The Right Way to Finance Ukraine’s Defense – Project Syndicate

Published on: 2025-10-20

Intelligence Report: The Right Way to Finance Ukraine’s Defense – Project Syndicate

1. BLUF (Bottom Line Up Front)

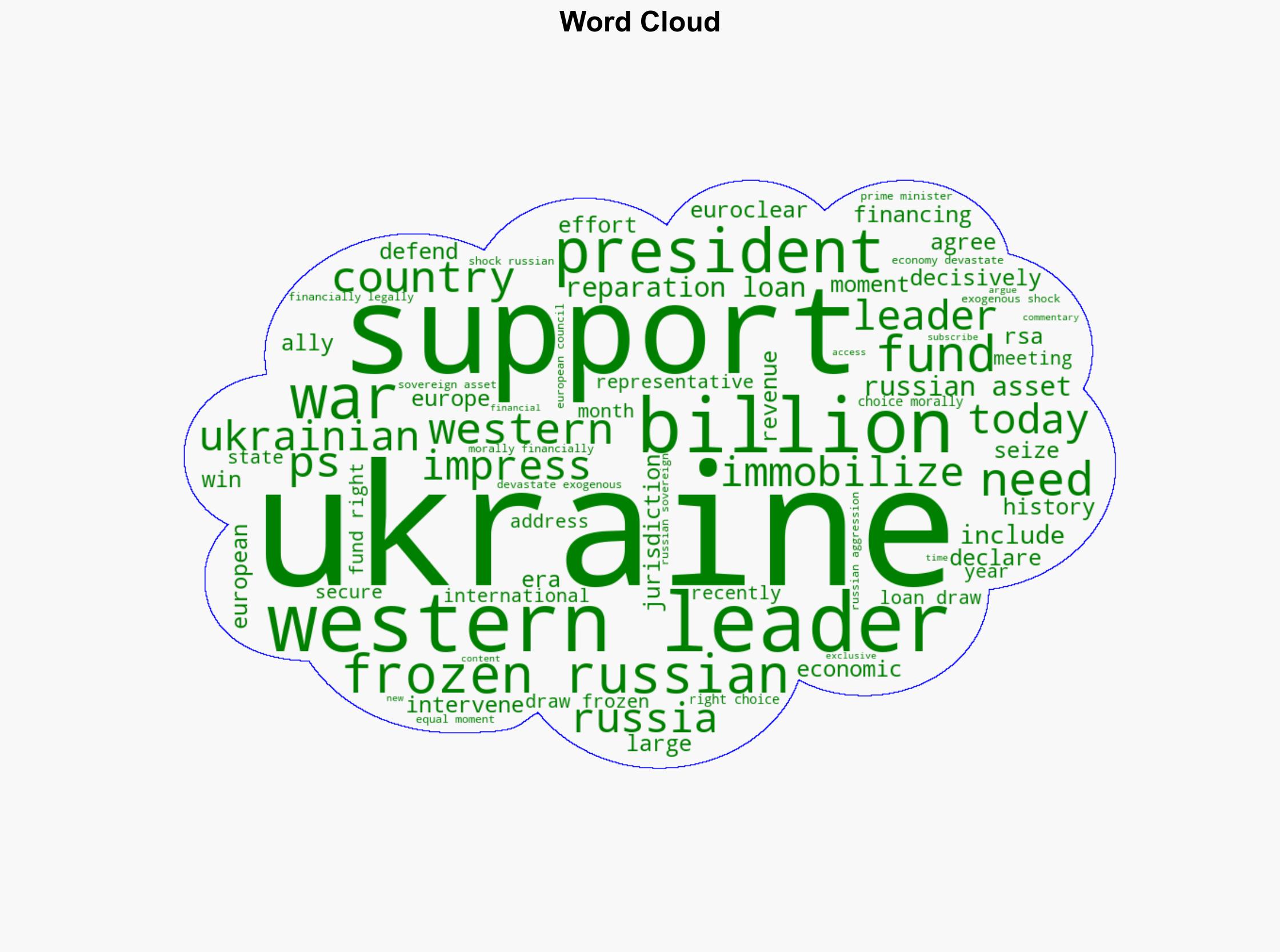

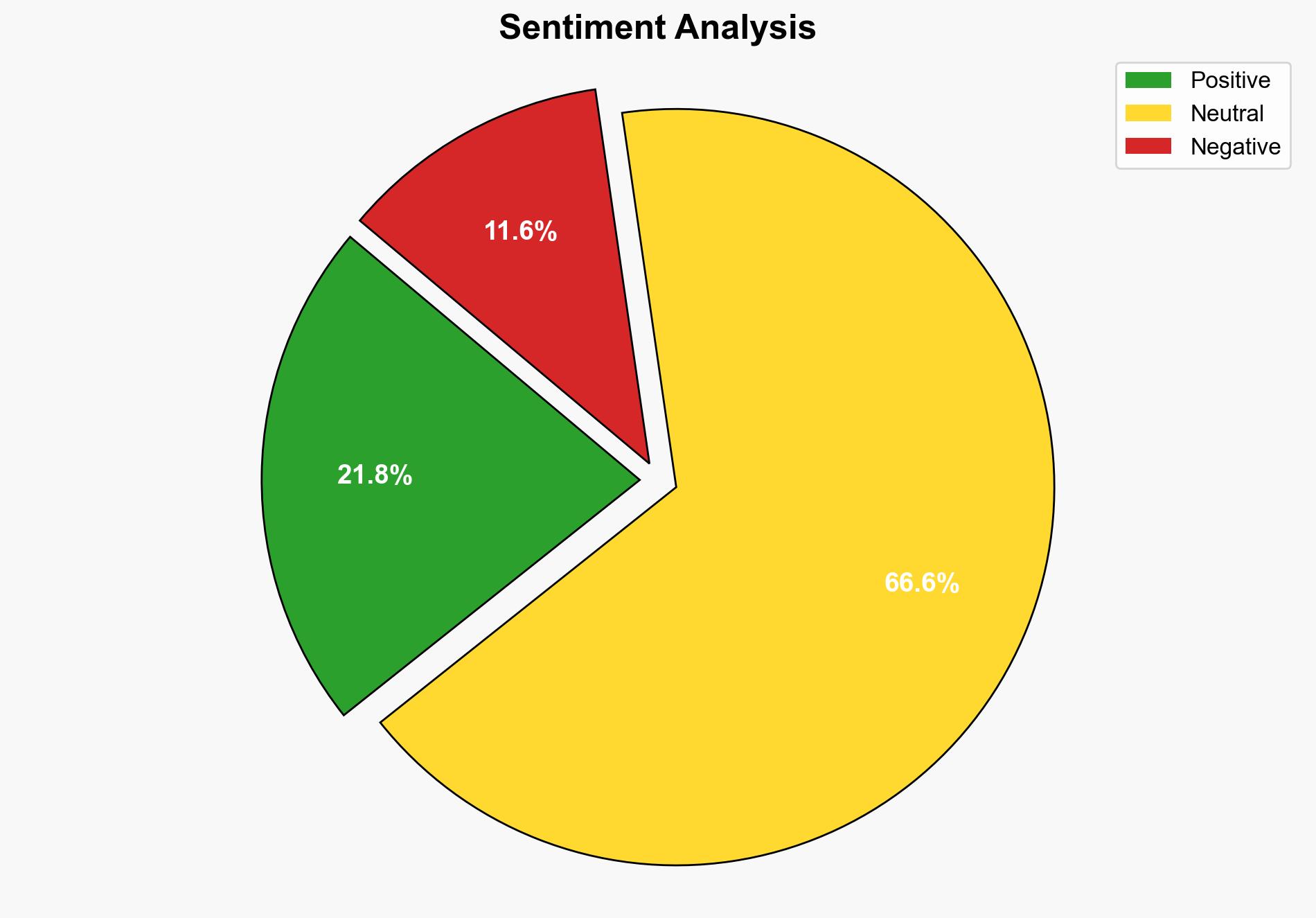

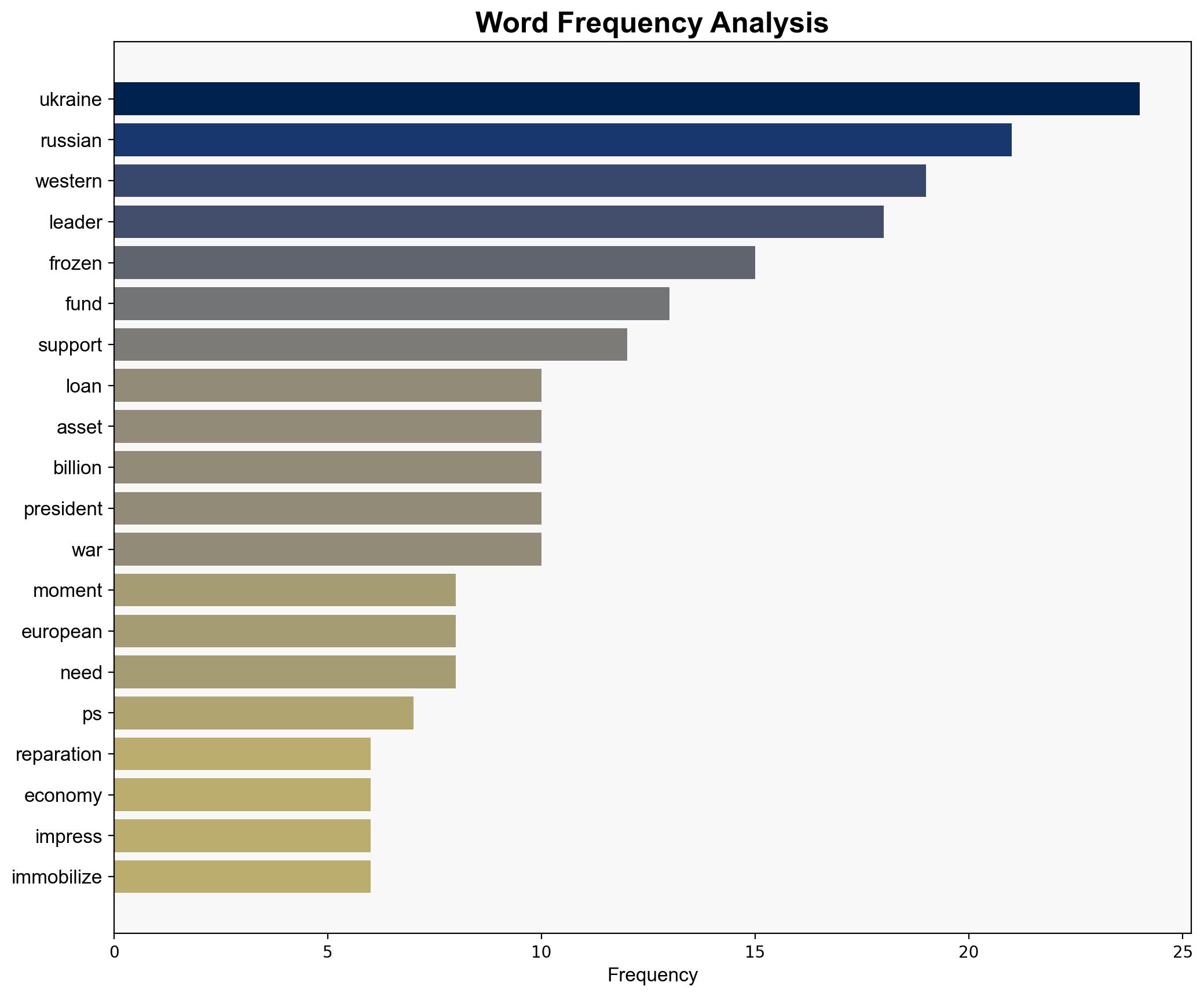

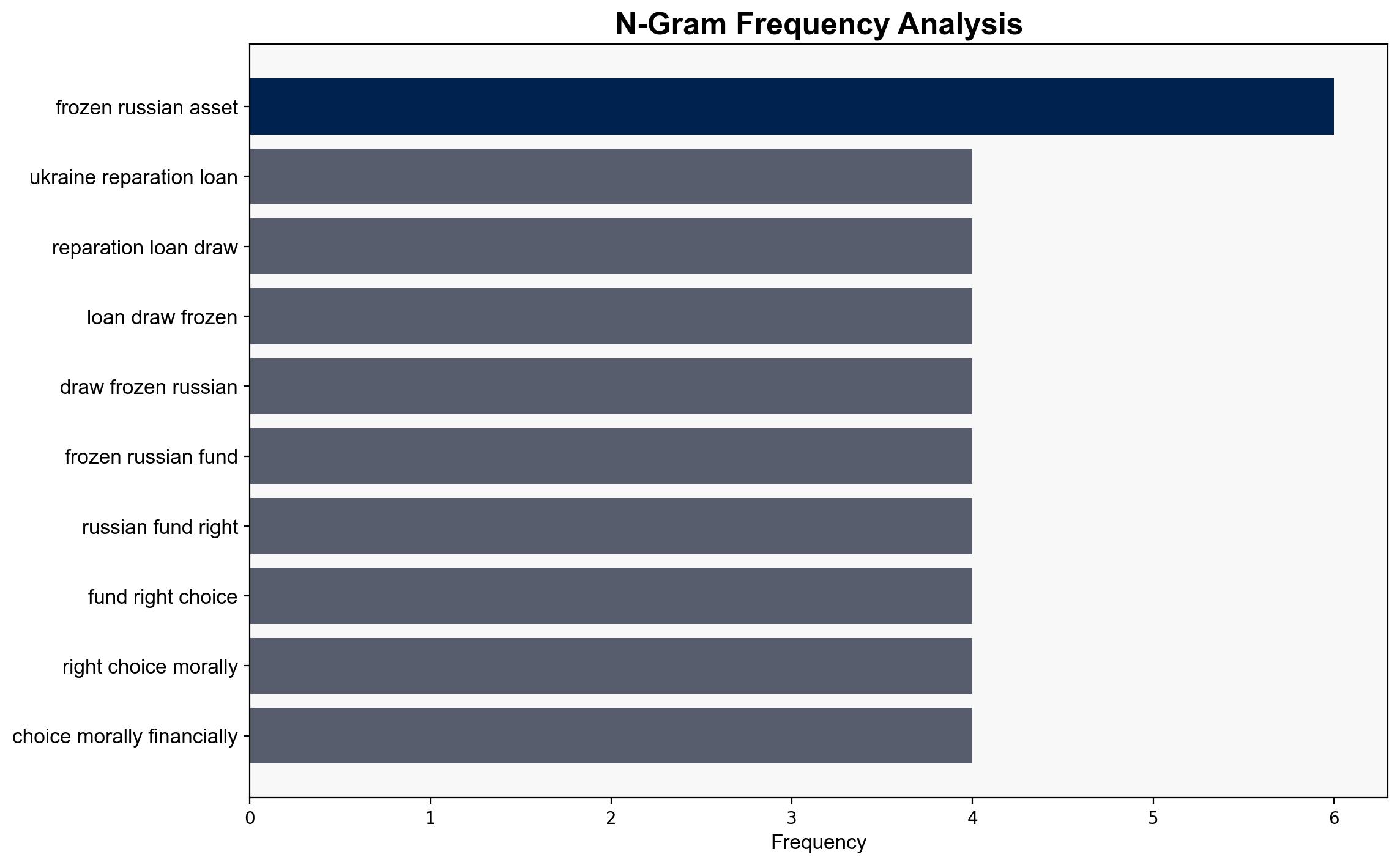

The most supported hypothesis is that utilizing frozen Russian assets to finance Ukraine’s defense is a strategically viable option, with a moderate to high confidence level. This approach is legally contentious but could provide significant financial support to Ukraine while exerting pressure on Russia. The recommended action is to pursue a coordinated international legal framework to legitimize the use of these assets, ensuring compliance with international law and minimizing geopolitical backlash.

2. Competing Hypotheses

1. **Hypothesis A**: Utilizing frozen Russian assets for Ukraine’s defense is a feasible and effective strategy. This approach would provide immediate financial resources, reduce the burden on Western economies, and serve as a punitive measure against Russia.

2. **Hypothesis B**: The legal and political challenges of using frozen Russian assets make this strategy impractical. The potential for international legal disputes and diplomatic tensions could outweigh the benefits, necessitating alternative funding mechanisms such as increased loans or grants from Western allies.

3. Key Assumptions and Red Flags

– **Assumptions**:

– Hypothesis A assumes that the legal framework can be established to allow the use of frozen assets without significant international backlash.

– Hypothesis B assumes that legal challenges will be insurmountable and that alternative funding will be readily available.

– **Red Flags**:

– Lack of consensus among Western leaders on the legality and morality of using frozen assets.

– Potential for Russia to retaliate economically or militarily if assets are seized.

– Insufficient exploration of alternative funding sources.

4. Implications and Strategic Risks

– **Economic**: Utilizing frozen assets could relieve financial pressure on Western economies but may lead to legal disputes that could destabilize financial markets.

– **Geopolitical**: This strategy could escalate tensions with Russia, potentially leading to retaliatory actions or increased military aggression.

– **Legal**: Establishing a legal precedent for asset seizure could have long-term implications for international financial systems and state sovereignty.

5. Recommendations and Outlook

- Develop a comprehensive legal framework in collaboration with international partners to legitimize the use of frozen assets.

- Engage in diplomatic efforts to build consensus among Western allies and mitigate potential geopolitical fallout.

- Explore alternative funding mechanisms to ensure financial support for Ukraine in case legal challenges delay asset utilization.

- Scenario Projections:

- Best Case: Successful legal framework established, assets utilized, and minimal geopolitical backlash.

- Worst Case: Legal disputes lead to financial instability, and Russia retaliates, escalating the conflict.

- Most Likely: Partial utilization of assets with ongoing legal and diplomatic negotiations.

6. Key Individuals and Entities

– Volodymyr Zelensky

– Donald Trump

– Chrystia Freeland

– Ursula von der Leyen

– Friedrich Merz

– António Costa

– Kaja Kallas

– Petteri Orpo

7. Thematic Tags

national security threats, international law, economic sanctions, geopolitical strategy