Reliance Snaps Up Middle East Oil – Rigzone

Published on: 2025-10-24

Intelligence Report: Reliance Snaps Up Middle East Oil – Rigzone

1. BLUF (Bottom Line Up Front)

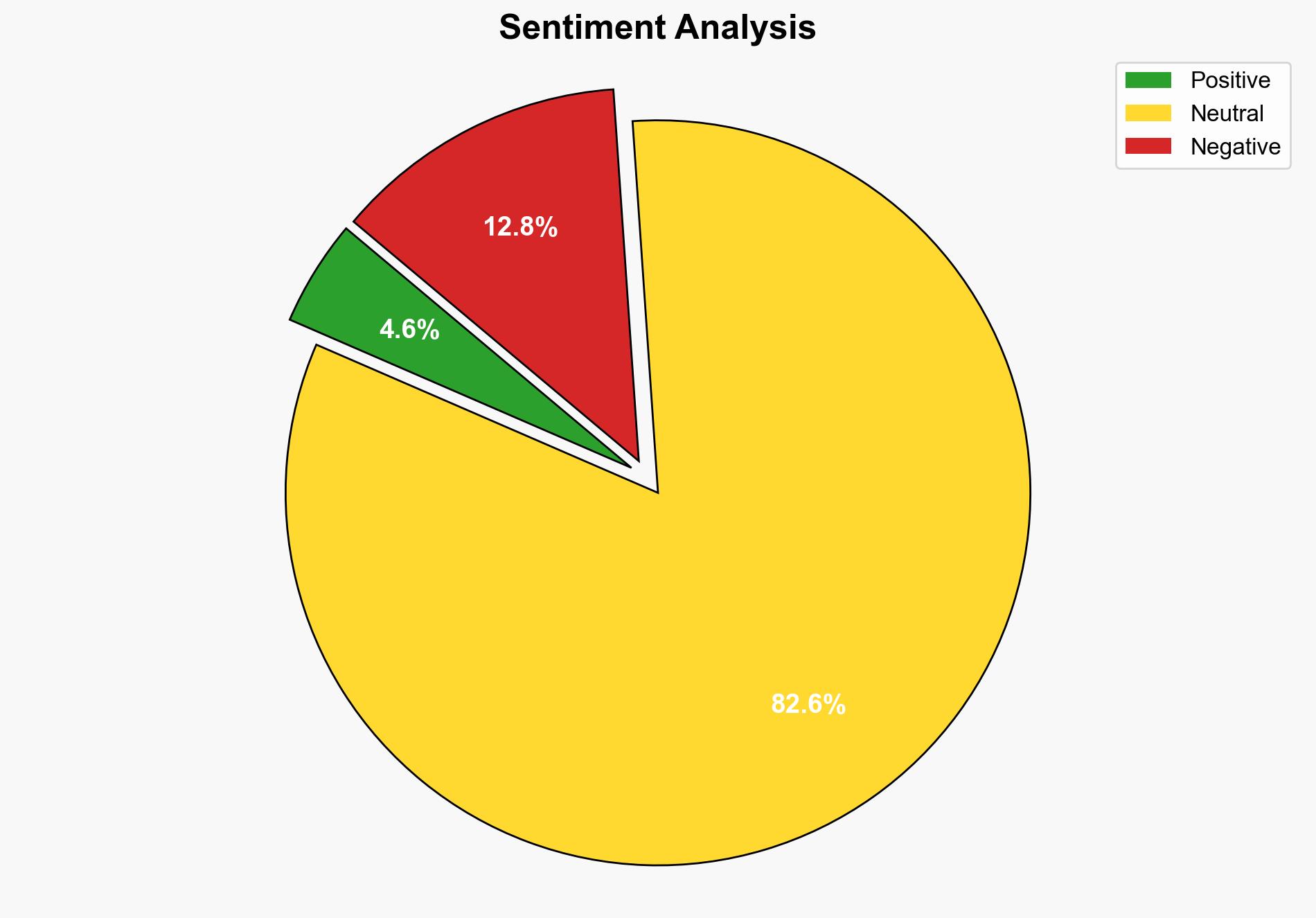

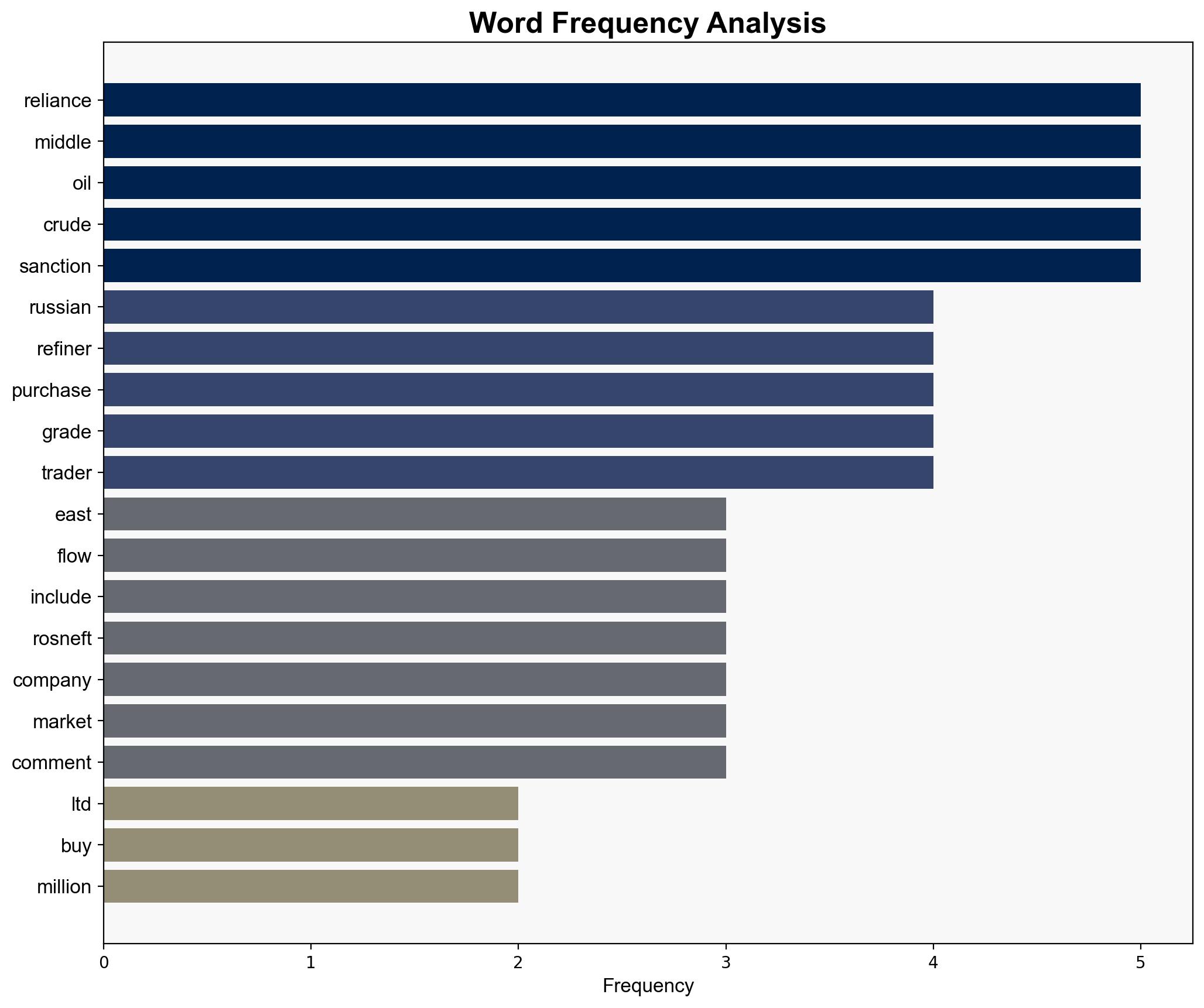

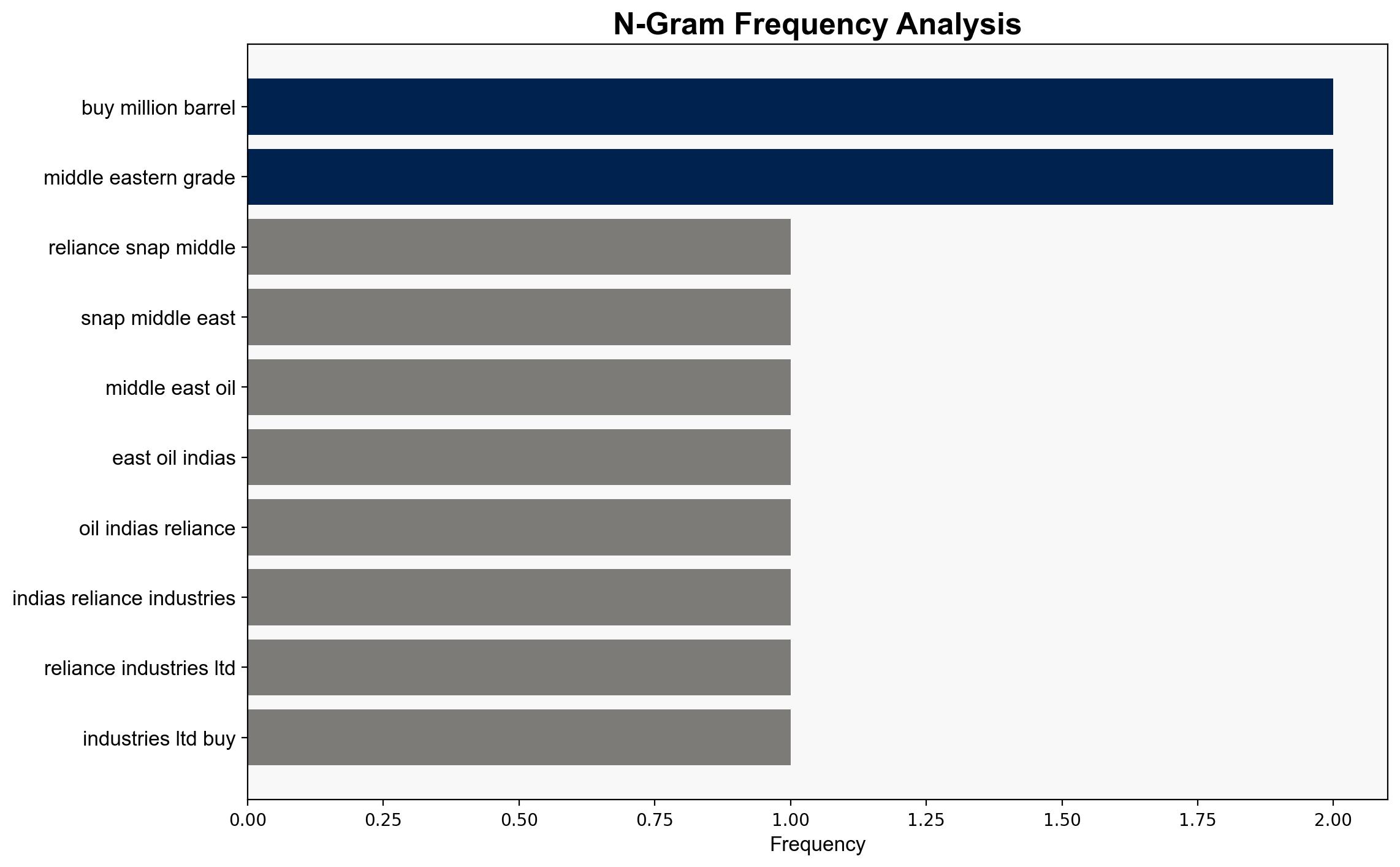

Reliance Industries Ltd.’s strategic shift towards Middle Eastern oil sources is likely a response to geopolitical tensions and sanctions on Russian oil. The most supported hypothesis is that Reliance is diversifying its oil supply to mitigate risks associated with Russian sanctions. Confidence level: High. Recommended action: Monitor Reliance’s procurement patterns and assess potential impacts on global oil markets and regional geopolitical dynamics.

2. Competing Hypotheses

1. **Hypothesis A**: Reliance is diversifying its oil sources primarily due to geopolitical risks and sanctions on Russian oil, aiming to ensure supply chain stability.

2. **Hypothesis B**: Reliance’s increased procurement from the Middle East is driven by opportunistic market conditions, such as favorable pricing and availability, rather than geopolitical pressures.

Using ACH 2.0, Hypothesis A is better supported. The sanctions on Russian oil and the strategic importance of maintaining stable supply chains in a volatile market environment align with Reliance’s actions. Hypothesis B is less supported as the market conditions alone do not fully explain the shift, given the geopolitical context.

3. Key Assumptions and Red Flags

– **Assumptions**: Reliance’s actions are primarily influenced by geopolitical factors and sanctions. Market conditions are secondary.

– **Red Flags**: Lack of detailed information on pricing agreements and potential undisclosed strategic partnerships. Possible overreliance on Middle Eastern sources could introduce new vulnerabilities.

– **Blind Spots**: Potential internal strategic shifts within Reliance that are not publicly disclosed.

4. Implications and Strategic Risks

– **Economic**: Increased reliance on Middle Eastern oil could affect global oil prices and influence regional market dynamics.

– **Geopolitical**: Shifts in oil procurement may alter India’s diplomatic relations with Russia and Middle Eastern countries.

– **Strategic Risks**: Over-dependence on Middle Eastern oil could expose Reliance to regional instability and supply disruptions.

5. Recommendations and Outlook

- Monitor Reliance’s procurement strategies and potential shifts in supplier relationships.

- Engage in scenario planning to assess impacts of prolonged sanctions on Russian oil.

- Best Case: Successful diversification leads to stable supply chains and competitive pricing.

- Worst Case: Regional instability disrupts Middle Eastern oil supplies, causing market volatility.

- Most Likely: Continued diversification with moderate impact on global oil markets.

6. Key Individuals and Entities

– Reliance Industries Ltd.

– Rosneft PJSC

– Nayara Energy Ltd.

– Lukoil PJSC

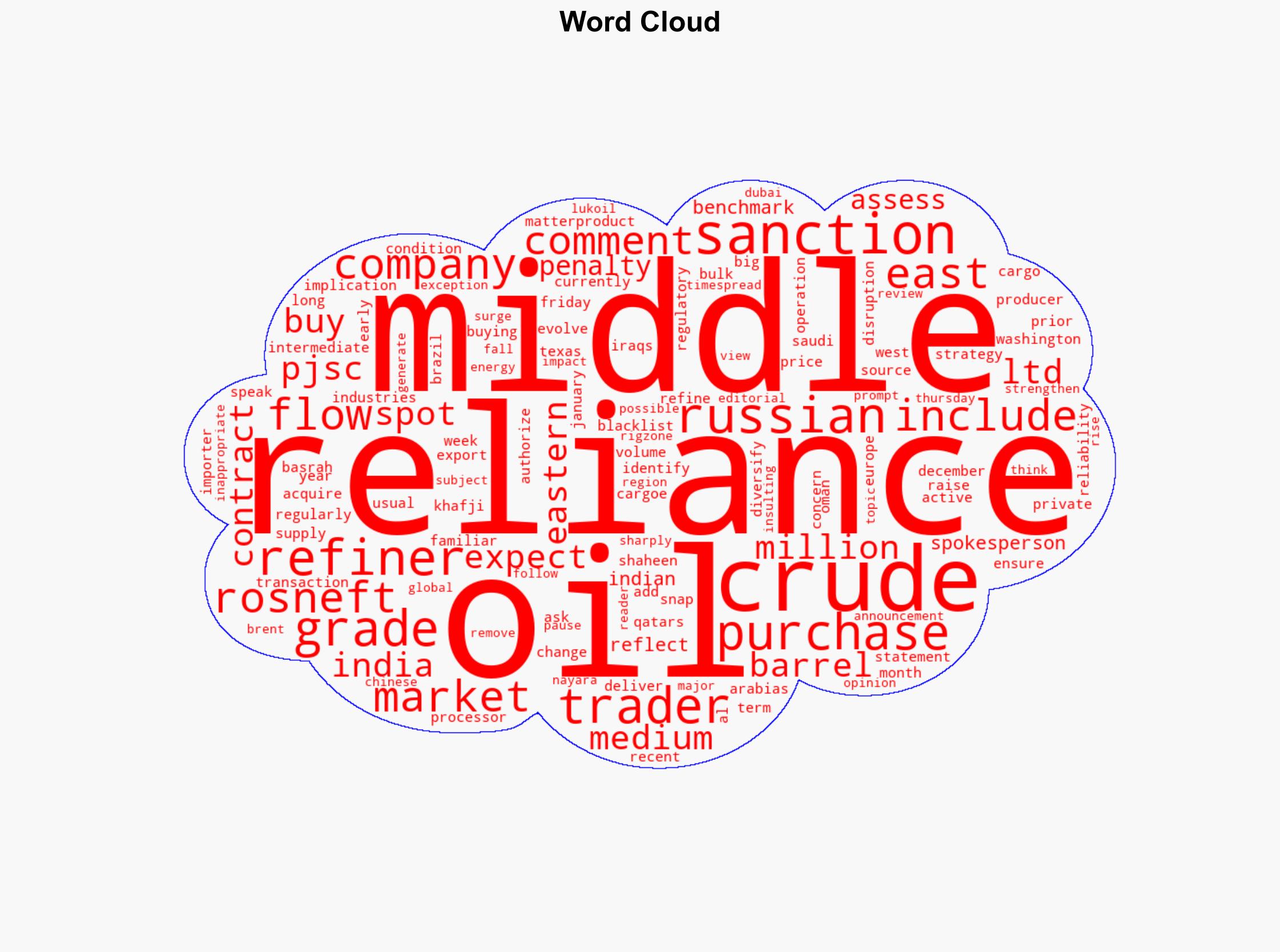

7. Thematic Tags

national security threats, geopolitical strategy, energy security, regional focus