US Abu Dhabi governments to invest 18 billion with Orion into critical minerals – The Times of India

Published on: 2025-10-24

Intelligence Report: US Abu Dhabi governments to invest 18 billion with Orion into critical minerals – The Times of India

1. BLUF (Bottom Line Up Front)

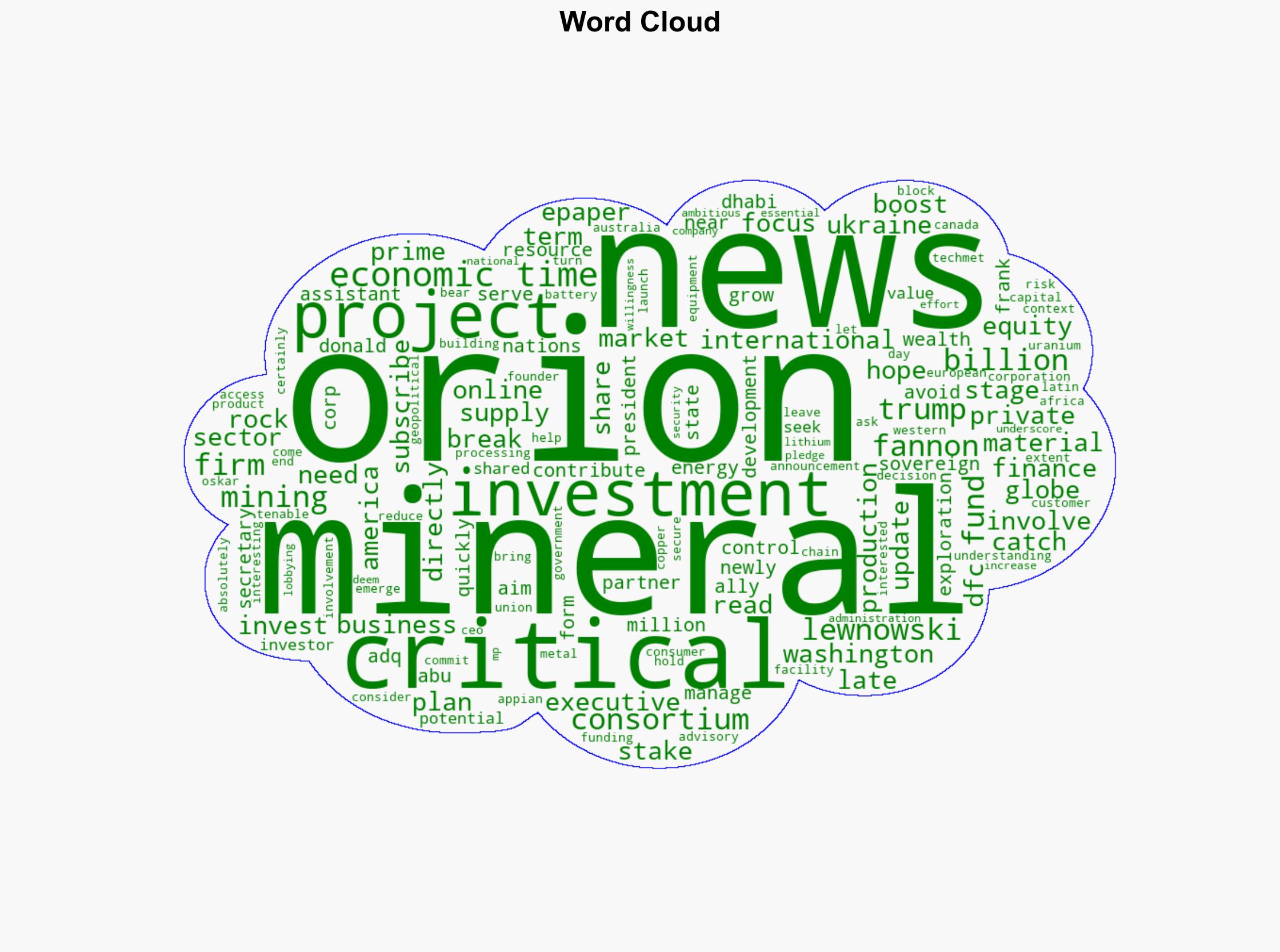

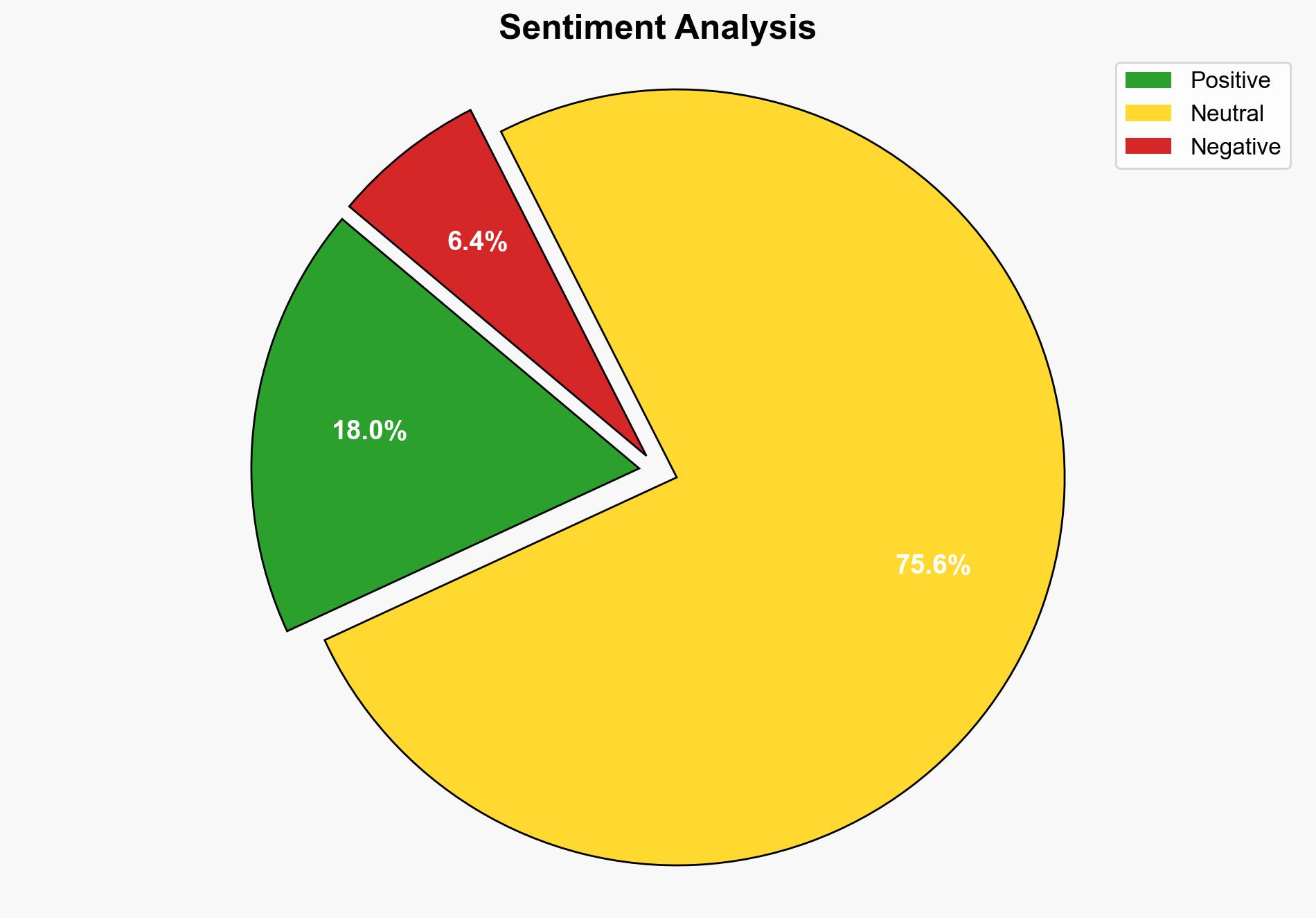

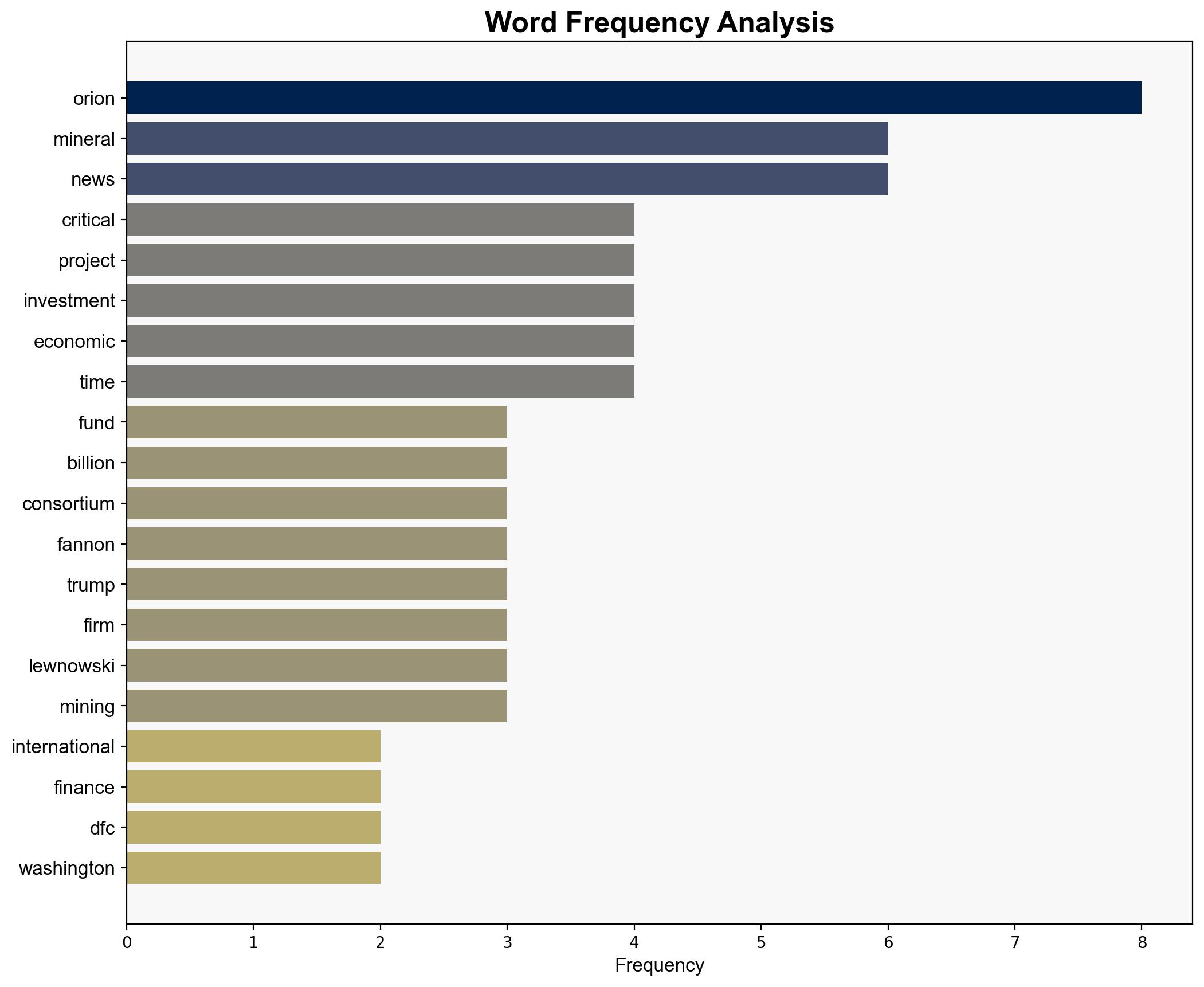

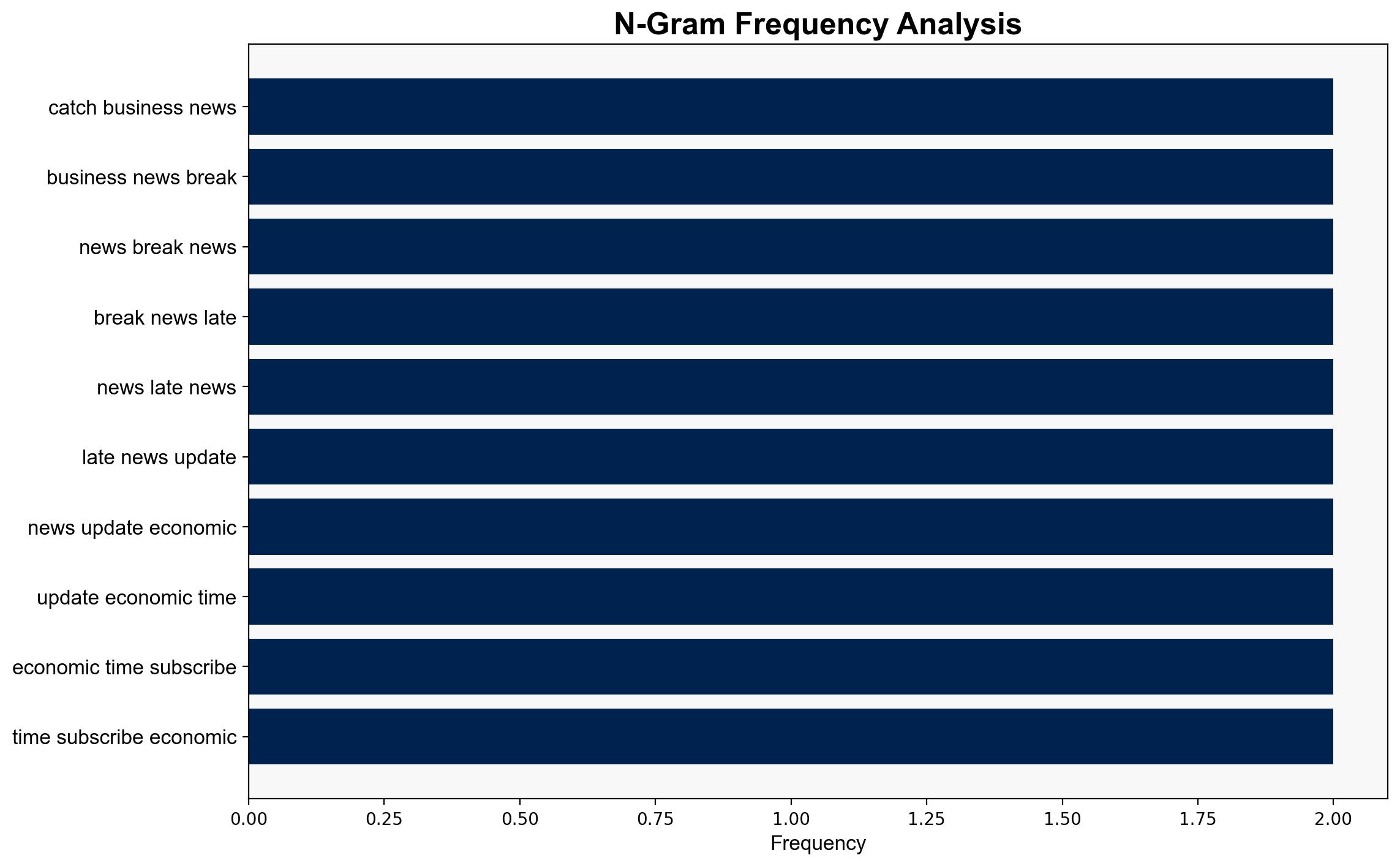

The strategic partnership between the US, Abu Dhabi, and Orion to invest $18 billion in critical minerals is primarily aimed at securing supply chains for essential minerals, reducing geopolitical risks, and enhancing Western access to these resources. The most supported hypothesis is that this investment is a strategic move to counterbalance China’s dominance in the critical minerals market. Confidence level: Moderate. Recommended action: Monitor the implementation of this investment and assess its impact on global mineral supply chains and geopolitical alignments.

2. Competing Hypotheses

Hypothesis 1: The investment is primarily driven by economic interests to capitalize on the growing demand for critical minerals used in technology and renewable energy sectors. This hypothesis suggests that the primary goal is financial return and market positioning.

Hypothesis 2: The investment is strategically motivated to reduce dependency on Chinese mineral supplies and to strengthen geopolitical alliances with key Western and allied nations. This hypothesis posits that the investment is a geopolitical maneuver to enhance national security and economic resilience.

3. Key Assumptions and Red Flags

Assumptions:

– The demand for critical minerals will continue to rise, driven by technological and renewable energy advancements.

– The US and Abu Dhabi have aligned interests in reducing dependency on Chinese mineral supplies.

Red Flags:

– Lack of detailed information on specific projects and timelines.

– Potential overestimation of the ability to quickly bring projects to production.

– Possible underestimation of geopolitical tensions arising from this investment.

4. Implications and Strategic Risks

The investment could lead to a shift in global mineral supply dynamics, potentially reducing China’s influence. However, it may also escalate geopolitical tensions, particularly if perceived as a direct challenge to Chinese economic interests. Economically, the success of this initiative depends on the timely execution of projects and the stability of involved regions. Cybersecurity risks may arise from increased digital integration in mining operations.

5. Recommendations and Outlook

- Monitor geopolitical responses, particularly from China, to anticipate potential retaliatory measures.

- Ensure robust cybersecurity measures are in place for the digital infrastructure supporting these projects.

- Scenario Projections:

- Best Case: Successful diversification of mineral supply chains, reducing dependency on China.

- Worst Case: Geopolitical tensions escalate, leading to trade conflicts and supply chain disruptions.

- Most Likely: Gradual progress in project implementation with moderate geopolitical friction.

6. Key Individuals and Entities

– Frank Fannon

– Oskar Lewnowski

– Orion Resource Partners

– Abu Dhabi Sovereign Wealth Fund (ADQ)

7. Thematic Tags

national security threats, economic strategy, geopolitical dynamics, mineral supply chains