Equities Rally On China-US Hopes New Japanese PM Lifts Tokyo – International Business Times

Published on: 2025-10-21

Intelligence Report: Equities Rally On China-US Hopes New Japanese PM Lifts Tokyo – International Business Times

1. BLUF (Bottom Line Up Front)

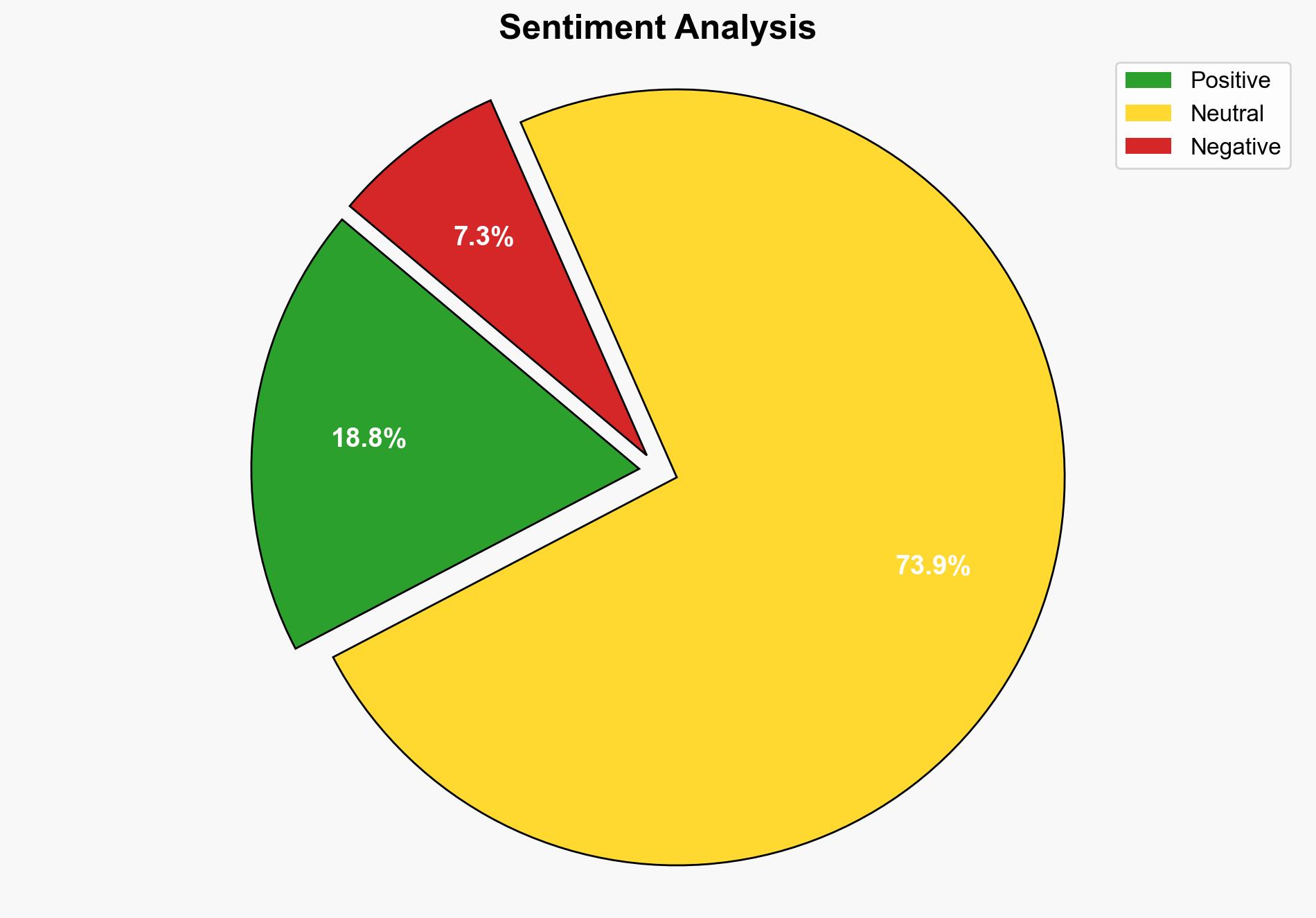

The most supported hypothesis is that the recent rally in Asian markets is primarily driven by optimism over improved China-US relations and political stability in Japan. Confidence level is moderate, given the complex geopolitical landscape and economic uncertainties. Recommended action includes monitoring upcoming diplomatic engagements and economic indicators closely to anticipate market shifts.

2. Competing Hypotheses

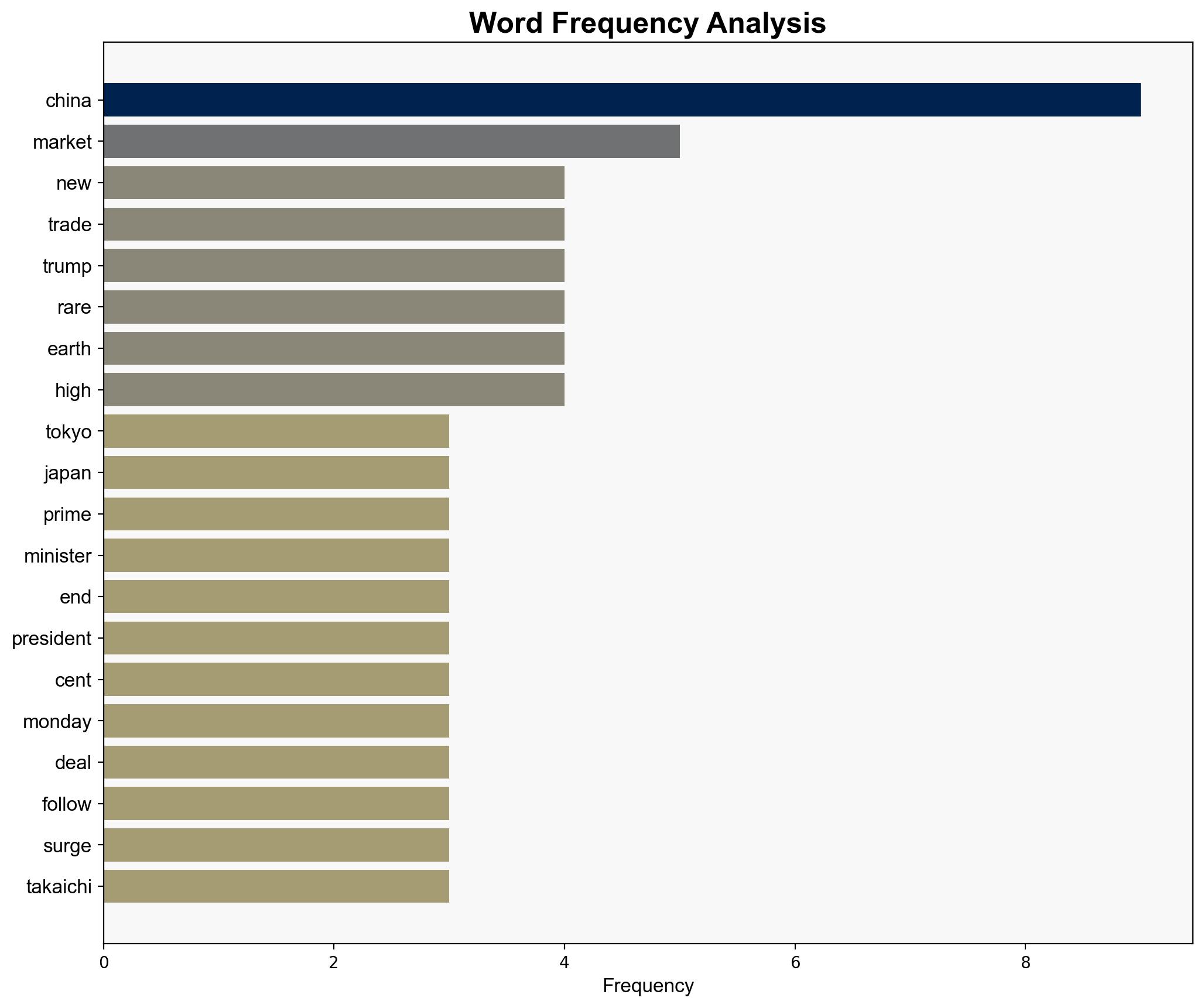

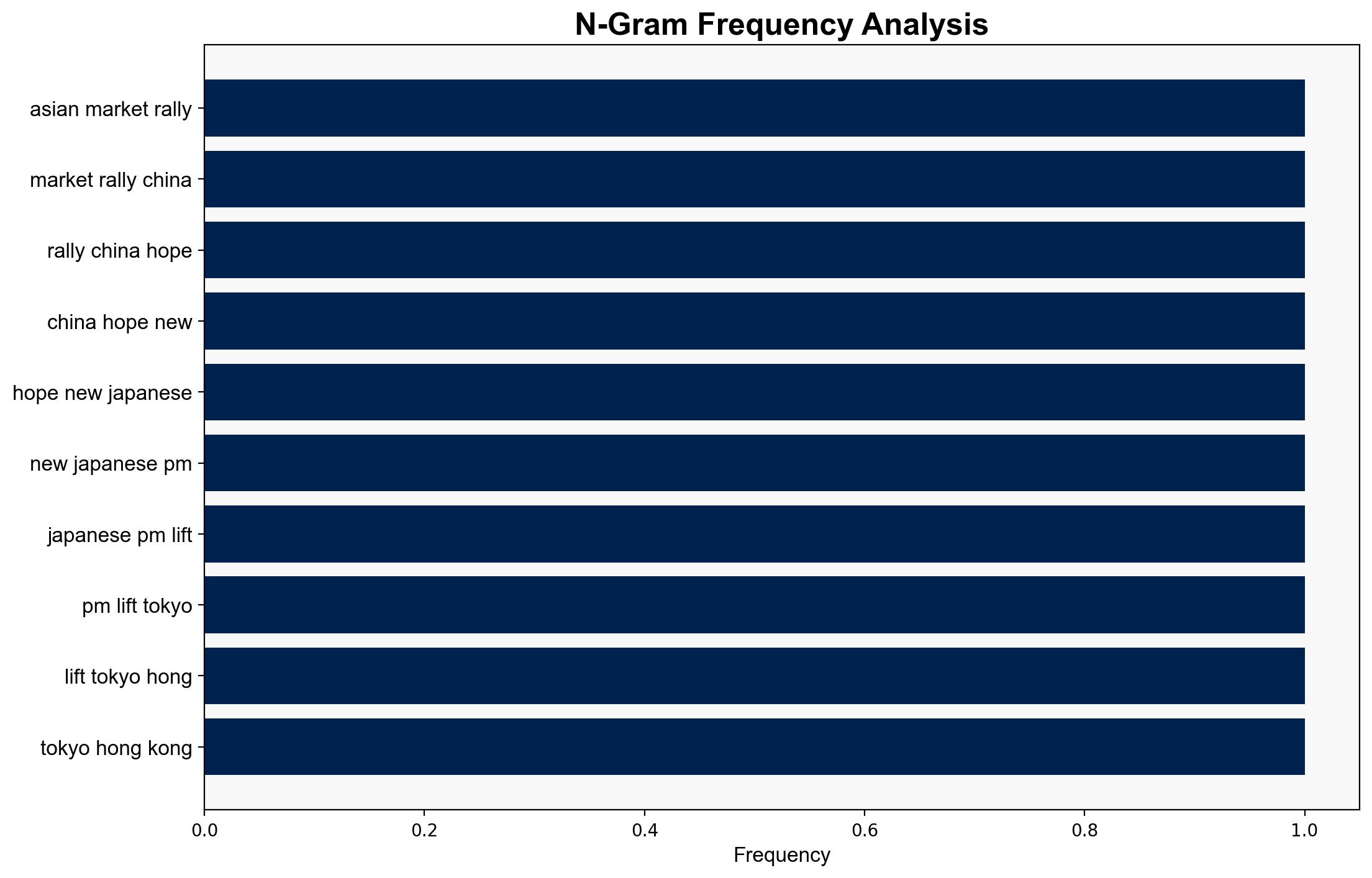

1. **Hypothesis A**: The market rally is primarily due to easing China-US trade tensions and positive rhetoric from both sides, particularly ahead of the APEC summit.

2. **Hypothesis B**: The rally is mainly driven by domestic factors in Japan, including the appointment of a new Prime Minister and the potential for aggressive economic policies similar to those of former Premier Shinzo Abe.

Using ACH 2.0, Hypothesis A is better supported due to the broader regional market impacts and the timing of the rally coinciding with international diplomatic developments. Hypothesis B is plausible but less supported as it primarily affects the Japanese market.

3. Key Assumptions and Red Flags

– **Assumptions**: It is assumed that diplomatic rhetoric will translate into tangible policy changes. The market’s positive response assumes stability in Japan’s political landscape.

– **Red Flags**: Potential over-reliance on diplomatic statements without concrete policy actions. The assumption that Japan’s new leadership will maintain economic stability could be challenged if internal political dynamics shift.

– **Blind Spots**: The impact of China’s internal economic issues, such as the property sector’s struggles, is not fully accounted for in the market optimism.

4. Implications and Strategic Risks

– **Economic**: A failure to achieve substantial progress in China-US trade talks could reverse market gains.

– **Geopolitical**: Rising tensions in other areas, such as Taiwan, could disrupt diplomatic progress.

– **Psychological**: Investor sentiment is highly sensitive to diplomatic signals, which could lead to volatility if expectations are not met.

5. Recommendations and Outlook

- Monitor diplomatic engagements between China and the US closely, particularly around the APEC summit.

- Track Japan’s domestic policy announcements for indications of economic strategy shifts.

- Scenario Projections:

- **Best Case**: Successful trade negotiations lead to sustained market growth.

- **Worst Case**: Breakdown in talks or geopolitical tensions lead to market downturns.

- **Most Likely**: Gradual progress with intermittent volatility as negotiations unfold.

6. Key Individuals and Entities

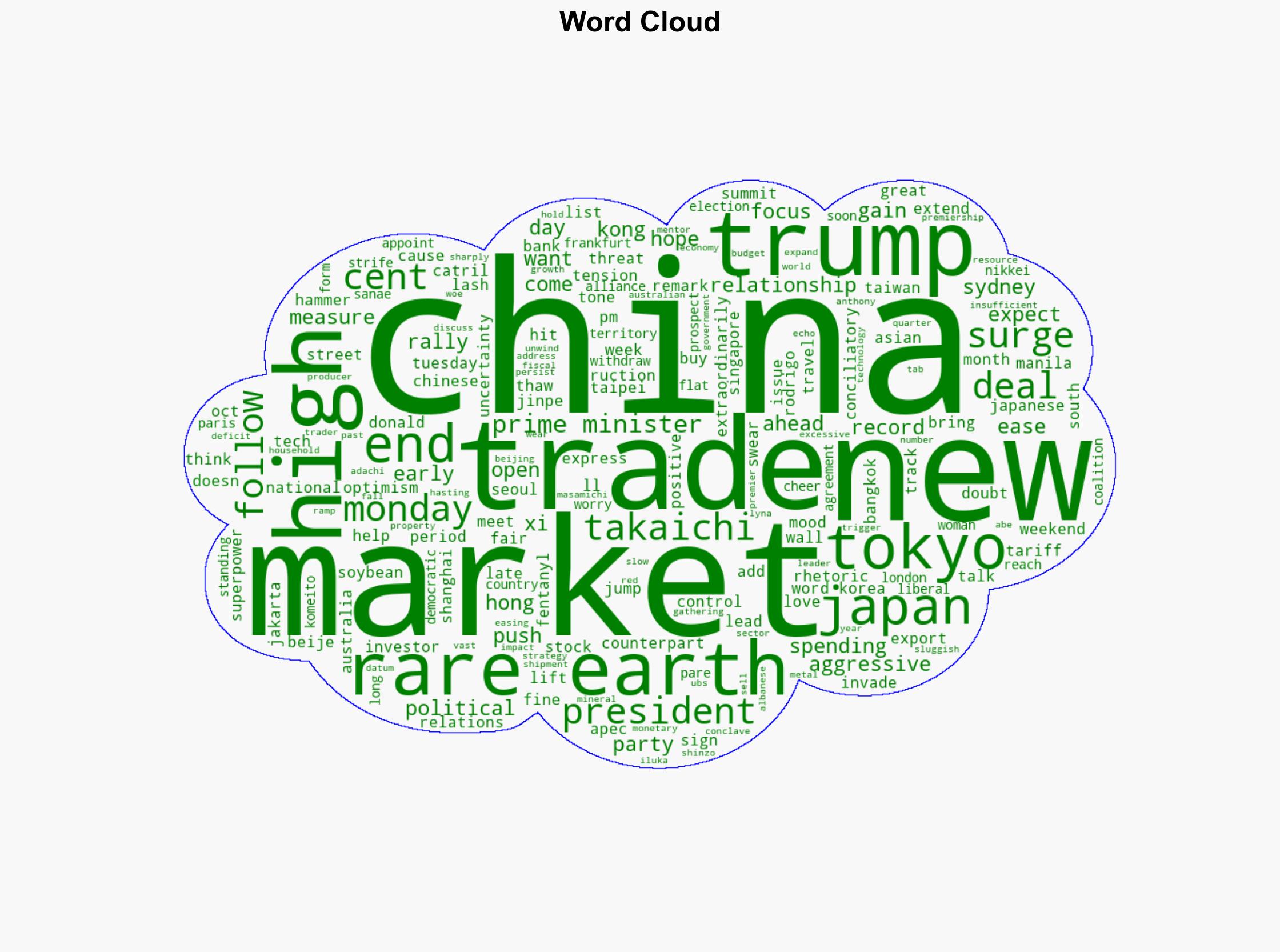

– Donald Trump

– Xi Jinping

– Sanae Takaichi

– Anthony Albanese

7. Thematic Tags

national security threats, economic stability, geopolitical relations, market volatility