Japan’s century-old Fujikura rides AI data centre boom to become Nikkei standout – CNA

Published on: 2025-10-24

Intelligence Report: Japan’s century-old Fujikura rides AI data centre boom to become Nikkei standout – CNA

1. BLUF (Bottom Line Up Front)

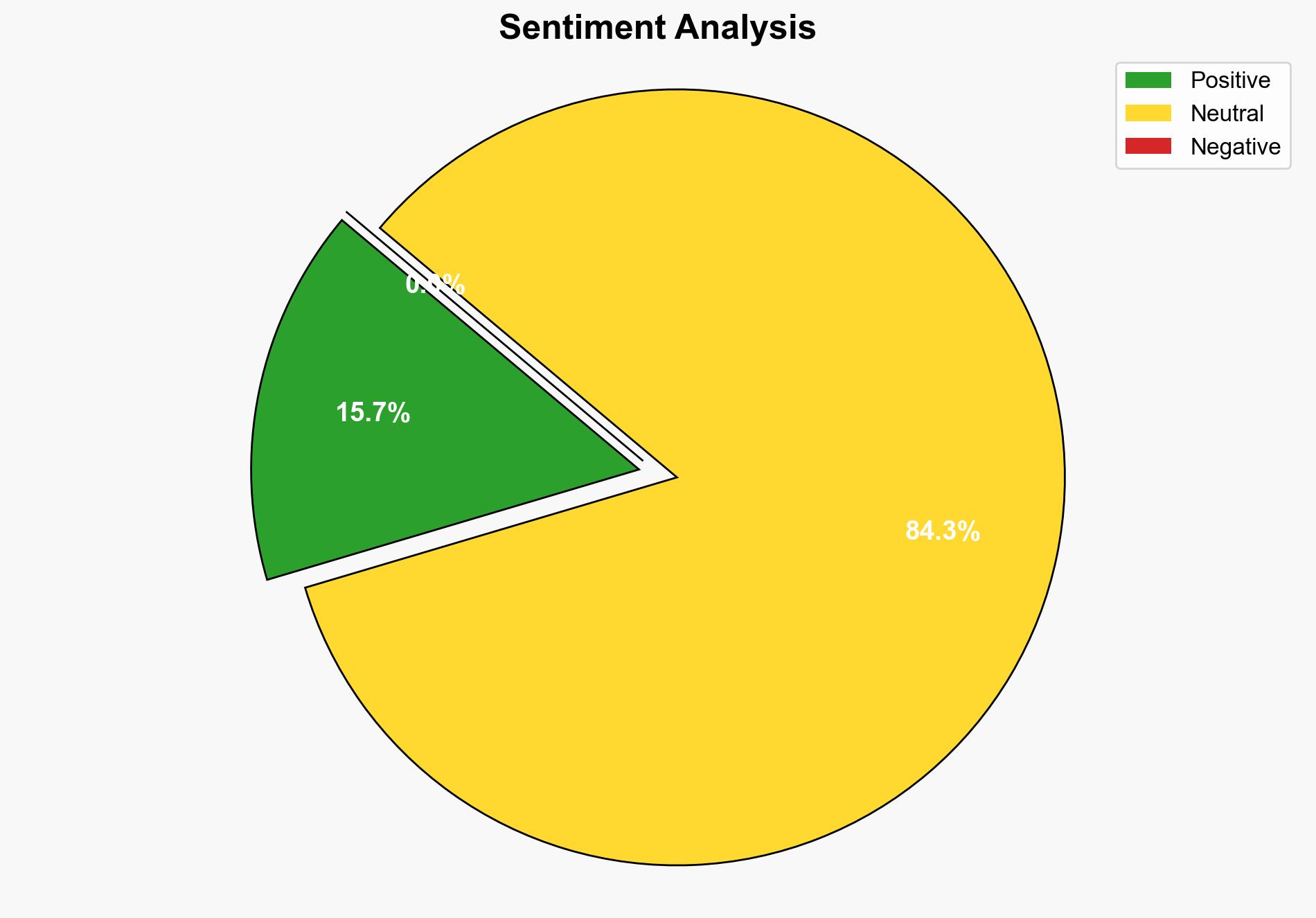

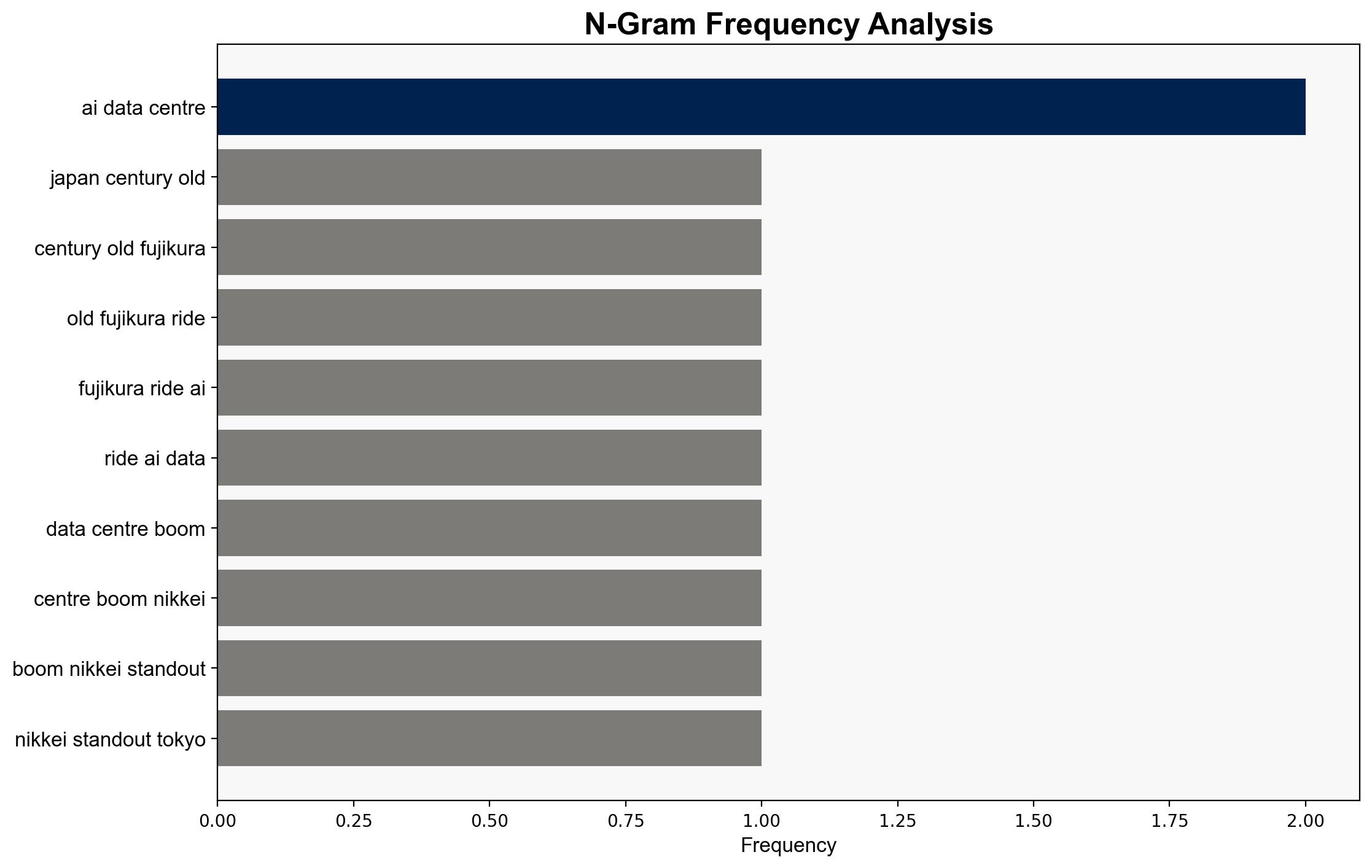

Fujikura’s significant rise in market value is primarily driven by its strategic positioning within the AI data center supply chain, particularly in optical fiber production. The most supported hypothesis is that Fujikura’s growth is sustainable due to increasing global demand for AI infrastructure. Confidence level: Moderate. Recommended action: Monitor Fujikura’s production capacity expansions and partnerships to assess long-term viability.

2. Competing Hypotheses

Hypothesis 1: Fujikura’s market surge is sustainable, driven by long-term global demand for AI data centers and its strategic role in the supply chain.

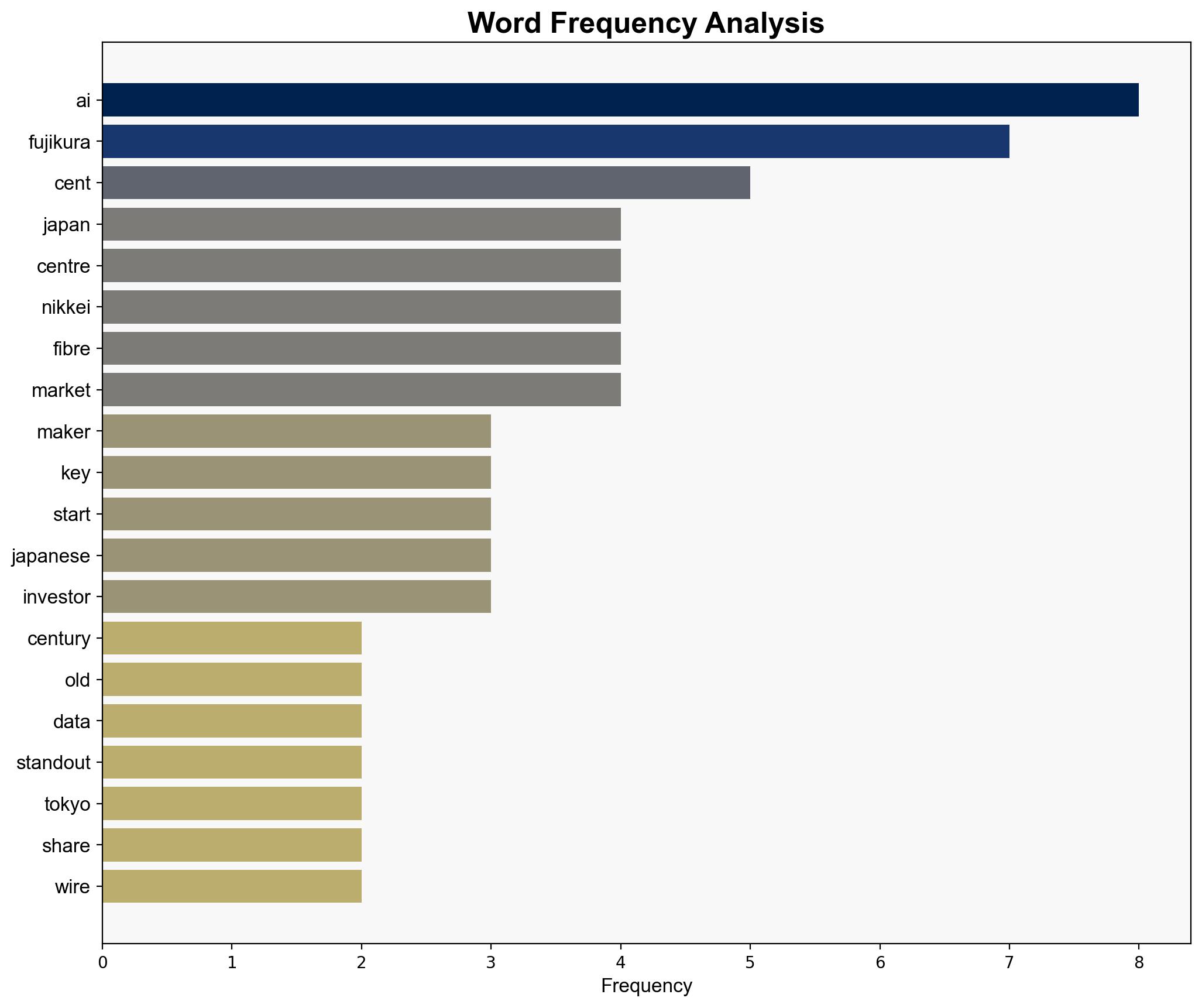

– Supported by Fujikura’s expansion in optical fiber production and increased investments in AI infrastructure.

Hypothesis 2: Fujikura’s market performance is a short-term phenomenon, primarily influenced by speculative investment and market euphoria around AI.

– Supported by the rapid rise in share price outpacing the Nikkei average, suggesting potential overvaluation.

3. Key Assumptions and Red Flags

– Assumption: Global demand for AI infrastructure will continue to grow at the current rate.

– Red Flag: The rapid increase in Fujikura’s share price could indicate speculative investment rather than fundamental growth.

– Blind Spot: Potential geopolitical tensions affecting global supply chains are not addressed.

4. Implications and Strategic Risks

– Economic: Sustained growth in AI infrastructure could bolster Fujikura’s financial stability, but reliance on global markets poses risks.

– Geopolitical: Trade tensions or regulatory changes could disrupt supply chains.

– Cyber: Increased focus on AI infrastructure may attract cyber threats targeting Fujikura’s operations.

5. Recommendations and Outlook

- Monitor Fujikura’s expansion efforts and partnerships to evaluate long-term growth potential.

- Scenario Projections:

- Best Case: Fujikura solidifies its position as a leading supplier, benefiting from sustained AI infrastructure investment.

- Worst Case: Market correction leads to a significant drop in share value due to overvaluation.

- Most Likely: Moderate growth as Fujikura capitalizes on AI infrastructure demand while navigating market volatility.

6. Key Individuals and Entities

– Sanae Takaichi

– Kazuaki Shimada

– Companies: Fujikura, Daikin, Komatsu, Nvidia, Amazon, Microsoft, Alphabet

7. Thematic Tags

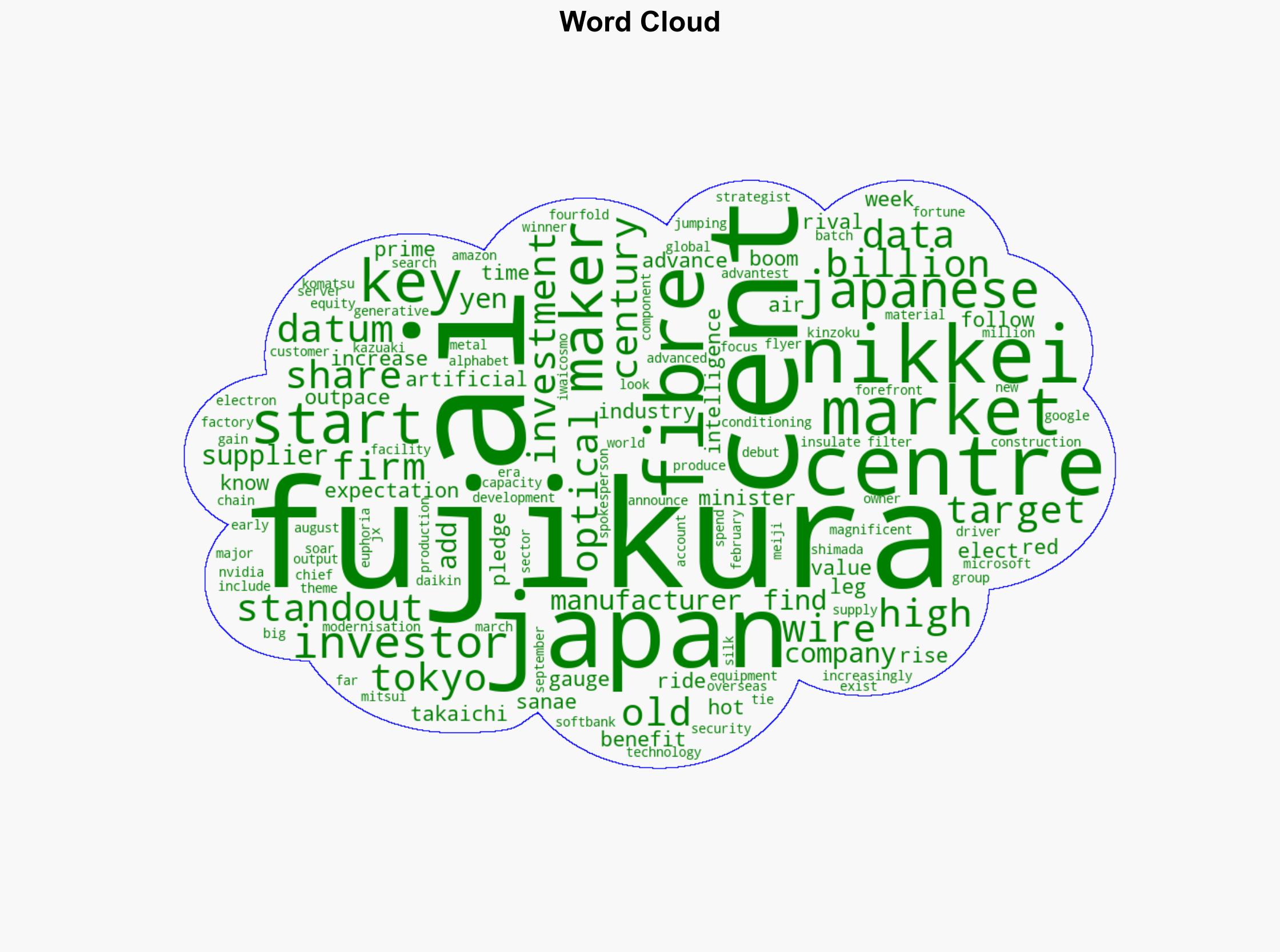

economic trends, AI infrastructure, market analysis, supply chain dynamics