An AI adoption riddle – MIT Technology Review

Published on: 2025-10-28

Intelligence Report: An AI Adoption Riddle – MIT Technology Review

1. BLUF (Bottom Line Up Front)

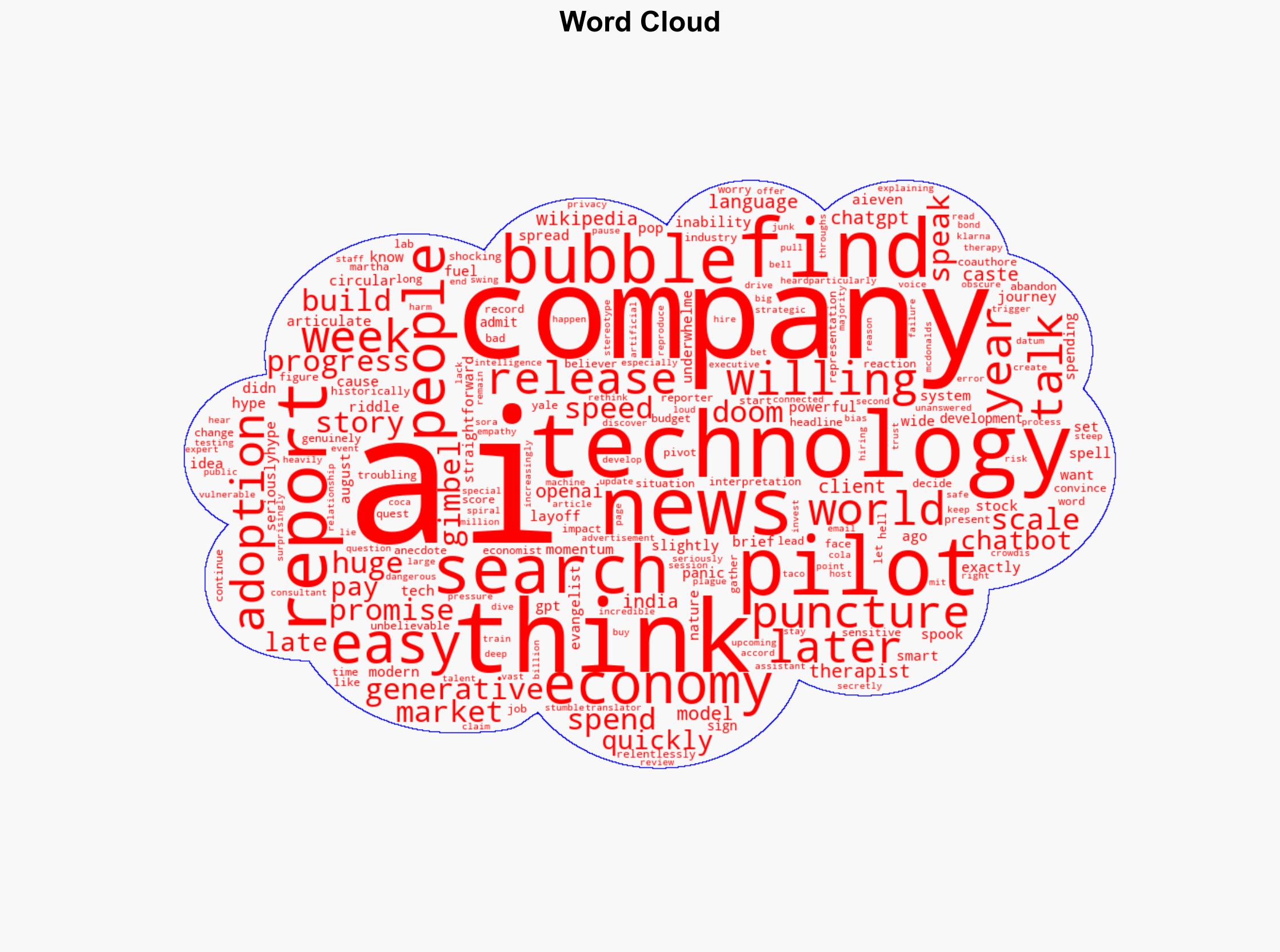

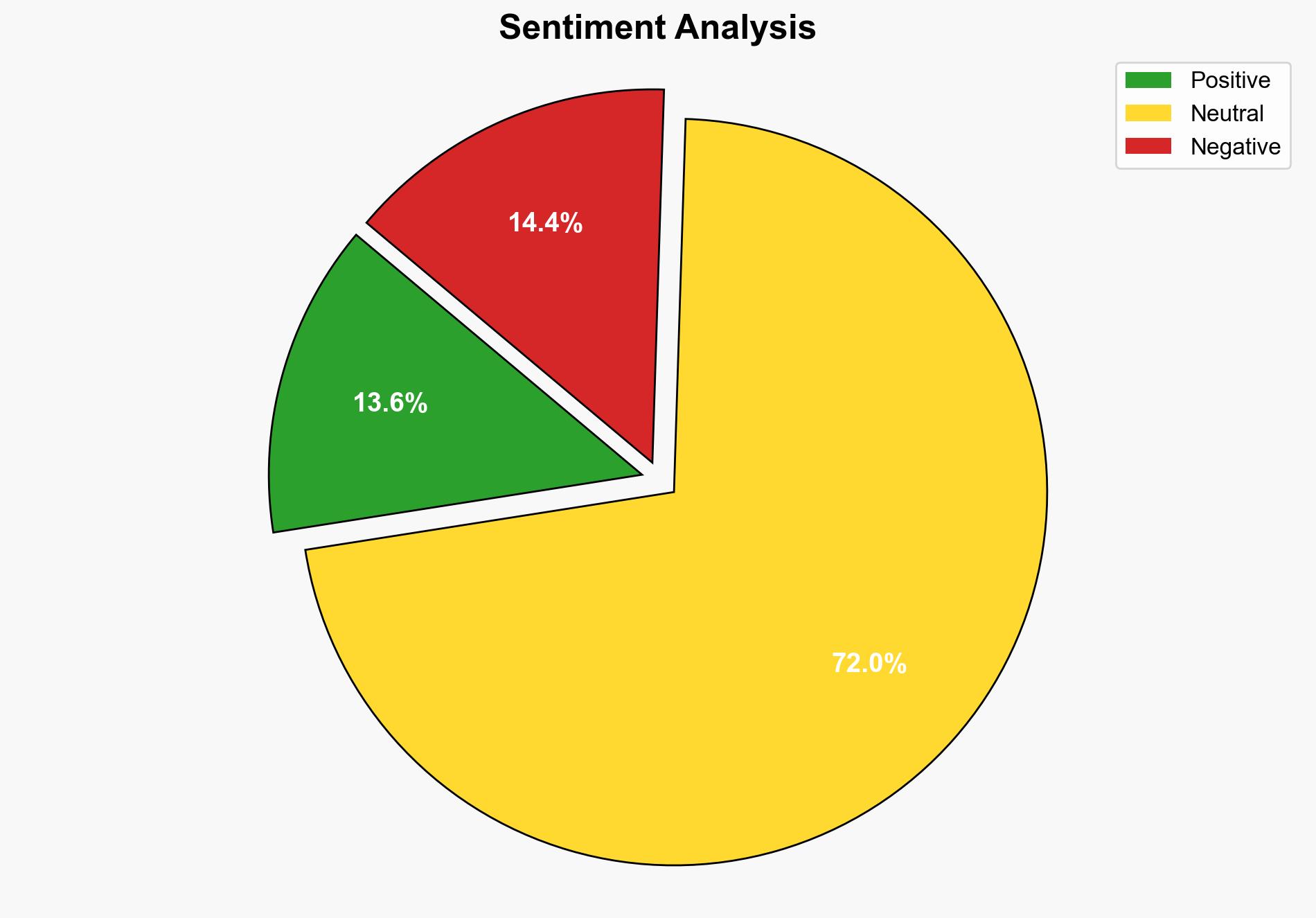

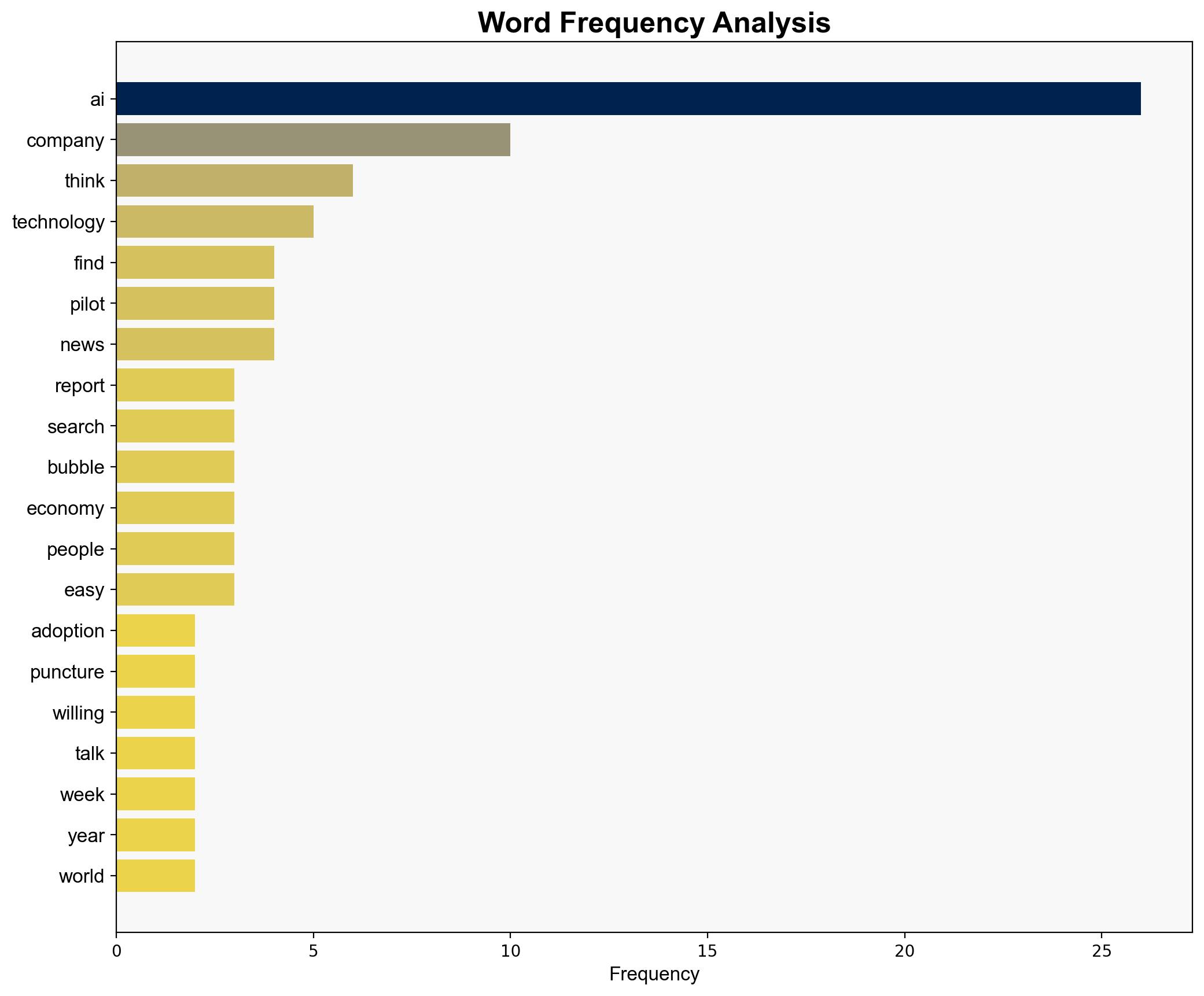

The strategic judgment is that the current AI adoption landscape is characterized by significant uncertainty and potential overvaluation, with a moderate confidence level. The most supported hypothesis is that AI adoption is driven by a mix of genuine technological advancement and speculative investment, leading to a potential bubble. Recommended action includes monitoring AI investment trends and preparing for potential market corrections.

2. Competing Hypotheses

Hypothesis 1: AI adoption is primarily driven by genuine technological advancements and strategic necessity, leading to sustainable integration into business operations.

Hypothesis 2: AI adoption is largely fueled by speculative investment and hype, creating a potential bubble that could lead to economic instability if not managed properly.

Using the Analysis of Competing Hypotheses (ACH) 2.0, Hypothesis 2 is better supported due to the evidence of companies struggling to articulate AI benefits and the rapid, possibly unsustainable, pace of AI investment despite unclear returns.

3. Key Assumptions and Red Flags

– **Assumptions for Hypothesis 1:** Companies have the necessary data and strategic clarity to implement AI effectively. AI technology will continue to advance at a pace that justifies current investment levels.

– **Assumptions for Hypothesis 2:** Current AI investments are primarily speculative, and companies lack clear strategies for AI integration.

– **Red Flags:** The inability of companies to clearly articulate AI benefits, potential bias in AI systems, and rapid shifts in AI-related employment trends.

4. Implications and Strategic Risks

– **Economic Risks:** A potential AI bubble burst could lead to significant financial losses and layoffs, impacting broader economic stability.

– **Cyber Risks:** Increased reliance on AI systems without adequate security measures could expose companies to cyber threats.

– **Geopolitical Risks:** Nations heavily investing in AI may face strategic vulnerabilities if AI advancements do not meet expectations.

– **Psychological Risks:** Public and investor sentiment could shift negatively if AI fails to deliver on its promises, leading to decreased trust in technology.

5. Recommendations and Outlook

- Monitor AI investment trends and company performance to identify signs of a potential bubble.

- Encourage companies to develop clear AI strategies and articulate expected benefits to stakeholders.

- Scenario-based projections:

- Best Case: AI integration leads to increased efficiency and economic growth.

- Worst Case: AI bubble bursts, causing economic downturn and job losses.

- Most Likely: A mixed outcome with some successful AI implementations and some failures, leading to moderate economic impact.

6. Key Individuals and Entities

– Martha Gimbel, associated with Yale Budget Lab, provides insights into the economic implications of AI adoption.

– Companies like Klarna and McDonald’s are mentioned in the context of AI adoption and its challenges.

7. Thematic Tags

national security threats, cybersecurity, economic stability, technology adoption, speculative investment