Oil prices dip after surge remain on track for weekly gain amid supply fears – CNA

Published on: 2025-10-24

Intelligence Report: Oil prices dip after surge remain on track for weekly gain amid supply fears – CNA

1. BLUF (Bottom Line Up Front)

The most supported hypothesis is that oil prices are experiencing volatility due to geopolitical tensions and market reactions to sanctions on Russia. This is supported by evidence of sanctions impacting Russian oil exports and market responses to potential supply disruptions. Confidence level: Moderate. Recommended action: Monitor geopolitical developments and market responses closely to anticipate further price fluctuations.

2. Competing Hypotheses

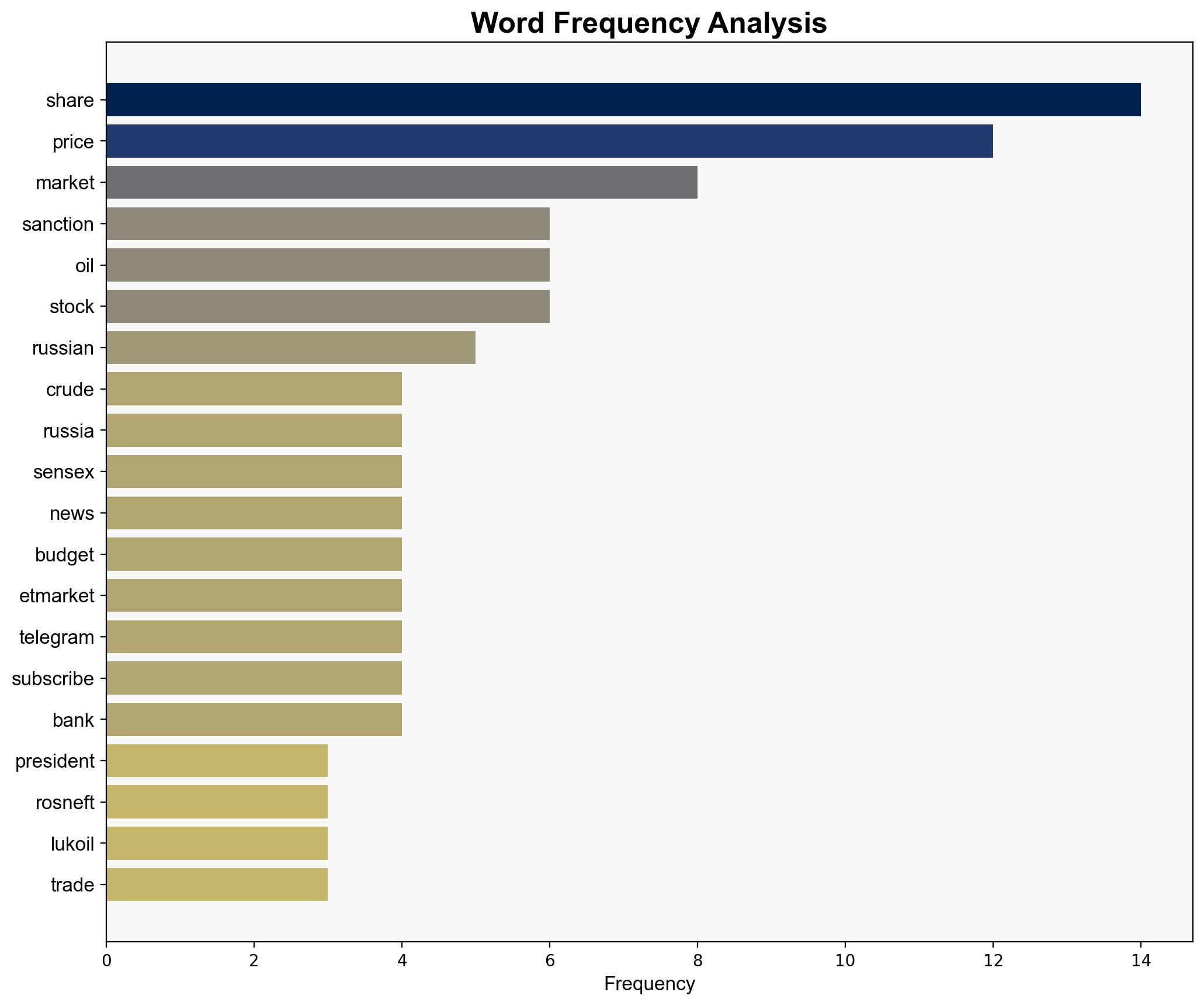

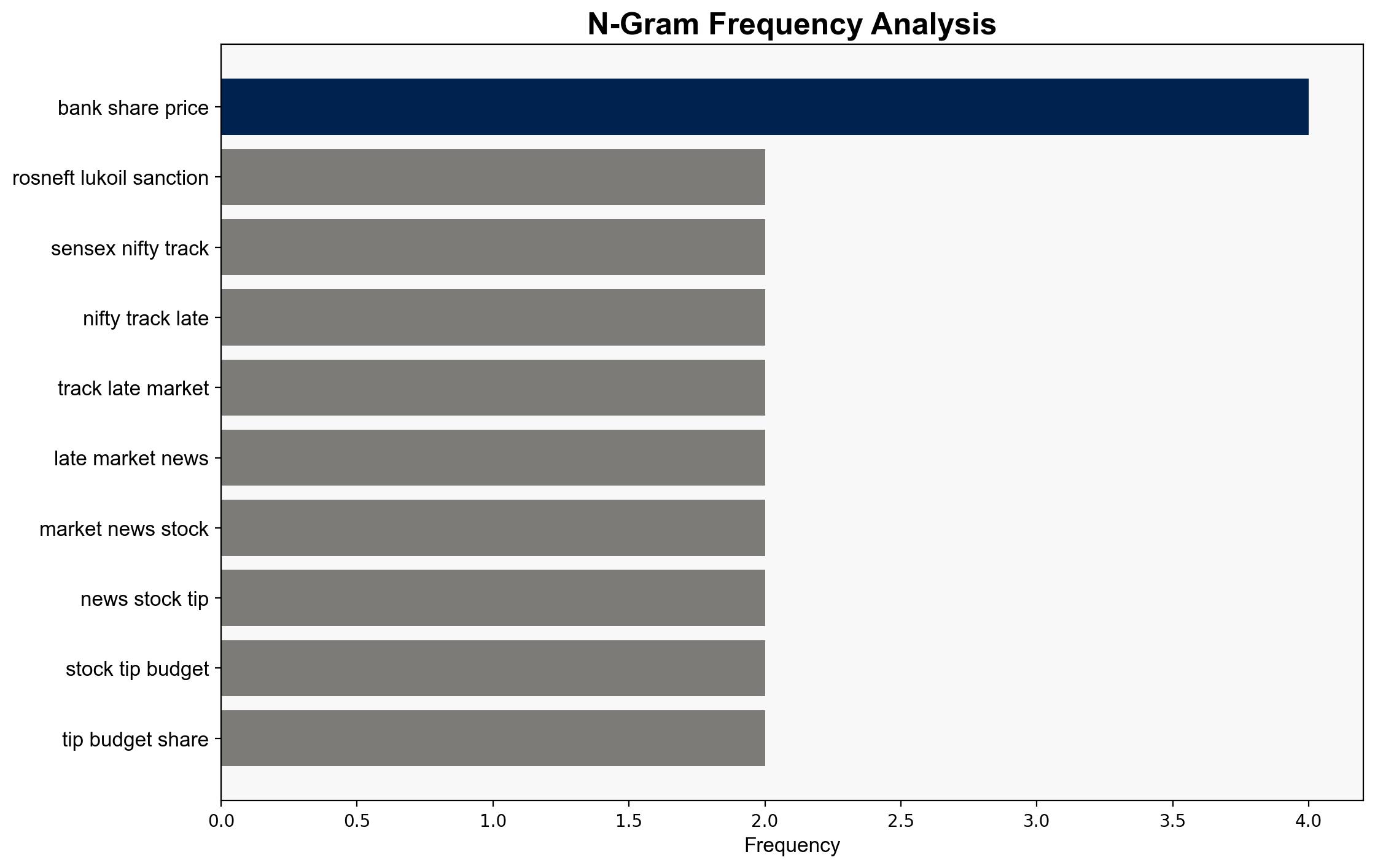

1. **Hypothesis A**: The dip in oil prices is primarily driven by geopolitical tensions, particularly sanctions on Russian oil companies, which create supply fears and market volatility.

2. **Hypothesis B**: The dip in oil prices is a temporary market correction following a speculative surge, with underlying supply-demand dynamics remaining stable.

Using ACH 2.0, Hypothesis A is better supported due to the direct correlation between sanctions and market reactions, as well as the involvement of key global players like China and India in adjusting their import strategies.

3. Key Assumptions and Red Flags

– **Assumptions**:

– Sanctions will continue to impact Russian oil exports significantly.

– OPEC’s spare capacity is limited and cannot fully offset potential shortages.

– **Red Flags**:

– Lack of detailed data on OPEC’s actual spare capacity.

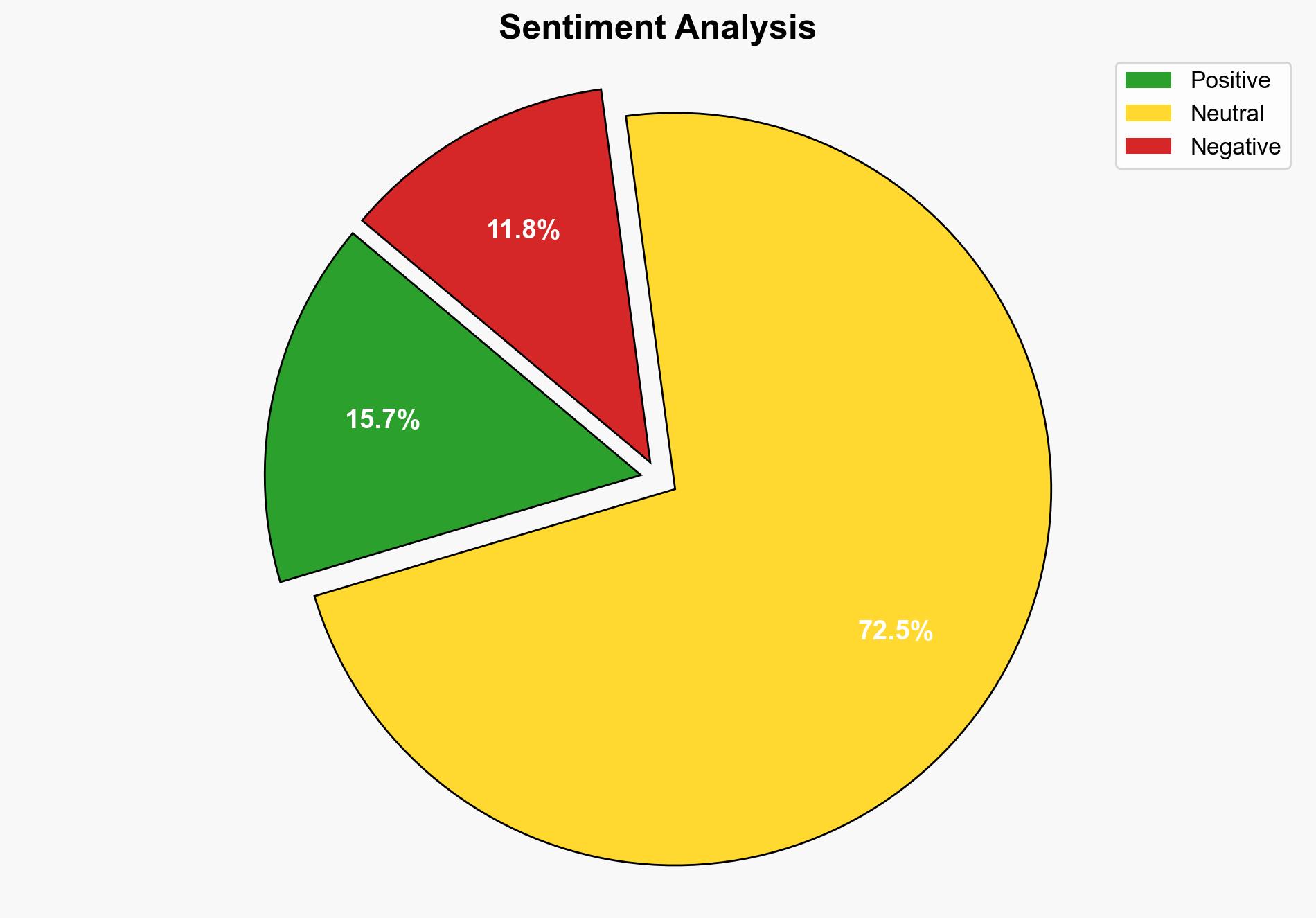

– Potential bias in market reactions influenced by speculative trading.

4. Implications and Strategic Risks

– **Economic**: Prolonged volatility in oil prices could lead to increased costs for energy-dependent industries and impact global economic stability.

– **Geopolitical**: Escalating tensions between Russia and Western countries could lead to further sanctions and countermeasures, affecting global oil supply chains.

– **Psychological**: Market uncertainty may lead to decreased investor confidence and increased volatility in related financial markets.

5. Recommendations and Outlook

- Monitor geopolitical developments closely, particularly any changes in sanctions or diplomatic relations involving Russia.

- Engage with OPEC and other oil-producing nations to assess actual spare capacity and potential for increased production.

- Scenario-based projections:

- Best Case: Diplomatic resolutions ease tensions, stabilizing oil prices.

- Worst Case: Escalation of sanctions leads to significant supply disruptions and sharp price increases.

- Most Likely: Continued volatility with periodic price corrections as markets react to geopolitical developments.

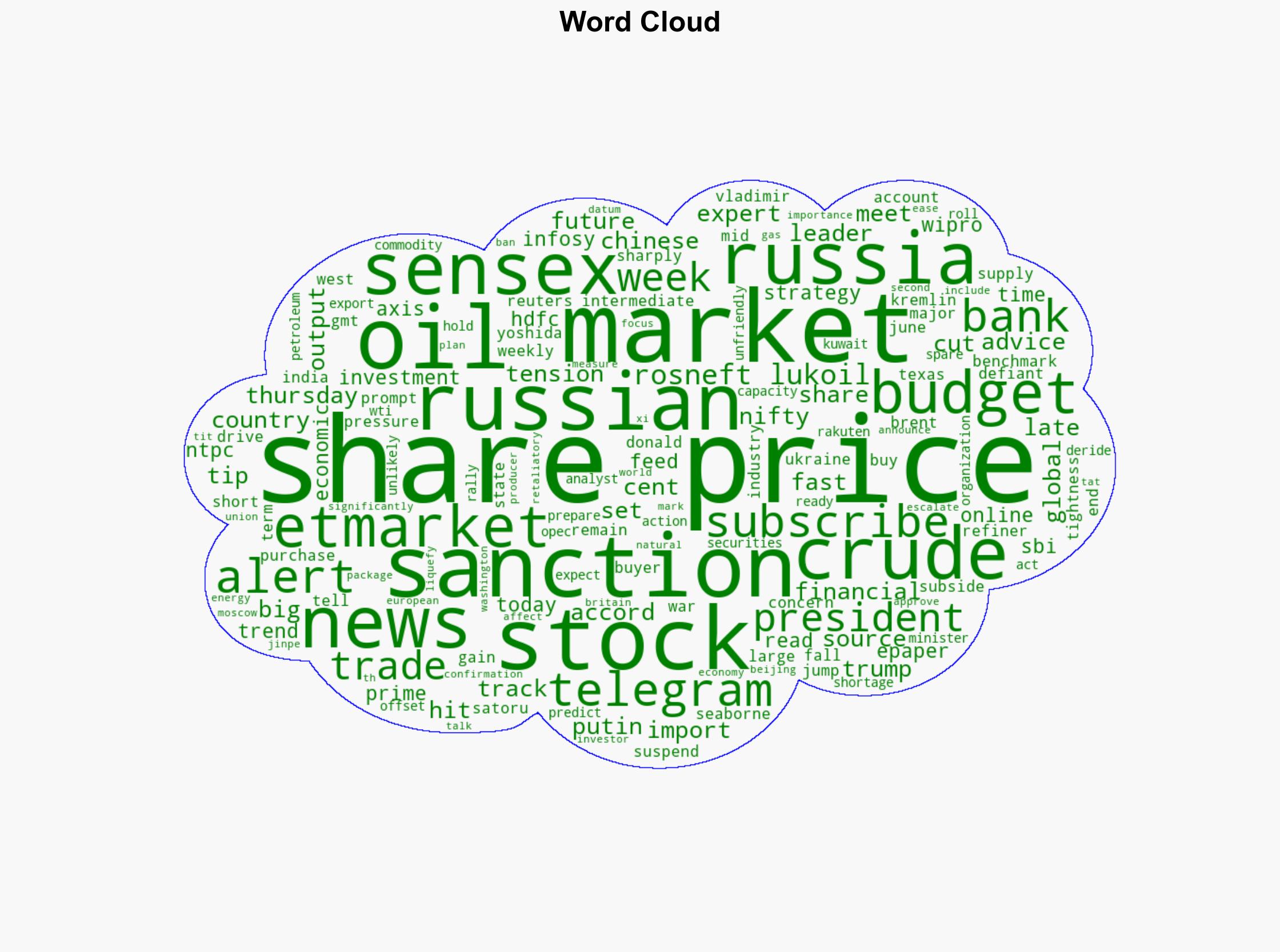

6. Key Individuals and Entities

– Vladimir Putin

– Donald Trump

– Xi Jinping

– Rosneft

– Lukoil

– OPEC

7. Thematic Tags

national security threats, geopolitical tensions, energy security, market volatility