Crude Spikes As Trump Threatens Russian Giants Stocks Turn Lower – International Business Times

Published on: 2025-10-23

Intelligence Report: Crude Spikes As Trump Threatens Russian Giants Stocks Turn Lower – International Business Times

1. BLUF (Bottom Line Up Front)

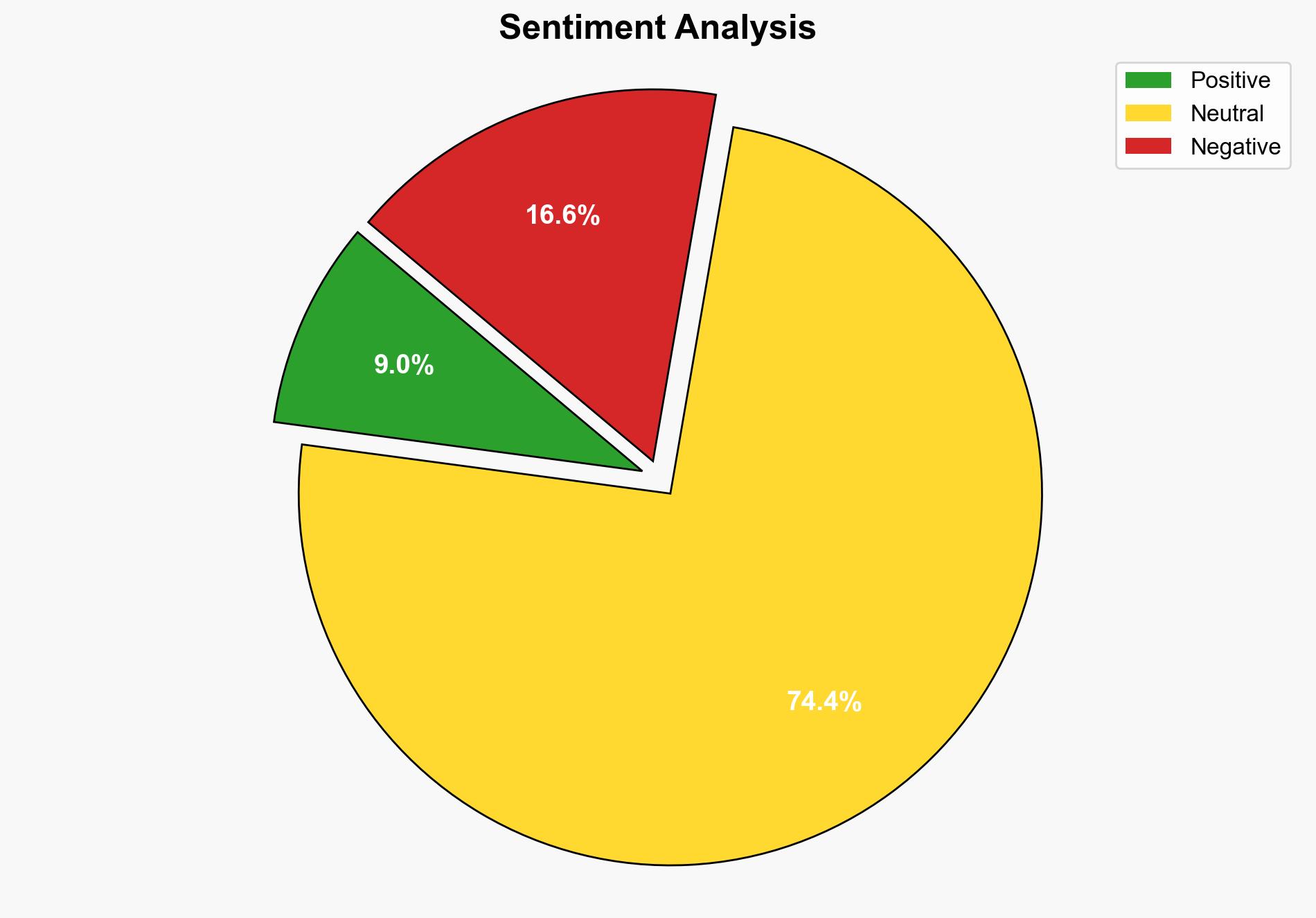

The most supported hypothesis is that the threat of sanctions against Russian oil companies by Donald Trump is primarily a strategic maneuver to exert pressure on Russia regarding its actions in Ukraine, with secondary effects on global markets. Confidence in this hypothesis is moderate due to the complex interplay of geopolitical and economic factors. Recommended action includes monitoring the situation closely for further developments in U.S.-Russia relations and potential retaliatory measures from Russia or China.

2. Competing Hypotheses

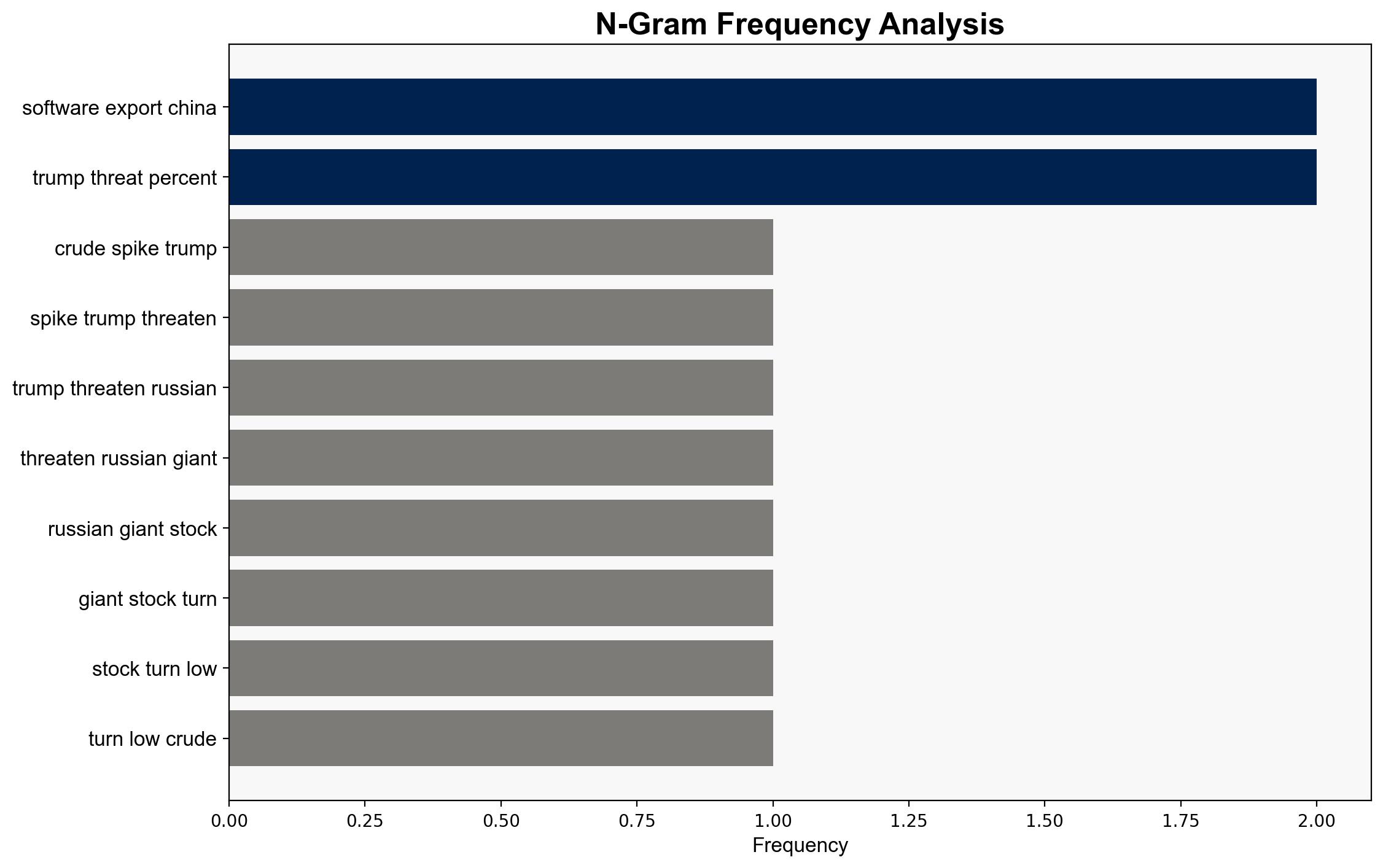

1. **Hypothesis A**: The sanctions threat is a calculated geopolitical strategy by Trump to pressure Russia into compliance with international norms regarding Ukraine, with the oil market impact being a secondary consideration.

2. **Hypothesis B**: The sanctions threat is primarily an economic strategy aimed at disrupting Russian oil companies to benefit U.S. oil interests, with geopolitical considerations being secondary.

Using ACH 2.0, Hypothesis A is better supported as the primary driver due to the alignment of sanctions with ongoing geopolitical tensions and the historical context of U.S. foreign policy towards Russia. Hypothesis B is less supported as it lacks direct evidence of economic gain as a primary motive.

3. Key Assumptions and Red Flags

– **Assumptions**: It is assumed that the sanctions will effectively pressure Russia without significant backlash. There is also an assumption that the U.S. administration’s actions are primarily driven by geopolitical rather than economic motives.

– **Red Flags**: The potential for Russia to retaliate economically or militarily is a significant risk. Additionally, the lack of clear communication from the U.S. administration on the primary objectives of the sanctions introduces uncertainty.

4. Implications and Strategic Risks

The sanctions could lead to increased geopolitical tensions, potentially escalating into broader economic conflicts involving key global players like China. The impact on global oil markets could destabilize economies reliant on oil imports. There is also a risk of retaliatory cyber actions from Russia, targeting U.S. infrastructure or allies.

5. Recommendations and Outlook

- Maintain diplomatic channels with Russia to mitigate escalation risks.

- Prepare for potential cyber threats by enhancing cybersecurity measures.

- Scenario Projections:

- **Best Case**: Russia complies with international demands, leading to a de-escalation of tensions.

- **Worst Case**: Escalation into a broader economic or military conflict.

- **Most Likely**: Continued geopolitical tension with periodic market disruptions.

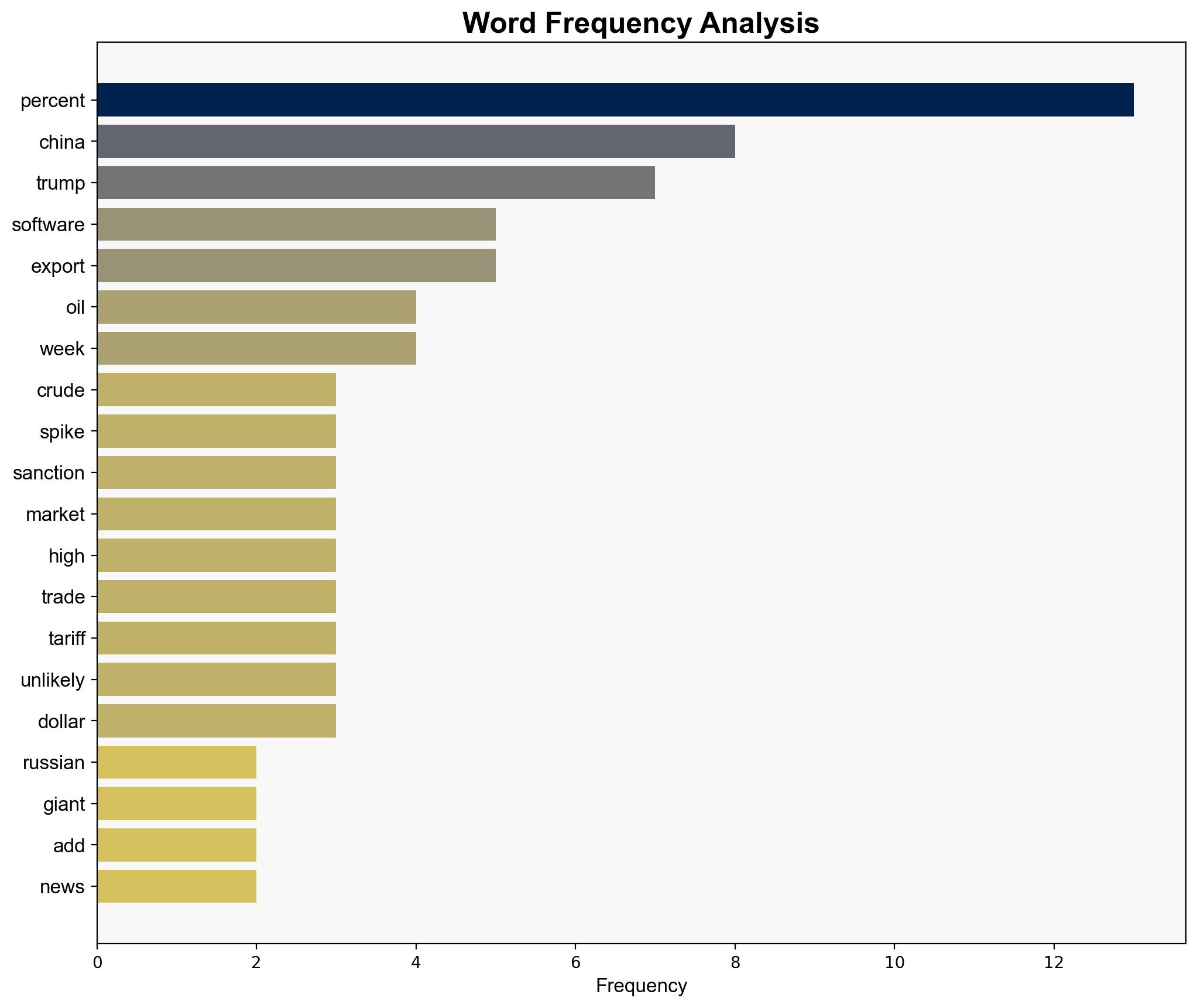

6. Key Individuals and Entities

– Donald Trump

– Vladimir Putin

– Rosneft

– Lukoil

7. Thematic Tags

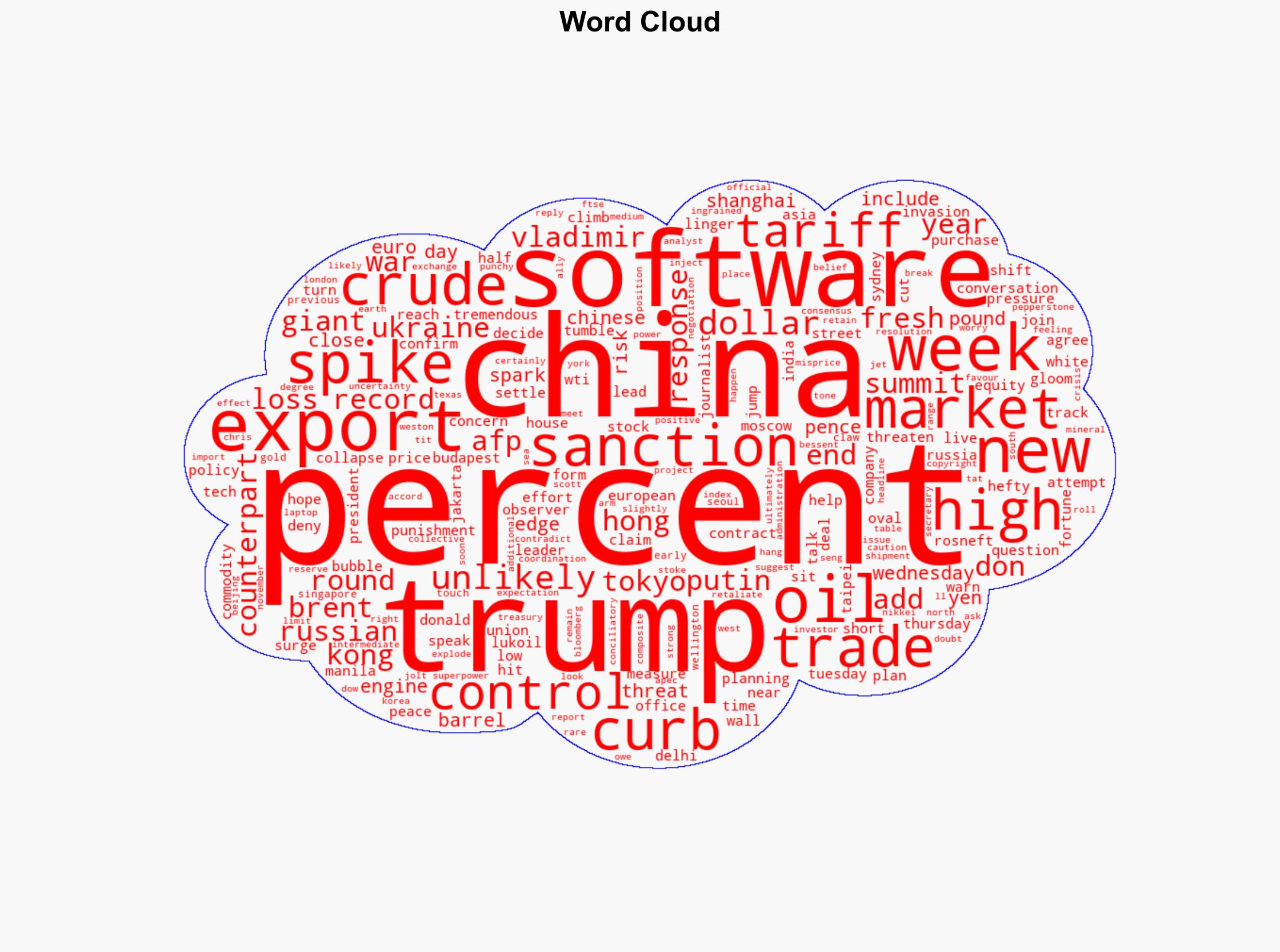

national security threats, economic sanctions, geopolitical strategy, energy markets