FII interest could revive Indias underperforming market Sunil Koul – The Times of India

Published on: 2025-10-28

Intelligence Report: FII interest could revive India’s underperforming market – Sunil Koul

1. BLUF (Bottom Line Up Front)

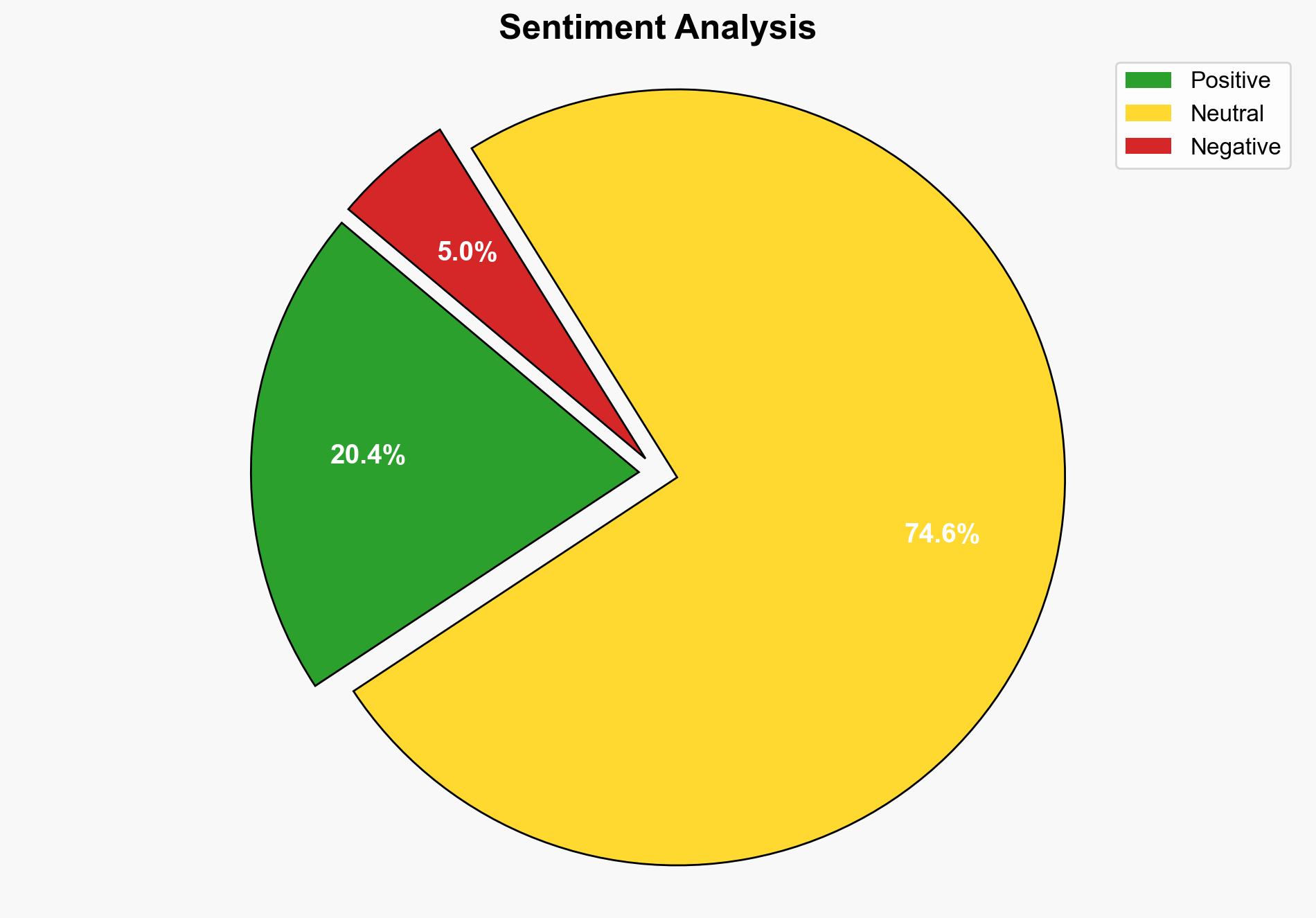

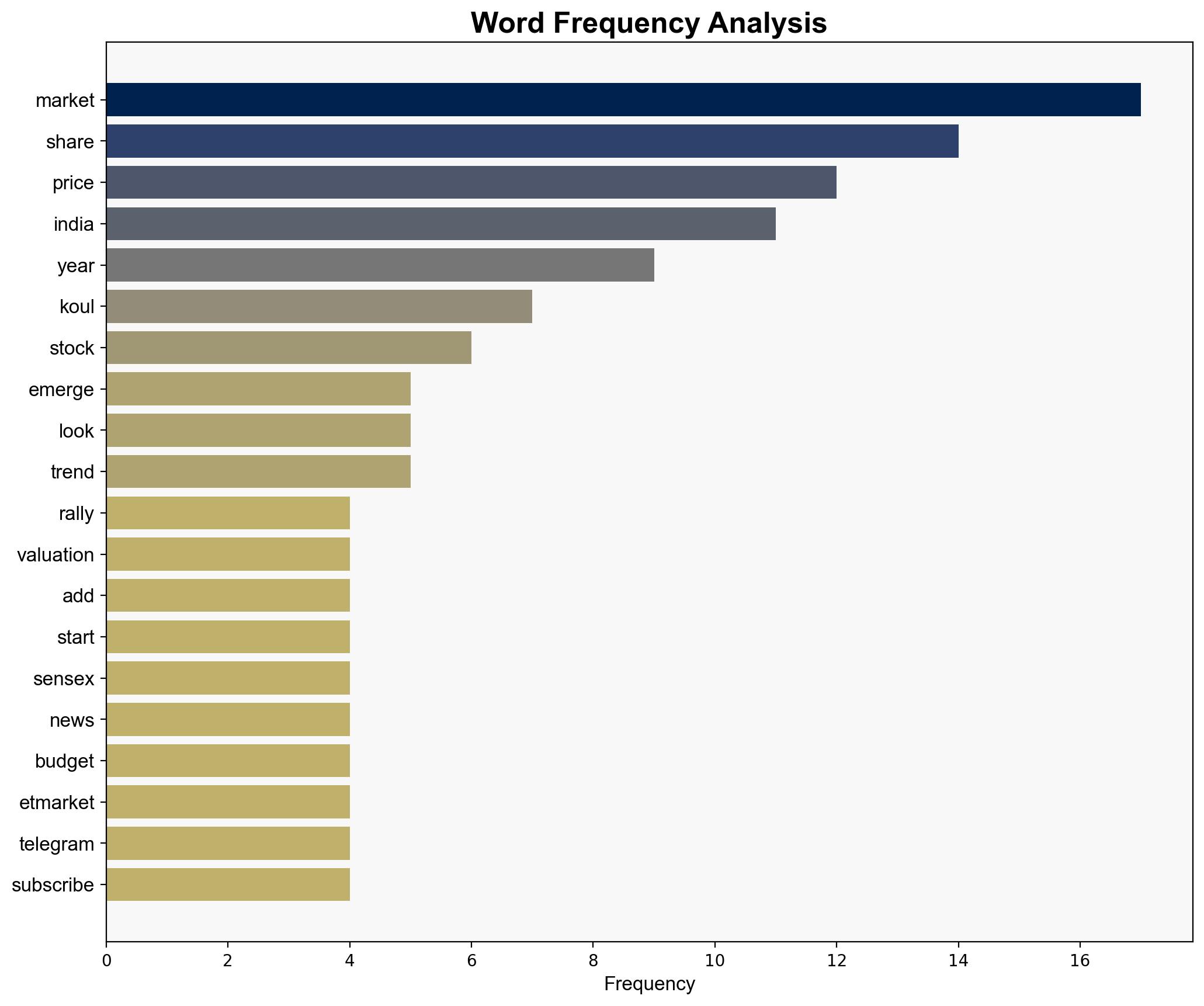

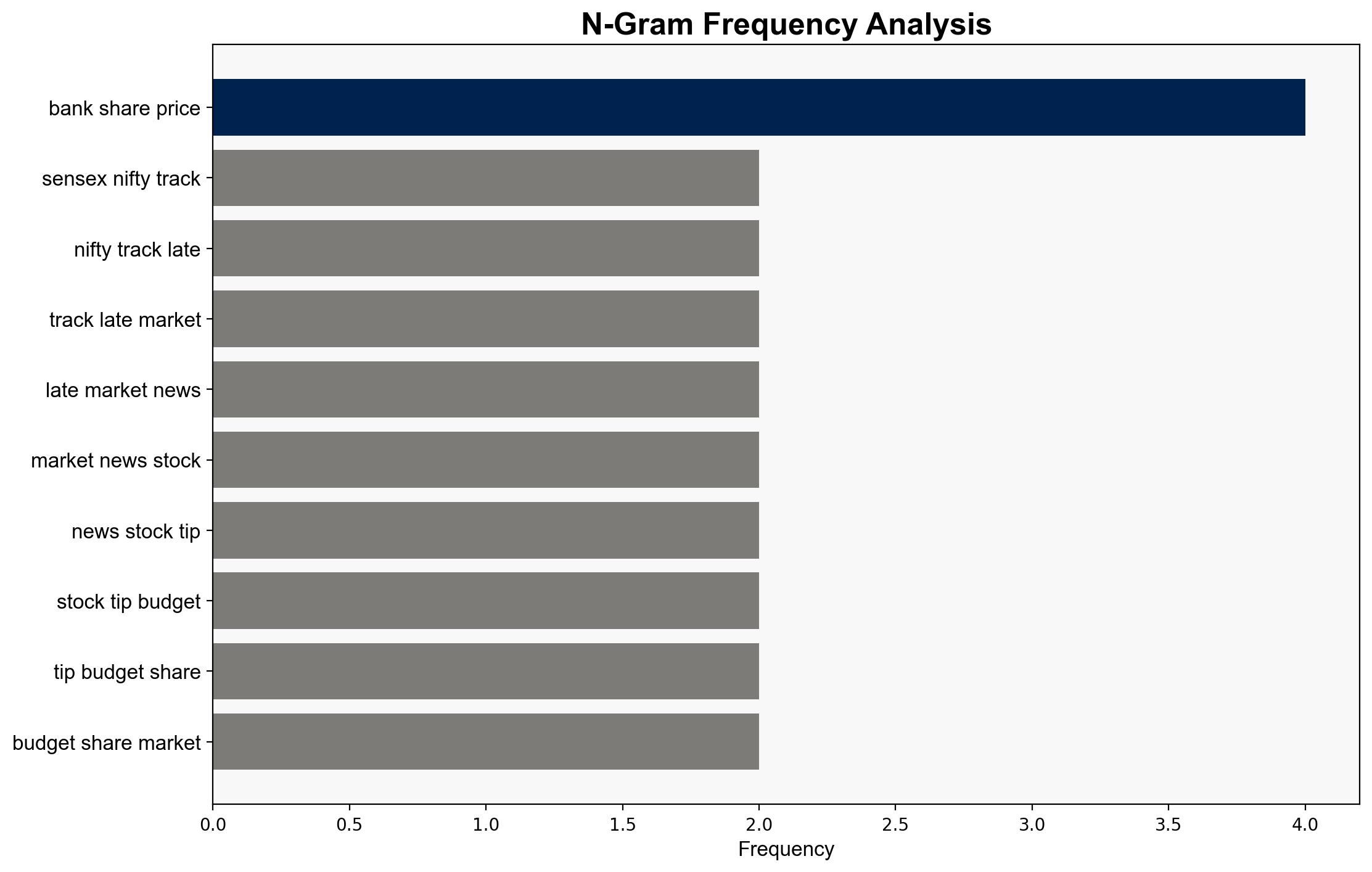

India’s market underperformance may reverse due to increased Foreign Institutional Investor (FII) interest, driven by improving corporate earnings and easing valuations. This hypothesis is moderately supported by current trends and historical parallels. Strategic recommendation: Monitor FII flows and corporate earnings closely to capitalize on potential market recovery. Confidence level: Moderate.

2. Competing Hypotheses

1. **Hypothesis A**: FII interest will lead to a significant recovery in India’s market performance. This is supported by recent FII inflows, improving corporate earnings, and historical trends of market rotation favoring emerging markets like India.

2. **Hypothesis B**: Despite FII interest, India’s market will continue to underperform due to persistent high valuations and global economic uncertainties. This is supported by the current underweight position of India in emerging market portfolios and potential geopolitical risks.

3. Key Assumptions and Red Flags

– **Assumptions**:

– FII flows are a reliable indicator of market recovery.

– Corporate earnings will continue to improve.

– Global economic conditions will remain favorable for emerging markets.

– **Red Flags**:

– Over-reliance on historical trends without considering current geopolitical tensions.

– Potential overvaluation of Indian equities despite recent corrections.

– Lack of detailed analysis on sector-specific performance variations.

4. Implications and Strategic Risks

– **Economic Risks**: Continued underperformance could deter long-term FII, affecting capital inflows and economic growth.

– **Geopolitical Risks**: Regional tensions or policy shifts could disrupt market recovery.

– **Psychological Risks**: Investor sentiment may shift rapidly due to global economic news or domestic policy changes.

5. Recommendations and Outlook

- **Mitigation**: Diversify investment portfolios to hedge against potential market volatility.

- **Opportunities**: Leverage sectors showing strong earnings growth, particularly in finance.

- **Projections**:

– **Best Case**: Sustained FII inflows and earnings growth lead to a robust market recovery.

– **Worst Case**: Geopolitical tensions and economic downturns exacerbate market underperformance.

– **Most Likely**: Gradual improvement with periodic setbacks due to global economic fluctuations.

6. Key Individuals and Entities

– Sunil Koul

– Goldman Sachs

7. Thematic Tags

economic trends, market analysis, investment strategy, emerging markets