IBM’s slowing cloud growth eclipses upbeat third-quarter results – The Times of India

Published on: 2025-10-23

Intelligence Report: IBM’s slowing cloud growth eclipses upbeat third-quarter results – The Times of India

1. BLUF (Bottom Line Up Front)

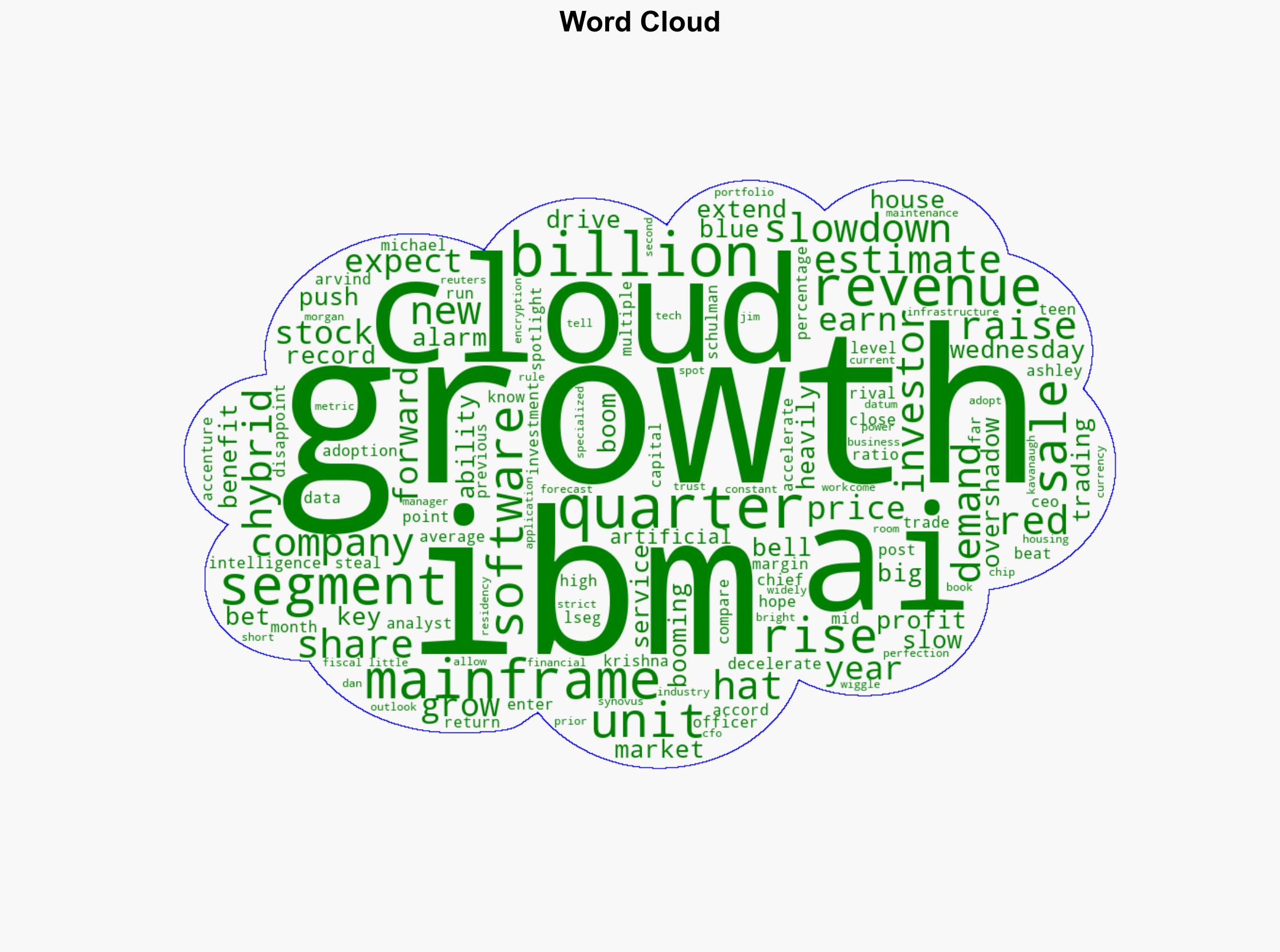

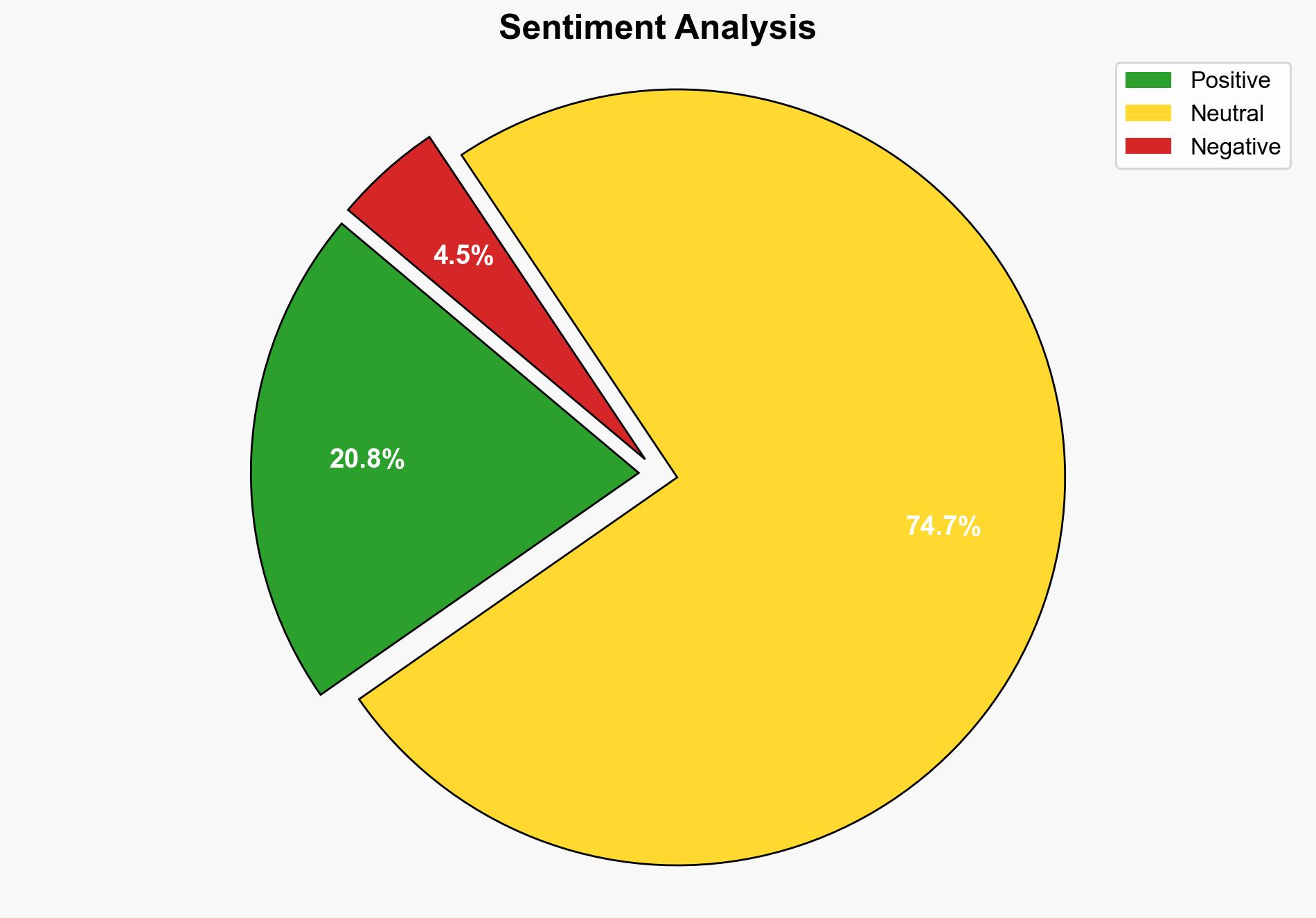

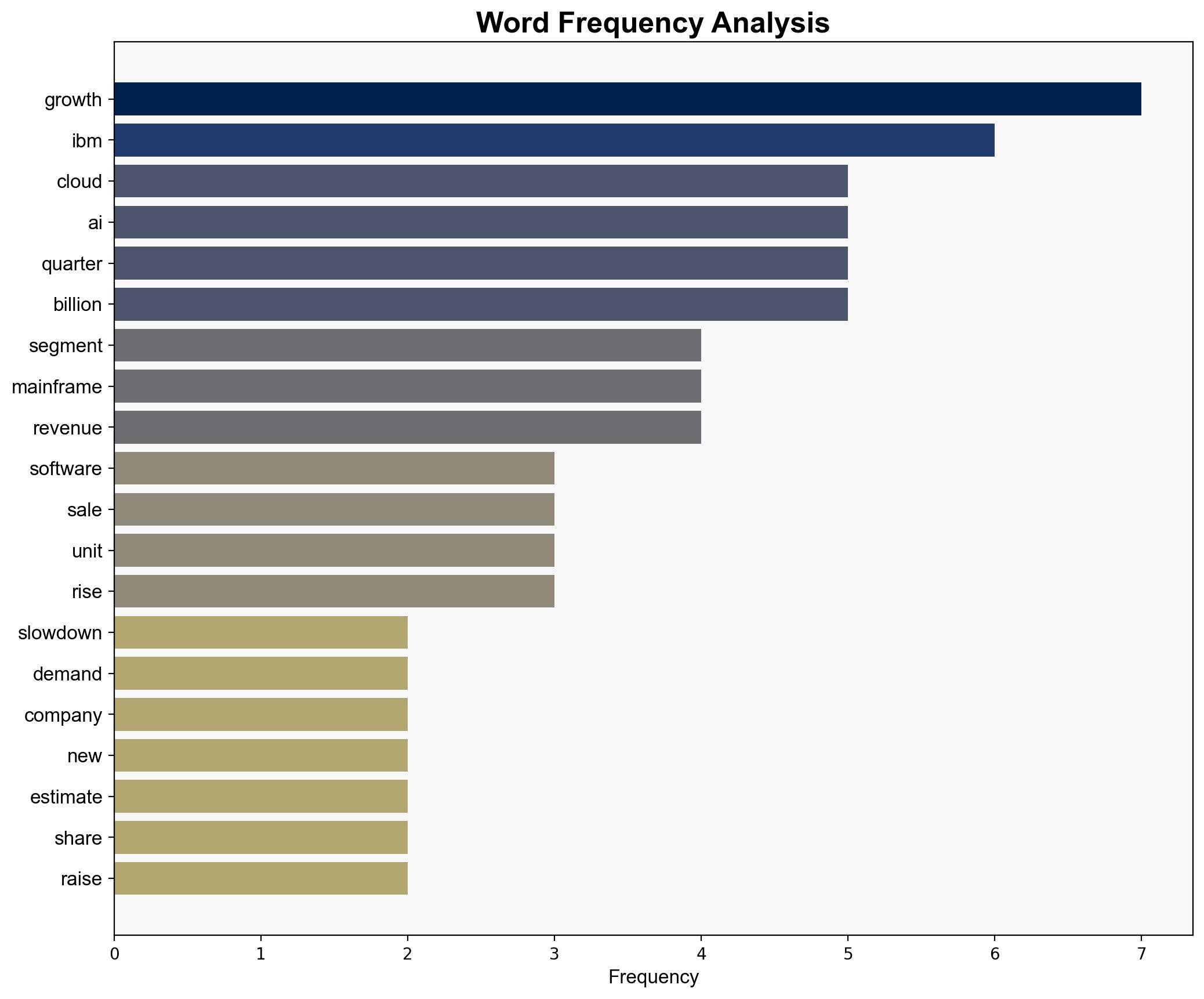

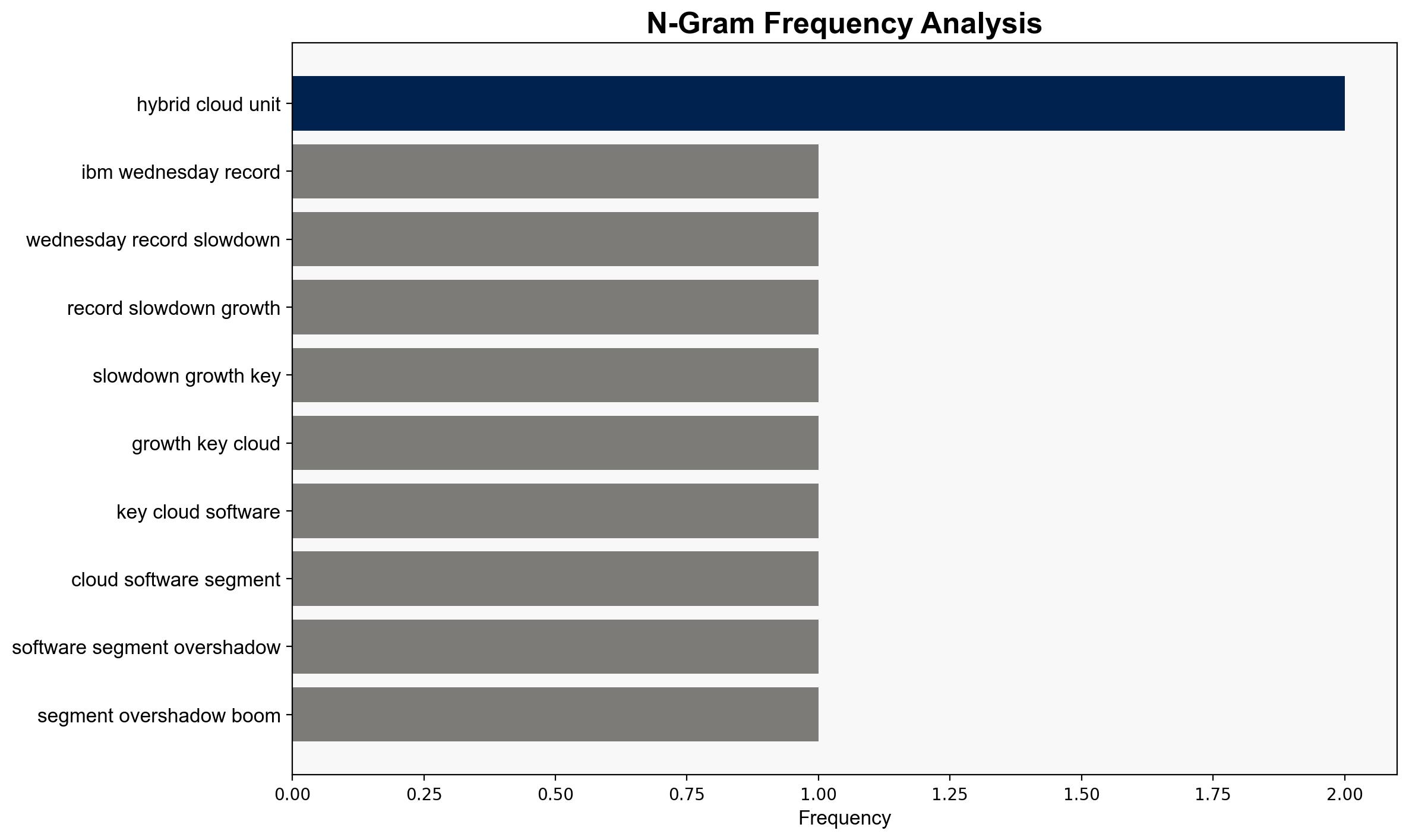

IBM’s recent financial results reveal a complex picture where slowing growth in its cloud segment, particularly the hybrid cloud unit, overshadows positive developments in AI and mainframe sales. The most supported hypothesis suggests that IBM’s strategic pivot towards AI and mainframe technology may compensate for the cloud segment’s deceleration. Confidence level: Moderate. Recommended action: IBM should intensify its focus on AI and mainframe innovations while addressing cloud segment challenges to maintain investor confidence.

2. Competing Hypotheses

Hypothesis 1: IBM’s slowing cloud growth is a temporary setback, and the company will recover by leveraging its strengths in AI and mainframe technologies.

– **Supporting Evidence:** Strong AI and mainframe sales; new mainframe with AI capabilities; raised revenue outlook.

Hypothesis 2: The slowdown in IBM’s cloud segment indicates a deeper structural issue that could undermine long-term growth prospects.

– **Supporting Evidence:** Continued deceleration in hybrid cloud growth; investor concerns over cloud performance; IBM’s reliance on cloud growth for future success.

Using ACH 2.0, Hypothesis 1 is better supported due to IBM’s proactive measures and positive performance in other segments, suggesting resilience despite cloud challenges.

3. Key Assumptions and Red Flags

– **Assumptions:**

– IBM’s AI and mainframe segments will continue to grow and offset cloud segment weaknesses.

– The cloud market slowdown is not indicative of a broader industry trend.

– **Red Flags:**

– Persistent underperformance in the cloud segment despite market growth.

– Heavy reliance on AI and mainframe sales could be risky if these markets face downturns.

– **Blind Spots:**

– Potential overestimation of AI and mainframe market size and growth rate.

– Lack of detailed competitive analysis on cloud segment performance.

4. Implications and Strategic Risks

– **Economic Implications:** IBM’s financial health could be at risk if cloud growth does not rebound, affecting stock prices and investor confidence.

– **Strategic Risks:** Over-reliance on AI and mainframe segments could expose IBM to vulnerabilities if these markets contract or face increased competition.

– **Cascading Threats:** A prolonged cloud segment slowdown may lead to reduced R&D investment, impacting innovation and competitive edge.

5. Recommendations and Outlook

- IBM should enhance its cloud offerings and address any structural issues to regain growth momentum.

- Invest in AI and mainframe technologies to capitalize on current strengths and emerging market demands.

- Scenario Projections:

- Best Case: Cloud growth rebounds, AI and mainframe sales continue to rise, leading to strong overall performance.

- Worst Case: Cloud segment continues to falter, AI and mainframe markets stagnate, resulting in financial strain.

- Most Likely: Moderate recovery in cloud growth, sustained AI and mainframe sales, maintaining steady performance.

6. Key Individuals and Entities

– Arvind Krishna

– Michael Ashley Schulman

– Dan Morgan

– Jim Kavanaugh

7. Thematic Tags

corporate strategy, technology innovation, market analysis, financial performance