Mining execs embrace ‘phenomenal’ rare earths interest from the Middle East – CNBC

Published on: 2025-10-28

Intelligence Report: Mining execs embrace ‘phenomenal’ rare earths interest from the Middle East – CNBC

1. BLUF (Bottom Line Up Front)

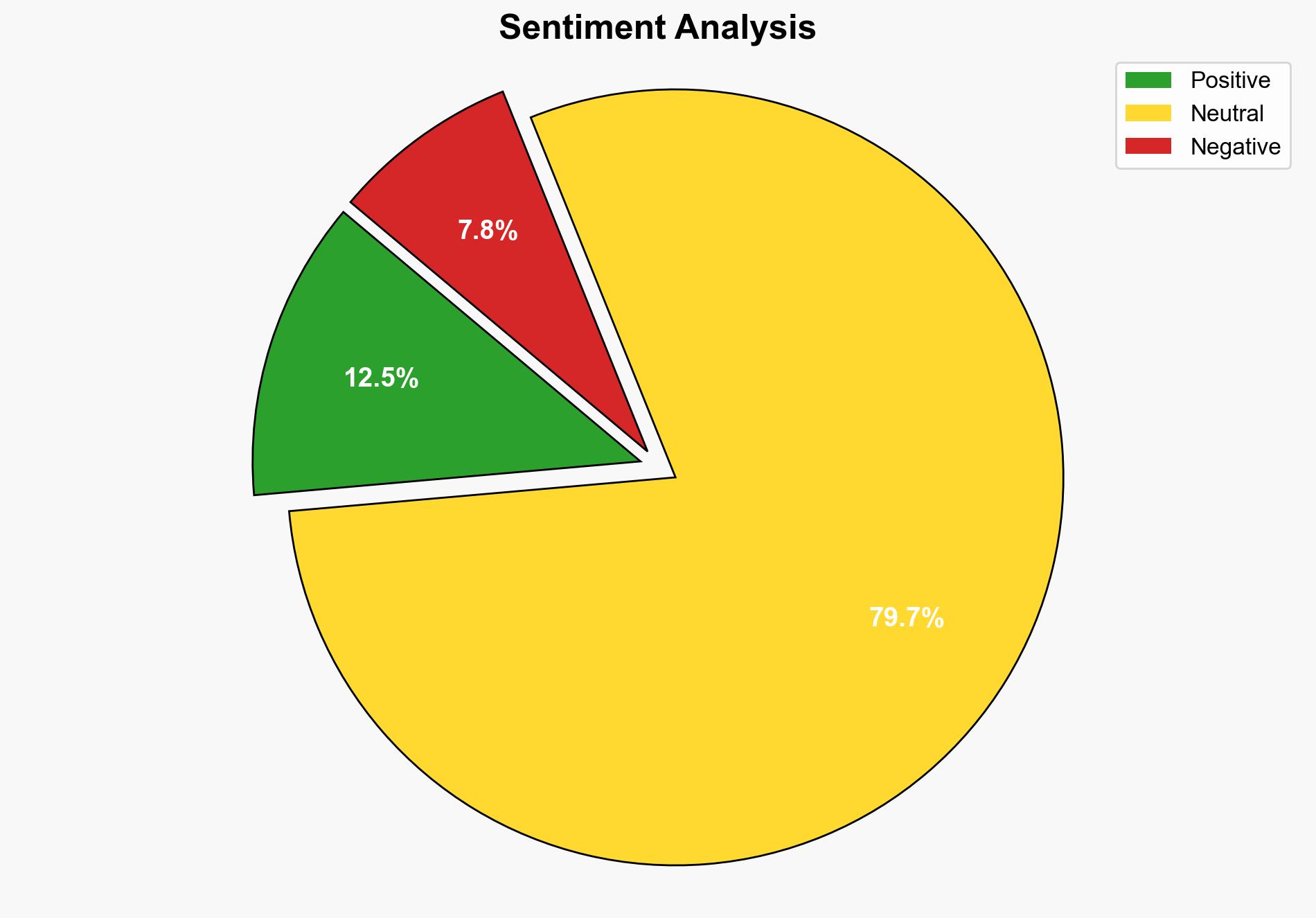

The increasing interest from Middle Eastern investors in rare earth elements presents both opportunities and strategic challenges. The most supported hypothesis suggests that this interest is primarily driven by economic diversification efforts and the strategic positioning of Gulf states in the global critical minerals market. Confidence level: Moderate. Recommended action: Monitor developments in Middle Eastern partnerships and investments in rare earths to assess potential shifts in global supply chains and geopolitical influence.

2. Competing Hypotheses

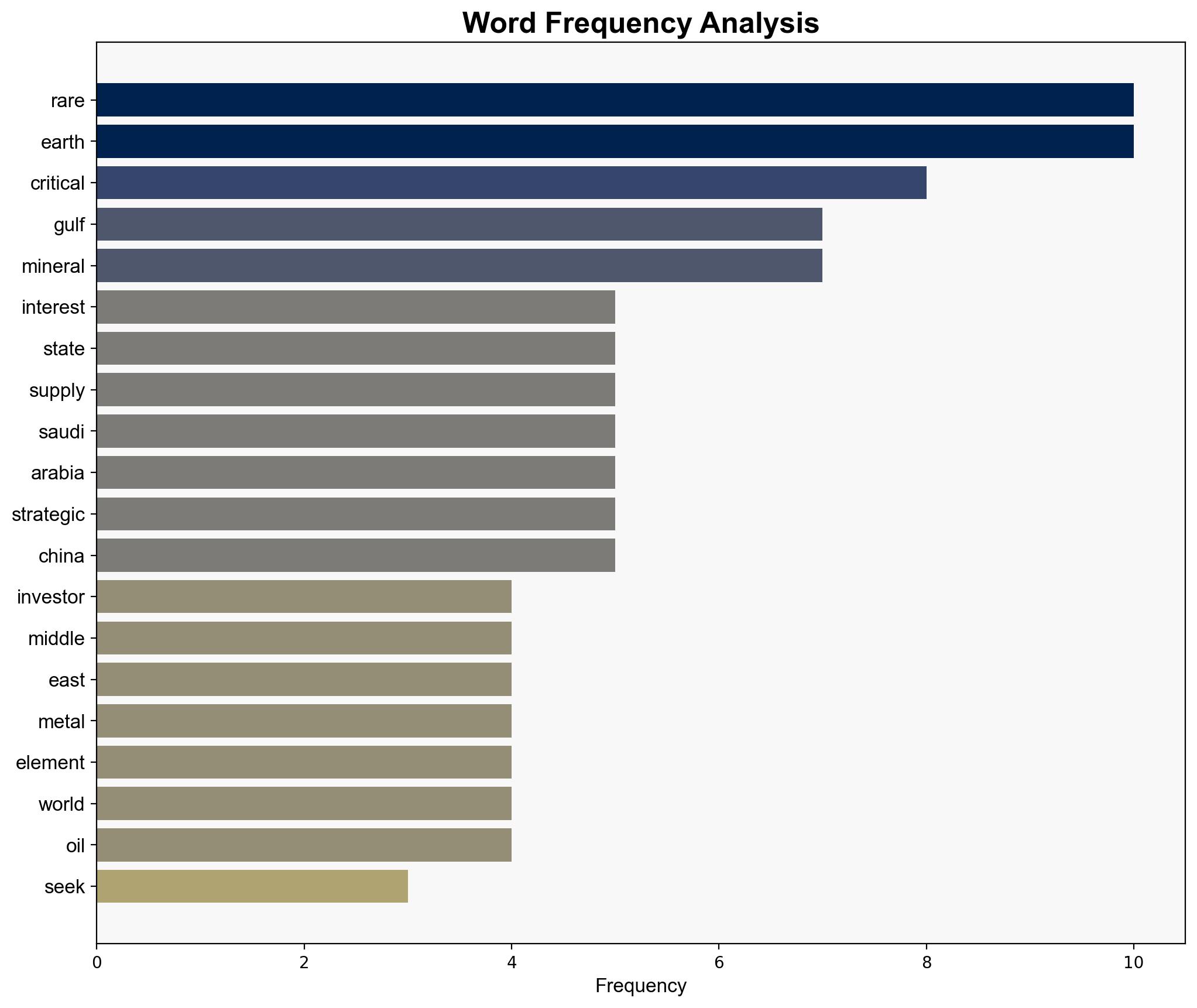

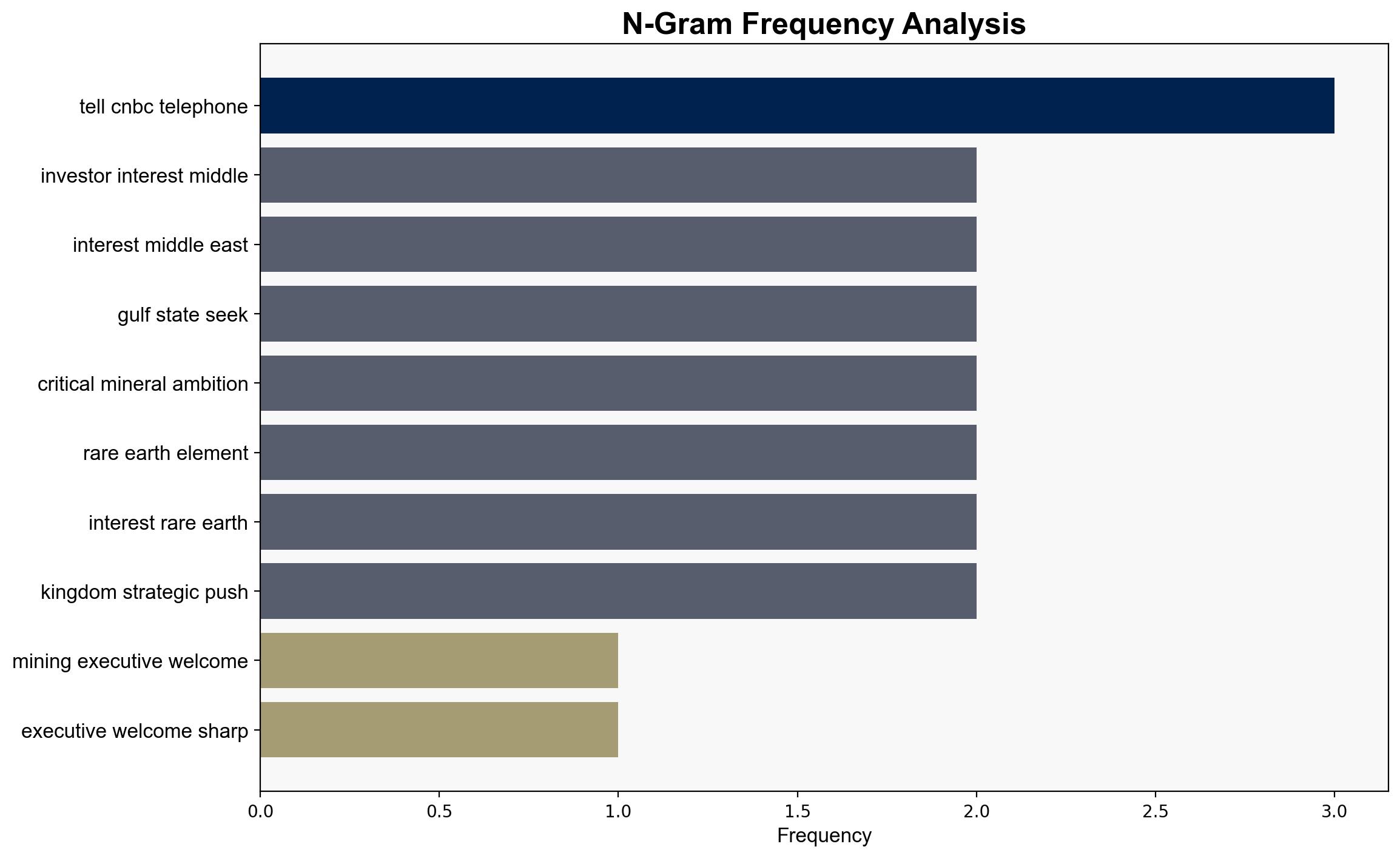

1. **Economic Diversification Hypothesis**: Middle Eastern interest in rare earths is primarily driven by a strategic push to diversify their economies away from oil dependency, leveraging financial capital and geographic location to capture market share in critical minerals.

2. **Geopolitical Leverage Hypothesis**: The interest is part of a broader geopolitical strategy to gain leverage over Western nations by positioning themselves as alternative suppliers of critical minerals, potentially replacing dependency on China.

Using ACH 2.0, the Economic Diversification Hypothesis is better supported due to the explicit statements from executives and analysts about diversification goals and the early stages of mining ventures in the region.

3. Key Assumptions and Red Flags

– **Assumptions**: It is assumed that Middle Eastern countries have the capability and resources to establish a significant presence in the rare earths market. Another assumption is that Western nations will be receptive to shifting dependencies from China to the Gulf states.

– **Red Flags**: The current marginal production capacity of Gulf states in critical minerals could undermine their strategic ambitions. Additionally, the reliance on foreign expertise and partnerships may delay or complicate these efforts.

4. Implications and Strategic Risks

– **Economic Implications**: Successful diversification could stabilize Gulf economies and reduce their vulnerability to oil market fluctuations.

– **Geopolitical Risks**: Increased influence in the critical minerals market could alter power dynamics, potentially leading to new alliances or tensions, especially if Western nations perceive a shift in dependency as a strategic risk.

– **Supply Chain Vulnerabilities**: The transition of supply chains to include Middle Eastern sources may introduce new vulnerabilities, particularly if political instability arises in the region.

5. Recommendations and Outlook

- Monitor Middle Eastern investments and partnerships in the rare earths sector to assess progress and potential impacts on global supply chains.

- Engage in dialogue with Gulf states to understand their strategic intentions and explore collaborative opportunities that align with Western interests.

- Scenario Projections:

- Best Case: Successful diversification leads to stable Gulf economies and strengthened global supply chains.

- Worst Case: Geopolitical tensions rise as Western nations become wary of new dependencies.

- Most Likely: Gradual integration of Gulf states into the rare earths market with mixed outcomes for global supply chains.

6. Key Individuals and Entities

– Tony Sage

– Kevin Das

– Shaun Bunn

– Asna Wajid

– Obeikan Group

7. Thematic Tags

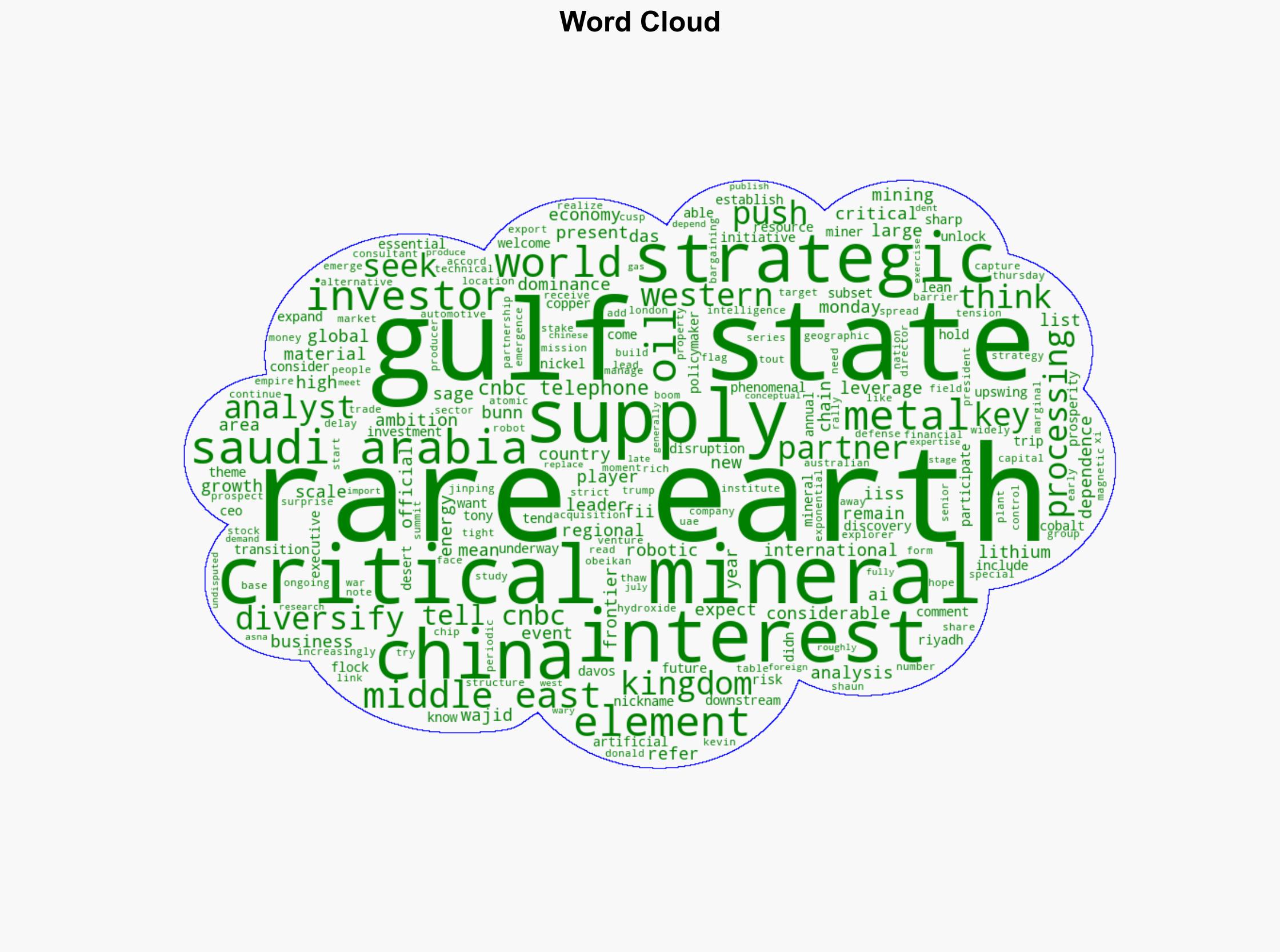

national security threats, economic diversification, geopolitical strategy, critical minerals, Middle East investments