Andreessen Horowitz Says Crypto Has Entered a New Era of Real Utility – CoinDesk

Published on: 2025-10-22

Intelligence Report: Andreessen Horowitz Says Crypto Has Entered a New Era of Real Utility – CoinDesk

1. BLUF (Bottom Line Up Front)

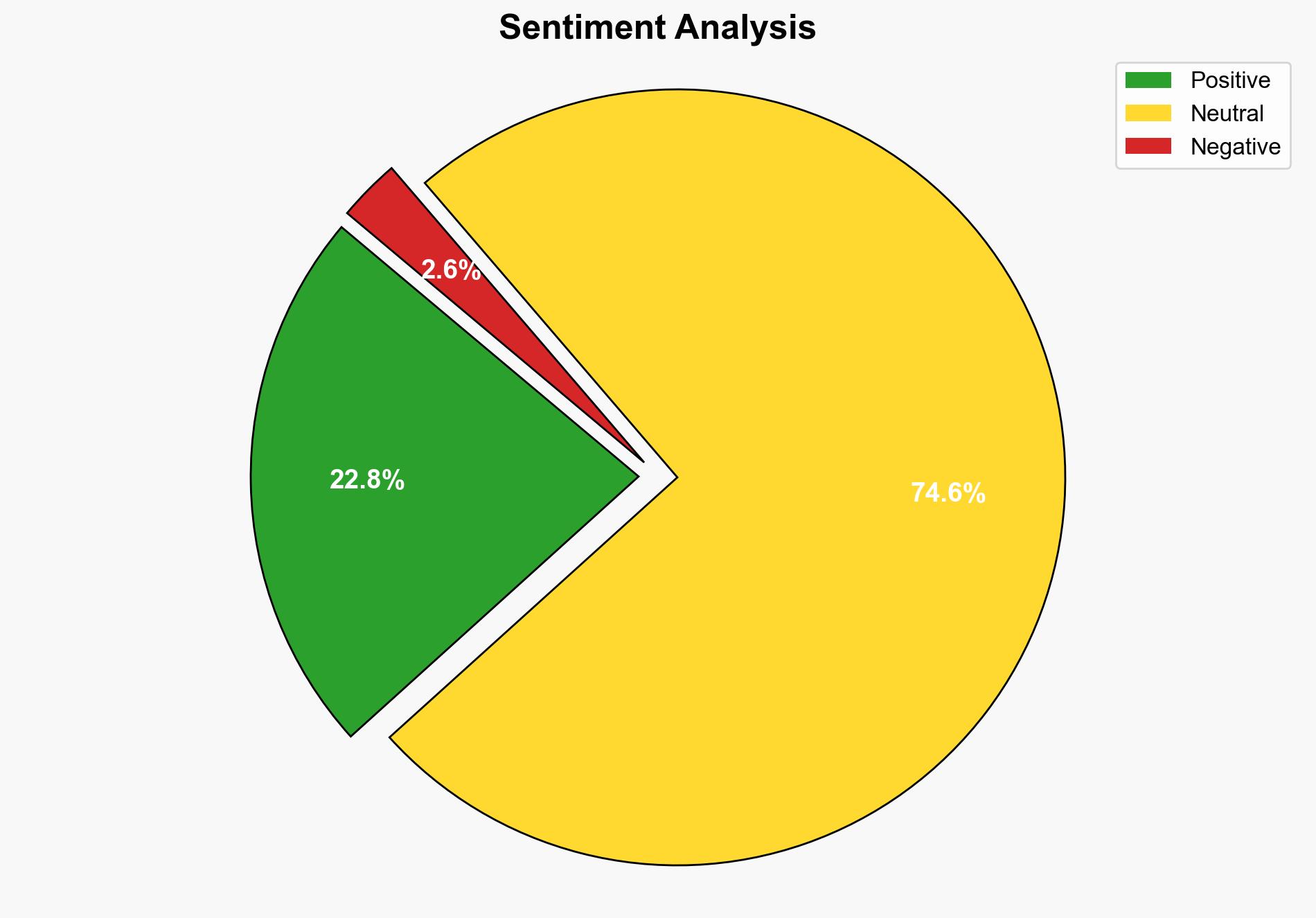

The most supported hypothesis is that the cryptocurrency industry is transitioning towards real utility, driven by regulatory clarity, AI integration, and stablecoin adoption. Confidence in this assessment is moderate, given the reliance on projections and the inherent volatility of the crypto market. Strategic recommendation: Monitor regulatory developments and technological advancements to identify investment and partnership opportunities in the crypto sector.

2. Competing Hypotheses

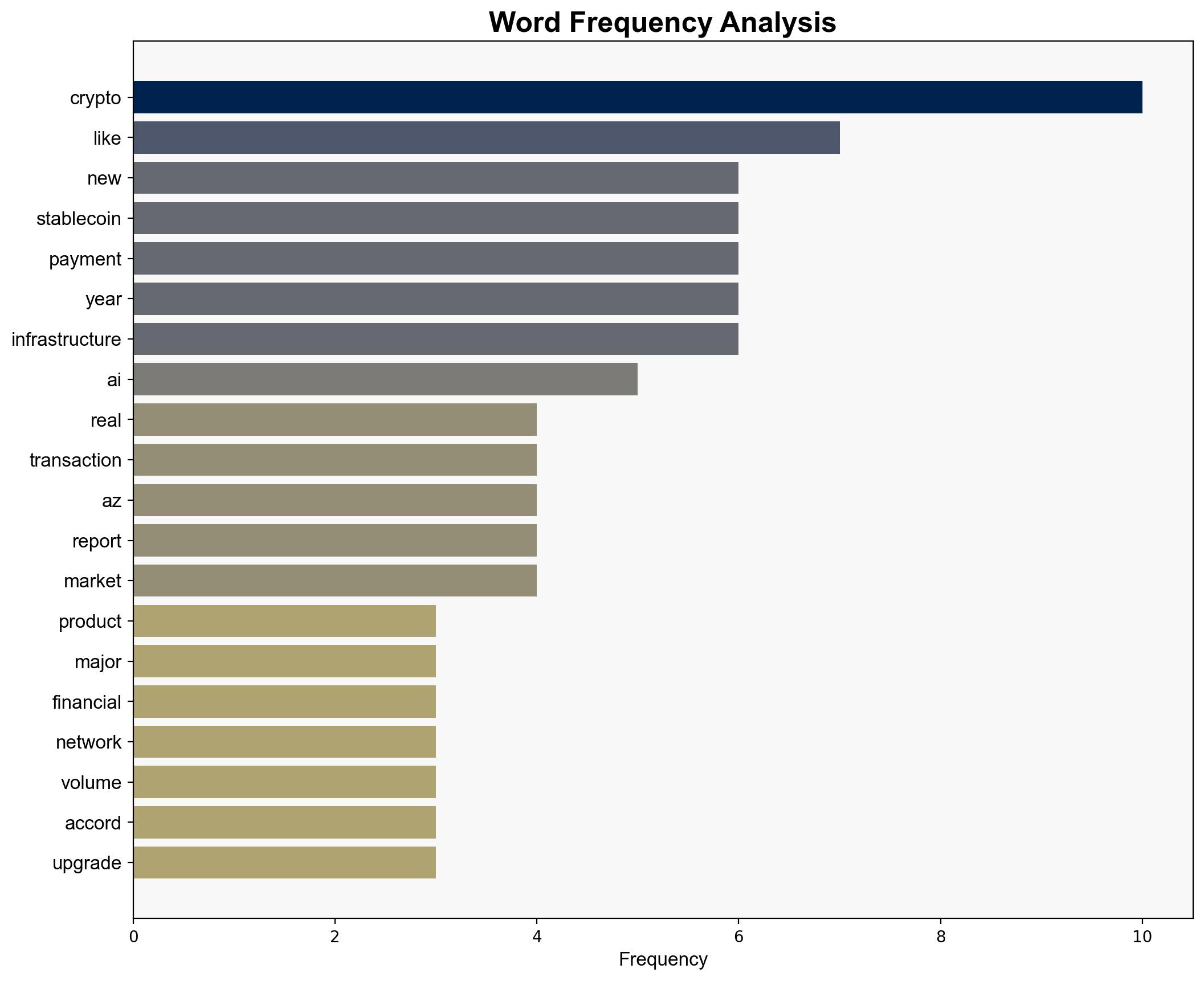

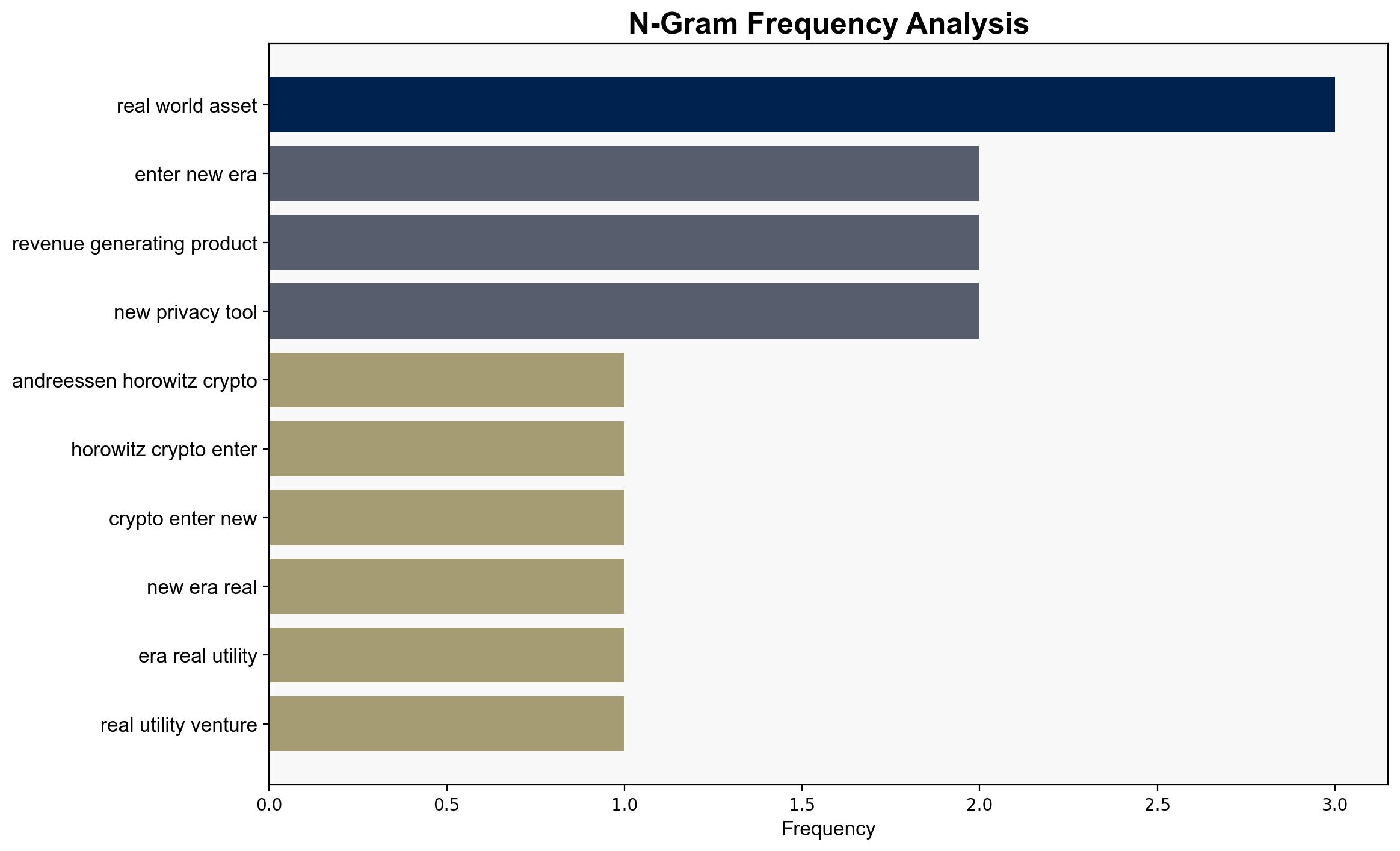

Hypothesis 1: The cryptocurrency industry is entering a new era of real utility, characterized by regulatory clarity, AI integration, and increased adoption of stablecoins and tokenized assets. This hypothesis is supported by the reported growth in transaction volumes, institutional interest, and technological advancements such as Ethereum upgrades and Solana’s growth.

Hypothesis 2: The perceived transition to real utility in the cryptocurrency industry is overstated, with ongoing volatility and speculative behavior continuing to dominate. Despite advancements and institutional interest, regulatory challenges and technological limitations may hinder widespread adoption and integration into the traditional financial system.

3. Key Assumptions and Red Flags

Assumptions:

– Regulatory frameworks will provide clarity and facilitate growth.

– AI integration will enhance the functionality and appeal of cryptocurrencies.

– Institutional adoption will continue to increase.

Red Flags:

– Overestimation of regulatory progress and its impact.

– Potential overreliance on AI as a transformative factor.

– Speculative behavior may still overshadow utility-driven growth.

Blind Spots:

– Unforeseen technological challenges or failures.

– Geopolitical tensions affecting regulatory environments.

4. Implications and Strategic Risks

The transition to real utility in the crypto industry could lead to significant shifts in global financial systems, offering new opportunities for economic growth and innovation. However, risks include potential regulatory crackdowns, cybersecurity threats, and the destabilization of traditional financial institutions. The integration of AI and blockchain technologies may also lead to increased centralization of power among tech giants, posing a threat to decentralization principles.

5. Recommendations and Outlook

- Monitor regulatory developments closely to anticipate changes that could impact the crypto market.

- Invest in AI and blockchain technologies to capitalize on emerging trends and innovations.

- Develop contingency plans for potential regulatory or technological disruptions.

- Scenario Projections:

- Best Case: Regulatory clarity and technological advancements drive widespread adoption, integrating crypto into the global financial system.

- Worst Case: Regulatory crackdowns and technological setbacks stall progress, leading to market instability and loss of investor confidence.

- Most Likely: Gradual integration of crypto into traditional finance, with ongoing challenges and opportunities shaping the market landscape.

6. Key Individuals and Entities

– Andreessen Horowitz

– Visa

– Citi

– PayPal

– BlackRock

– JPMorgan

– Morgan Stanley

7. Thematic Tags

national security threats, cybersecurity, financial technology, regulatory developments, economic innovation