Midwest IPO How to check share allotment status on BSE and Kfin Technologies as GMP holds steady – The Times of India

Published on: 2025-10-20

Intelligence Report: Midwest IPO How to check share allotment status on BSE and Kfin Technologies as GMP holds steady – The Times of India

1. BLUF (Bottom Line Up Front)

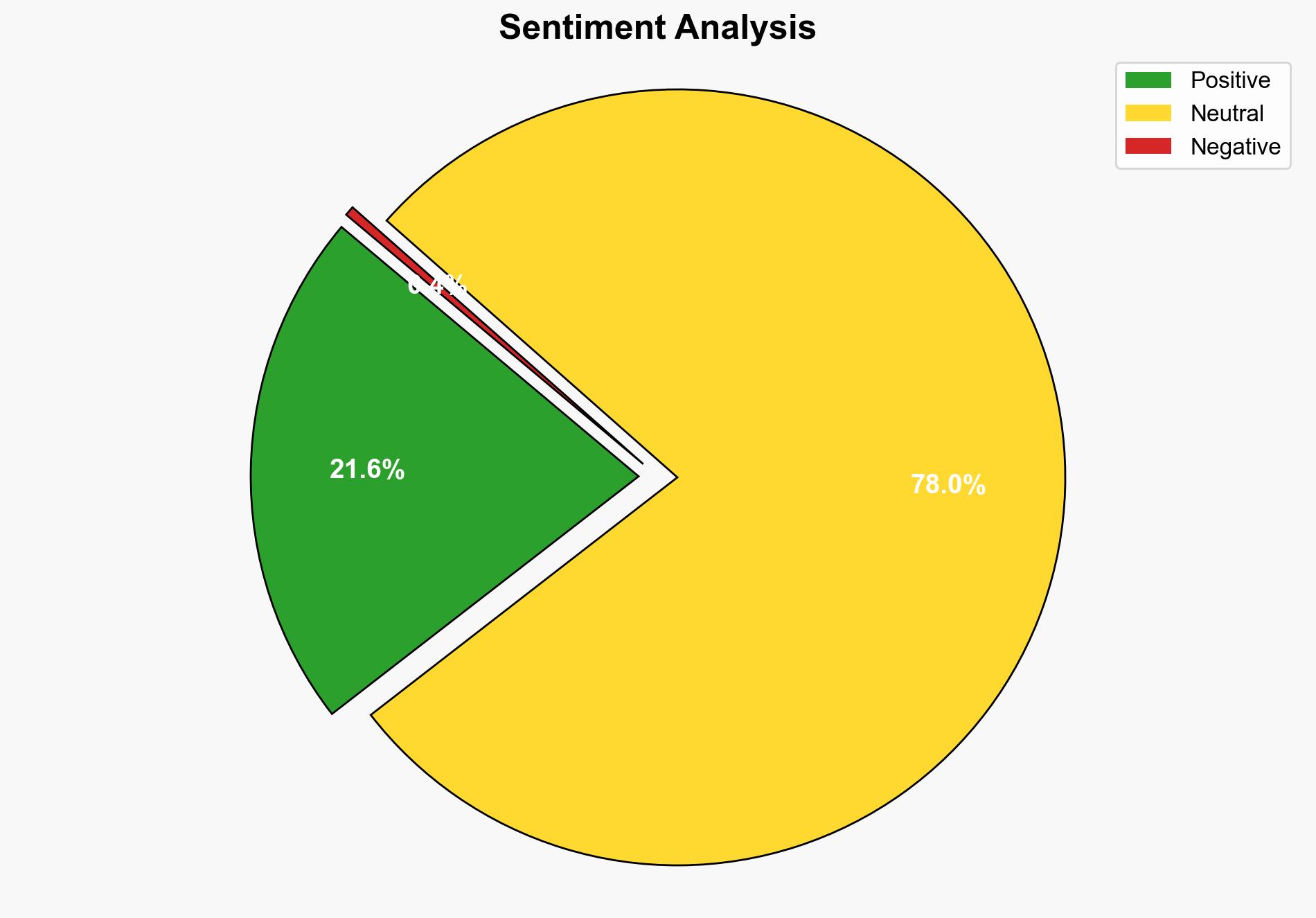

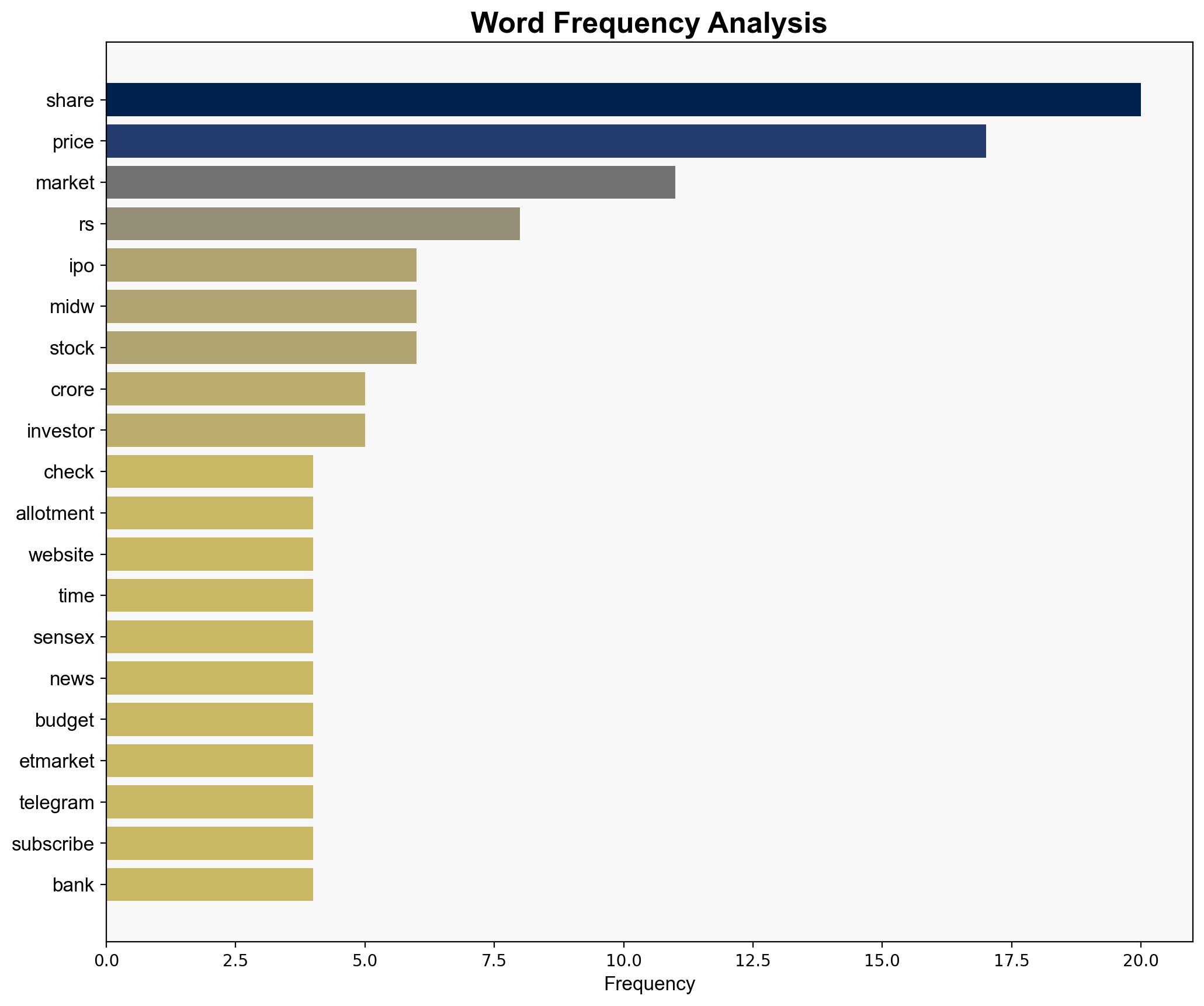

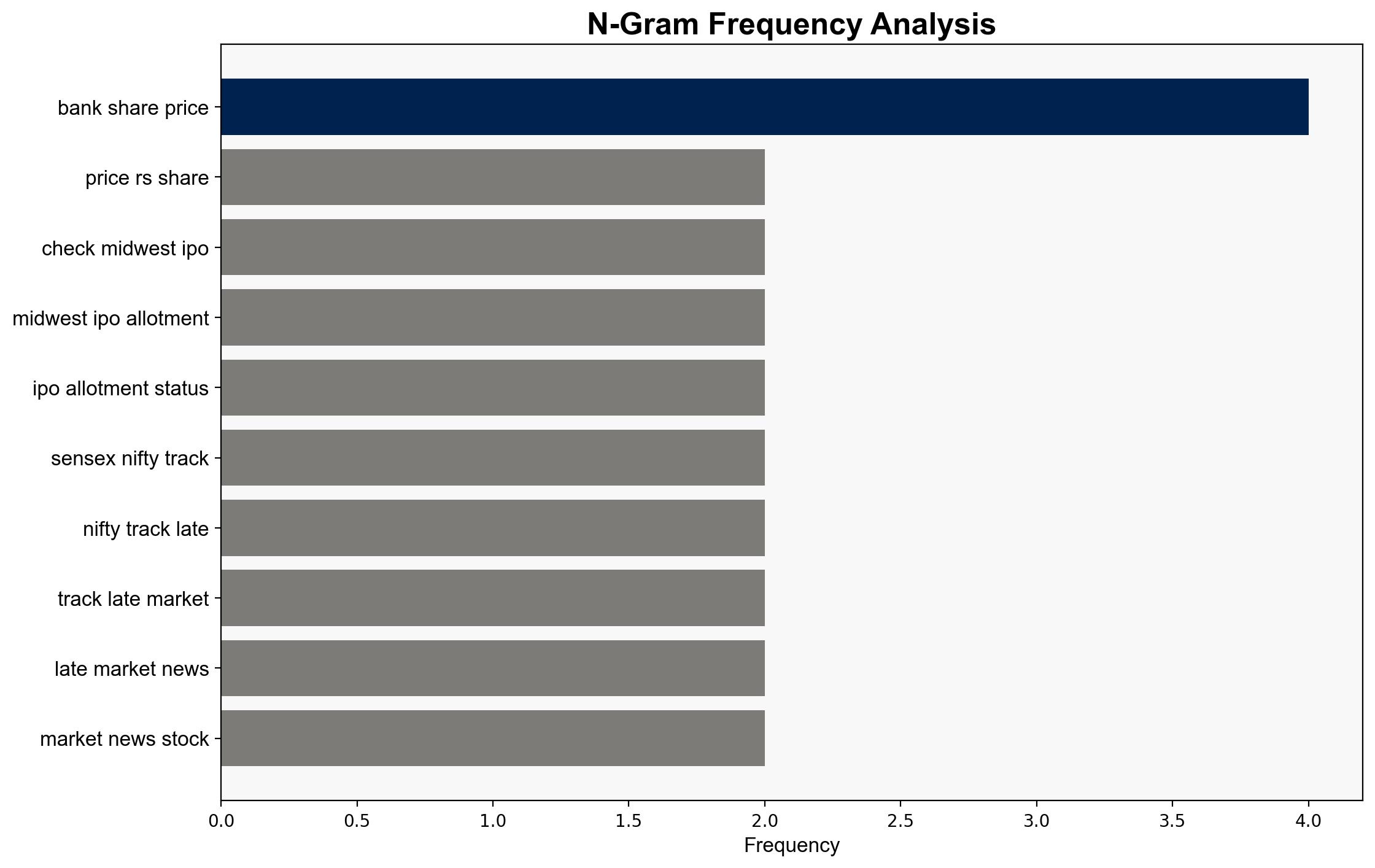

The Midwest IPO is experiencing strong demand, particularly from institutional investors, with a steady grey market premium (GMP) suggesting a positive market perception. The most supported hypothesis is that the IPO will be successful, driven by robust investor interest and a favorable market environment. Confidence level: Moderate. Recommended action: Monitor post-listing performance and investor sentiment closely to assess long-term viability.

2. Competing Hypotheses

1. **Hypothesis A**: The Midwest IPO will be successful, characterized by strong initial demand and a stable GMP, leading to a positive listing performance. This is supported by high subscription rates from institutional investors and a steady GMP.

2. **Hypothesis B**: Despite initial interest, the Midwest IPO may face challenges post-listing due to potential overvaluation and market volatility, which could lead to a decline in share price. This is based on concerns about the fully priced valuation and potential market corrections.

Using ACH 2.0, Hypothesis A is better supported due to the strong demand indicators and steady GMP, which suggest confidence in the company’s market prospects.

3. Key Assumptions and Red Flags

– **Assumptions**: The steady GMP is a reliable indicator of market sentiment. Institutional investor interest will translate into sustained demand post-listing.

– **Red Flags**: The IPO’s valuation is fully priced, which could deter future growth. Market volatility could impact the share price negatively.

– **Blind Spots**: Potential geopolitical or economic shifts that could affect investor sentiment are not accounted for.

4. Implications and Strategic Risks

– **Economic**: A successful IPO could boost investor confidence in similar offerings, while failure could dampen market enthusiasm.

– **Geopolitical**: Changes in trade relations, particularly with key markets like China and Italy, could impact Midwest’s export-driven revenue.

– **Psychological**: Investor perception of overvaluation could lead to a sell-off, impacting market stability.

5. Recommendations and Outlook

- Monitor post-listing performance and investor sentiment to gauge long-term success.

- Scenario-based projections:

- Best Case: Sustained demand leads to a stable or rising share price.

- Worst Case: Market corrections lead to a significant drop in share price.

- Most Likely: Initial volatility stabilizes as the market adjusts to the new listing.

6. Key Individuals and Entities

– Midwest, Kfin Technologies, BSE, NSE

7. Thematic Tags

economic trends, market analysis, investment strategy, IPO performance