Barclays seeks CMA licence to expand into Saudi Arabia – Privatebankerinternational.com

Published on: 2025-10-28

Intelligence Report: Barclays seeks CMA licence to expand into Saudi Arabia – Privatebankerinternational.com

1. BLUF (Bottom Line Up Front)

Barclays is strategically positioning itself to expand its operations in Saudi Arabia by obtaining a provisional licence from the Capital Market Authority (CMA). The most supported hypothesis is that Barclays aims to leverage Saudi Arabia’s economic transformation under Vision 2030 to enhance its investment banking and market presence in the Middle East. Confidence level: High. Recommended action: Monitor regulatory developments and potential competitive responses in the region.

2. Competing Hypotheses

1. **Hypothesis A**: Barclays’ expansion into Saudi Arabia is primarily driven by the country’s economic reforms and Vision 2030, which present significant growth opportunities in investment banking and financial services.

2. **Hypothesis B**: Barclays’ move is a defensive strategy to counteract potential market saturation in other GCC countries and to diversify its regional portfolio amidst global economic uncertainties.

Using ACH 2.0, Hypothesis A is better supported due to the explicit mention of Saudi Arabia’s growth ambitions and Barclays’ strategic alignment with these goals. Hypothesis B lacks direct evidence but remains plausible given the broader economic context.

3. Key Assumptions and Red Flags

– **Assumptions**: It is assumed that Saudi Arabia’s regulatory environment will remain conducive to foreign investment. Another assumption is that Barclays’ existing operations in the GCC will not be adversely affected by this expansion.

– **Red Flags**: Potential over-reliance on Saudi Arabia’s economic projections. There is also a risk of underestimating local competition and regulatory hurdles.

– **Blind Spots**: The impact of geopolitical tensions in the region on Barclays’ operations is not addressed.

4. Implications and Strategic Risks

Barclays’ expansion could set a precedent for other financial institutions, increasing competition in the Saudi market. Economic risks include potential volatility in oil prices affecting Saudi Arabia’s economic stability. Geopolitical tensions could disrupt operations and investor confidence. Cybersecurity threats may arise as Barclays integrates into a new regulatory and technological environment.

5. Recommendations and Outlook

- Monitor Saudi regulatory changes and align compliance strategies accordingly.

- Develop contingency plans for geopolitical disruptions.

- Enhance cybersecurity measures to protect new operations.

- Scenario Projections:

- Best Case: Successful integration and market capture, leading to significant revenue growth.

- Worst Case: Regulatory or geopolitical setbacks hinder operations, resulting in financial losses.

- Most Likely: Gradual market penetration with moderate growth aligned with Saudi economic reforms.

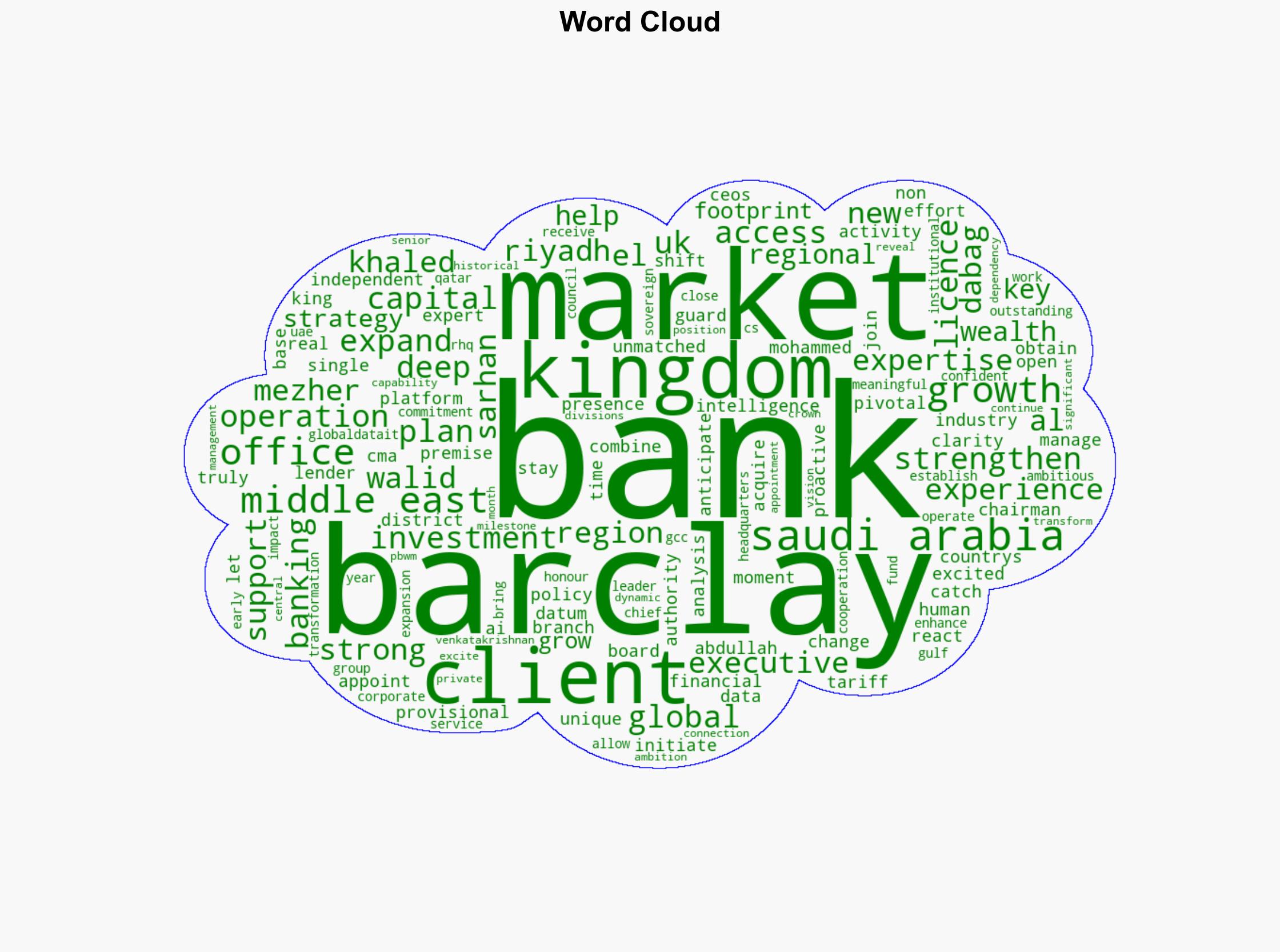

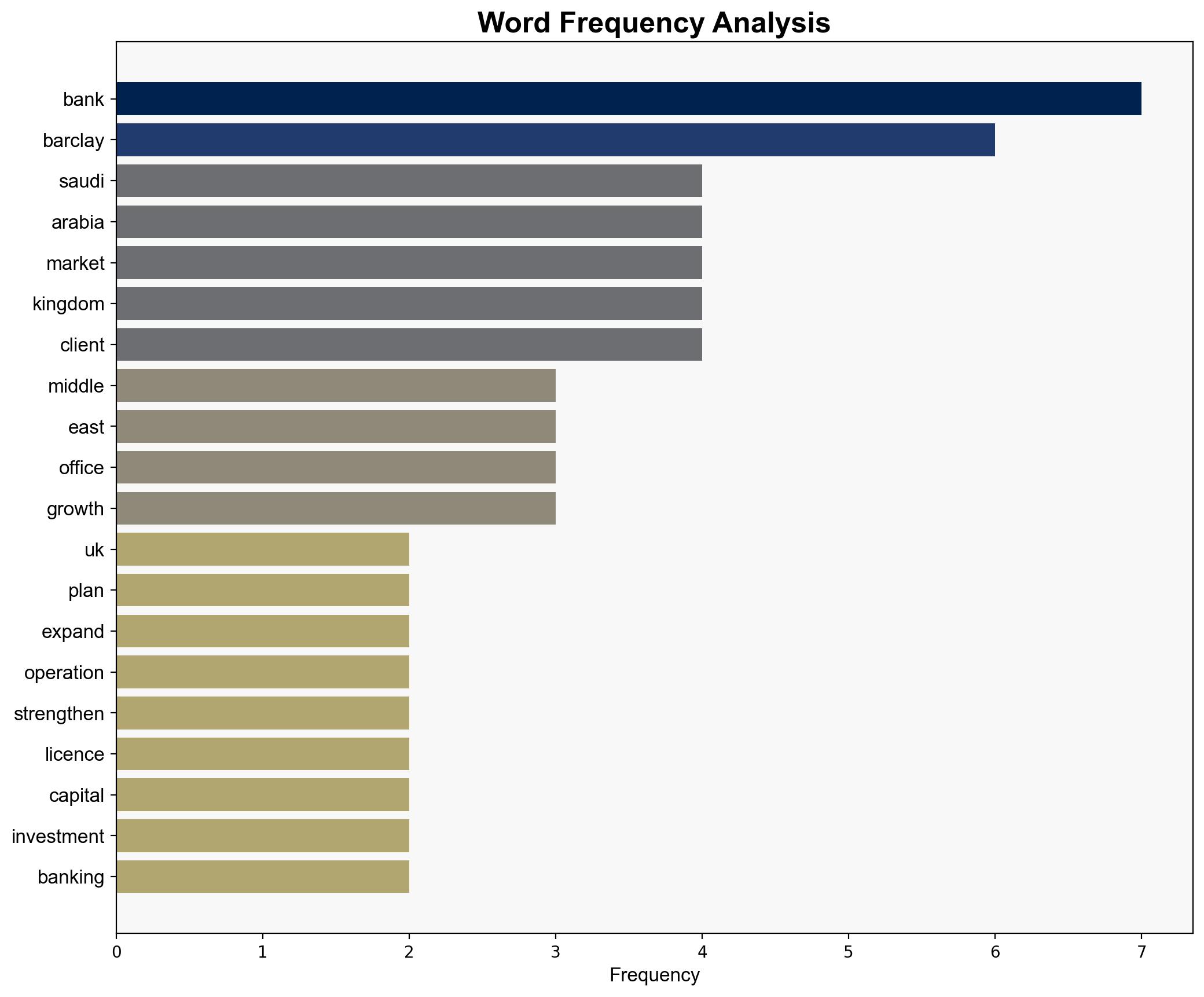

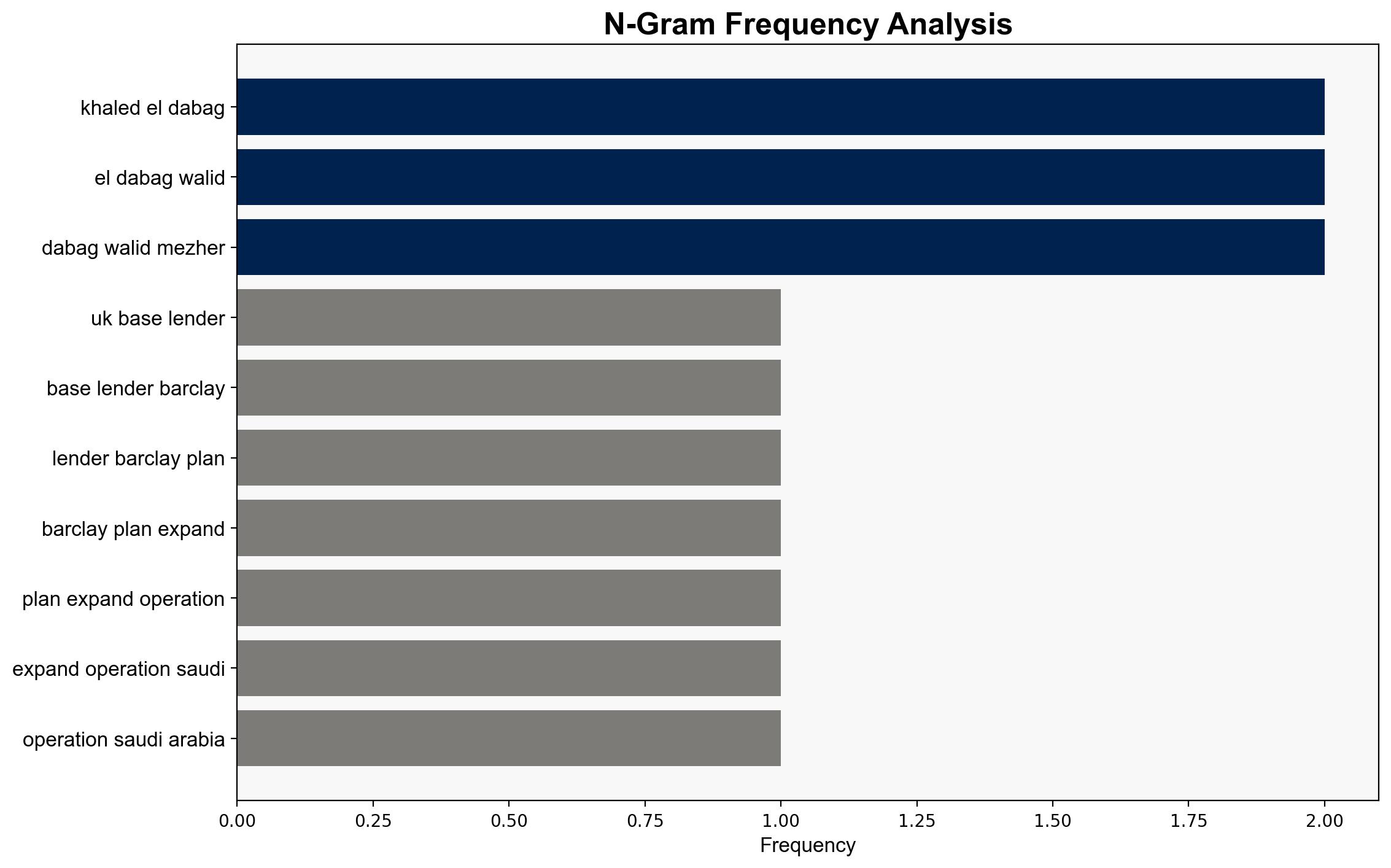

6. Key Individuals and Entities

– Mohammed Al Sarhan

– Khaled El Dabag

– Walid Mezher

– CS Venkatakrishnan

– Barclays

– Saudi Arabia’s Capital Market Authority (CMA)

7. Thematic Tags

national security threats, cybersecurity, counter-terrorism, regional focus