Glut Hysteria Clashes with Missing Oil Barrels – OilPrice.com

Published on: 2025-10-23

Intelligence Report: Glut Hysteria Clashes with Missing Oil Barrels – OilPrice.com

1. BLUF (Bottom Line Up Front)

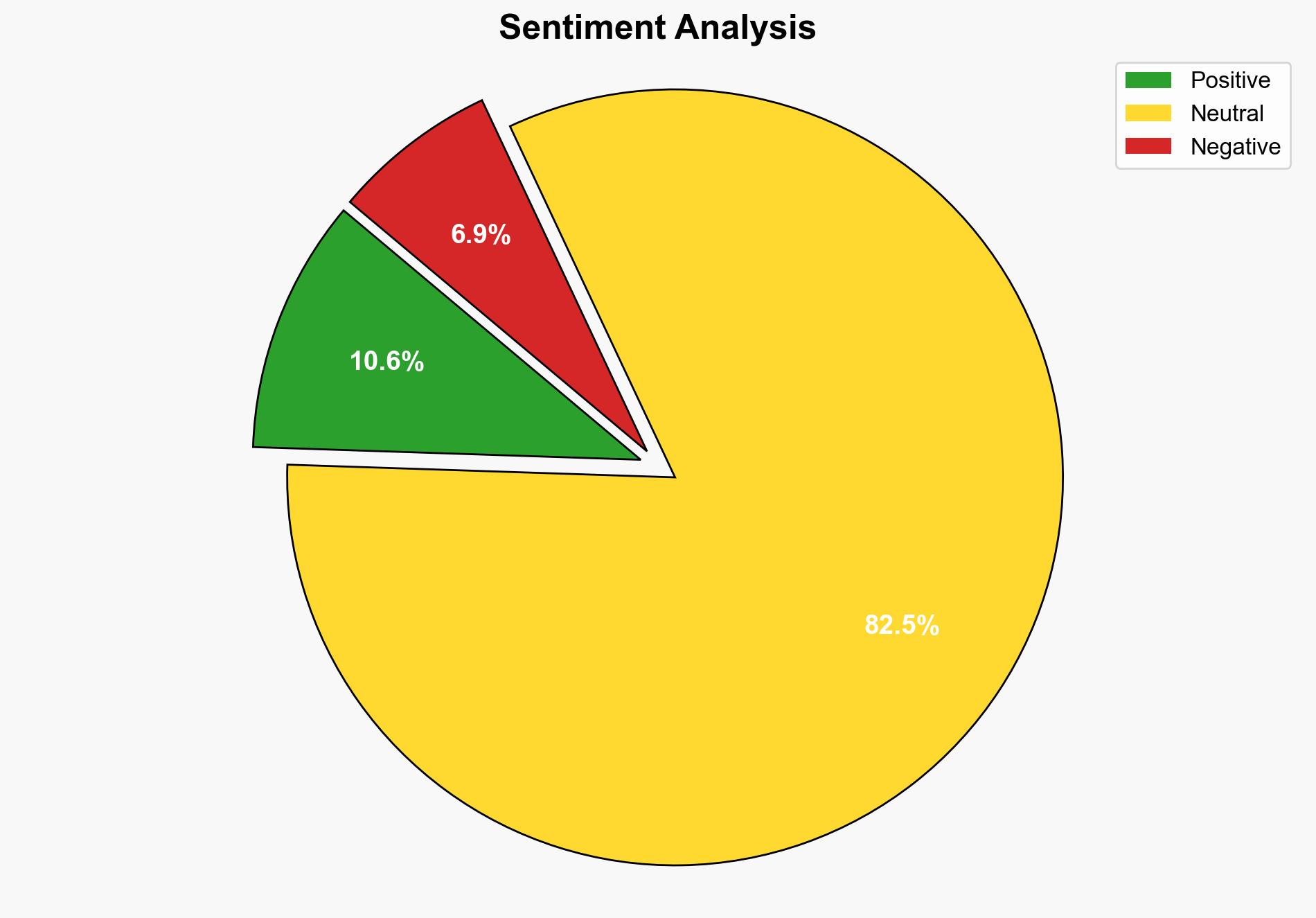

The most supported hypothesis is that the perceived oil glut is exaggerated due to unaccounted barrels and geopolitical factors, leading to market volatility. Confidence Level: Moderate. Recommended action: Monitor geopolitical developments and adjust strategic reserves to mitigate potential supply disruptions.

2. Competing Hypotheses

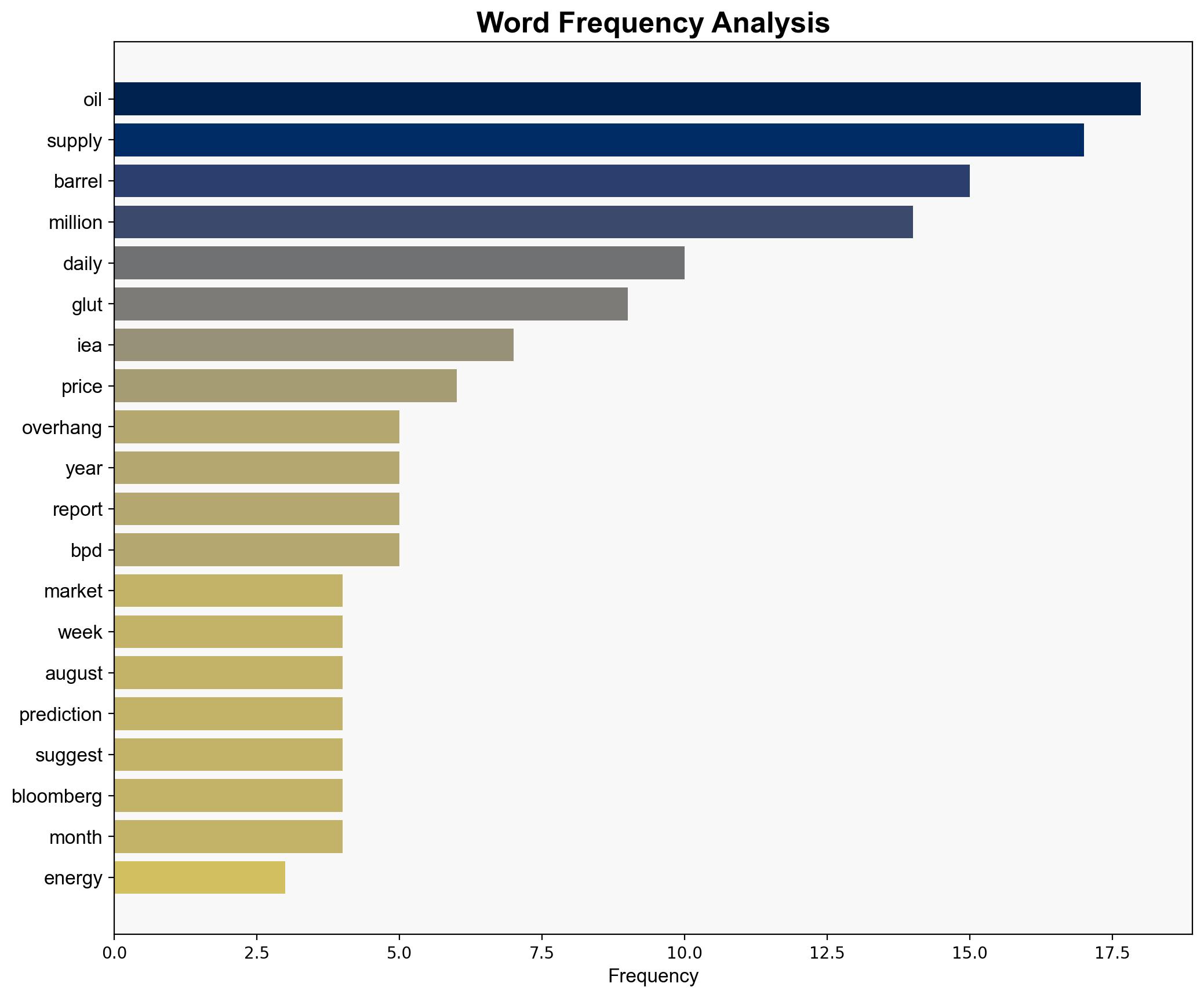

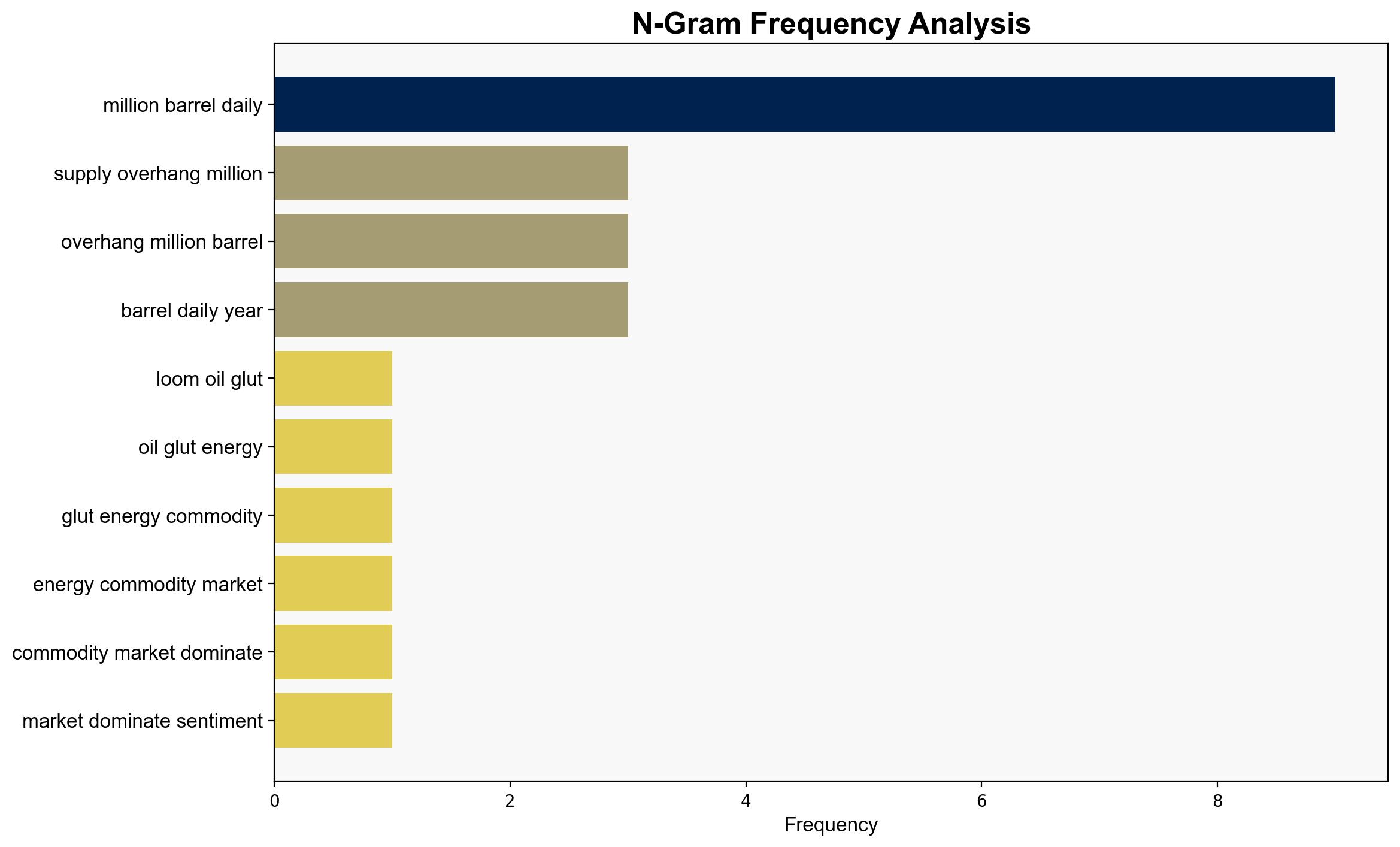

Hypothesis 1: The oil market is genuinely oversupplied, as indicated by multiple reports suggesting a significant surplus of oil, leading to a potential price decline.

Hypothesis 2: The perceived glut is overstated due to unaccounted barrels and geopolitical dynamics, such as sanctions and trade shifts, which are causing market misinterpretations.

Using Analysis of Competing Hypotheses (ACH), Hypothesis 2 is better supported. The presence of unaccounted barrels and geopolitical influences, such as EU sanctions and shifts in Russian oil trade, suggest that the oversupply narrative might be misleading.

3. Key Assumptions and Red Flags

Assumptions:

– Reports accurately reflect global oil supply and demand.

– Geopolitical factors are influencing oil distribution rather than actual supply levels.

Red Flags:

– Discrepancies in reported oil supply figures.

– Potential bias in reports from entities with vested interests in oil price movements.

– Lack of clarity on the destination and purpose of unaccounted barrels.

4. Implications and Strategic Risks

The perception of an oil glut could lead to decreased investment in oil production, impacting long-term supply stability. Geopolitical tensions, particularly involving Russia and China, could exacerbate supply chain disruptions. Economic implications include potential price volatility affecting global markets. Psychological impacts might include reduced confidence in market forecasts.

5. Recommendations and Outlook

- Enhance monitoring of geopolitical developments and their impact on oil supply chains.

- Consider strategic reserve adjustments to buffer against potential supply disruptions.

- Scenario Projections:

- Best Case: Geopolitical tensions ease, leading to stabilized oil markets.

- Worst Case: Escalation of geopolitical conflicts results in significant supply disruptions.

- Most Likely: Continued market volatility due to ongoing geopolitical uncertainties.

6. Key Individuals and Entities

– Ron Bousso (Reuters)

– Ben Luckock (Trafigura)

– Giovanni Staunovo (UBS)

– Rory Johnston (Commodity Context)

7. Thematic Tags

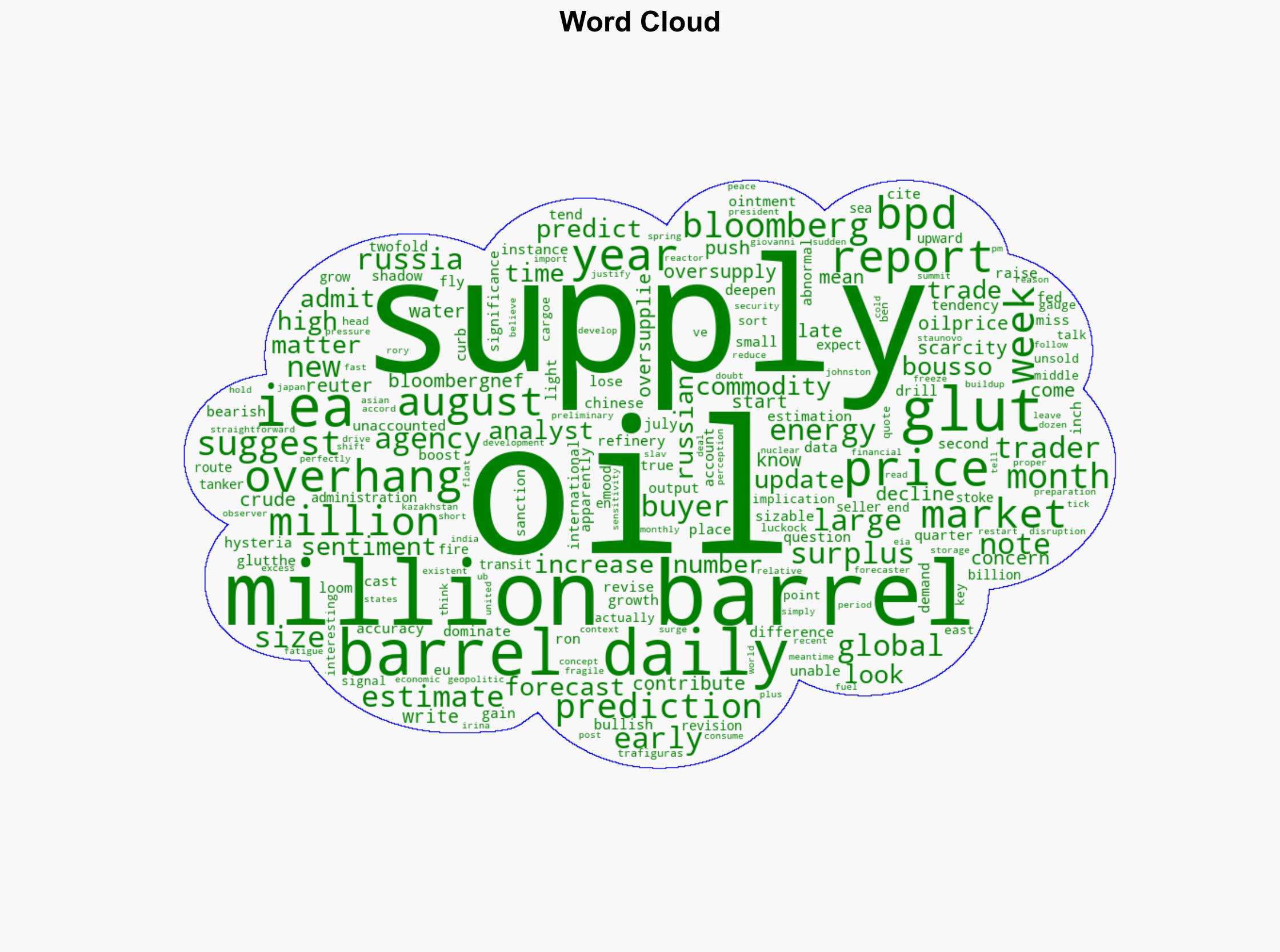

national security threats, energy security, geopolitical dynamics, market volatility