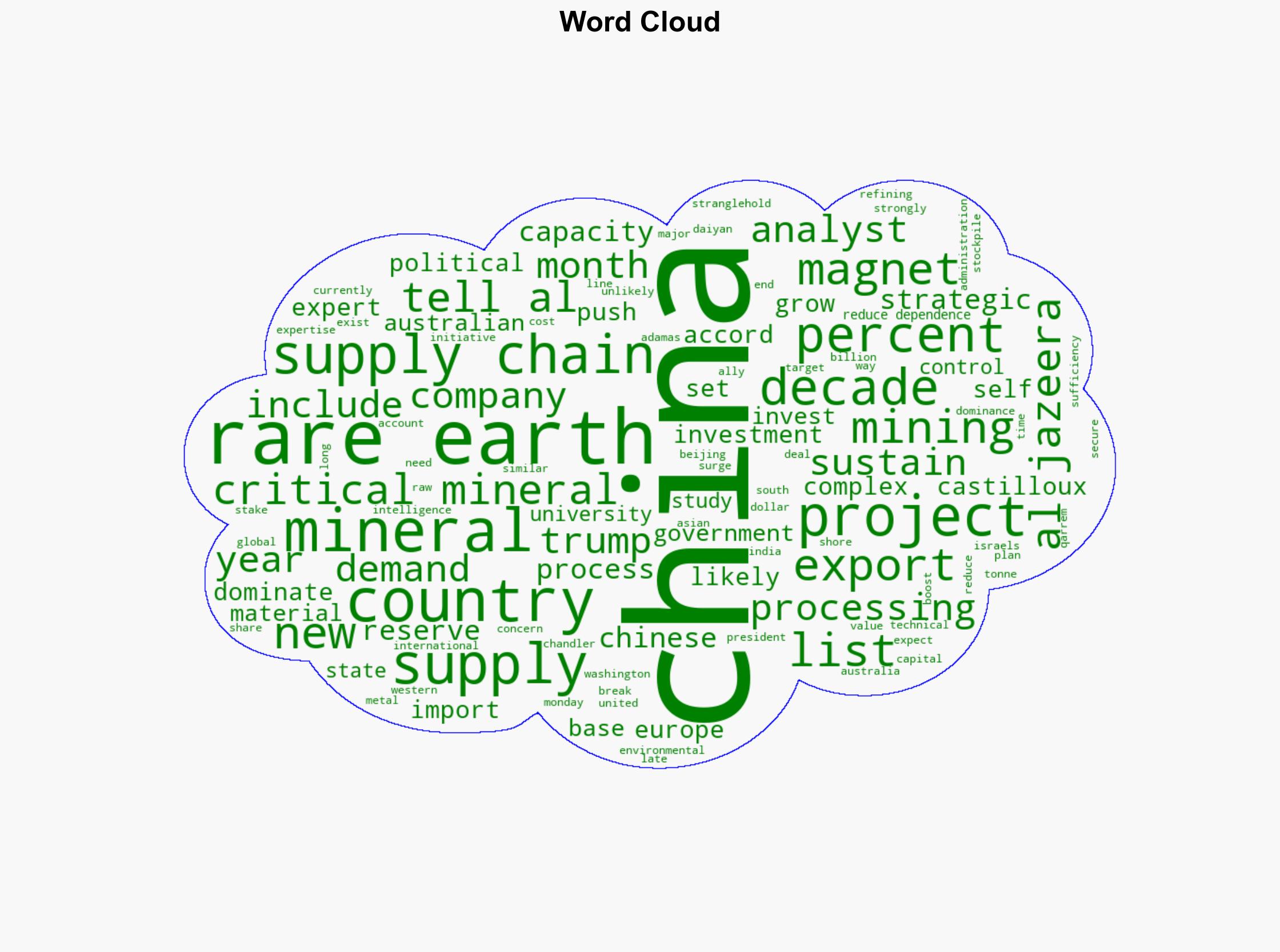

Despite US push China poised to dominate rare earths for years – Al Jazeera English

Published on: 2025-10-21

Intelligence Report: Despite US push China poised to dominate rare earths for years – Al Jazeera English

1. BLUF (Bottom Line Up Front)

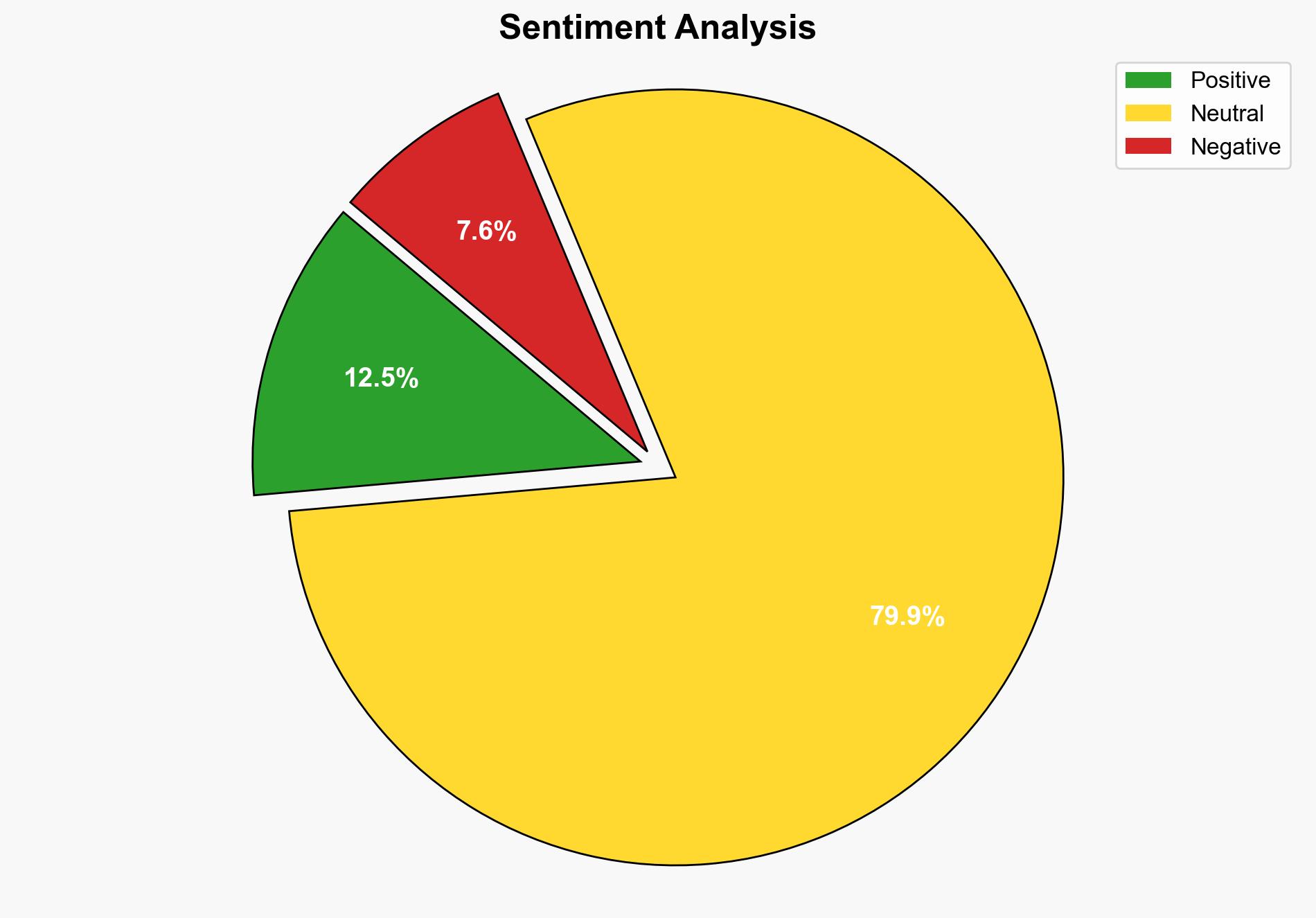

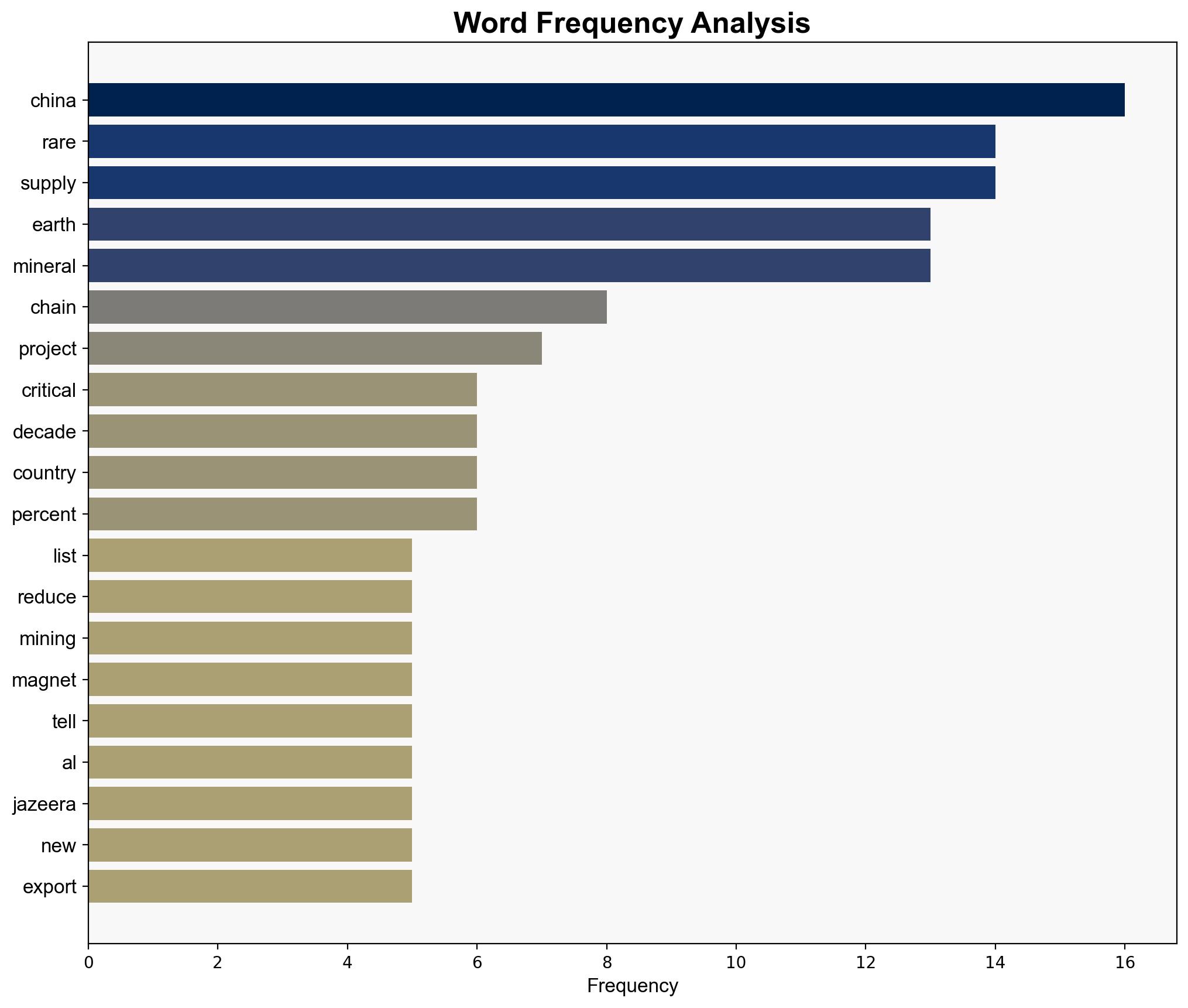

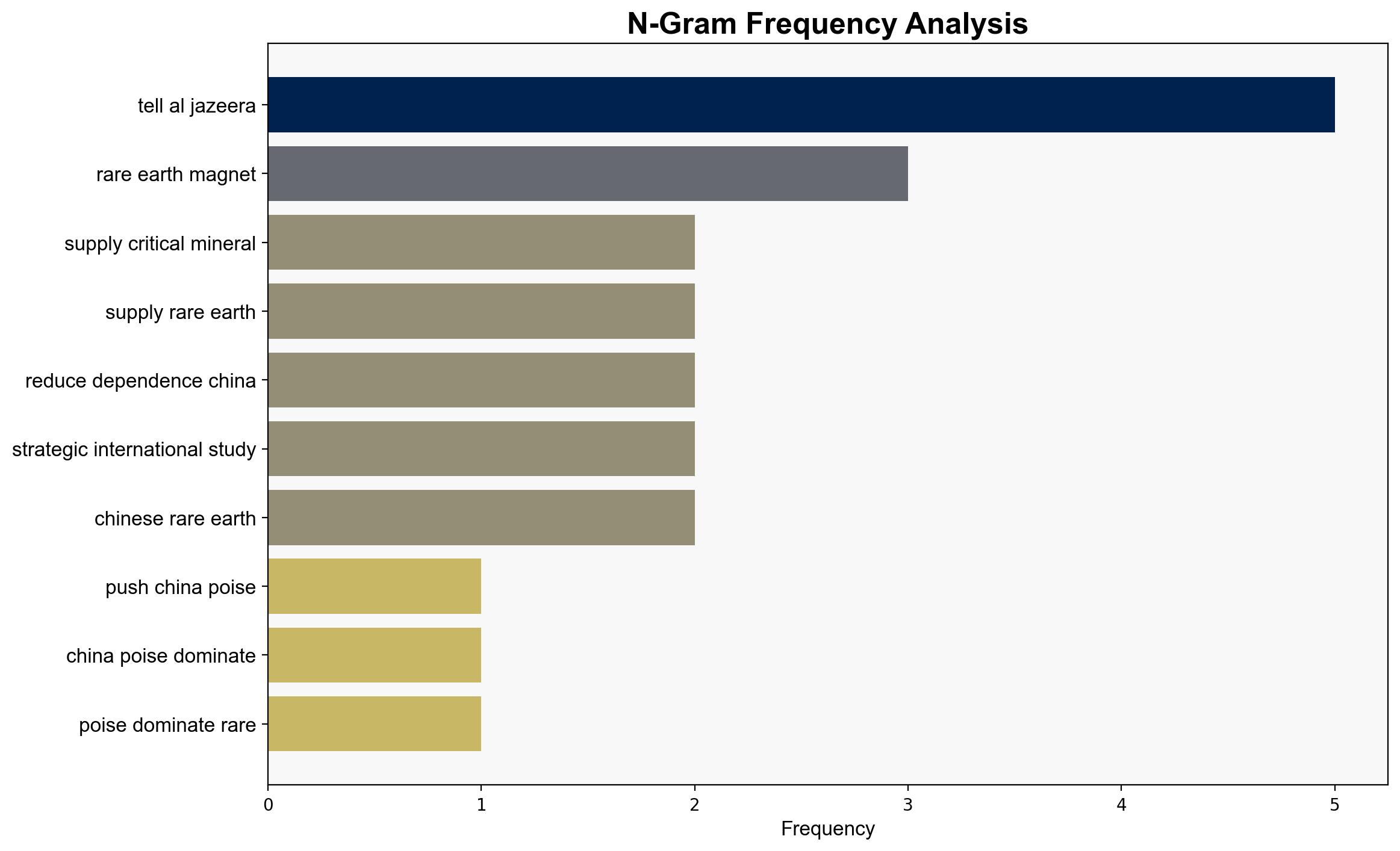

China is likely to maintain its dominance in the rare earths market for the foreseeable future, despite efforts by the US and its allies to diversify supply chains. This assessment is based on structured analytic techniques, including Bayesian Scenario Modeling, which indicate a high confidence level in China’s continued leverage over rare earths. Strategic recommendations include increasing investment in alternative supply chains and fostering international collaborations to mitigate dependency risks.

2. Competing Hypotheses

Hypothesis 1: China will continue to dominate the global rare earths market due to its established infrastructure, technical expertise, and significant reserves.

– Supported by China’s current control over supply chains and the slow pace of alternative developments.

Hypothesis 2: The US and its allies will successfully diversify their rare earth supply chains within the next decade, reducing China’s market dominance.

– Supported by ongoing investments and international agreements aimed at establishing new supply chains.

Using Cross-Impact Simulation, Hypothesis 1 is better supported due to the entrenched nature of China’s supply chain dominance and the significant time and investment required for alternative sources to become viable.

3. Key Assumptions and Red Flags

– Assumption: China’s political and economic stability will allow it to maintain its current production levels.

– Red Flag: Potential geopolitical tensions or economic sanctions could disrupt China’s supply chain.

– Blind Spot: The impact of technological advancements in rare earth alternatives is not fully considered.

4. Implications and Strategic Risks

– Economic: Continued reliance on China for rare earths could lead to supply chain vulnerabilities and increased costs for industries reliant on these materials.

– Geopolitical: China’s leverage over rare earths could be used as a strategic tool in international negotiations.

– Cyber: Increased cyber threats targeting rare earth supply chains as nations seek to secure their resources.

– Psychological: Perception of dependency on China could influence policy decisions and public opinion.

5. Recommendations and Outlook

- Increase investment in domestic and allied rare earth mining and processing capabilities.

- Strengthen international collaborations to share technology and expertise in rare earth extraction and processing.

- Scenario Projections:

- Best Case: Successful diversification of supply chains within a decade, reducing dependency on China.

- Worst Case: Geopolitical tensions lead to supply disruptions, impacting critical industries.

- Most Likely: Gradual progress in diversification with China maintaining significant influence over the market.

6. Key Individuals and Entities

– Ryan Castilloux, founder and managing director of Adamas Intelligence

– President Donald Trump (mentioned in historical context)

– Anthony Albanese, Australian Prime Minister

7. Thematic Tags

national security threats, economic security, geopolitical strategy, resource dependency