BNP Paribas shares fall after US jurys Sudan verdict – Al Jazeera English

Published on: 2025-10-20

Intelligence Report: BNP Paribas shares fall after US jury’s Sudan verdict – Al Jazeera English

1. BLUF (Bottom Line Up Front)

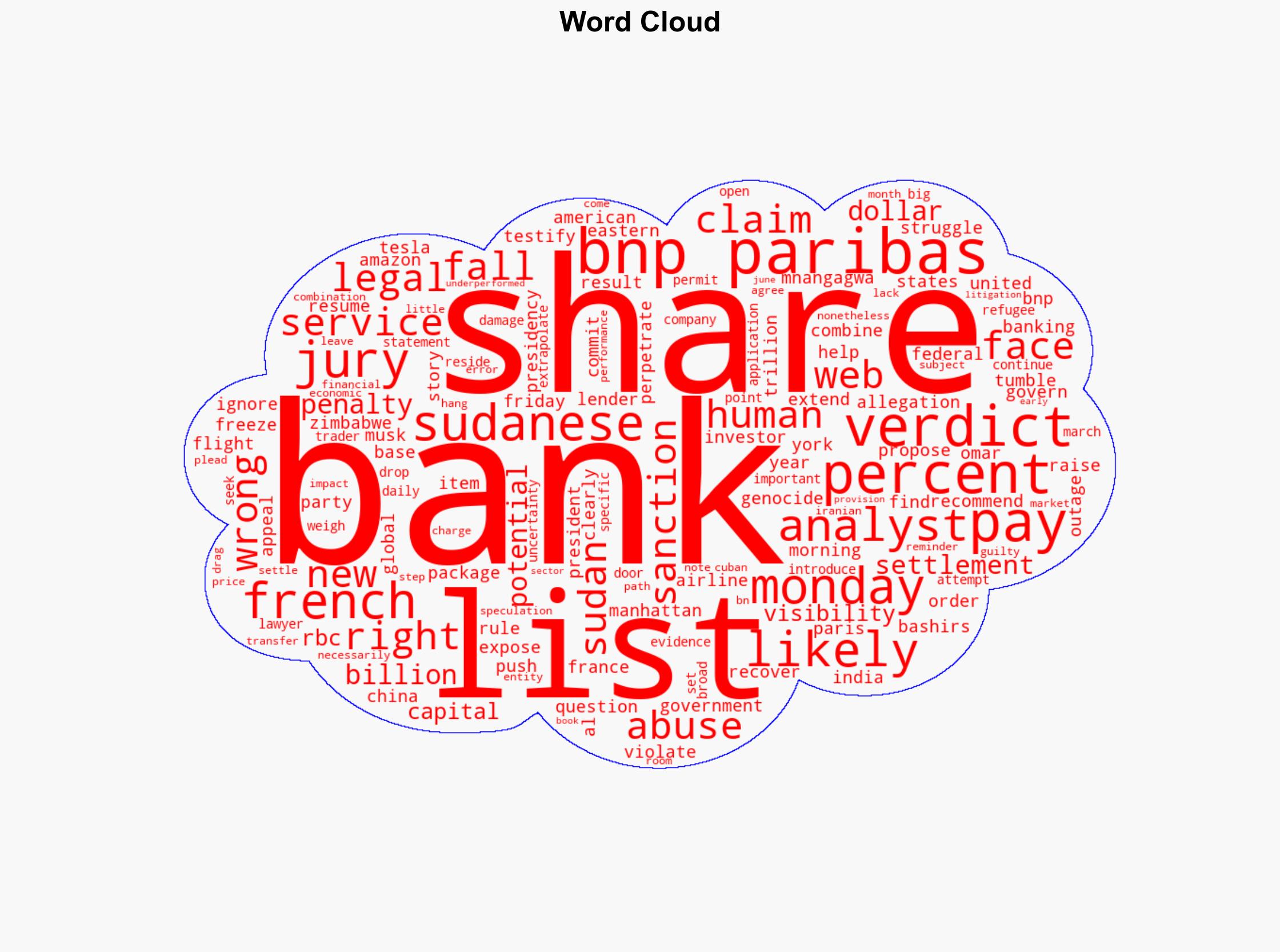

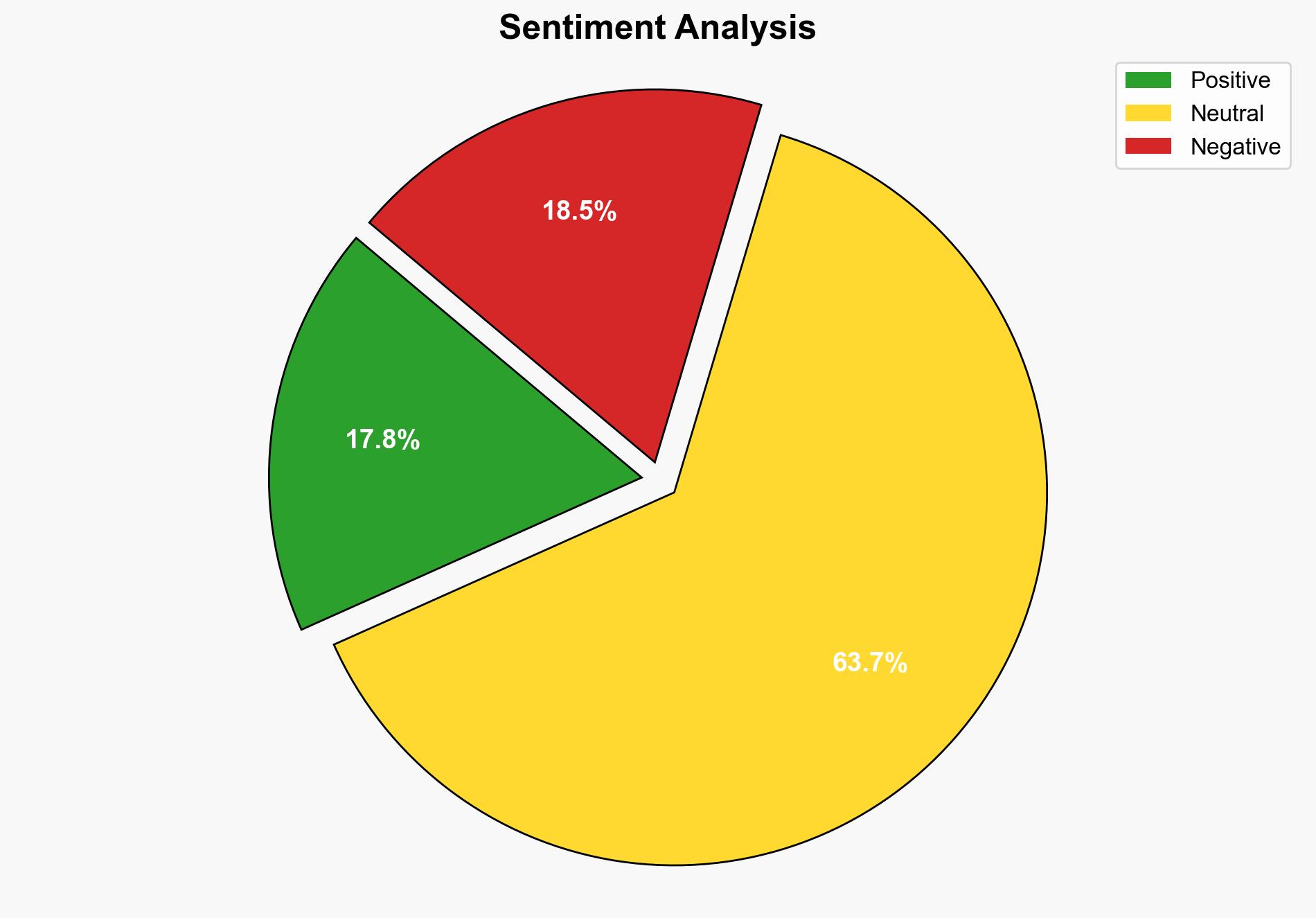

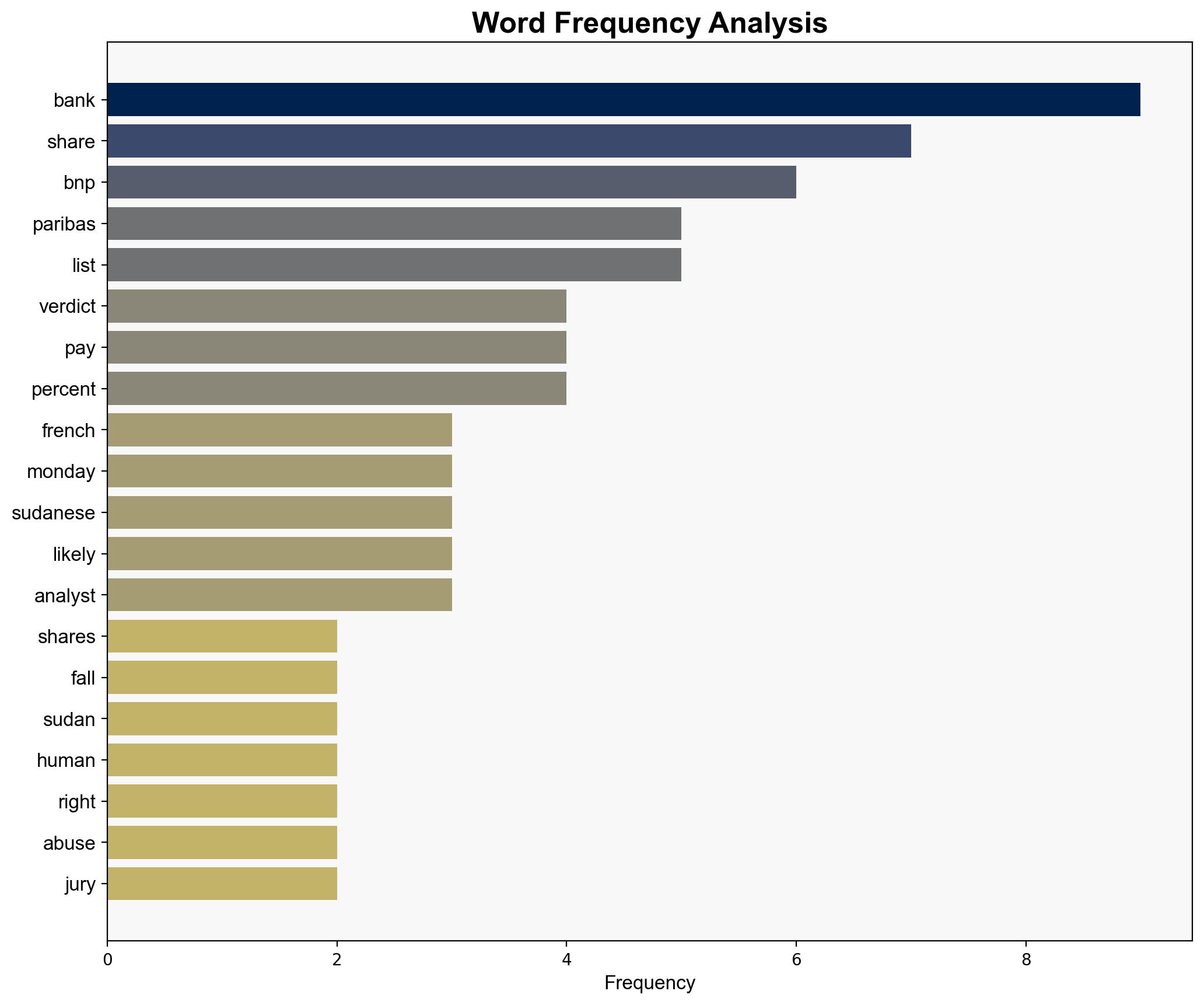

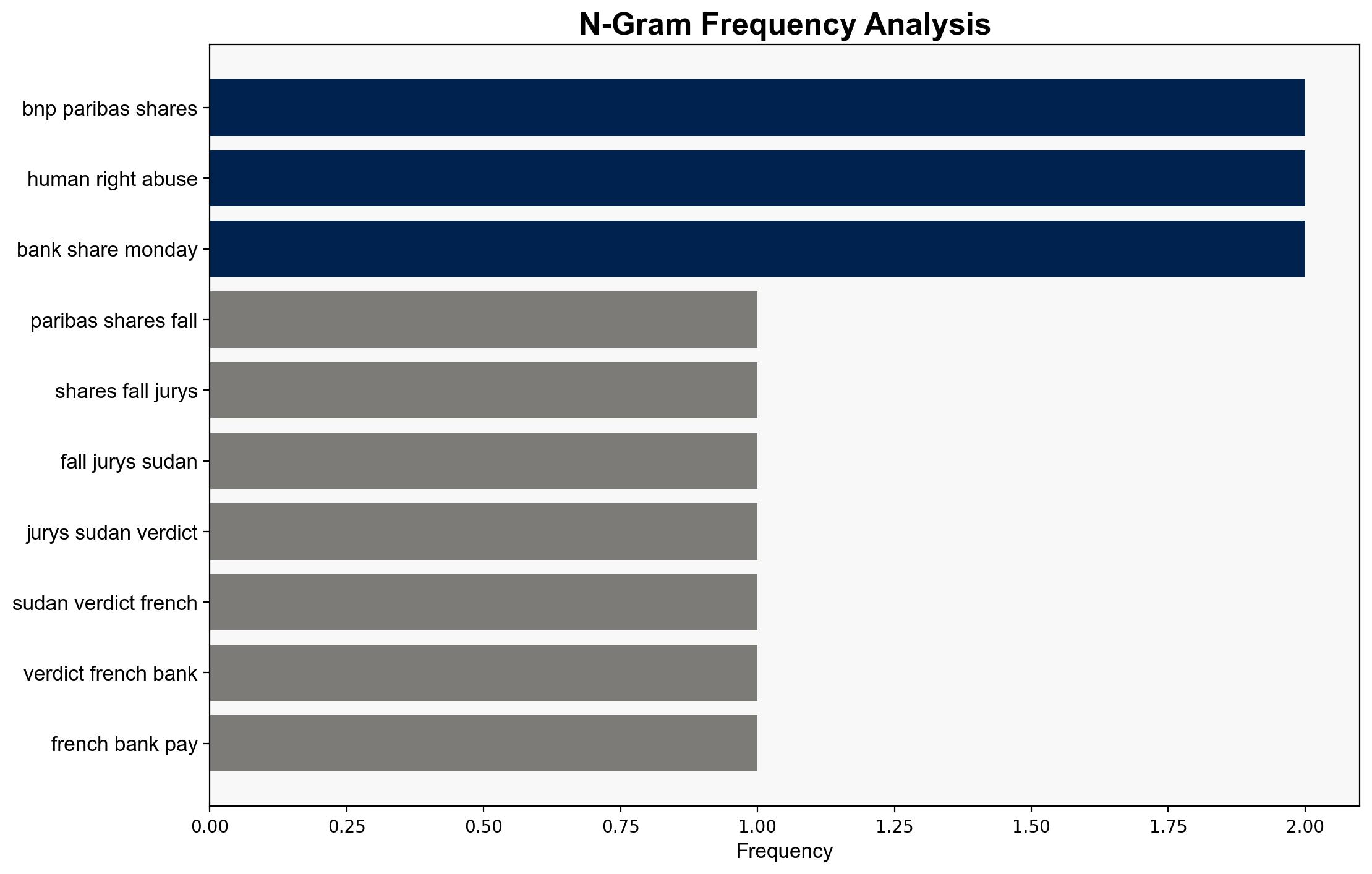

The most supported hypothesis is that BNP Paribas faces significant legal and financial challenges due to the US jury’s verdict, which could lead to prolonged share price volatility and potential financial penalties. Confidence level: Moderate. Recommended action: BNP Paribas should enhance legal defenses and prepare for potential settlements while communicating transparently with stakeholders to mitigate share price impact.

2. Competing Hypotheses

1. **Hypothesis A**: The US jury’s verdict will lead to substantial financial penalties and prolonged legal battles for BNP Paribas, significantly impacting its financial performance and share price.

– **Supporting Evidence**: The verdict opens the door for further claims from Sudanese refugees seeking damages, and the bank’s shares have already dropped significantly.

– **Contradictory Evidence**: BNP Paribas plans to appeal the verdict, which could mitigate immediate financial impacts.

2. **Hypothesis B**: The impact of the verdict on BNP Paribas will be limited, with the bank successfully appealing or settling the case without significant financial repercussions.

– **Supporting Evidence**: BNP Paribas has previously settled similar charges, indicating potential for a negotiated resolution.

– **Contradictory Evidence**: The scale of the allegations and the precedent set by the verdict could lead to more extensive claims and financial liabilities.

3. Key Assumptions and Red Flags

– **Assumptions**: It is assumed that the legal system will allow BNP Paribas to appeal effectively and that settlements can be negotiated. It is also assumed that the market’s reaction will stabilize over time.

– **Red Flags**: The potential for additional claims from other plaintiffs, the unpredictability of legal outcomes, and the bank’s previous underperformance in the sector are critical concerns.

– **Blind Spots**: The full extent of the bank’s exposure to similar legal risks in other jurisdictions remains unclear.

4. Implications and Strategic Risks

– **Economic Risks**: Prolonged legal battles could strain BNP Paribas’s financial resources, impacting its ability to invest and expand.

– **Geopolitical Risks**: The case highlights the risks of operating in regions with complex political and human rights issues, potentially affecting the bank’s global operations.

– **Psychological Risks**: Investor confidence may be shaken, leading to further share price volatility and potential capital flight.

5. Recommendations and Outlook

- BNP Paribas should strengthen its legal strategy and prepare for potential settlements to minimize financial impact.

- Engage in proactive communication with investors to maintain confidence and mitigate share price volatility.

- Scenario Projections:

- Best Case: Successful appeal or favorable settlement limits financial impact, stabilizing share price.

- Worst Case: Prolonged legal battles and additional claims lead to significant financial penalties and share price decline.

- Most Likely: A combination of appeal and settlement results in moderate financial impact and gradual share price recovery.

6. Key Individuals and Entities

– BNP Paribas

– Sudanese plaintiffs

– Omar al-Bashir

7. Thematic Tags

national security threats, geopolitical risk, financial stability, legal risk