Indias Reliance Snaps Up Middle East Oil After Russia Sanctions – Financial Post

Published on: 2025-10-24

Intelligence Report: Indias Reliance Snaps Up Middle East Oil After Russia Sanctions – Financial Post

1. BLUF (Bottom Line Up Front)

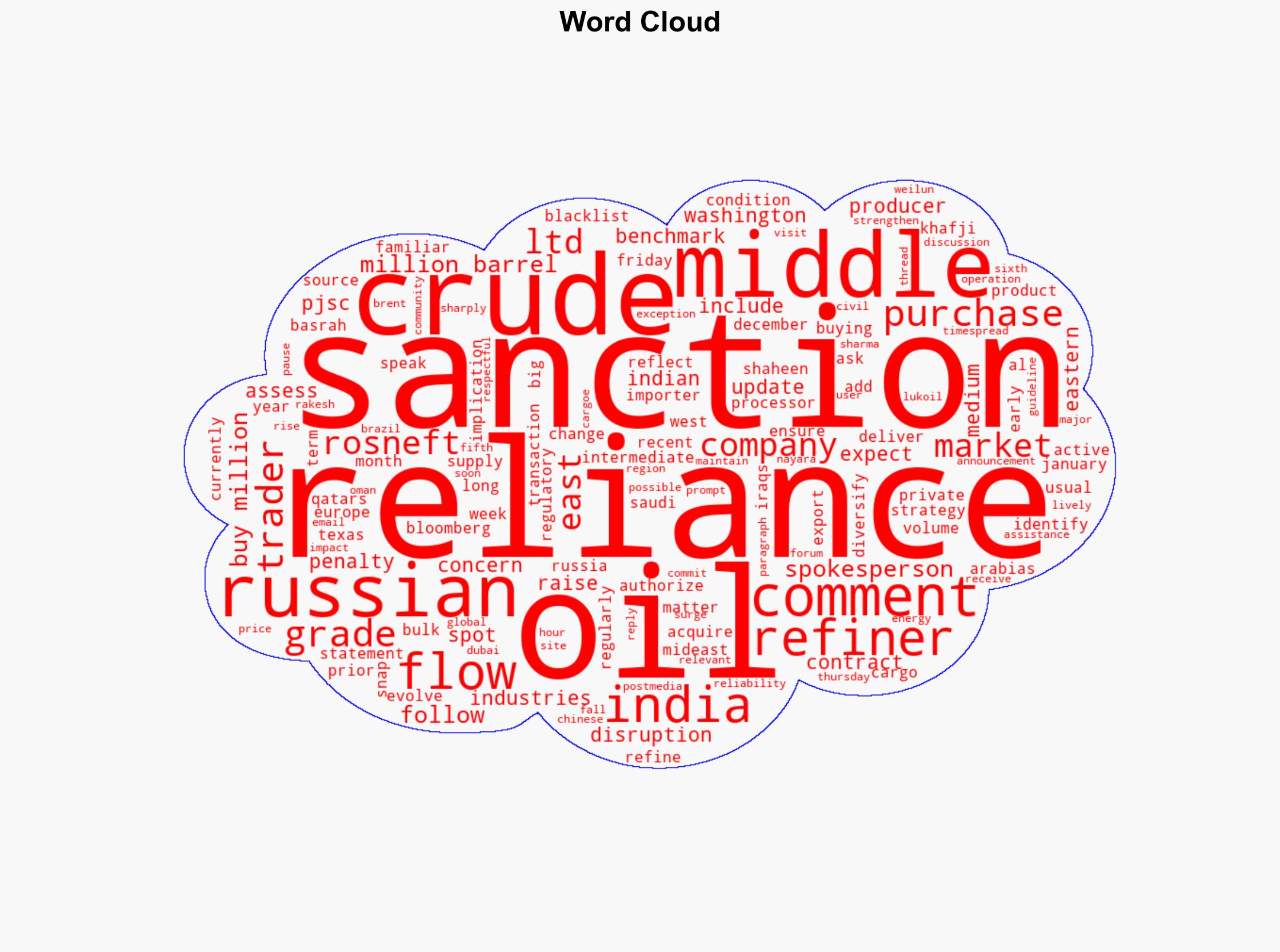

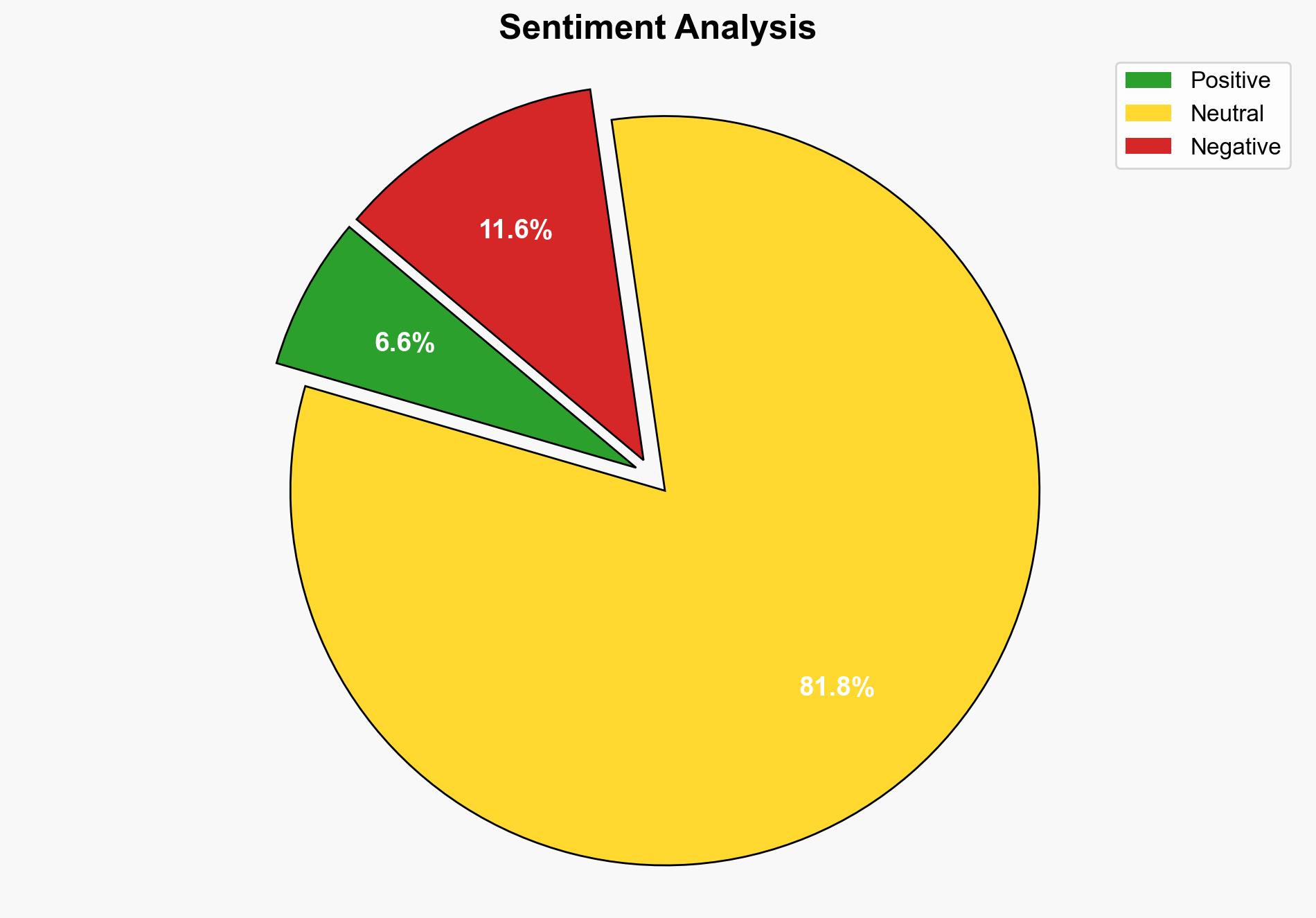

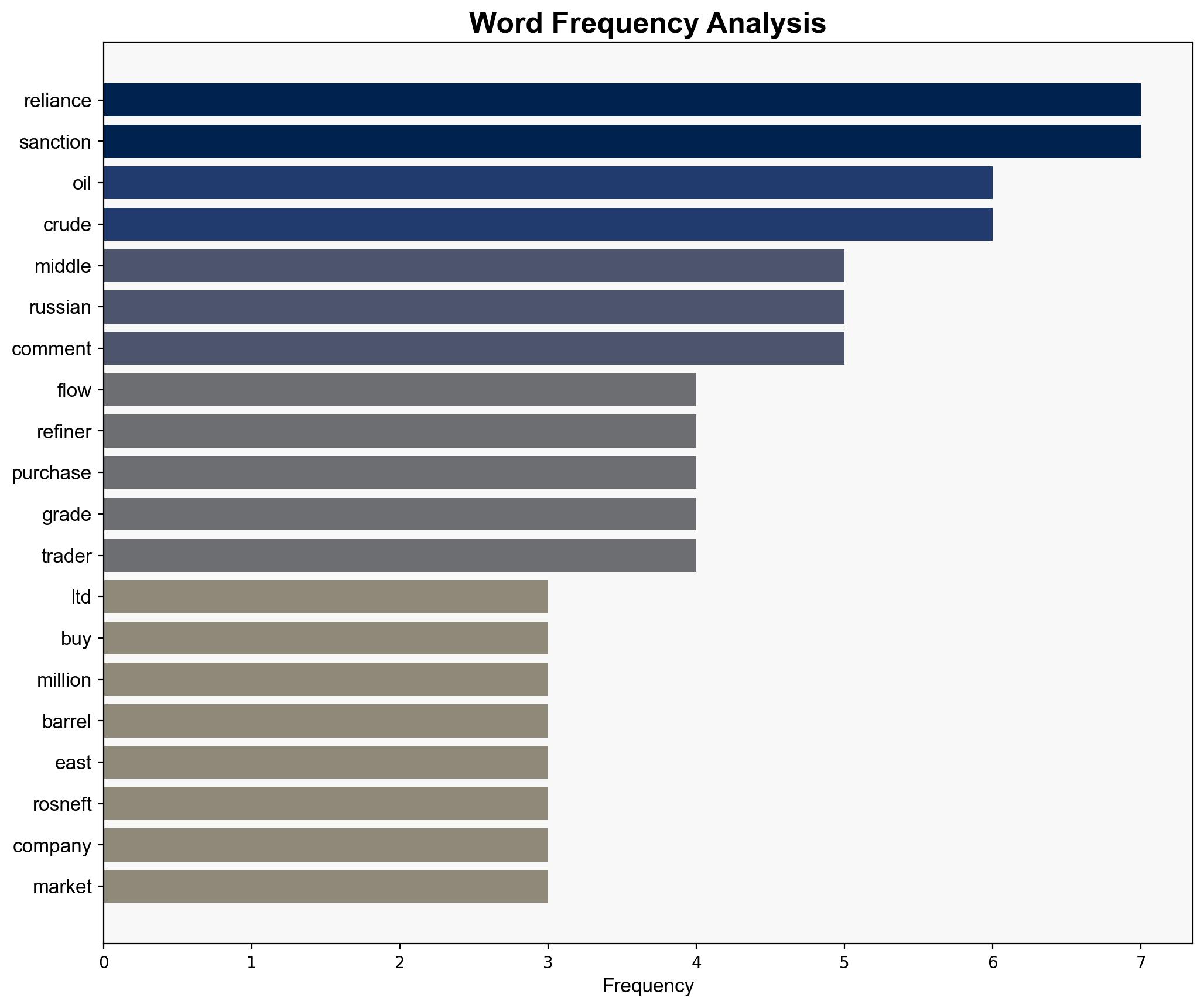

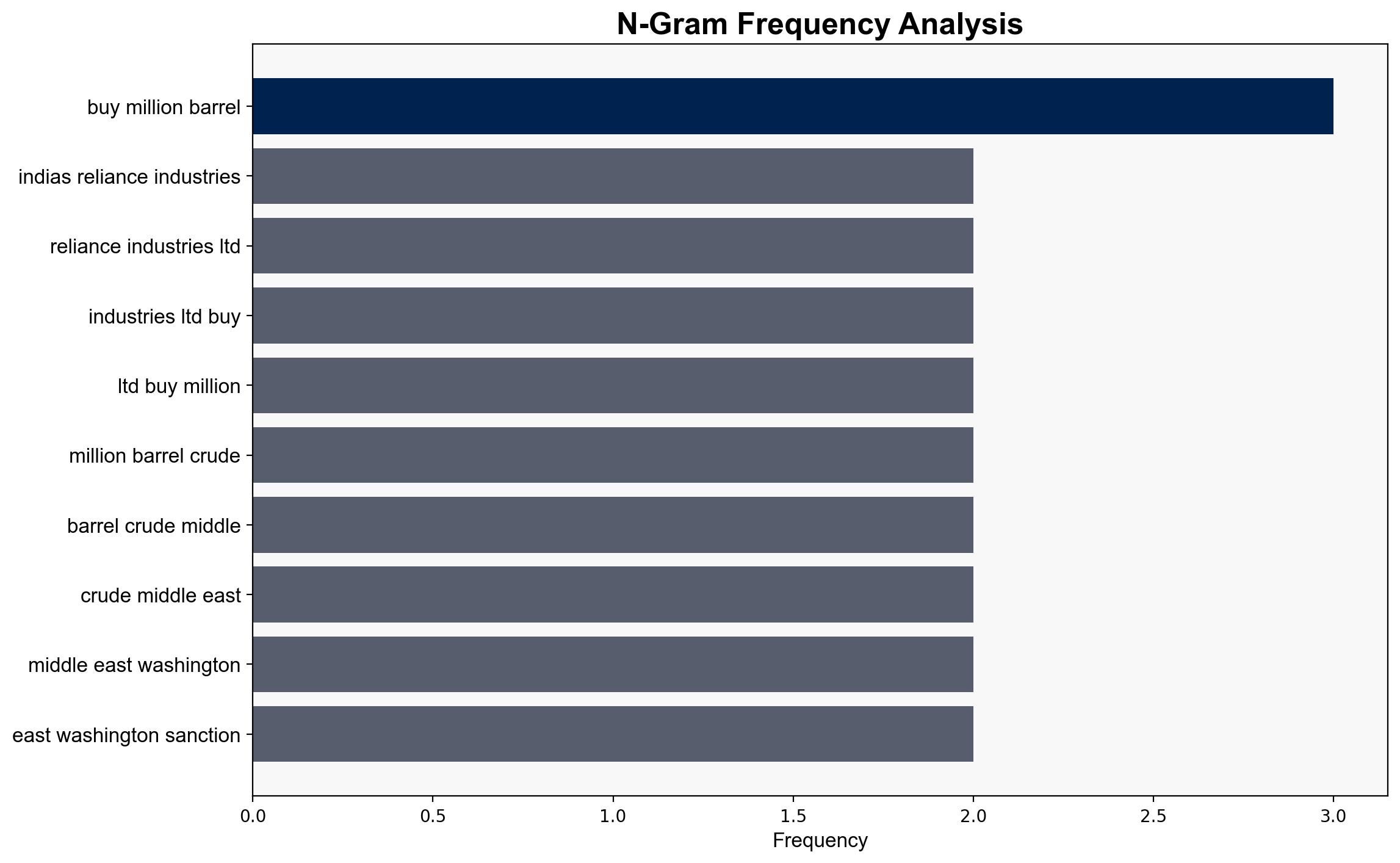

India’s Reliance Industries is strategically increasing its oil imports from the Middle East in response to sanctions on Russian oil producers. The most supported hypothesis is that this shift is a tactical move to ensure supply chain stability amidst geopolitical tensions. Confidence Level: Moderate. Recommended action includes monitoring Reliance’s procurement patterns for further shifts and assessing the impact on global oil markets.

2. Competing Hypotheses

1. **Hypothesis A**: Reliance Industries is diversifying its oil sources to mitigate risks associated with Russian sanctions, ensuring uninterrupted supply for its refining operations.

2. **Hypothesis B**: Reliance is opportunistically capitalizing on potentially lower prices and availability of Middle Eastern oil due to geopolitical shifts, rather than purely reacting to Russian sanctions.

Using ACH 2.0, Hypothesis A is better supported by the evidence of Reliance’s immediate increase in Middle Eastern oil purchases following the sanctions announcement, indicating a strategic response to potential supply disruptions.

3. Key Assumptions and Red Flags

– **Assumptions**: It is assumed that Reliance’s actions are primarily driven by supply chain security concerns. There is an assumption that Middle Eastern suppliers can meet increased demand without significant price hikes.

– **Red Flags**: Lack of clarity on the long-term sustainability of Middle Eastern oil supply and potential over-reliance on a few suppliers. The absence of detailed pricing information raises questions about economic motivations.

4. Implications and Strategic Risks

The shift in oil procurement patterns could lead to increased competition for Middle Eastern oil, potentially driving up prices. Geopolitically, India’s move may strain relations with Russia, impacting broader economic and defense ties. There is also a risk of over-dependence on Middle Eastern oil, which could be problematic if regional tensions escalate.

5. Recommendations and Outlook

- Monitor Reliance’s oil procurement strategies for further diversification or consolidation trends.

- Engage in diplomatic channels to ensure stable relations with both Russian and Middle Eastern partners.

- Scenario Projections:

- Best: Stable supply chains with diversified sources, maintaining competitive pricing.

- Worst: Escalation of geopolitical tensions leading to supply disruptions and increased costs.

- Most Likely: Continued diversification with moderate price fluctuations.

6. Key Individuals and Entities

– Reliance Industries Ltd.

– Rosneft PJSC

– Lukoil PJSC

– Nayara Energy Ltd.

7. Thematic Tags

national security threats, energy security, geopolitical strategy, economic impact