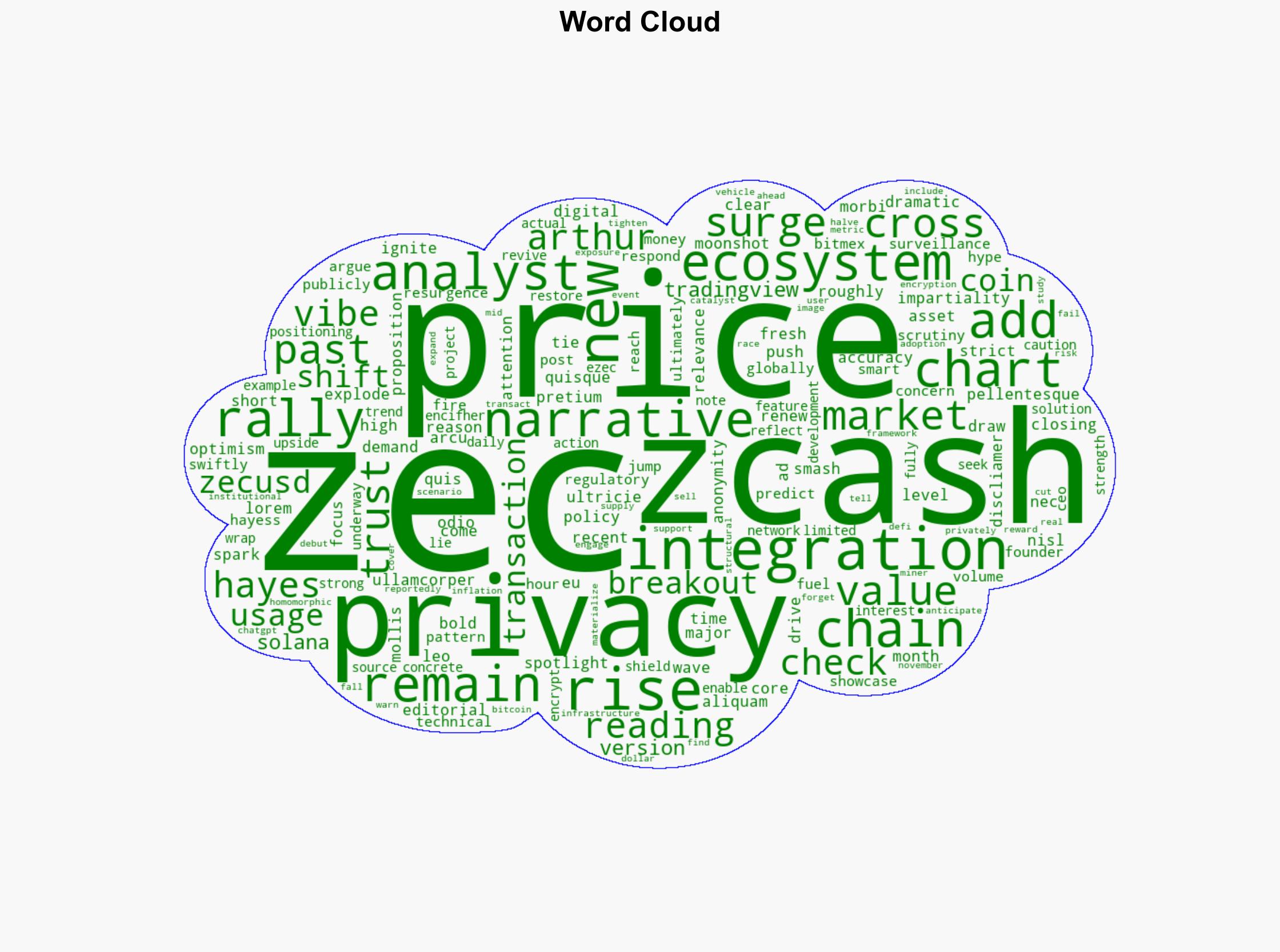

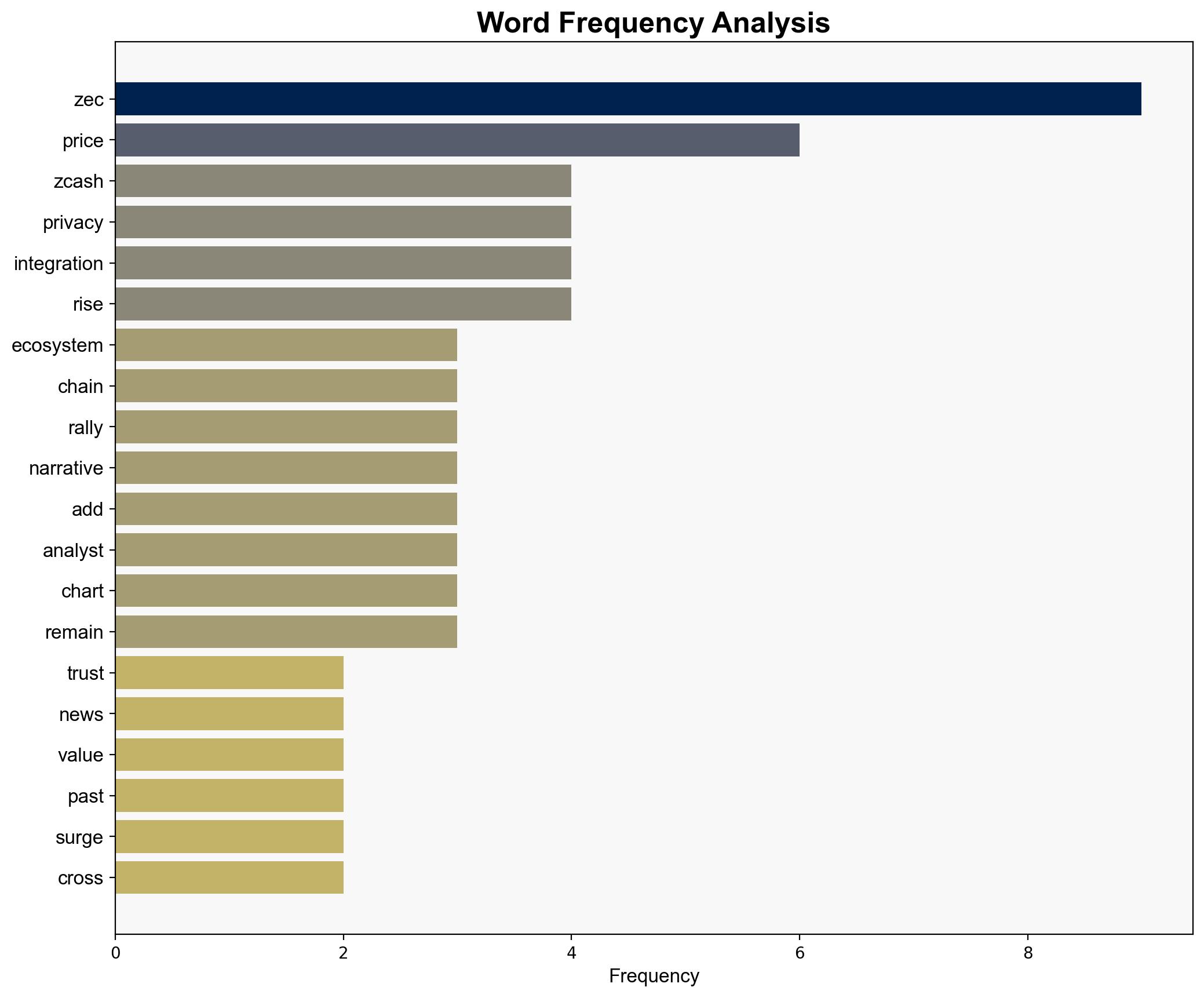

Zcash ZEC Soars Past 2021 Highs as Arthur Hayes Predicts 10K and Privacy Narrative Reignites – newsBTC

Published on: 2025-10-28

Intelligence Report: Zcash ZEC Soars Past 2021 Highs as Arthur Hayes Predicts 10K and Privacy Narrative Reignites – newsBTC

1. BLUF (Bottom Line Up Front)

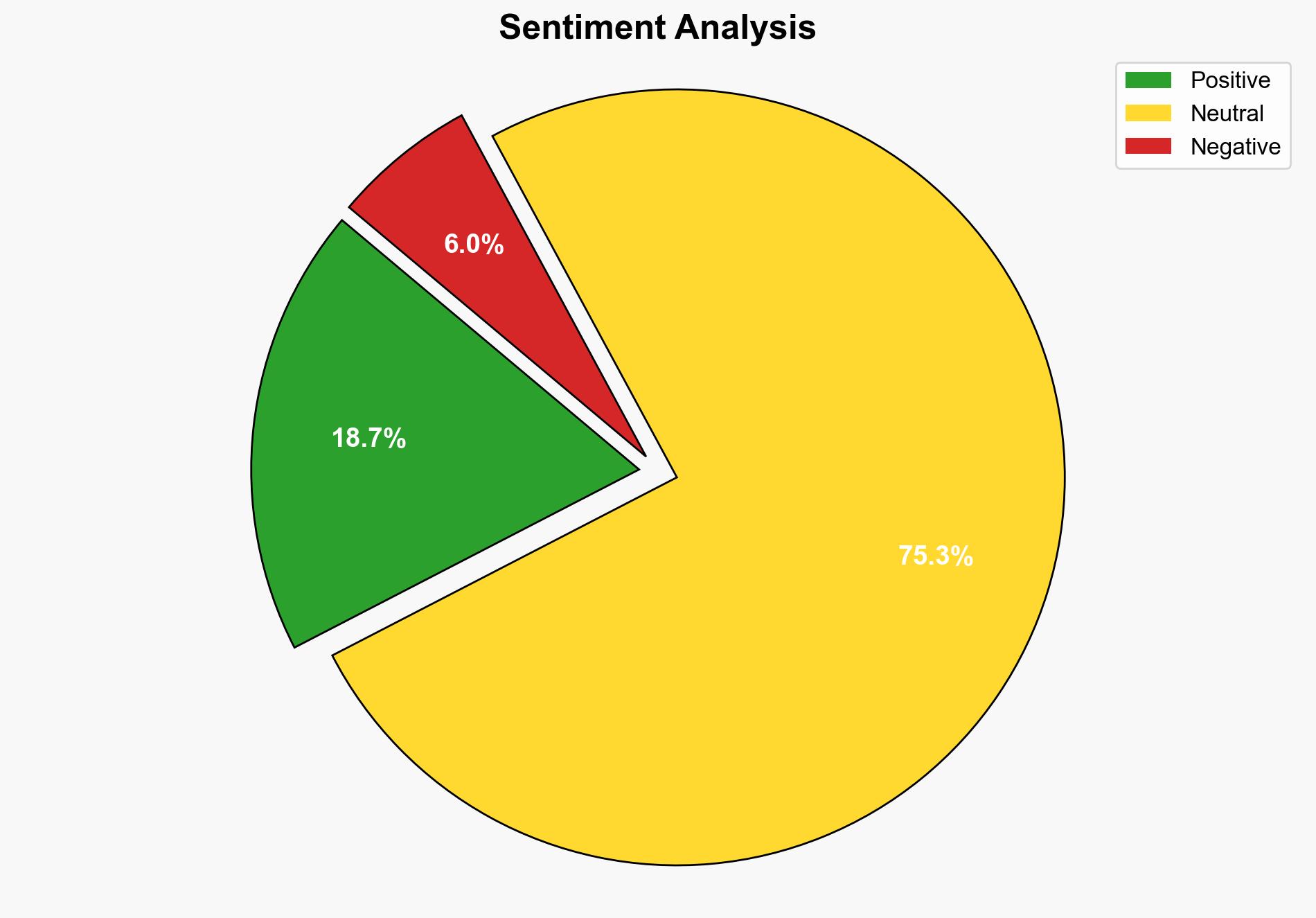

The most supported hypothesis is that Zcash’s recent price surge is primarily driven by speculative trading and market sentiment influenced by Arthur Hayes’ prediction and the renewed interest in privacy features. Confidence level: Moderate. Recommended action: Monitor market sentiment and regulatory developments closely, as these factors will significantly impact Zcash’s future trajectory.

2. Competing Hypotheses

1. **Hypothesis A**: Zcash’s price increase is driven by speculative trading and hype, fueled by Arthur Hayes’ prediction and a renewed focus on privacy narratives.

– **Supporting Evidence**: The article highlights a dramatic price surge following Hayes’ prediction and increased attention to privacy features. Analysts caution that the rise is more narrative-driven than based on actual usage.

2. **Hypothesis B**: Zcash’s price surge is due to genuine ecosystem development and increased adoption of privacy features across blockchain networks.

– **Supporting Evidence**: The integration of Zcash with other chains and projects like Encipher and the anticipation of a halving event suggest structural developments that could support long-term value.

Using ACH 2.0, Hypothesis A is better supported due to the immediate market response to Hayes’ prediction and the lack of substantial evidence of increased real-world adoption or usage metrics.

3. Key Assumptions and Red Flags

– **Assumptions**: Hypothesis A assumes that market sentiment and speculative trading are the primary drivers of price changes. Hypothesis B assumes that ecosystem developments are significant enough to drive price increases.

– **Red Flags**: The article notes that actual usage of Zcash’s privacy features remains limited, which contradicts the narrative of increased adoption. The reliance on a single prediction by Arthur Hayes raises concerns about market manipulation or over-reliance on influential figures.

4. Implications and Strategic Risks

– **Economic**: A speculative bubble could lead to significant volatility and potential losses for investors if the narrative-driven price increase is not supported by actual adoption.

– **Cyber**: Increased focus on privacy features may attract regulatory scrutiny, potentially impacting Zcash’s usability and adoption.

– **Geopolitical**: Global regulatory developments concerning privacy coins could influence Zcash’s market position and legal status.

– **Psychological**: Investor sentiment may be highly volatile, influenced by prominent figures and market narratives rather than fundamentals.

5. Recommendations and Outlook

- Monitor regulatory developments globally, especially concerning privacy coins, to anticipate potential impacts on Zcash.

- Encourage transparency and real-world usage metrics to support sustainable growth and mitigate speculative risks.

- Scenario Projections:

- Best Case: Regulatory clarity supports privacy coins, and real adoption increases, stabilizing Zcash’s value.

- Worst Case: Regulatory crackdowns lead to delisting and reduced market access, causing a sharp price decline.

- Most Likely: Continued volatility driven by market sentiment and speculative trading, with gradual adoption improvements.

6. Key Individuals and Entities

Arthur Hayes

7. Thematic Tags

cryptocurrency markets, speculative trading, privacy technology, regulatory scrutiny