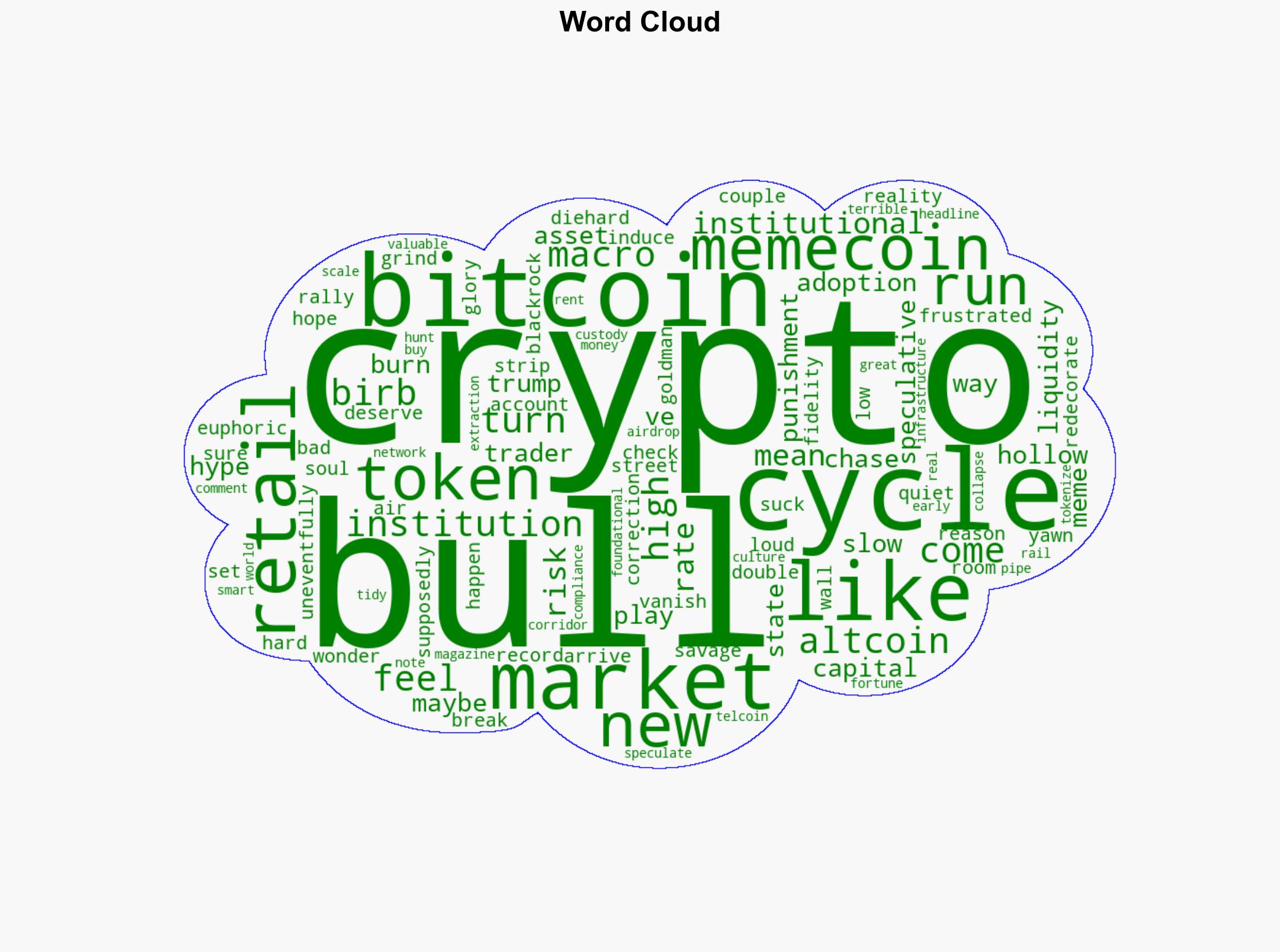

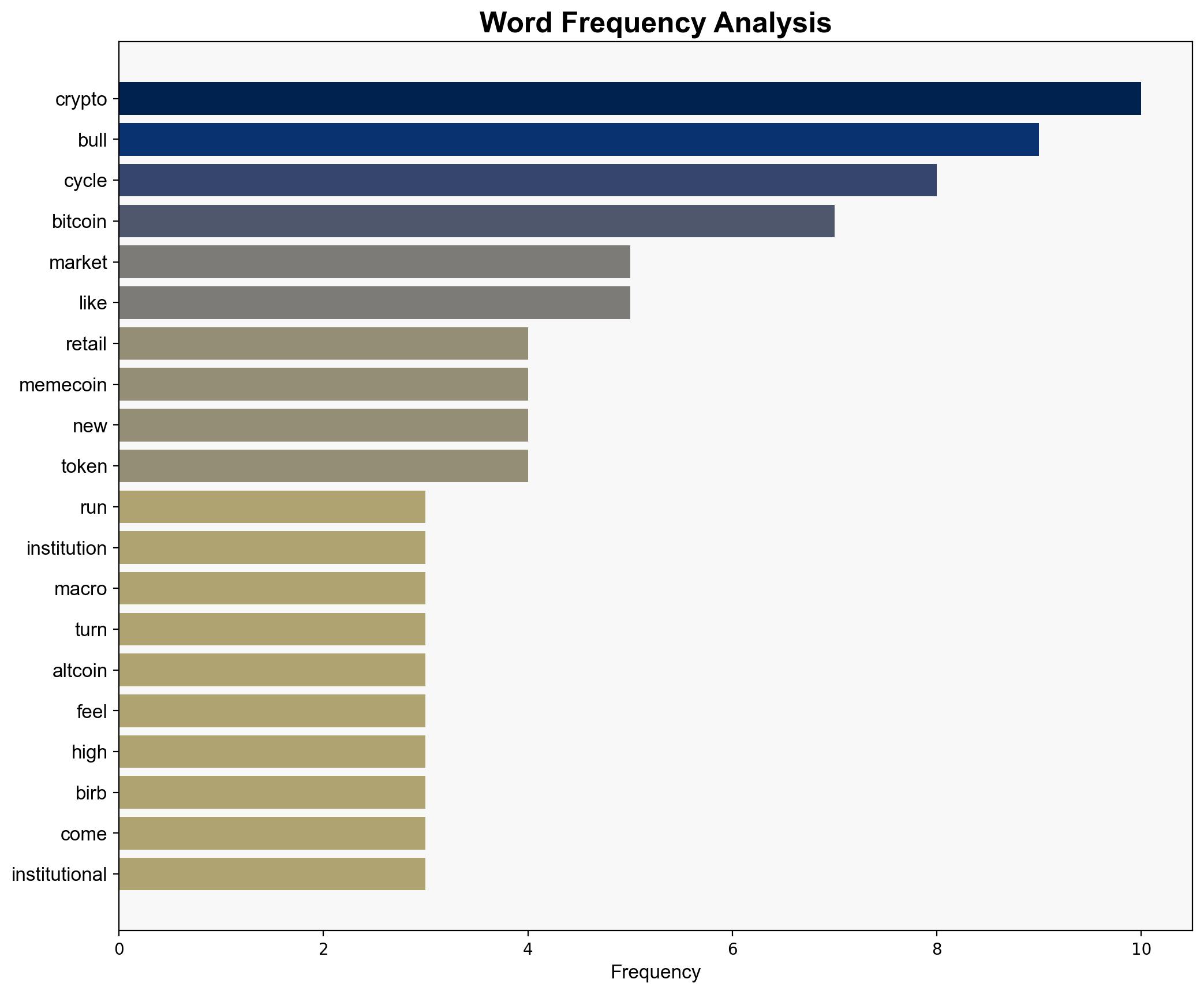

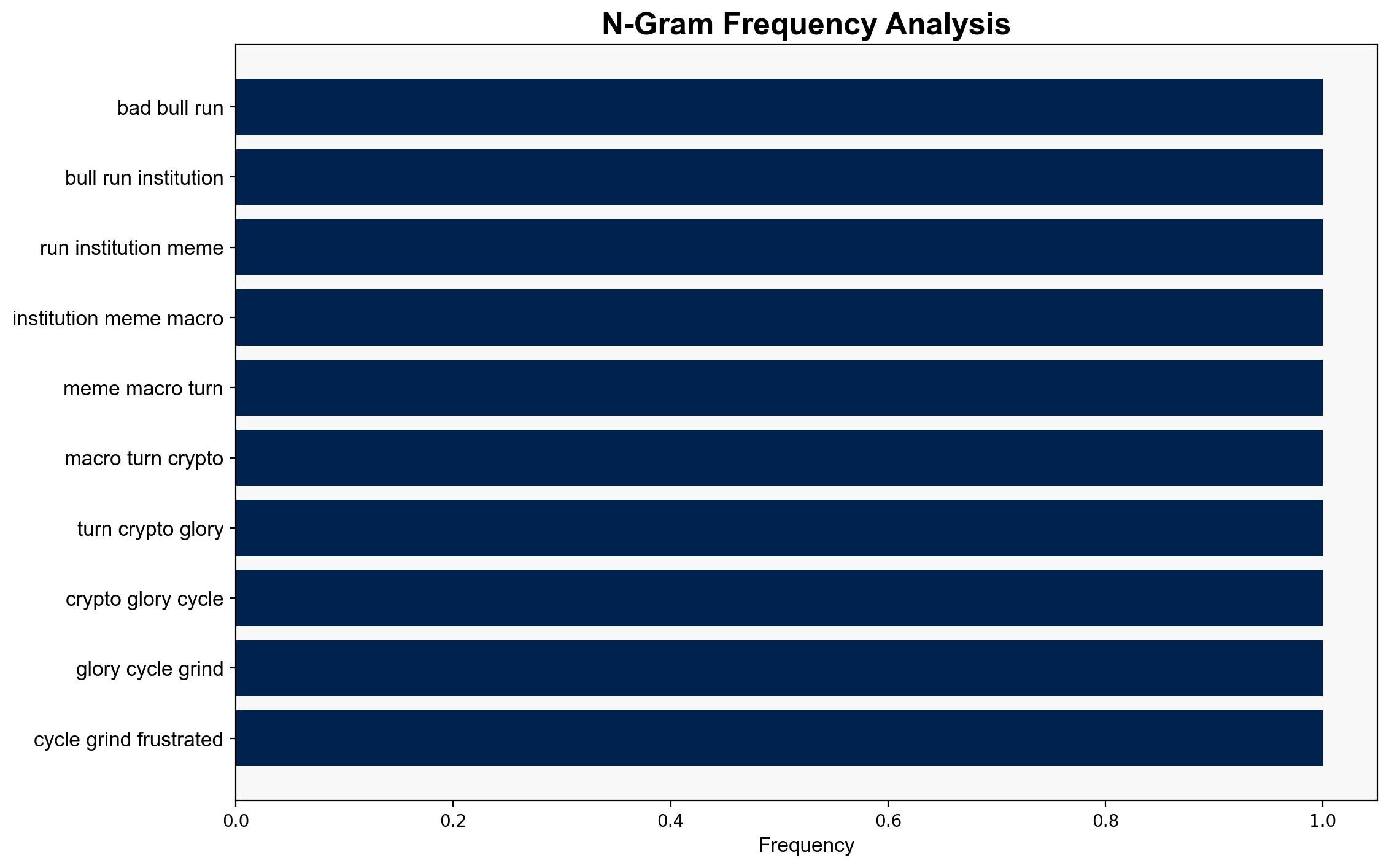

The worst bull run ever How institutions memes and macro turned cryptos glory cycle into a grind – CryptoSlate

Published on: 2025-10-27

Intelligence Report: The worst bull run ever How institutions memes and macro turned cryptos glory cycle into a grind – CryptoSlate

1. BLUF (Bottom Line Up Front)

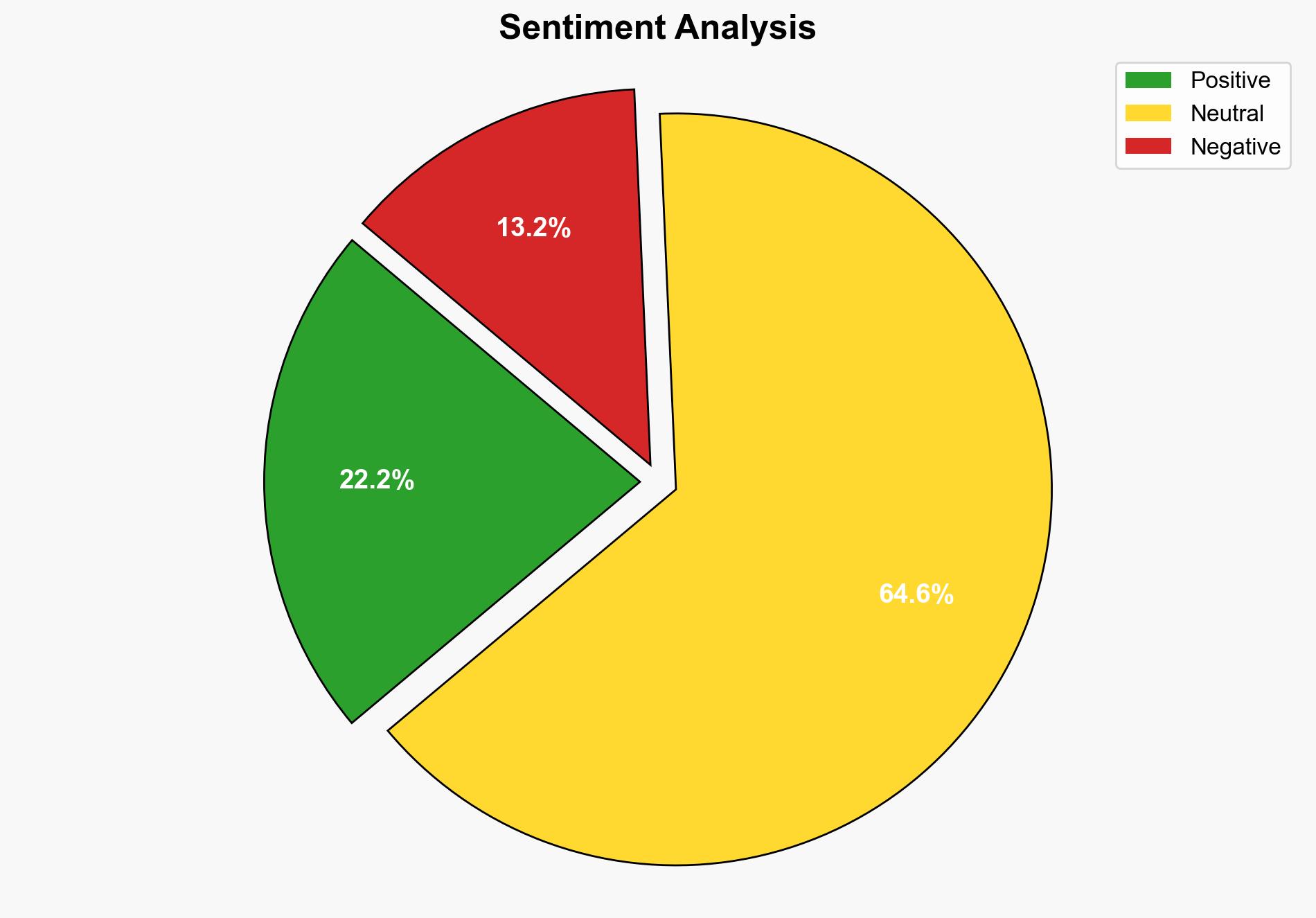

The current crypto market, described as a “bull run,” lacks the traditional euphoria and is instead characterized by institutional dominance and macroeconomic pressures. The most supported hypothesis suggests that institutional adoption and macroeconomic conditions are reshaping the crypto landscape, leading to a subdued market environment. Confidence Level: Moderate. Recommended action is to monitor institutional strategies and macroeconomic indicators closely to anticipate market shifts.

2. Competing Hypotheses

1. **Hypothesis A**: Institutional adoption and macroeconomic factors are transforming the crypto market into a more stable, less volatile environment. This hypothesis is supported by the presence of major financial institutions like BlackRock and Fidelity, focusing on infrastructure and compliance rather than speculative trading.

2. **Hypothesis B**: The current market stagnation is primarily due to retail investor fatigue and the collapse of meme-driven speculative assets, leading to a temporary lull in market excitement. This is evidenced by the decline in retail participation and the failure of memecoins to sustain value.

3. Key Assumptions and Red Flags

– **Assumptions**: Hypothesis A assumes that institutional involvement inherently stabilizes markets, which may overlook the potential for institutional-driven volatility. Hypothesis B assumes retail investors are the primary drivers of market excitement, potentially underestimating institutional influence.

– **Red Flags**: The lack of detailed data on institutional trading volumes and strategies presents a blind spot. Additionally, the assumption that macroeconomic conditions will remain stable is precarious given global economic uncertainties.

4. Implications and Strategic Risks

The shift towards institutional dominance could lead to increased regulatory scrutiny and a more mature market, potentially reducing opportunities for rapid gains. However, this could also stabilize the market, attracting more conservative investors. The macroeconomic backdrop, including high interest rates and geopolitical tensions, poses risks to capital flows into crypto assets.

5. Recommendations and Outlook

- Monitor institutional investment patterns and regulatory developments to anticipate market shifts.

- Scenario Projections:

- Best Case: Institutional adoption leads to a stable, mature market with steady growth.

- Worst Case: Economic downturns and regulatory crackdowns lead to a prolonged market slump.

- Most Likely: A gradual market recovery as institutions solidify their presence and macroeconomic conditions stabilize.

6. Key Individuals and Entities

– BlackRock

– Fidelity

– Goldman Sachs

7. Thematic Tags

financial stability, institutional investment, macroeconomic impact, regulatory environment