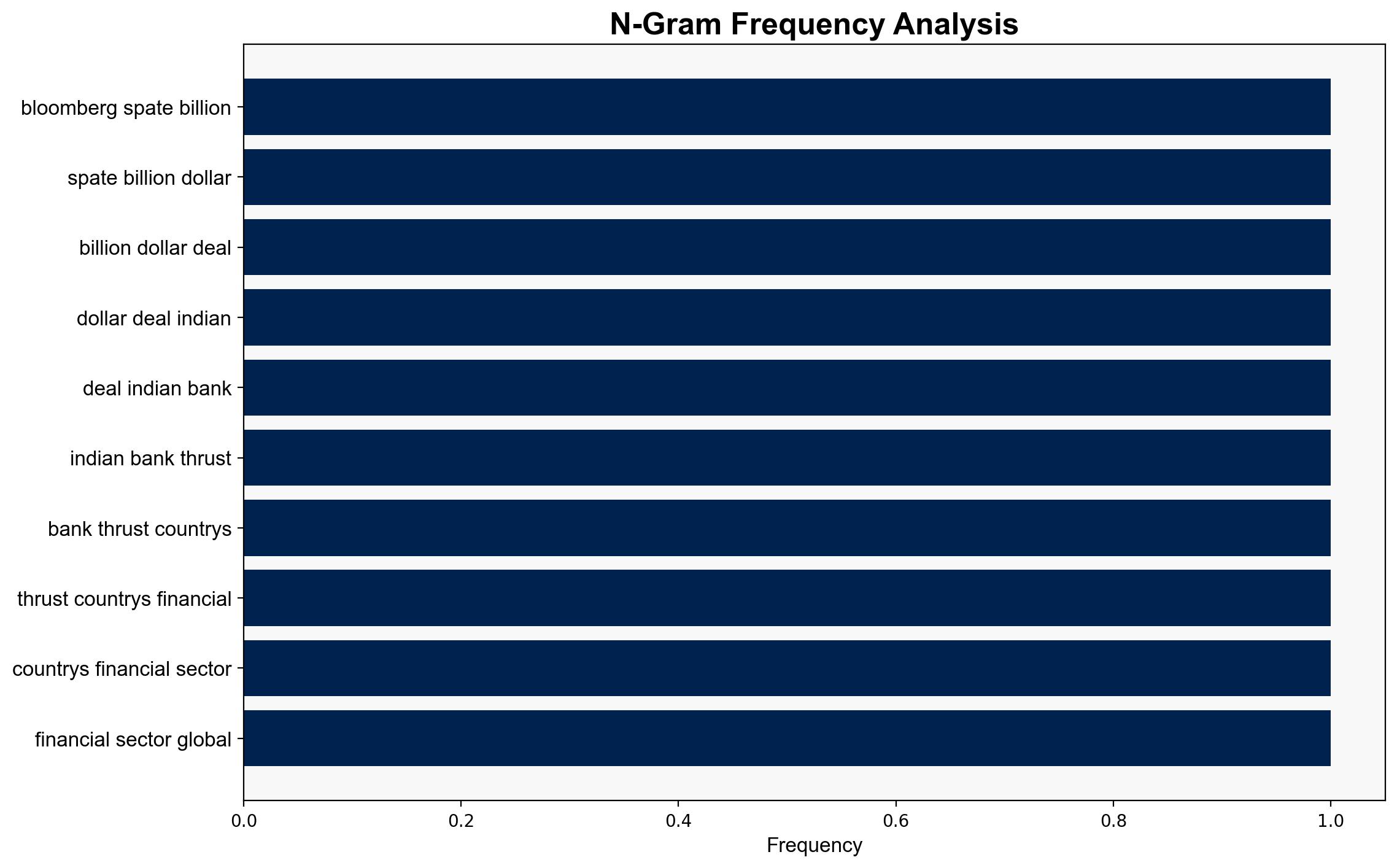

The most supported hypothesis is that global banks are investing in India to capitalize on its rapid economic growth and relatively stable financial system, despite potential risks from entrenched local players and past financial crises. This hypothesis is supported by the strategic moves of major banks and the Indian government’s regulatory enhancements. Confidence level: Moderate. Recommended action: Monitor the impact of these investments on India’s financial stability and potential shifts in global banking strategies.

2. Competing Hypotheses

1. **Hypothesis A**: Global banks are investing in India primarily to leverage its fast-growing economy and stable financial system, viewing it as a lucrative opportunity amidst global credit uncertainties.

2. **Hypothesis B**: These investments are driven by a strategic need to diversify and mitigate risks associated with the US credit market and geopolitical tensions, rather than a genuine belief in India’s economic potential.

Using ACH 2.0, Hypothesis A is better supported by the evidence of significant foreign investments and India’s regulatory measures to strengthen its financial sector. Hypothesis B is less supported as it assumes a reactionary motive without substantial evidence of direct correlation to US credit issues.

3. Key Assumptions and Red Flags

– **Assumptions**:

– India’s economic growth will continue at a robust pace.

– Regulatory measures will effectively mitigate financial risks.

– **Red Flags**:

– Over-reliance on historical growth trends without considering potential economic slowdowns.

– Possible underestimation of entrenched local competition and past financial crises’ impact.

4. Implications and Strategic Risks

– **Economic Risks**: Potential for overvaluation of Indian financial assets if growth expectations are not met.

– **Geopolitical Risks**: Increased foreign investment could lead to regulatory backlash or protectionist measures.

– **Financial Risks**: Shadow banking issues and bad loans could resurface, impacting foreign investments.

5. Recommendations and Outlook

- Monitor India’s regulatory changes and their impact on the banking sector.

- Encourage diversification of investment portfolios to mitigate potential risks from local competition and economic fluctuations.

- Scenario Projections:

- Best: Continued economic growth and successful integration of foreign investments.

- Worst: Economic slowdown and resurgence of financial crises, leading to investment losses.

- Most Likely: Moderate growth with some challenges from local competition and regulatory adjustments.

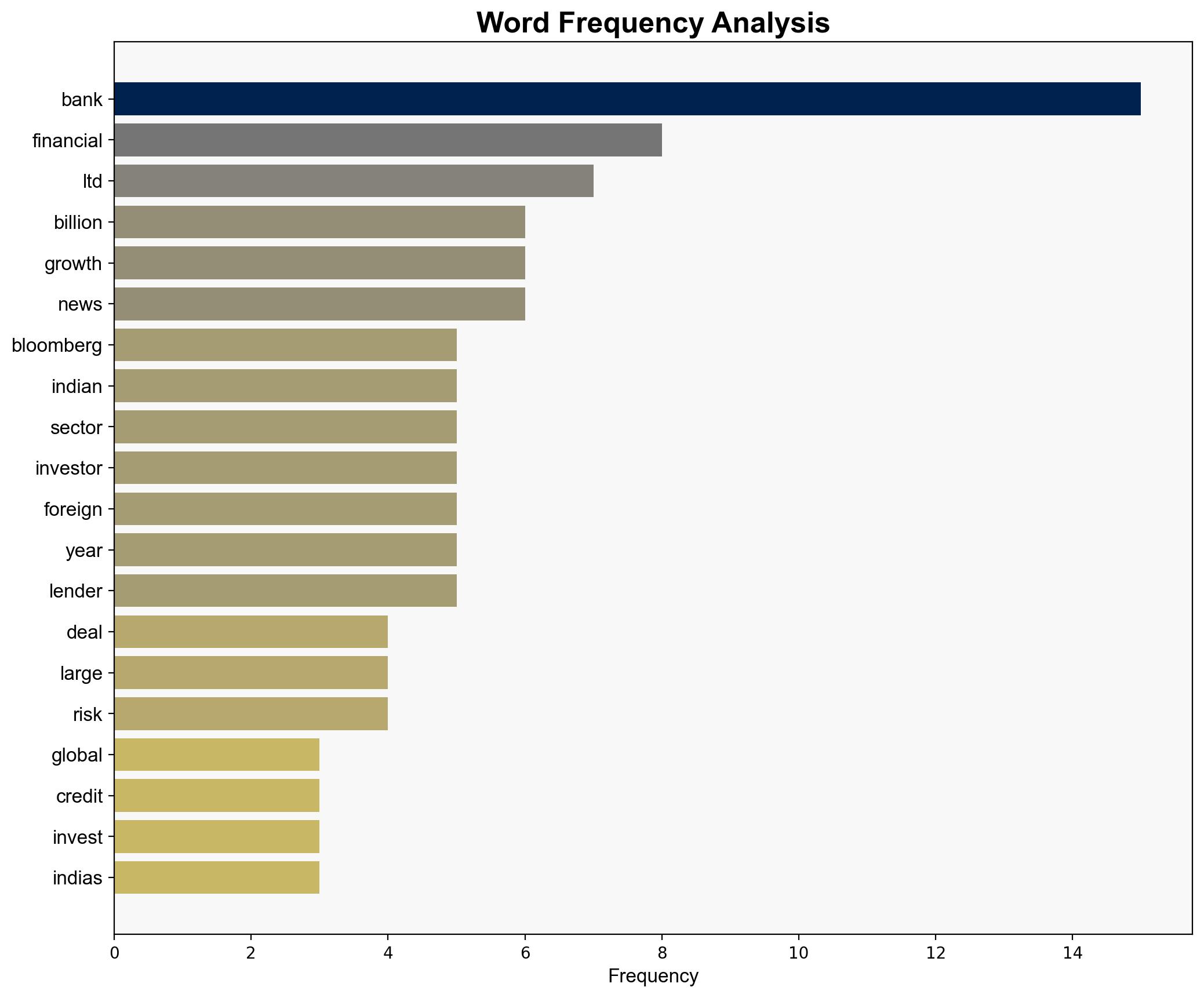

6. Key Individuals and Entities

– Subramaniakumar (RBL Bank)

– Emirates NBD Bank PJSC

– Abu Dhabi’s International Holding PJSC

– Sumitomo Mitsui Financial Group

– Mitsubishi UFJ Financial Group

7. Thematic Tags

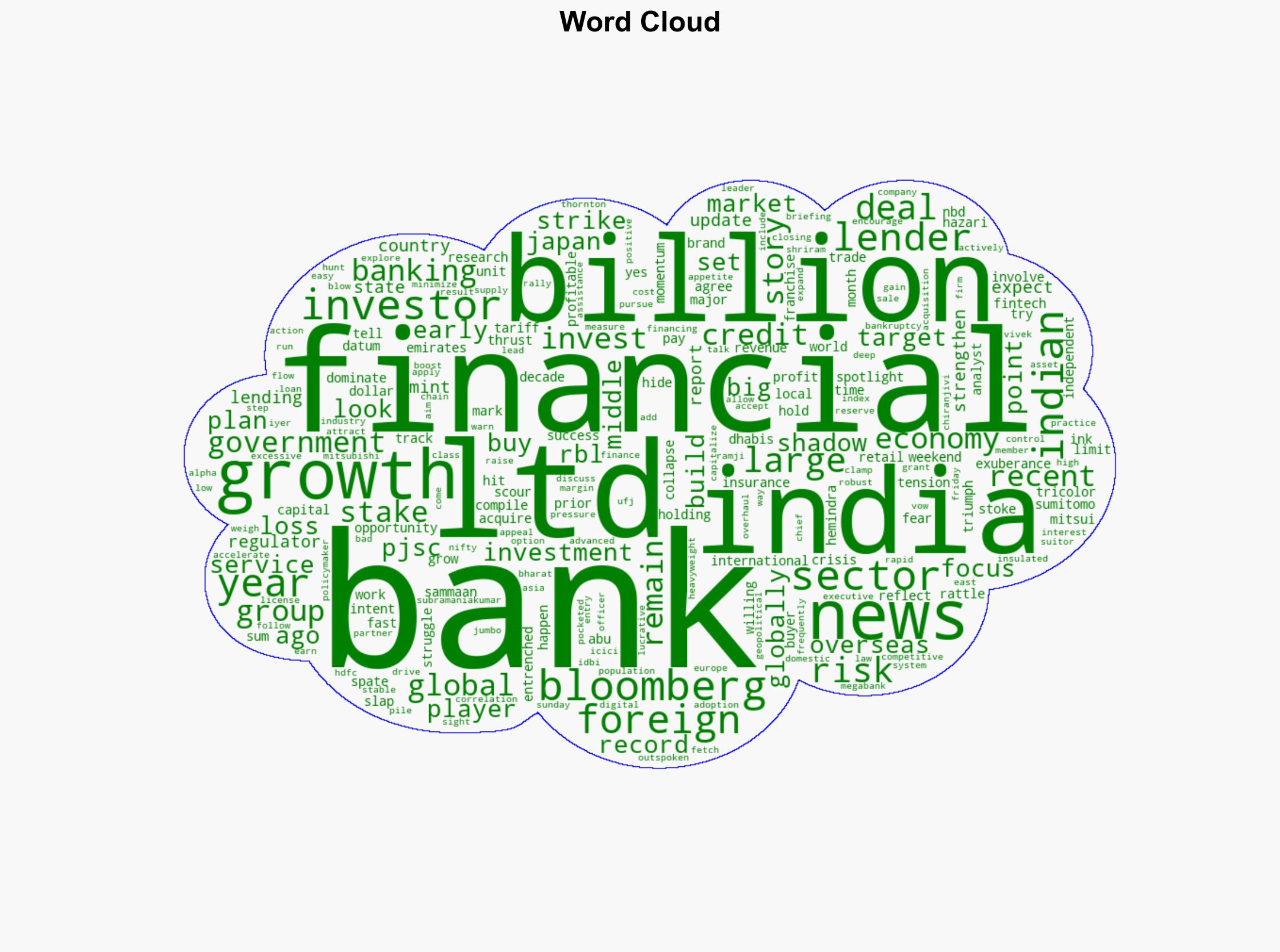

economic growth, foreign investment, financial stability, regulatory environment, geopolitical strategy